The Corporate Financial Sector

All the various investment banks fall under the duty of being named as the intermediate bridge between capital markets that are public and the large business companies. Investment banks are exactly that what consumer banks are. The only difference that they have is on the service department. Their services are not only focused to retail therapy but even the corporate client body. Just like the consumer banks, these investment banks mostly engage in primary functioning such as,

Advice and facilitation: these investment bank bodies make the great offer of advising its clients. Both solicited and unsolicited as a matter of fact. And also the great assistance that is to come along with it. These factors matter a lot if and when the business modules take in or wish to adapt investments of a large designation. There are hence mergers and acquisitions that are involved.

Capital intermediation: all investment banks lend out capitals to their clients and also act like some sort of agent body. They do so on the behalf of business firms and the capital providers. These banks even orchestrate the entire process along with the legal aspects that involve the collective functions that are called underwriting.

All these chapters make a roll with the apt details that are concerned over with the varied details. Hence, this gives us a great opportunity that can make the detail look more appealing with the capital that is issued. This is hence the mergers and acquisitions process sorted.

23.1 The Investment Banking Business

Now let us take a closer look. There are two basic things about the business functioning, there are really small minute view point. Looking at these you can understand that there is only a precise detail that you can get from the banking industry.

23.1 A What Exactly is Underwriting?

One of the most important business ventures that are termed under the financial department under write the security that is offered by the investment banks. The original term that is used is that of an underwritten study and the issuing process take the place of a major productivity. There must be many brands that take the name of a foreign bank.

The large institutional organization makes a very contagious communication and thus is a large investor all around the globe. This is how the brands maintain their business modules. There is a grand affirmation that can be used too to calculate and settle of the bond figures.

The main chapters will explain this to you as to how there can be a change in the world of finance. The main functions that you need to understand are the functions that the writers are making them different from the others.

Issue of origination: the underwriter groups must be having experience and must be experts in handling all sorts of legal and operational procedures.

The issue of placement: they must also maintain the investor networks in order to understand that all the investors are exercised by the issuing branch.

Reputation and the signaling: all underwriters must go through the integration and understand the process before ensuring the quality to any of the investors.

All writers are supposed to learn the basic thought that is to be involved with the completion of the investment. The different investment ventures that are being used can have a liable effect on the investment bank. There is a certain need for the information to flow. Many of the banks are greatly influenced by it, and the values that are saved up can greatly harm the substances. As of syndicate banks that put the deals that are meant to be held together, there is a lead running reference among it. Book managers make it their ideal deal to learn the values of charging a book to its main view point.

On a more normal and general term, there can be a record that is kept for the book keeping. There may be many a rumor suggesting that there can be a very unique approach, however, there is a main basic format that is needed to be followed in these cases. All that these offices claim is the right to brag about their brand and make a display out of it. There are ample spaces and opportunities that can be shared along with the brand features. Sample can be obtained and accumulated. However, the thing that you need to remember is that there is a need to recruit the major variations that are needed.

Rankings that are offered can be placed on the basis of locations and even financial strategy of advising. This entire deal is called as the tombstone of advertisement.

23.1 B WHAT EXACTLY IS M&A ADVICE?

M&A happens to be the 2nd largest business strategy that all investment banks undertake. What can we say, but it does seem like a great way to think and do thinks the way common brokers do it. The jobs are hence equivalent to each other. All that happens is that they basically differ in the scale of primary afflictions. What the good advisors do is,

Identification of potential clients, or vice versa. Many times clients want to buy or sell a contract. The investor takes over this category and makes a definite debit out of it.

Valuation services are also offered. Hence all the potential subjects are touched.

Advisor suggests and makes a valuation of all the particular positions that are restored. This forms a whole new routine that makes the use of the subjects a great and easy deal.

The complex task of hiring is lowered as the advisor makes a due routine that helps in the suggestive valuation.

As an advisor is filled with knowledge, the t6argets are better met and all the virtues are hence again established.

Advisor knows the process of taxation and all the possible ways the tax structure is affecting the deal. Thus, it can be assumed that he will gratefully save all the money allowances that are to be saved. Saving up to a values of 20% on most deals.

Being so close bonded with the way that the taxation works, the deals are sure to fetch the maximum of the closure while maintaining the state SEC regulations.

The most difficult deal that you get a hold with is greatly turned into something fruitful by the advisor that you hired. Hence this is absolute role that an investment banker undertakes.

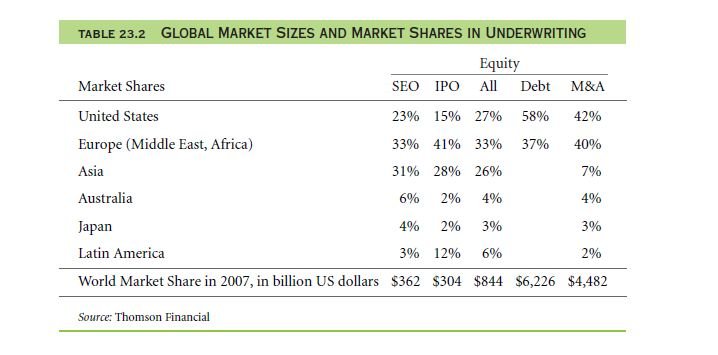

23.1 C THE GLOBAL MARKET

Global investment banking is not a sector of isolated departure, but only an existential context that is to drive on the large and worldwide globe platform. All the banks over the world are competing against the institutions to form the base line and get a hold of the investment cycle. Loans that are of the capital base makes up for the colonial investment sources. Almost all of the cycle is effected. Many global and diverse markets make a rule that is to make the world a better standard to invest and make a profit.

Looking at the broader aspect:

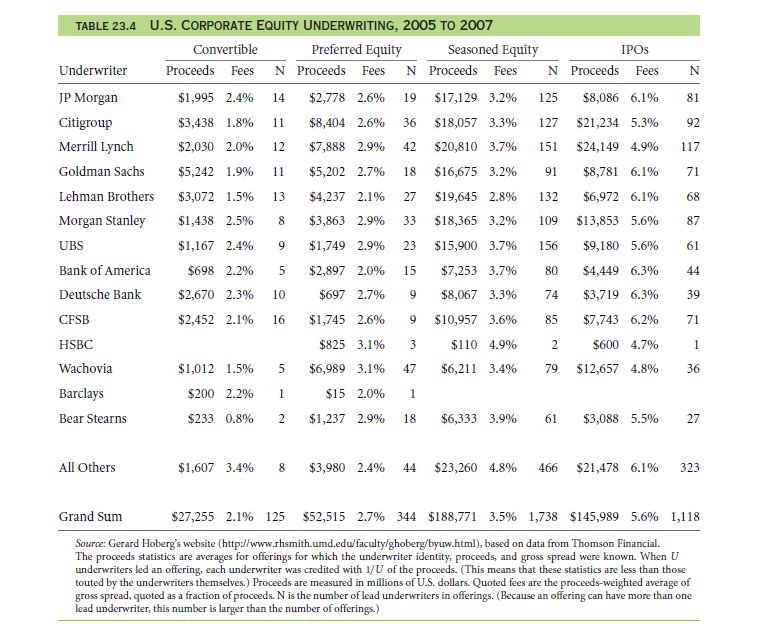

The commercial sector of banking: as the 23.1 table points out, there is a list of 25 banks that are global. This of course is for the year 2007. Many of them are not intermediates and hence are mostly acting as the principle capital lenders. Many of the foreign country banks make an interesting revelation that is by making many public awareness medium. Along with this the world market is made a regulation of the high made investment.

Global investment market in the field of banking: all the given and applauded banks value their seasoned ventures that are all focused and depicted on the account of money lending. The principal amount that is landed by these big brands makes a very interesting effect on the global compound structure. The seasoned equity offerings are clearly distributed even though these are not public offerings.

These numbers however keep on changing every year and must not be taken absolutely literally.

The capital is demanded throughout the world while this investment bank makes a great summarizing point on the way and sort of investment that they would like to do. The prediction that is held on for all the projects that are in hand make a great venture point. As most of the capital is traded methodically, there is a great requirement that it follows.

Banking operations are all mostly functioning from the new york city on a massive global scale.

23.1 D THE INVESTMENT BANKING HISTORY IN THE UNITED STATES

There seems to be a clear cut distinct rate that is formed in case of banking investment. There has to be a couple of concepts. As for the investments that are made, can be easily calculated and followed. As for the time of great depression there had been banks that had made brilliant depositions. There was a law that made sure of that no brand made any retail investments. The possible consumer banks make a great venture. The distinction that you can get hold of is mostly made in the investment procedure.

