It is time to look at the prospective of services offered by investment banking from the client’s point of view. That starts right from the underwriting. In most of the cases, when it comes to public trade firms, you will usually find no other method to get an underwriter hired. It takes too much of time and resources to do so.

As such, there needs to be a better way to do things. After all, there is a lot to think about here; how much to pay, how to work and how to divide the said resources. As mentioned before, it is ignorant on behalf of the CFO’s to think that these investment banks are nothing more than agents who work under their command. The thing that you need to realize is that a lot of money is being made during this entire process. As such, a lot is at stake here. So things are not that simple to get away with.

Any decent investment bank will be able to identify some valuable targets for the clients so that they can make a profit in the long run. It is advisable to not try and read in between the lines when such events do take place. Also, the importance of being aware of all the conflicts taking place is equally important.

23.2 A Underwriter Selection

So how exactly do you go about selecting an underwriter for yourself? How do you make the pick? How do you judge if one person is better than someone else for the job? There are exactly 3 distinguishable situations that you need to take into consideration here:

Regulated Offerings:There are firms and establishments who are willing to hire their writers by the aid of a competitive exam procedure.

Initial Public Offerings: The Firms who engage in IPO activities usually go through a process of interviewing a set of underwriters and selecting one from them, in accordance to their needs. The thing is, the larger based underwriters often charge a greater sum of money. Obviously, this is something only the well established firms can afford to pay out.

One of the biggest requirements in this field is that of industry expertise. It is through the help of such expertise that these underwriters are capable of going through the motions in a smoother manner, connecting with the firm in a better way and to overall do their job in a manner that is efficient and profitable for both the individual and the establishment.

There are a lot of packages available in this field. In most cases, underwriters charge something around 7% of the total spread. This is of course when the total offering is less than a $100 million. These packages also tend to include things like trade price stabilization, marketing, process management, placing of shares and things like that. The establishment then proceeds to select the one whom they like the most.

Seasoned Offerings: If the underwriter they are hiring matches the required standard of expertise, then in most cases, these firms have one simple rule for hiring: to go for the bank whom they have worked with in the past. And that makes complete sense from a business point of view. The only real reason why a separation may occur is that the firm has outgrown the underwriter and is now in dire need of a bigger firm.

In such a scenario, the process for selection that takes place is pretty much the one that has already been mentioned right above. Of course, the managers and the ones in the upper hierarchy will try to analyze other options and make a group that is as good as possible for the establishment.

Now there exists a myth that these firms do not promote competition amongst the underwriters when it comes to choosing them. Have you ever wondered why that is? Well, there can be a lot of reasons why that is the way things are. Here are some of the main reasons.

It is possible that these firms are very different to begin with. If more and more firms made use of competition to push the boundaries, there might be a need to offer more than what is already being paid.

It could also be that the firms accept the fact that they will have to offer far more. This is in relation to the fact that they will have to shake off interest on their underwriter from other similar services. Firms which are smaller in size will definitely not be fazed by the prospect of having to offer more money for services like coverage, which is without question one of the most important things needed. Not only that, it would be better if the underwriter is familiar with this company through some sort of past experience.

Another thing that may be the reason is the fact that some of these firms base their hiring in terms of the personal relationship they have with these underwriters.

However, the most pragmatic line of thought would be that these executives are people who like personal involvement from their underwriters. After all, this exists in all professions. As such, this is no exception either. There are people who enjoy getting personal favours from their underwriters. As such, a lot of these job placements are completely based on this criteria alone.

Do keep in mind however that these are not completely mutually exclusive. You may think that some of the prices being asked of you are extremely high to begin with but they’re not. In reality, there are a lot of circumstances due to which this kind of pricing is justified. Things like extra services, taking full advantage of governmental breakdowns and things like that are all part of the ordeal which will be explained in the coming chapter.

23.2 B Direct Underwriting Fees and Costs

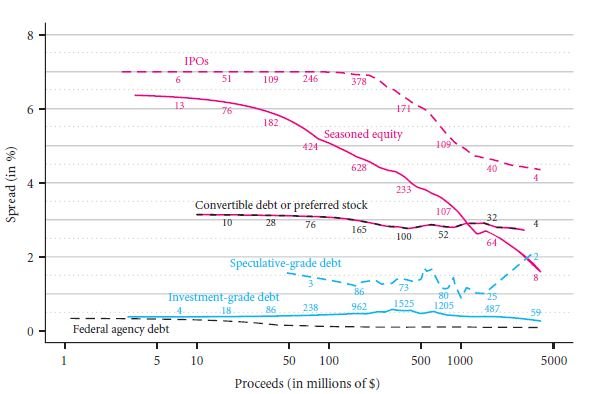

You are probably aware of exactly how much these underwriters charge you for their debt and their equity. However, that will not give you full info about the cost of the issue. The graph below will give you a better idea of how that is supposed to work. You will be surprised to know that the investment which occurs most frequently is offered at around a total of $300 million.

