From the other sections it is clearly comprehendible how managers require to handle an d make proper adjustments with corporate income taxes. There are still few problems associated to tax that is important to be discussed. This is to give you clarity on such prospects considering the future prospects.

17.6 A. Which methodology for tax adjustment is best?

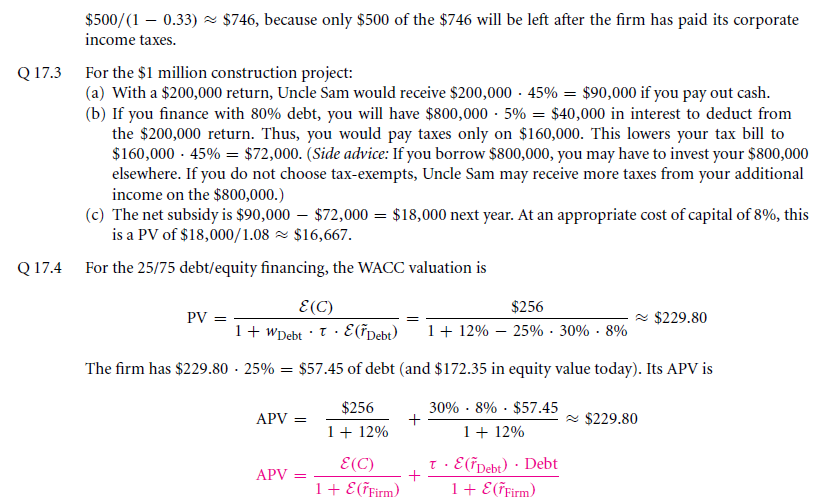

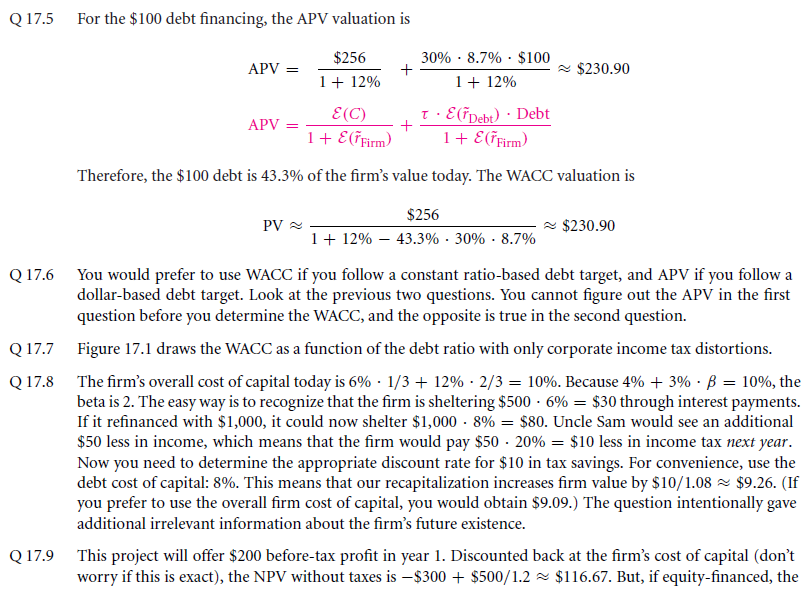

Now this is an important question that arises when it comes to selecting one of the good methods. Although there are 3 methods from which tax adjustment is required to best opted, the decision depends on both the pros and cons of all the 3methods.

Those 3 techniques are:

- WACC

- APV

- Flow to equity

Even if the resultant of all the 3 methods are similar, the process is entirely different when compare amongst the 3. Everything in this aspect depends on proper arrangement. Because of this, differential aspect in outcome amongst the 3e will be modest.

This is inevitable in case of expected cash flows in future when comparisons are made on valuation methodology. This assessment is with respect to tax code simplification and appropriate capital cost.

In this 3way all of the methods are explained in simple way.

- WACC

As per this formula, calculating an increase in debt and determining in percentage is easy. This can be stated to be an easy formulation when it is about capital structure policy and change in target ratio with respect to it.

- APV

When it comes to the assessment of a company’s value in the sense of hike of an extra dollar in debt value, APV is an easy option. Ina project, with this formulation, additions regarding specific cost are simply calculated with this formula.

- Flow to Equity

Being a lucid method, flow to equity is a profitable option when calculating firm value. This is because there are negligible chances of it to making any mistakes in assessing expected cash flow. This can be taken as a benefit of it. Now looking forward to the cons of this method, construction of complete financials is mandatory. Taken as an extra effort technique, this methodology does not involve debt and tax advantages when counted for simplified tax code assessment. This makes tax-induced consequences regarding changes in anticipated capital structure.

After seeing all these 3 methods, it can be clearly comprehended that between WACC and APV, the second option is easier to deal with. It can be explained via few aspects. APV highlight about projects and capacities related to debt by showcasing it by stages of people in real world.

With this fact, a common question arises. What are the factors or what exactly does it takes debt capacity to function? Answer to this complicated question is simple. Increase in higher debt capacity level is influenced by a higher number of collateralizable or tangible projects. Reason for this is being an easy resalable and repossess able property that banks can use as a tangible asset.

Requirement of equity investment for R&D or research and development projects do follow laboratory construction with the funds denoted as debt financing. In this case, you will not find research and development projects debt capacity. It is solely dependent on laboratory construction. In later stages of this project, you can see debt capacity addition done by APV methodology.

In addition of simplified workings, assigning a company’s tax shields and assigning various other discount factors is achieved by APV.

Where APV does all the calculation work with ease, WACC is difficult methodology performing the same functionality with utmost difficulty. It is tough to assess multiyear compounding WACC depending upon the working with time variation. The outcome can only be obtained from this method if there is a consistency of debt ratio of a company in the future. This can be only expected, making WACC an easy formula than APV. However, as factors related to funds usually do not remain constant, this assessment cannot be converted tofact.

In certain case, it has been seen that publicly traded corporations rarely maintain constant debt ratios. These are not based on basic assumptions but on empirical evidence. This makes WACC not so preferred methods that firms like to use for their valuation purpose.

Technically speaking, we can say that with WACC one can assume the fact that as per competitive requirement borrowing rates is a better option. Because of assumption it can be stated NPV to be zero.

So, when the assumptions are made, it is leant more towards normal scenario where appropriate cost of debt capital works as payment to creditors. When it comes to above or below market, you will not find WACC to follow priced loans that are unfairly made. We can consider a near version of what we can see in CAPM is unable to provide.

Important aspect that requires to be avoided

One of the biggest mistakes that you need to avoid when using either APV or WACC formula is incorrect cash flow (expected) utilisation. In case you have used mistaken rate of discount with incorrect value of tax liability or that of tax shelter it can be rectified. But in this case, too that mistake has to be within bounds. However, using any of these formulas with incorrect expected cash flow will not give the desired result nor will its rectification be done.

Amongst the 3, projected cash flow related to debt and that of debt is achievable easily with the help of flow to equity formula. When debt tax shield is already implied, it is easy to use ‘pro forma cash flows.’

It is always recommended that under present capital structure you should not make use of company’s expected cash flow. It is also for current equity. Nevertheless, if that company is completely financed, the resultant will appear for cash flow.

17.6 B. Heuristic Rule for Tax-Savings

This concept should not be confused with other aspects of tax savings. It is also not in question when it comes to correct discount factors. Tax saving is no so bigger aspect when compared with discount factor.

In most cases, people think tax to be not a huge issue for what they need to sweat. What you require to consider is that conclusions cannot be drawn on any aspect before knowing the facts. Tax savings by companies do not lie on the fact of extra effort or any special and innovative methods to achieve so. Materialisation of taxes is what you can see every year.

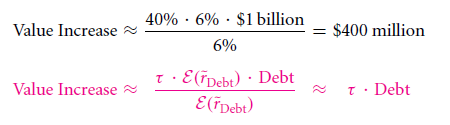

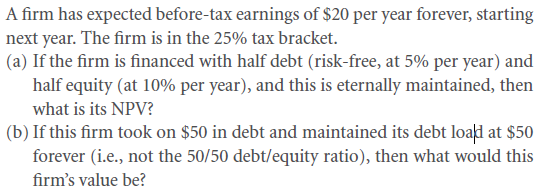

This can be easily comprehended by an example. In this, we need to use the formula of APV. Suppose a company take a debt of $1 billion instead of taking the same amount in the firm of equity. Also, let us consider the fact that rate of interest on this interest amount gives $60 million per annum. This makes interest percentage to be 6%. As for most organisations the tax saving percentage is 40%. If we implement this same percentage here, this makes the tax saving amount to be $24 million. This saving amount is for the 1st year making this to be perpetuity.

Now if percentage of tax shelter is equivalent todebt capital cost, which is 6%, increase in company’s total value will be $400 million. This amount is obtained by division of $24 million by 6%. Its formulation will be:

This process acts as a shortcut method to generate the value of a firm when it comes to calculation of external debt on the basis of extra dollars. This also influences growth of that company by tax rate. Being one of the simplest formulations, it can be calculated in head.

Another of the examples to showcase the simplicity of this formula is to take another company project whose financing amount is $1 million. In place of being an all equity company, it takes a debt of 50%. This makes the marginal tax percentage to be 40%. This company does not repay this amount. As the provided percentage is 40%, calculation for $500,000 (50% debt) will give the reluctant as $200,000.

Debt formula(τ)is an important aspect that you need to consider for tax savings. Being heuristic in nature, this will give you the answer but not an accurate one. It will give you more than 1 expected answer where the resultant of the first may be perpetual related to tax shelter and debt. The 2nd answer may state debt cost capital to have similar value with that on tax shelter having the implementation of rate of discount.

After all these issues, this formula mostly used and seen as long-term benefit related to extra debt.

17.6 C. Financing and investments are different. Is it?

When consideration is taken as that of M&M world, decisions related to investment and finance are taken separately. Finance department usually takes care of the company finances,and the decisions related to investment is taken care by managers. This case is of no importance in 2 scenarios.

- Presence if market imperfections

- Debt amount having tax benefits

An example gives simplification of this statement. Suppose there are 2projects going on side by side. One is related to R&D and the bother us related to building. Also assume that both of these projects have same capital cost, NPV, payoff and even costs.

In this can be only possible in an imaginary situation as in real world no banks will be ready to fund ant R&D projects. This is because if that project fails to reach completion, banks will not do anything as collateral assets which they can resell and acquire the loan amount.

Now when it comes to the project dealing with building, it is more approachable to banks. This is because banks, in this case, will have a property, or in better words, an offer having higher debt capacity which they can possess and sell to extract loan amount. This aspect makes this more valuable when compared to R&D project. Selection between the 2by managers can be only possible when they can analyse the company’s debt capacity.

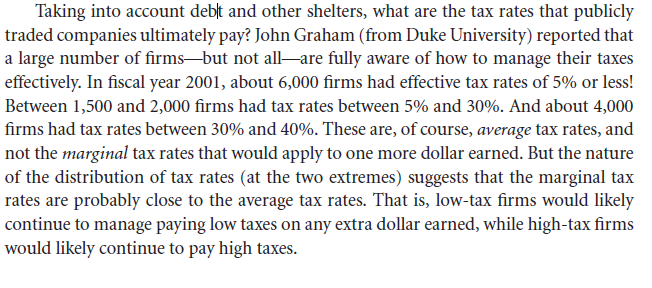

There is another of a complicacy that comes to light because of debt capacity value and also on the factor of who the actual owner of the stated company is. You will find most settled and noteworthy companies to come under the bracket of higher tax payer. There will only be a selective number of new companies in this group too. However, in a generalized sense, most new companies will be under less tax payer group.

A closer look will make you see that huge corporations like PepsiCo have to pay more as a tax even after they deduct certain immediate tax amount. But in comparison to this, debt capacities of new companies are extremely less.

17.6 D. Marginal and Average Capital Cost

If you go back to the last chapter, you can see the difference between marginal capital cost and average capital cost. In this section, we have been only considering about average capital cost. Now as a general fact, in most cases managers only concentrate on marginal capital cost. Imperfect or imaginary world scenario will allow you to compute using average capital cost. This is due to the fact that its value is less than marginal capital cost.

In most cases, lenders are not so keen investing in R&D projects, even if they see that you can finance with debt relate to preferred tax. If you can learn about your company’s average capital cost, it will not only be a profitable aspect, but you can also assess its marginal capital cost.

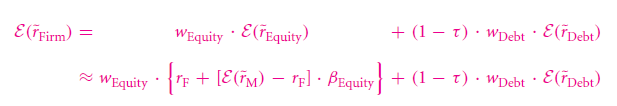

17.6 E. CAPM combination with tax-adjusted WACC

CAPM is an excellent model which is designed as per markets in real world. But textual suggestions always point out not to make use of this model in actual world. One of the practical answers is to take heed of this advice but also use CAPM.

Combination of this model, with that of tax-adjusted WACC,can be given with the help of this formulation. (You need to consider estimated equity capital from this model.)

CAPM is a widespread aspect where its utilisation is based on E (˜r Equity) or equity capital cost. This is because there are no other models than this whichst and as a better option. This model’s imperfection is mainly with respect to corporate income tax. It also highlights quality approximation with respect to personal income taxes.

As a general sense, most people consider that this CAPM model is an ideal tool showcasing different imperfections related to market.

An explanatory factor that can be helpful to highlight this thinking is treasuries. If investors are offered higher return rates on their personal income taxes, as per CAPM parameters, the company of yours will also enjoy the same slashed rate. An aspect like this makes personal income tax an important element in this model.

As a significant part of capital cost, most companies use this models and extra payable compensation to their respective investor. Reason behind this is tax imperfection that investors have to bear

Practices related to debt capital cost are different for different corporations. CAPM cannot be taken as a good model if you want to evaluate your capital cost or expected interest rate and also for bond pricing. Such a negative aspect of this model is due to it being a risky option for bonds.

The areas of significance for this model are:

- Imperfect market premiums

- Liquidity

Quoted rate of interest that your bank provides should not be believed, especially when it comes to bonds, personal debts or corporate debts.If you rely on such quoted rates, value for default premium will be skipped.

It is often seen that analysts also commit such mistakes considering it as modest error. This is more prevalent in case of huge corporations than in smaller companies.

17.6 F. Schemes to avoid certain corporate taxes

Tax experts employed by Main Street and Wall Street are mainly to provide assistance to their clients in avoiding huge tax amount payment. This can mainly be relayed as an arms race that takes place between investors and Congress (IRS). Where avoidance schemes for new taxes are what investors try to find, loopholes are found by IRS in the first place to close such schemes. It is a surprising fact that there were many present and past schemes that are currently being used. However, a majority of past schemes are closed.

Amongst those, there are still very many essential schemes, and some of them are highlighted here.

- In case of immediate utilisation, there are certain companies paying higher tax amount, who have funds to buy even low tax companies. They do it easily by obtaining NOL or net operating losses of the present company.

A simplified example of it was highlighted in 10th February 1994 in the Financial Times. As per this, a corporation named GKN made an antagonistic bid for Westland Corporation for £300 million. The main reason for this step is to decrease corporate tax rates which GKN can achieve by acquiring NOL of Westland.