For all the unlikely laws that had been invented and made an infliction on is of the same investment venture. There has been a legal segregation among the banks that is corporate and other ones. The services charge that made a distinct value was made a brilliant changing point.

23.1 E AN EXAMPLE: GOLDMAN SACHS

It is not an easy deal to find the right virtue of correct and appropriate information that you need an out all the firms, i.e., financial firms. On a more general term, the financial markets that are influenced with the information may not be loaded in the data that is obtained. However, full confidentiality must be obtained in the case of the investment that you are about to make. The total disclosure must be awarded to any potential investor and trader as a matter of fact. The banks that are in the investment bank followings are made the prime orientation.

ANECDOTE

An Investment Banking Job?

There is a high chance of making the cut for what is earned in the solution of the banking investments that are being done. With a graduation field covered in the duration of 15 years, there is a good chance of getting a return of more than 60% of the total capital that was invested in the stock market value. If you however look at the initial values, you might be surprised as to what has been done.

There is a perfect investment pattern that these brands follow on and make an investment that is of arbitrage on the business section. There seems to be a proper equity equation that needs to be solved and put on the manner of all sort of real estate investments.

In the chapter, we will learn the investment opportunities that are made in the focus of the primal assortment. Keeping in mind that there is a need for all sort of indulgent and also the use of finance book here, you can focus too. The investment pattern is a very easy one, if you can just follow it. Keeping a wide look out for the talent that most firm possess, here are all the details:

Financial advisory is that branch which works on the M&A section for the most part. This is what the entire value of dependence depends upon. The policy for Goldman’s project is a beautiful claim that you need to make. There can be many branches associated to the brand values. This is to make the moral reasons stand out.

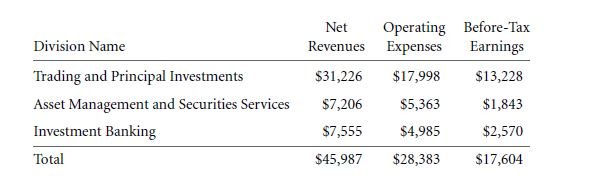

There however will not be much financial break down that is offered as in case of the Goldman’s financial decision. So, what you must do is look up for all the information that is stored in the validation point. The main financial report that can be complied will look something like this:

As you can make a note of, Goldman takes the place of a great big name. hence, it is one of the big fishes in the market – both international as well as domestic. Having a share value of 5% & 10%, this brand makes a premium value that is proportionate to all the equity. Thus it is in fact the bigger fetcher in the market.

23.1F THE UNDERWRITING BUSINESS

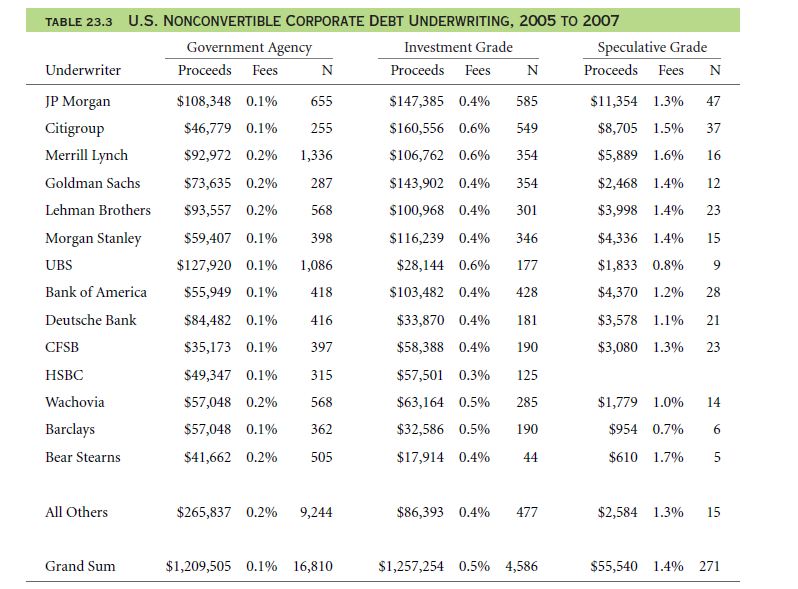

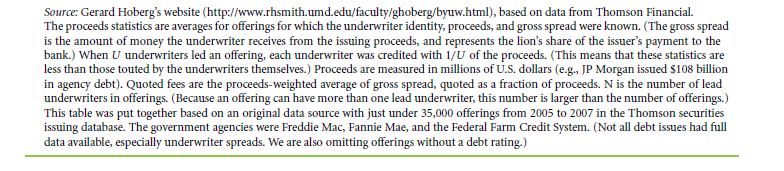

All these troubles that were faced on the year of 2008, makes up for the fee structure. All these figures may vary and keep on changing depending on the specified conditions like underwriter, market, etc.

