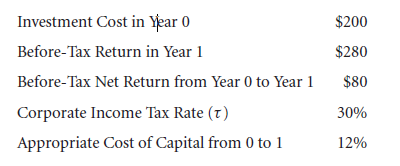

In order to understand a company’s goals and objectives, here is a simple method. Let us assume that there is an imaginary company where the parameters are as follows:

This chart will help you get a clear idea about tax regimes of different companies.

17.1A. Capital Budgeting and Hypothetical Equal Taxation

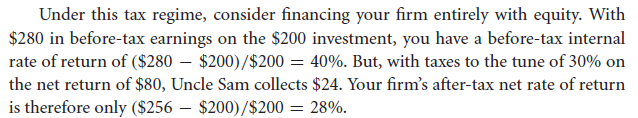

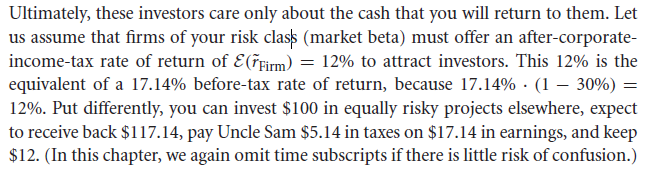

How can a management body evaluate their company’s valuation if imposed tax rate is similar in case of both equity and debt? Even if that company has well managed finance, still they may face with issues regarding their valuation. Now if you consider the fact in terms of real world, you will find that these speculations are simply unrealistic. As part of this hypothetical circumstance, you will find that an investor does not acknowledge about returns labelled ‘before corporate income tax’. What they are concerned about is ‘after corporate income tax.’

After this, there is an important question for which you have to go through different economic opportunities of an investor keeping those economic factors constant.

If asked from the point of view of an investor, how can a corporate income tax change affect its application on that particular company where he or she is making an investment?

Being an investor, you are considered a price taker from a company perspective and raising capital. As there are many other companies associated with that particular firm of your (participation as an investor), you are only a contender in line. This makes very less difference when it comes to your ideas and decisions.

Now there is another important question with reference to the above explanation. Why these taxes are of importance when it comes to a project’s return rate?

Owners or Investors who investor funds in any project do not wish to consider the inside story. For them, the output in the form of profit matters more. There are certain instances that can affect a company, its financial state and its ongoing project. Some of the important ones are:

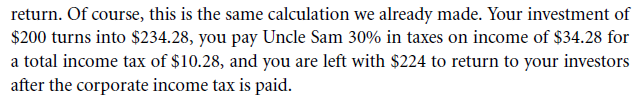

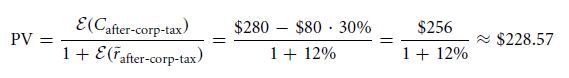

Coming back to handling back of corporate income taxes, one of the best formulas is NPV. It is imperative that you compute present value only following a specific rule. This includes after-tax quantities utilisation in both denominator and numerator.

Let us consider that a company’s before corporate income tax is around $280. ‘After corporate income tax rate’ is 12%. So, its PV can be calculated via:

Now, while computing with this, there are chances that you may come across few mistakes. You cannot expect to get the correct solution if you are using the values of ‘before-tax required return rates’ and ‘before-tax cash flows which are expected’. This will give an incorrect outcome when compared with the outcome related to capital cost.

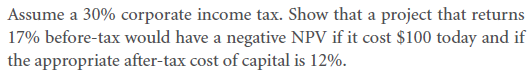

Solve it

17.1B. Realistic Differential Taxation related to Equity and Debt

Explanation of tax code with the help of a model can help you understand better about how it really works. If you consider the example of USA, you will find both firms and individuals have similar policies and laws related to tax treatments. It also includes equality in tax rates and tax schedules. A detailed research will help you understand that changes do take place frequently when it comes to tax code details. Its variations include:

- City to city

- County to county

- State to state

- Year to year

It can be maintained from this information that there is close similarity when it comes to tax codes as its application is followed all over the world.

