The Empirical Evidence

Previously explained in Chapter 15, by now you can have a brief idea on the basic patterns involved in financing. Therefore, let us now consider few key points of the financial pattern that publicly traded corporations’ follows to function in USA.

I know that there is not much information available about the financing of private firms. However, here in this book I have tried to simplify it by taking a systematic approach aided with proper evidence.

Providing you with the most advanced research these are what I conclude after going through all evidences and information. Sharing my knowledge with you can clearly depict what we have come across till date.

22.1 How to Measure Leverage

Measuring the total debt of the company in the market can help you to move forward. This will help you later to know the future of the firm’s financial matters. Let’s start with Leverage Ratios:

22.1 A Book or Market Value?

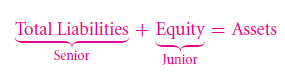

Basically Firms comprise of:

Understand to measure the value of equity. You need to decide between:

- The market value of equity

- The book value of equity

Therefore, decide on the falling things that it is based on:

- Market Value –always measured upon economic value

- Book value – varies in books of accounting every year. Preferably, becomes less.

Generally in the United States publicly traded enterprises:

The market value =2× as large as the book value

Do not always go with this for the ratios will vary from firm to firm. But, the most important thing to remember about the firm who depends on its book value is that they will always sign contracts and bonds depending on their book value.

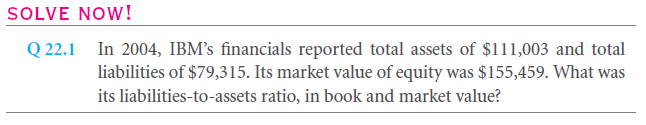

22.1 B Total Leverage: The Total-Liabilities-To Total-Assets Ratio

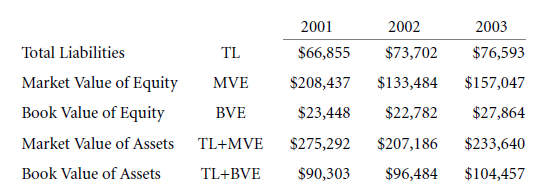

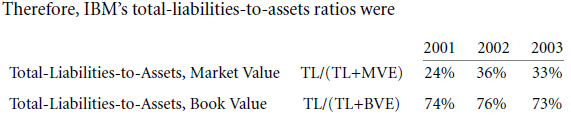

According to the previous formula what you can understand, I have tried to illustrate it measuring through IBM:

To calculate the market worth:

On a balance sheet

Book value of assets – Equity’s + Equity’s market value

Example: for 2001: $90,303 − $23,448 + $208,437 = $275,292

Thus we can conclude that normally the old firms have less ratio of market debt. Similarly in case of IBM, we can see the pattern of the market worth= 2× the book value. These things come into consideration during interpretation. Therefore, the way a reporter highlights about the company will differ with how the CEO will portray the leverage ratio. However, as a researcher or student you keep your analysis simple abiding by the equation rules through comparison with different firms.

If you have problem understanding then just remember:

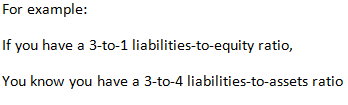

Closely related ratio = liabilities to equity ratio.

Thus you can see that it depends on the same inputs:

- Liabilities

- Equity

However, you will not get the denominator by adding it.

Sometimes, you can face difficulty with handling ratios of equity that is denominated. The problem it has that it’s book worth can be less or even sometimes negative.

Again previously when we said there is no need of adding it, it doesn’t apply to WACC computations. Here, the requirement is of a denominated ratio that has been added. Read on to know other details!

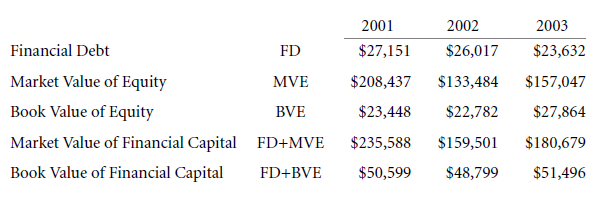

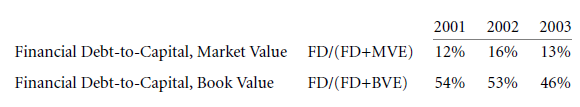

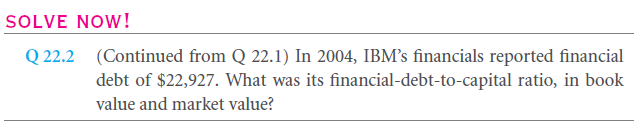

22.1 C Financial Leverage: The Financial-Debt-To-Financial Capital Ratio

Ratio of Liabilities-to-asset contains mainly the non-financial claims. For example

- Accounts payable

- Invented Liabilities

Thus, non-financial liabilities are often ignored. Therefore, you can break these financial claims:

- Long-term debt

- short-term liabilities debt

And thus, obtaining the ratio of debt-to-capital becomes easy.

Step 1: Another conclusion can be drawn that publicly traded companies decide their finance capital to remain between ½ & 1/3 of total liability of the firm

Step 2: In measuring the 2nd financial leverage you need to divide

Financial Debt

Financial Capital

Refer to Table 15.1 for more data:

Thus you can take the financial ratios of debt-to-capital as:

If you are trying to figure out financial stability of a company start by going through the measurements which uses the company’s:

- Short-term liabilities

- Not the short-term financial debt

Here, you can see yourself considering three factors while calculating the short-term liability ratio:

- Assets

- Equity

- Cash holdings

However, always remember that different analysts will refer to different procedure but the main formula remains same. You need to select the formulas that will give results in for of the firm you choose.