- When it comes to advantageous tax arrangement, leasing can be a better option than buying something on credit. Now efficiency of a borrower is of question if they don’t have much funds in possession yet look for an option for a tax deduction, it is better to handover the asset to anyone who is more responsible. If this is not done, an option that will stand in front of the official owner may be to lease the property and enjoy interest deductibility and avail all the benefits with it.

- Shifting of profitable assets which are difficult-to-value is mainly seen by multinational companies. This shifting takes place between high tax and low tax countries. For better understanding, let us take the example of Switzerland, where corporate income tax is 7.80%. Higher percentage for this can be somewhere around 25%. Both are for the case of holding firms.

Now, if corporate income tax percentage of Switzerland is compared with that of USA, you will find this percentage o be 45% in the U. S. Contrasting aspects of taxes is in case of Federal and State. For instance, we assume that a company has designed a patent, having a yearly worth of $10 million. In case that patent is owned by a branch of USA, retention of funds by that company will be $5.5million each year. This calculation is made via [(1 – 45%) x 10 dollar].

Now, if Swiss branch also owns a patent, amount retention will be of $9.2 million, which can be computed by [(1 – 7.8%) x 10 dollars]. But why is this pause at $10 million? This is because there will be a decrease in tax obligation from the side of US companies if charges made but Swiss branch is $20 million per annum to US company. This year decrease amount will be about $9 million.

Calculation for it will be,

$20 million x 45% = $9 million

However, there will be a hike in Swiss tax obligations resulting in a steady growth. Computation will be,

$20 million x 7.8% = $1.56 million per annum

After all this calculation from a relative scenario, the yearly net gain will be $7.4 Million.

Attainment of capital transfer having tax-efficiency is done via capital structure. Suppose, US branch borrows money from Swiss branch. Instead of the usual 6%, they have imposed a tax percentage of 36% on the loan amount which will lead to a company’s reduction in tax liabilities. Now for an extra interest payment, say for $1000, $372 will be the extra amount that the company will have as yield.

It is easily calculated via:

(45 – 7.8)%, giving the result of 37.2%

This tax game can be played by firms who select municipality and state of US.

- To avoid tax related issues, especially about the U. S., many companies shift their headquarters to other countries or even states.If you take the instance of Microsoft, just to avoid corporate tax, they shifted their bases (headquarter) to Nevada. This decision of theirs made sure that yearly their tax savings would be $50 million.

Now when you are reading about these tax avoidance schemes, you will be finding this to be outrageous. However,there are also few advantageous points congress and tax lawyers use for tax burden escape option.

Investors mostly think these companies to be equivalent to vehicles for which corporate income tax payment is necessary. This thought is prevalent for small investors.

There are no specific corporate locations that are offered by U.S. In case the taxes are out of the range of certain companies;they shift to some place else.These are not just assumptions but have taken place in reality. Strong financial centres (especially see through services) are built on the grounds of tax regulations and laws. Some of the places in the list are:

- Switzerland

- Cayman Islands

- Bermuda

The tax code of NewYork is built keeping Greenwich, Connecticut the main centre.

The basic idea for this hedge fund movement in Greenwich isto avoid city taxes and state taxes in New York. In fact, if compared to most European companies, they too prefer Greenwich instead of setting their bases in the U. S.

ANECDOTE

Stanley Works and Foreign Domiciles

Taking in consideration of Stanley works in the half of 2002, they planned to shift their headquarters in Bermuda. Now this company is a century old global tool manufacturing company whose bases was initially in Connecticut. This relocation decision was an excellent plan that would have allowed foreign subsidiaries of Stanley to avoid income taxes as per US laws.

On the basis of complete worldwide income, payment of income tax by U.S. corporations is mandatory. If we assume that there is a foreign company, there will be making the payments related to tax only on the amount earned as US income.