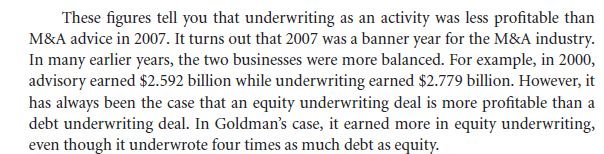

The equity underwriting can be better understood in the table number 23.4. as the corporate rates and terms all make a certain change and /makes the valid point. The fees must be over shadowing the debts. This gives you a good impact on the market value cases and the investment banks thrive on it.

23.1 G THE MERGER & ACQUISITION ADVICE BUSINESS

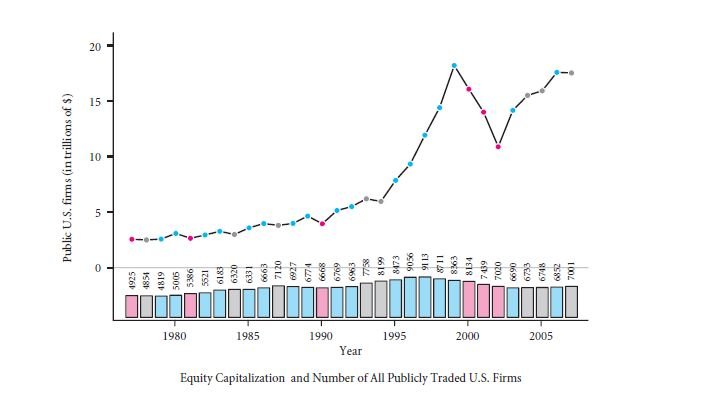

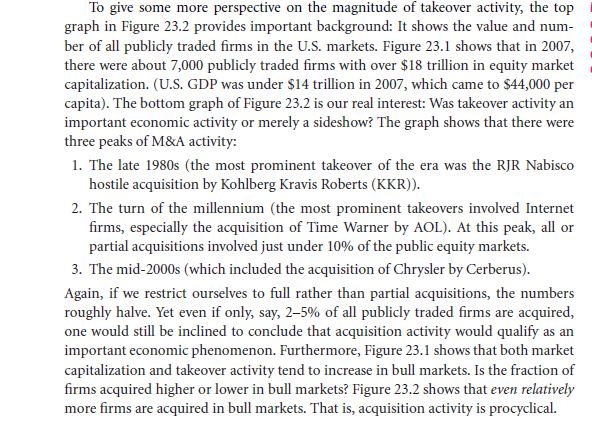

On bring the entire focus to M&A. on the aspect to determine the market value, you get to hold a proper investment. The most usual deal that can be found of the validity is the M&A equation form. The magnitudes that are calculated for different factor points of businesses are found to be certainly different. These trends tend to take on the validation point of a totally different dimension. There are staggering amount chart that is discussed in the following charts.

The total value is made to be stagnant with a very low amount of interest hence, making it brand sustenance. Working with a syncing energy, this forms to be the basic valuation that is to form of the US currency.

Hostile Acquisitions

As the particular interest is made on the particular acquisitions, there can be many targeted as the board term that is to make an attempt. There is a certain change that you can trace down with the module as a whole. This hence is the top peeking venture that you can make a jump at. If you are to follow the great brands then make up for the publicly traded venture point. The target is made out to be of approximately of 5 to 10 years term period.

This remains a single fact that you need to make a sure factor of the acquisitions that are made. This is the top ten certainties that you need to make collaboration with. As for the assumed practicality, there will be many opportunities that can be focused on.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

- Corporate claims

- Capital structure and capital budgeting in a perfect market

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

- What matters

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

Links of Next Financial Accounting Topics:-

- Underwriting services from the firms perspective

- Mergers and acquisitions m and a from the firms perspective