Capital at market worth – cash holdings (also the short-term holdings) = enterprise value

Here also the ratio of financial-debt-to-equity ratio considers similar inputs. But, this below amount will not be required for evaluating weighted average cost of financial capital

22.1 D Comparing Total and Financial Leverage Ratios—and WACC

Comparison between Ratio of liabilities-to-assets & ratio of debt-to-capital ratio

- They are cousins

- Firms can have same ranks despite the use of different measures

- Ratio of liabilities-to-assets takes into account the liabilities which are non-financial. In case of the ratio of debt-to-capital it will always ignore that factor.

Now start dissecting few terms

Claim: which a firm gives in exchange to a person when it receives assets from him/her

Financial Claims: comes from either shareholders or their bondholders. Therefore, the money is contributed directly to the firm.

Non-financial claims – the contribution is equal to the financial claims but not a monetory transaction.

In case of IBM:

Firm didn’t pay the full amount of its Employees’ contribution. Therefore, the employees still owe it to the firm. Thus this amount remains as a part of their firm assets.

Thus,

- Sometimes in non-financial liability the firm is subjected to give regular payments

- If the firm fails to pay it can also result in bankruptcy

- All payments should be made from the firm’s funds

- It is done before the calculation of income tax that falls under the category of corporate finance.

The reasons shows why you should go for ratios of liabilities-to-asset compared to ratio of debt-to-capital.

When calculating never ignore the non-financial liability as it may hamper your results.

Financial debt = the marginal source that the firm receives as funding.

Financial debt is paid in dollar that the firm will raise in the next project

Now a firm needs to keep in mind that while comparing productivity that is coming from the next corporate project they need to consider the cost of financial capital done on financial claims.

Now moving on to WACC calculation you will see that compared to the above evaluation, this is easier.

E.g., IBM’s 2003 cost of financial capital that is calculated on its debt & equity. Here do not consider non-financial liability’s cost. Thus as per my previous calculations obtained in reference to an estimation done by CAPM-type, around 7% the firm may have had its equity’s cost.

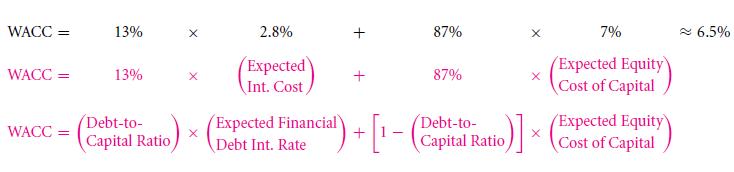

Thus to evaluate WACC follow the below mentioned formula:

The result 6.5% can be considered as a rough estimated cost of financial capital derived over the funds that IBM should have taken into consideration at a more early stage. However, this only applies to 2003 projects of IBM.

How bad are Mistakes?

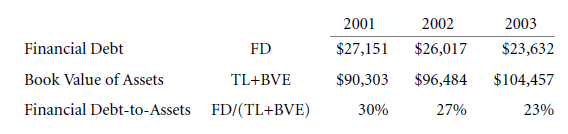

Financial Debt-To-Assets

Sometimes it also happens:

Financial debt ratio

—————————— = leverage measure

Assets Value

E.g.,for using assets’ book values:

Always remember that any company can play with their leverage ratio. It can be easily reduced by slowly increasing the firm’s non-financial liabilities.

Consider a case, if IBM added another amount of $100 billion dollars in favour of non-financial liability or they had received an extra obligation of income tax amounted to another $100 billion, other variables unchanged, and then they would have a reduced ratio of financial-debt-to-assets from $23.6/$104.5 ≈ 23% to $23.6/$204.5 ≈ 12%.

22.1 E A Flow-Based Approach: The Interest Coverage Ratio

Worry not, for I can suggest you another altogether different approach so that you can measure indebtedness. Your measurement can be done by considering the running obligations that the company loses for its debt relative to the flow of money entering the firm’s books.

Thus it gives you a time out from all levels of

- Equities

- Liabilities

- Debts

Thus this naturally flowing money’s ratio = ratio of interest coverage.

It measures:

Company’s operating income that goes to the debt service (primarily the payments received through interests)

It evaluates the enterprise’s financial distress in the coming future.

This scenario takes shape as the company fails to match up to the running debt’s it faces.

However you may notice that there is a problem you can face with this method. The output that comes from measuring the cash flows every year will differ at a bigger rate from year to year.You can also come up with some negative results coz corporate finance varies.

Thus you can understand that obligation coming from principal repayment can be more inflexible than the obligations a firms face from interest payment. Addition to this, a company has to match up to their obligations towards non-financial sources.

However this method throws light on your equation on a different aspect of leverage. Thus, remember a point that you can never make a capital structure fall under a proper category by only calculating through one ratio of indebtedness. You always need to have different styles and angles for measuring capital structure of a company situated in the United States.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

- Corporate claims

- Capital structure and capital budgeting in a perfect market

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

- What matters

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

Links of Next Financial Accounting Topics:-