Another firm piece of knowledge that you will be pleased to know about is that there is a greater amount of risk involved in an equity of $10 million as opposed to one which costs $100 million. As such, the costs involved in hiring an underwriter for the previous offer is far greater than one required for the latter one.

The spreads for an underwriter can be easily grouped as follows:

There is quite a strong relation between the size of the offering and the spread of the underwriter in terms of offerings from the equity. The spread is also unrelated to any other thing like the proceeds amount required for offering debts.

Any sort of debt enjoyed by the Federal Agency is usually of the low issuing types especially if the size of the offering is well over that of $50 million.

The costs involved in a debt issue related to investment is contained within a range of around 0.4-0.6%.

When it comes to expenses, issuing a debt related to speculative grade is far more costly as opposed to an investment grade based one. Anything in between the range of 0.8-2% is considered reasonable while the average standard is said to be around the 1.5% mark.

You should also know that there are quite a number of convertibles that you need to take into consideration as well. As far as the spreads are concerned, anywhere around 3% is considered correct.It is also worth noting that these spreads are not affected in any way by the size of the offering. That does not hold true for large sums of offerings, in which case there is a slight decline overall.

It is once again proved that the spreads decline in a monotonic manner with respect to the size of the offer. A small scale SEO will cost around 6% while a bigger may get as cheap as 2%.

For all the IPOs who are based below the $100 million mark, the proceeds they pay are around 7% of the total spread with respect to the underwriters. It is interesting to notice that after this point, the decline in spread is almost as equal as the one for seasoned offerings.According to the NASD, any offering above the usual rate of 7.5% is considered to be too much. The upper limit for any such things is set at around 7% which is considered reasonable. Anything beyond that is usually looked at as something unprofitable and unmanageable because of the costs required to recoup it all. As such, when the time comes that the corresponding equity fund becomes large enough, the fund is raised to meet the surplus requirements. For instance, you will need a total spread of around 6% for a $10 million equity while it is around 3% for the $1 billion mark.

The graph posted above are by no means the only expenditure which you need to take into consideration. There are others as well, which include:

You need to remember that this spread will not take into consideration the other costs involved. There have been many articles by people in the past that reports to this issue. It was reported that around $0.5 million was added due to this spread in small offerings while it extends up to an upper limit of $2 m million in case of large ones.

It also does not take into consideration the time required for getting the whole procedure issued. You will notice that this process takes a lot of time and effort and as such, is a lengthy process. Not only that, any further delays in time will prove to be costly as well. Due to lack of information on project management and delay, it is not possible to access such costs.

However, there are other alternative costs associated with the structure of the capital that has been revised itself.

Bond Rating Costs

A typical cost of around $5000-$25000 needs to be incurred per each issue of a bond if you want to go through with the additional cost related to the debt issued. Having a rating on the bond helps investors analyze the risks involved in each one. It is also worth noting that your firm can issue such bonds only if it is large and stable enough. Not only that, it serves as a requirement for taking part in the paper market.

ANECDOTE

Legal Monopolies: Bond Ratings

Before the year of 2003, there were only 3 main organizations which recognised on a national level. These were the Moody’s, the Standard & Poor’s and the Fitch. Towards the latter end of the 20th century, organizations decided to rely more and more on ratings in order to determine the kind of securities which could be owned. At the very beginning, these raters were merely agents which provided a sort of fee for these service agencies. However, they took on a bigger role later on due to the change in model from issuers to investors.

In the year of 1994, The Moody’s ranking system was ditched by the Jefferson School District. Despite this however, they still published a special comment regardless. This was basically a means to get a bad rating to the School District.It was also something that they sued Moody’s for. However, they could not be charge of anything because of the clause related to ‘Freedom of Speech’ involved in it.

This form of protection helps save countless other agencies as well. It was mainly the investors who sued these sorts of service providers. However, all of the 3 agencies responsible for the rating system received some amount of money for the part played by them. The money was of course, issued by none other than Enron. None of these agencies responded even at the time when Enron started trading at around $3 per each share.

In the year of 2008, on June 4th, it was reported by the Wall Street Journal that these firms had reached an agreement to restructure their method of payment. This was obviously done to make the trend of ‘agency shopping’ more difficult for others to pursue. Gone were the days of paying a firm some money and easily getting back good ratings. Starting from this year, hundreds of agencies started to delve deep into the matter in order to take a better look at the practices performed by these agencies.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

- Corporate claims

- Capital structure and capital budgeting in a perfect market

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

- What matters

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Investment banking and mergers and acquisitions

Links of Next Financial Accounting Topics:-