Risk Aversion in a Perfect Market

Next, we move on and take a step ahead in complexity. Still, we shall continue with our assumption that financial markets are perfect, which basically means many buyers, many sellers, no taxes, no transaction costs and no differences in information. However, we shall now abandon our assumption regarding investors who are neutral when it comes to risk. We won’t assume that they are indifferent when it comes to receiving a certain $1 million and receiving either $1,500,000 or $500,000 with same probability. Usually, risk averse investors would prefer the $1 million as it is a safer option.

There is an issue created by risk aversion. From an all-inclusive risk perspective, different projects can have an influence on one another under risk aversion. Suppose the return of a certain project is always low (-20% for example) while the return of other project is always high (+20% for example) and contrariwise. Then there might even be a possibility that overall risk is canceled out totally. Therefore, for corporate investors and subsequently their corporation’s managers, it gets a lot harder to determine the investment choice that is best, while selecting from a wide range of projects that are available. There is no such thing as self-sufficiency with investment projects.

Now, the question for corporate managers is how their projects work along with their other projects (internal risk management) and even the projects of their investors. So, it is also important to first understand the problems of the investors before determining the kind of projects they would like the corporate manager to undertake. In such a situation, there are a lot of questions to answer for a corporate manager.

Who their investors are? What are their likes and dislikes? How to evaluate the project staying relative to the alternatives of the investors? What are the exact alternatives of the investors? How other projects of the investor interact with your project? Subject is quite deep and wide, which is why expediting into three chapters are required.

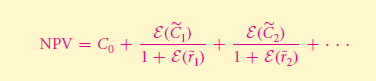

Even though now the details on how to invest have become harder, thankfully all the vital tasks and questions remain the same, so do a lot of their answers. For a corporate executive, it is still important to have an understanding of working with return rates. They also need to know how to decide on rejecting or accepting projects. Net present value method is still usable. There is still a requirement of knowing the expected cash flows and cost of capital of the project.

It is in the denominator where things get complicated. The risk aversion of the investor influences NPV just through the expected cash flows. Regardless of it, considering it as opportunity cost of capital remains to be the best. The difficulty for managers is just that they must calculate somehow on the prospect that should be in the best interest of the owners of their corporation (investors). The same thing is measured by cost of capital, i.e., whether there are better alternatives for their investors elsewhere. If there is a better alternative, the managers should return their capital and allow them to invest where it is better. The other opportunities are what determine the capital cost of a corporation, which consequently determines the projects that should be undertaken.

WHAT YOU SHALL LEARN IN THIS PART

In problems, our assumption is now that the investors are risk averse, just as they actually are in reality. Then, in net present value formula, what is the correct opportunity cost of capital. Just like previous chapters, good opportunities in other places still show themselves in the form of high cost of capital, which should be applied to projects. However, in this part, the opportunities need to be judged by their rewards as well as their risks.

- Chapter 7 provides a brief overview of historical return rates on various asset classes, while also explaining a few institutional setups of the equity markets.

Questions: Did bonds, stocks or cash perform better over past 30 years? In comparison to cash or bonds, how safe were stocks? What roles do brokers and exchanges play? How do stocks come and go? - Chapter 8 considers the options if investors prefer less risk and more reward. It requires an investor’s perspective. How the risks and rewards need to be measured is explained, while also explaining how risk is reduced through diversification. It strongly distinguishes between the own risk of a security and the contribution of a security to the overall portfolio risk of an investor.

Questions: On your portfolio, what is standard deviation of return rate? What is market beta of IBM and what it means for your portfolio? What own risk of IBM, whether or not you should care? What is the mean market beta of my portfolio?

- Chapter 9 undertakes a corporate CFO’s perspective. It explains how the opportunity cost of capital of an investor should be measured, considering that your investment projects can harm or help your investors, as far as the general risk-reward is concerned. This is domain of CAPM (Capital Asset Pricing Model).

Questions: What characteristics influence the expected rate or return? What is the appropriate return rate for a certain project? Where can all the required inputs for using the CAPM be found? Is it trustable?

Further, in Part III, you will be explained what might happen when decision rules or financial markets are not completely perfect.

A First Look at Investments

Historical Background of Return Rates and Market Institutions

Investment as a subject is very intriguing, which is why I wish to provide you a quick overview first rather than establish the foundation and then show you the proof later. You will get an idea about the world of historical on three primary asset classes of bonds, stocks, and cash. This way, you will be able to visualize the primarily important patterns, i.e., the patterns of reward, risk, and co-variation. In this chapter, you will also find a description of a few important institutions that help investors in trading equities.

Links of Previous Main Topic:-

- Uncertainty default and risk

- Working with time varying rates of return

- A first encounter with capital budgeting rules

- Stock and bond valuation annuities and perpetuities

- The time value of money and net present value

- Introduction of corporate finance

Links of Next Financial Accounting Topics:-