Stanley’s corporation didn’t have to bear the ill effect of their departure from the market only because of few reasons. Those were:

- Special legislations and their given threats

- Public outcries

- Strong media attention

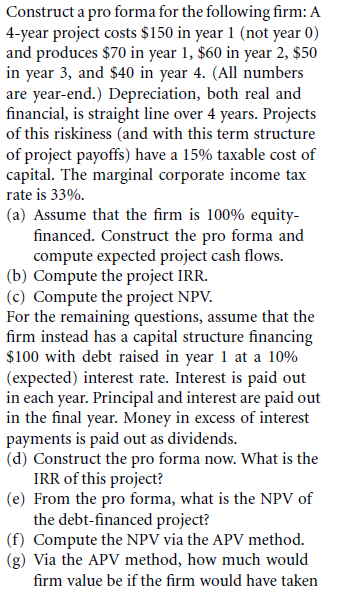

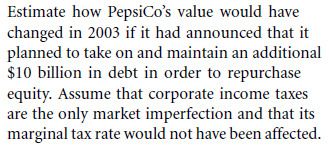

Questions to solve

Summary

There are certain major points that you have already seen covered in this chapter. Here is a summarised version of it.

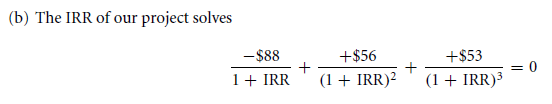

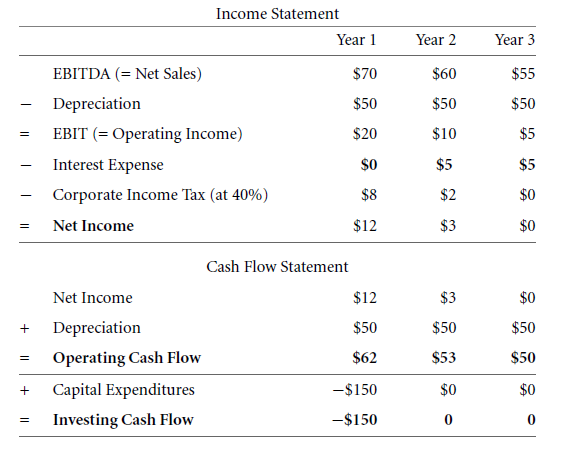

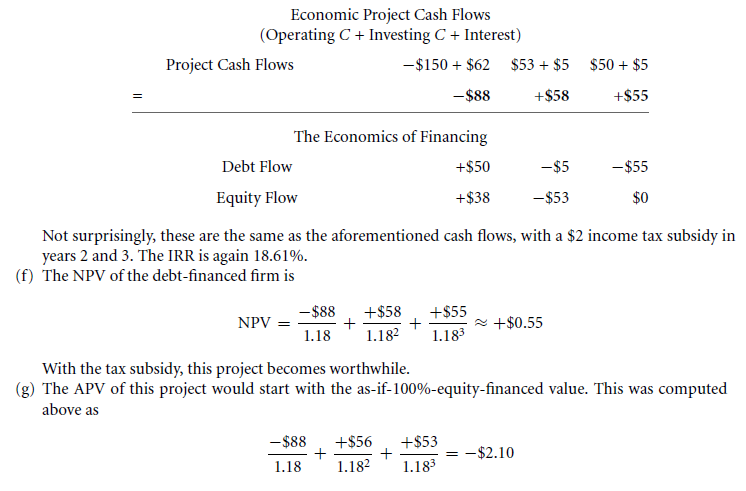

- It is with the help of APV method that you can easily calculate tax advantages. The other 2 methods for the same are flow to equity and WACC. Flow to equity can be stated as a pro forma that most companies employ in order to reduce interest amount. This helps in tax burden reduction on the overall income amount.

- As per textual knowledge and real world (imperfect), favours on debt more than that of equity is seen by U. S. tax code. In cases such as this, it is important that managers should consider benefits related to corporate income tax.

- As per the formula of APV, the entire process takes place by tax advantage addition. The formulation for this is:

- E(˜r) is an expression that highlights discount rate and is used for an expected tax shelter. In accordance with this formula, utilisation of debt capital cost is beneficial when there is a decline in debt ratio of a company. This change in debt ratio can be seen over a certain period.

If this ratio remains constant, you can find that capital cost in an overall term will be used up in the entire process. Now, equity capital cost can be only used if there is an increase in debt ratio.

- Initiating with cash flow, WACC and APV formula can both b applied (separately) only when the company is fully taxed and equity financed. Keeping this in mind, it is important and mandatory that tax advantage is added to debt amount.

- Both of these formulas have near similar valuation yet they are different, this is because, in APV value, there is the only assumption in case of discount This assumed rate is applicable to tax benefits in future. But for WACC, handling changing debt ratio and capital cost is not easy. And any way, even if there are any mistakes while calculation of tax shield (mainly discount rate), it is overshadowed by other uncertain aspects.

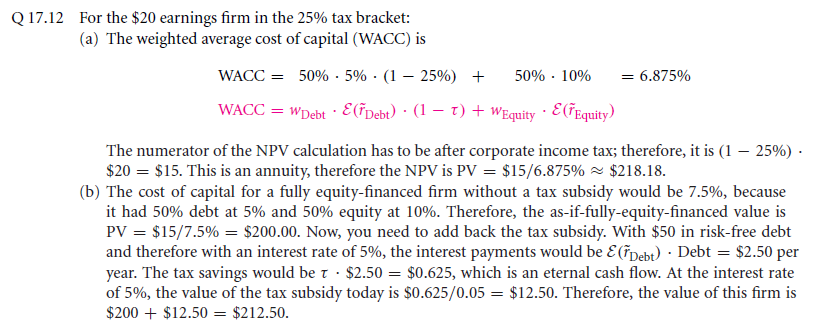

- Debt capital cost is lowered by WACC with the equation,

- There are certain trial and error methods that make the entire process convenient. One of the heuristics in the list is having an extra dollar on a constant basis. This factor hikes firm value by its rate of marginal income tax.

A simple explanation to this will be a supposed debt whose value is $100. As this debt is for eternal times, the valuation of a firm that will be created because if this amount will be $30. This calculation is entirely dependent on the 30% which is that same company’s marginal income tax.

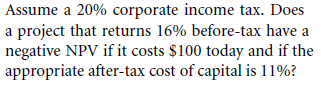

- It is imperative that you remember a key point which made the calculation for company valuation. Make sure that you have the correct details of expected cash flows. Error in it will always provide wrong answers. You also need to keep in mind that WACC with lower tax adjustment (capital cost) and tax subsidy related to APV should never be calculated for cash flow in special cases. This includes companies not having full taxation and equity financed.

- Even if it is an incorrect method, APV and WACC formula combination can take place with CAPM formula.

- Marginal capital cost cannot be stated as WACC if the consideration is taken in case of an imperfect

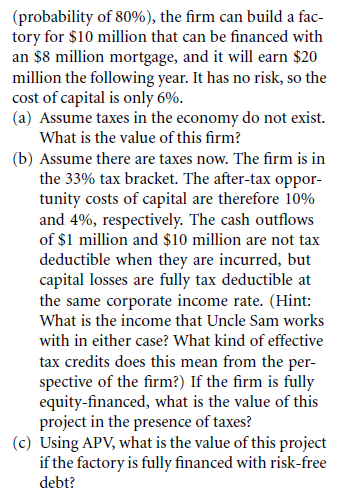

- In the case of the imperfect real world, both investment and financing decisions are same. It is via financing channels that higher debt capacity may be added to valuation of a project.

Key Terms

Solve now to get Solutions

Few important questions

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

- Relative taxation of debt and equity

- Firm value under different capital structures

- Formulaic valuation methods apv and wacc

- A sample application of tax adjusted valuation techniques

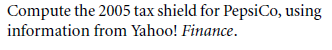

- The tax subsidy on pepsicos financial statement

Links of Next Financial Accounting Topics:-

- The discount factor on tax obligations and tax shelters

- What matters

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management