The features are made up to the very ultimate level of contrast where there are issues like many of the public offerings that are made initially, are the product of sale.

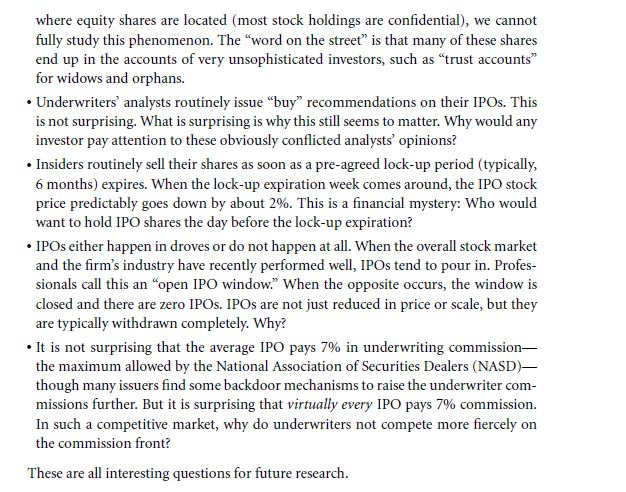

The features are all very different than the IPOs which are:

No established prices that are leapt into considerations, the shares are divided non equally and the prices are not measured into the value of the financial way of the market and hence do not respond to all the announcing ways.

The regulations are all unusual and are made the variants ad hence lead to the certainty that is getting of false or fake statements.

IPOs do not work in that way. They are very assuming and take and set the values of the stocks at different rates. Hence the stock prices both increase and decrease at various different rates in accordance to the market values.

Issuers that work with the IPO sector that is used and is maintained in the variances that the stocks give. When given the chance to make a profit value, there is a lot of chances to score a pretty good profit percentage. Along with the regal chance to be the very interesting optimal point, there is a major fluctuation that you get a factor of. The road of factor there is a heavy chance that the investors get a hold of.

It seems that there are many chances of an ultimate solicited matter that can be solved by the incorporation of all the variances. Coming up with the exact variant assumption that is made. On the verge of understanding the factors that work all the way through, there can be many legal terminology that are explained and created a bond with. The pricing that is included in the end does not complement the values that are presented.

The book representation will give a thorough explanation for all of the dealing and the pricing strategies that are followed. The rates are however no annualized to many people’s dismay. With a collaboration that is followed and made can get the derivation of a lifetime. The bubble that is made can get the various methods.

On the alternative likelihood that is to be encountered you can get the appropriate factorization value. if the IPO is under priced, it only gives a positive outcome such as the drive force to the validation.

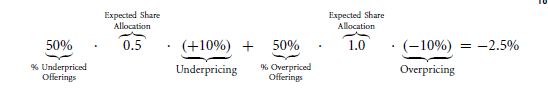

The values that are presented can be also derived by the following solution:

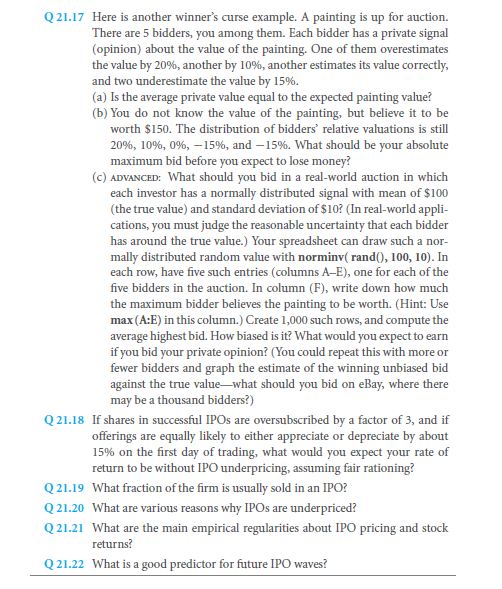

Winner’s curse: the uninformed investor is ought to make the collection of making certain allocation that is most positively stuck on the values to make the selling process a victorious one. On the contrary to what you have heard.

All the firms get the allocation and option to choose the values. This is in fact the strategy that needs to be followed. As the fact is termed and made to be the apt solution there is a great requirement that can be followed. Any conversion can be hence used as to the advantage of all the factors.

Investors can follow the delight of pure joy and avoid all the chances of falling prey to falsehood of promises. As the goods are paid off on a good value scale, makes the value of the project to invest on more worthy. This is how the most substantial demands are met.

The liquidity that you fetch on is a bragging right on the investment that you spent such a less time on. The value that is incorporated and demanded gives a natural hike to the value of the equity. On a term period of 3 to 5 years, all investors get the direct link of how and where to invest on. All the investments that are made are secured in a default manner and the service providers take a passive turn to the monetary evaluation. Hence it is the valid point of structural definition. As of the equity that is on the verge of being declined and made the compact structure of, can get the value that is determinant in the most usual way. The valuations that can be assorted for the topics of various factors are mostly being used in the terminology itself. The stocks are being withheld and called upon.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

- Corporate claims

- Capital structure and capital budgeting in a perfect market

- Capital structure dynamics firm scale

- Theories of capital structure levels changes and issuing activity

- Capital market pressures toward the optimal capital structure

- Working capital management and financial flexibility

- Debt and debt hybrid offerings

Links of Next Financial Accounting Topics:-

- Raising funds through other claims and means

- The capital market response to issue and dividend announcements

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance