In real case scenarios, you scarcely enjoy the luxuries of optimal capital structures and of the perfect size of a firm from the beginning. But, you are used to handling the situations which are caused in the company’s history or past. You obviously have a well-maintained set of instruments which you often put to use. Along with the tools, you also have some goals you wish to accomplish.

But, you should know the ways to decide your ambitions, and the way to achieve them. This chapter teaches you these facts. Here we connect all the dots starting from theoretical concepts of capital structures, to any changes in the very structure and also the firm size.

We well learn both on the conceptual stages and also grasp practical views on them.

This chapter is ample and equivalent to two chapters. Those are: management of working capital and public offerings.

21.1 Capital Structure and Firm Scale

Suppose you are a CFO of a big-scale company. And you want to maximize the wealth of shareholders. But, the current structure of capital was already determined through the past records of your firm—you do not have to start from the scratch.

But, also a fraction of these future changes can be controlled by you, while for some you cannot. Considering your present situation in this case, what are the questions or issues you have to stress upon?

Important points:

What are the special tools you have for applying? What can give you away?

21.1 A the Key Decision Questions

But, there happen to be a set of actions which you are able to take. These are:

- Paying out of cash

- And raising much more money

- Expand your activities

- And much more

Hence, there rise two fundamental questions:

What are you able to offer to your investors for the project opportunities they have?

How much do the investors understand?

But, what if you, you are the manager you want to act upon;for the company’s owner, then you have always to keep two elemental questions prepared:

- Is the only option available to the investor for better investments of money or the investor can find other effective ways of investment on their own?

And if you have doubt, you should indeed return the money of the investees back to them.But in the case of your firm’s ‘investors’ money, on which you can work. They must have ownership for the earnings that companies generate.

- Does your investor have faith in your methods; that there will be an increase in the value—and their money is spent well?

But, your investors have to agree with the judgments you provide, as is the case for a perfect environments for a market, then you will face no problems with them.But what if, there is disagreement among you and your investors?—as this is the usual case for imperfect markets.

For instance, investing is a newly introduced technology and proves itself worth; which is only known to you. But despite its worthiness; it demands to cut the dividends. Your investors may interpret these clauses negatively. So, your investors think that they have to hit on the right market value, which feels to them like throwing away the money.

But, if you can prove yourself correct, eventually they will realize the gain in values, and finally, investors will appreciate the share price.

But for this year, no consolation can work for the investors who were bound to sell the shares this year. So, will you keep on representing your current investor? Or will you switch for a future investor?

Practically, this is not an easy question, and hence there is no predicted answer.

Among the two dilemmas, the later shows that one may worry about the structure of the capital having intricate connections to the operations of your firm. Also, there may be disclosures for every project opportunity, corporate governances, and disclosure policies.

While, there are great opportunities to offer to the investors in your firm, all your managers will be motivated, and this can help you convince the investors to invest for these large scopes. In this case, the simple answer for both questions asked above is yes!

On the other hand, you can also create values by minimizing the dividends and repurchases of the shares and raising the equities.

But, consider that the answer to all the questions is a no, then your firm cannot issue for any equity and hence has to seek for chances to increase the dividends and vice versa.And if there is a dilemma in achieving an answer, you have to arrive at a judgment.

21.1 B Mechanisms Influencing Capital Structure and Firm Size

Let us assume; you have already found out the chief motives of the investors. You are aware of the financial structure and size of the firm. But, most tools you generally use for the capital structure are consequences for the scale of the enterprise.

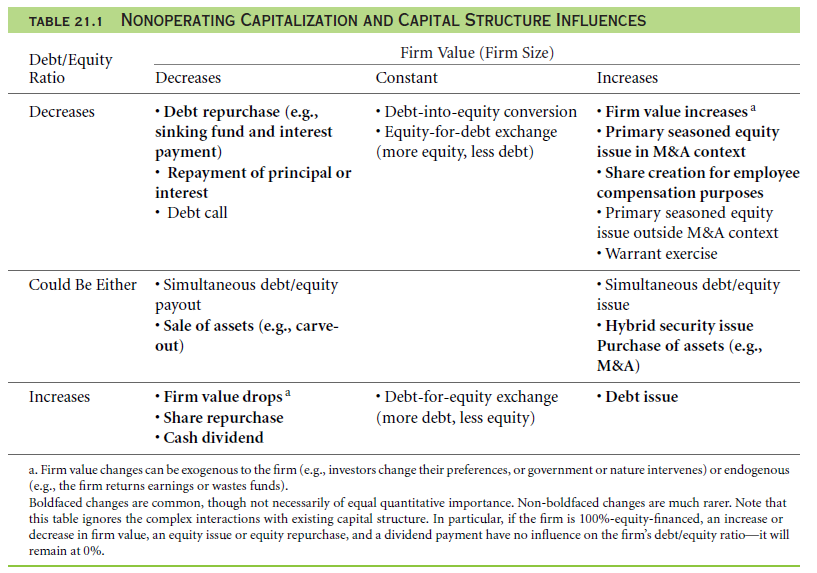

So, if you are issuing any debt or equity, your organization becomes of larger size. Hence, if your organization faces dynamic growth in the right year, Along with The increase in investment of the company, the leverage falls.As CFO, one should use their tools cautiously and should be aware of both possible outcomes—the financial structure and the firm size.Let us see a more conceptual theory for the proper use of your tools. Checkout the image

Among them, it is possible that you will suspect most of the mechanisms.

For instance, when a company issues debt, not only the firm size increases the debt proportion also increases.

It is not easy to deduce the company which for today may have the higher leverage through just a quick look out at their past financial transactions of debts and equities.