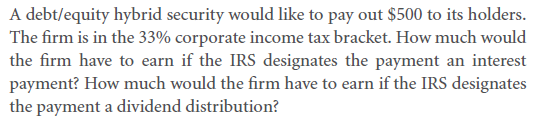

‘Net of interest payments’ is a term that denotes the tax amount that companies pay. We cannot compare this amount with reinvested money or share purchasing amount. In fact, we cannot also consider it to be similar to dividend distributions.

Interest payment of this category is considered as a company’s operation cost by IRS. As per this, it is mandatory for every company to consider these taxes not to be after tax earning distribution. Instead, it will be better if such tax is taken as before tax expenditure. This thoughtful consideration is an outcome from the positive side of a company which is a type of interest payments. This in reality is a mode of tax saving.

For a better understanding, let us take an example revolving around a beverage company. We name it, Campa Cola. Suppose you being an investor,invested$100 as costing related to operations. Again you have a certain amount that they owe to creditors. Let us assume that amount to be also $100. In this case, you will have nothing as funds and the entire $100 will be in the hands of creditors.

Now, if you do not pay in the form of interest that you can do in the form of corporate income tax collection. On the basis of assumption, let this tax be 30%. In this case, Campa Cola is left with $70 which it can distribute or keep it with itself.

It with the assistance of these details in this chapter, that a good CFO can identify and use this differential relative tax treatment.

Now you may think that you can also finance your company with limitless debt. As an answer, you can easily adopt such measure. This is because of the reality in this present world of business and finance. But it also has some consequences attached to it. As you continue to increase the debt leave, it will also hike your company’s cost capital. This increase can only grow to a certain point when there won’t be any value to the increase in debt.

You will come to understand about it later. But what you need to focus on this aspect are the methodologies that managers should adopt when it comes to capital budgeting. This consideration is to be based on no market distortions or any type of taxes apart from corporate income taxes.

Problem to solve

ANECDOTE

Corporate Welfare and Special Tax Breaks

For particular activities related to tax breaks, Congress enacted ‘Special income tax provisions’. These are often on behalf of firms that work individually. The provisional amount of these special income taxes as speculated remains to be of yearly $1 trillion. This fund amount is even higher than federal discretionary spending in totality. Because of such provisions, you will find huge corporations paying less income tax. This in comparison is less when the other side is rest of the relative OECD countries.

Now if we see the constituent of taxes and its effect in U. S., we can see that in 1965, 4.1% was corporate income tax of U. S.’s total GDP. It decreased to 2.5% in the year 2000. Further, there was another reduction in percentage making the new tax percentage to be 1.5%.

Now, there was a stark contrast on the percentage when comparisons were made with Canada and Germany. 4% was the rate for Canada, whereas 1.8% was for Germany.

It was even considered that this low rate of corporate income tax is an excellent example that will attract other countries towards the United States of America for the purpose of business. This in turn can prove to be an ample opportunity to create more job opportunities in the country.

However, this cannot be possible because of the rate of corporate income tax which is less effective. In addition to this, it also comes under the shelter of strange corporate tax. Now, in this case, U. S. has to bear the blunt from both sides.

Those 2 sections include:

- Receipts related to corporate income tax which is low

- Incentives that move out of the firms’ in U. S.

A close eye in the history of financial establishment and tax accumulation, there has been only 1 President who was able to go in the opposite direction of this constant trend. He was Ronald Reagan. In his duration of Presidential duty fulfilment, he reduced companies’ ability to circumvent the taxes, even for corporate income tax.

Links of Previous Main Topic:-

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

- Corporate claims

- Capital structure and capital budgeting in a perfect market

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

Links of Next Financial Accounting Topics:-

- Firm value under different capital structures

- Formulaic valuation methods apv and wacc

- A sample application of tax adjusted valuation techniques

- The tax subsidy on pepsicos financial statement

- Contemplating corporate taxes

- The discount factor on tax obligations and tax shelters

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management