Let us discuss some dwelling issues:

Non-financial claims: These claims are often of larger scales as financial liabilities of debts and assets. These operations of corporates can help in increasing both the assets and liabilities exactly like it happens for the financial claims.

Non-financial can be a result of your action. This may be intentional or unintentional.

Existing leverage: In this case, the former capital structure of the firm plays a significant role in issuing. Consider a $200 million worth company with cent percent Debt ratio. But these rates are non-linear in both debts and equities.

Hence, the ownership structures issue 100 million dollars in new shares of investments, and this does not transform the respective ratio of bonds. But on the other hand another, large scale firm with a worth of $180 to $200 having 90 percent debt ratio. It claims the same- 100 million dollars in the equity; this results in a drastic shrink in leverage approximately to $180 or $300 which stands up to 60% of debt ratio.

So, can a company which issues debt and equity of $400 million and $100 million respectively lower the leverage ratio?

If yes—then the firm has $900 million for debt and 100

Millions of dollars for equity. Thus the financial to debt ratio of the company will drop from 90 percent to 87.

Issues in issuing consecutive Debt and Equity: Equity issuing and debt issuing of these often occurs on a joint basis. And so most of these activities are synchronous and merger.

And it is seen that new equities or debts tend to increase in steeply when one firm is acquiring another company. Thus, the scenario often happens such that when a company issues an enormous amount of equity, the ratio of debt goes up. This is not because issuing equity, but because of other simultaneous activities.

Value changes: Various substantial benefits changes and also affects both scales of debt to equity ratio.

For instance, there is a firm that has financed $100 in a 50-50 risk-free situation of debt and equity. Now with doubles in the values of $200 we see that the debt to equity ratio change to 50-150. We are all aware of the aftershocks of return in stocks in the IBM scenario—when the share prices started tumbling from 121 dollars to 78 dollars for each share, the equity of the same is lost for one part of threes of the total value. Thus, the size of IBM reduces, and it increases IBM’s debt proportions.

What are the factors that may initiate the changes in firm value?

There are many factors, but some of them are beyond controls of the manager. For instance, the existing investors may suddenly start averting risks and hence may discontinue paying 121 dollars for per share for IBM anymore in a risky market.

While, there can be other factors which may also change the value of IBM. Such as; broad and diverse orders for video gaming machines, CPUs or a natural calamity can destroy all. So it can be both good and dreadful news.Indeed, a few fractions these changes in values are controlled by the manager. Either your firm is paying a huge amount for equity into dividends to the shareholders, or you are governing the company very poorly.

We usually ignore the effects due to changes in bond price. And when there is an increase in rates in economy-wide, or there is deterioration in the firm’s rating of credit, at those times the debt falls in value along with equity in numerous cases. Conversely, when there is drop in interest rates economy-wide, the credit ratings of the firm appreciate as there is an increase in debt and in equity as well.Thus, the results for changing the rates of interest on the debt to equity ratio are totally ambiguous.In sum, the prime point is simple: Do not ever make any common mistake in equating issuing of debt or equity causally.

The Multi-Consequence and Multi-Mechanism View

For every manager, they have distinct mechanisms which cannot be influenced by you and also you have some tools at your available range. All you need is to point at both the ratio of capital structure to the size of a firm.

The scale indicates the payment of Dividend, bond coupons, debt, and also repurchasing of equities. Issuing any debt and equity is the method of transferring money from the inside of the organization to the owners outside or vice versa.

The ratio of Debt refers to issues about Equity, repurchases of debt, and payments of interest. These are the tactics for diminishing the debt to equity ratio of the firm.

But how do these mechanisms work simultaneously?

Let me illustrate. Suppose you are in that previous example where the firm is in a perfect market environment of Modigliani-Miller.

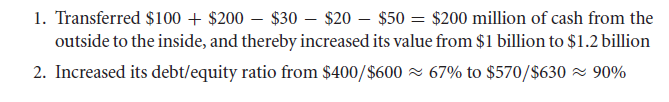

In this case financing it has no influence on the total value of the company. Now assume that the worth of your firm is 1 billion dollars,out of that 400 million dollars is the debt which also includes liabilities of a non-financial category.

Now let us presume you want to raise 100 million in any new equity and also raise 200 million in any new debt. So, you pay 30 million to complete the old debts both along with principal and interests, and also you pay $20 million for dividends. You may also repurchase the firm’s own equities worth $50 million.

Defector, the following is what you have done with your business:

Indeed, the reality is not perfect like M & M.

For instance, if the investors in the real world believe- your organization suffers terribly from every conflict among agencies so you may end up wasting their money. They will surely react in a negative way to the increase in extra money $200 million available to all managers.

However, if those investors have beliefs in higher debt to equity proportion will be able to save the firm; they might react in a positive way to this same increase in the proportion.Therefore, as a CFO, one should consider every valuable effect.But a lack of knowledge about our specific firm makes it hard to comes to a decision whether the markets will look favorable or not for the changes in capital structure.

Necessary notification: No managers can accept the structure of capital as a one-dimensional way. It is intimately linked with the firm size. The directors control the outcomes to some extent.

There is another unusual effect of capital structure. It is the difference between dividends and repurchases.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

- Corporate claims

- Capital structure and capital budgeting in a perfect market

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

- What matters

- Equity payouts

- For value financial structure and corporate strategy analysis

Links of Next Financial Accounting Topics:-

- Theories of capital structure levels changes and issuing activity

- Capital market pressures toward the optimal capital structure

- Working capital management and financial flexibility

- Debt and debt hybrid offerings

- Seasoned equity offerings

- Initial public offerings ipos

- Raising funds through other claims and means

- The capital market response to issue and dividend announcements