There are a certain number of formulations that allows a company to calculate their brand value. These are not just for calculating debt ratios but also for present financial arrangement. Do you know the prevalent ones?

You will find mainly find 3 essential technique. In this chapter, we will study about 2amongst the 3 methodologies.

WACC and AVP

- Generalisation of the formula related to WACC or weighted average cost of capital highlights preferential debt treatment by reducing debt capital cost

- APV or adjusted present value is easily calculated. This in addition tallies tax subsidies. When going back to previous section you will understand the main aspect with this addition is being made.

On further reading of this chapter you will come to know about another of the methodology related to tax benefit valuation. That method is known as ‘flow-to-equity.’ In context to hypothetical capital structuration, companies create financial aspects and allow calculating after-tax cash flows in a direct method.

It is important to keep in consideration about the small facets of these valuation methods. You have to understand that these are just based on tax models. When you are working for a particular company, on the basis of their savings on debt related taxes, you will find rate of income tax as for fixed marginal.

As this model is based only on assumptions, there are various problems that you will find here that is not taken for granted. The main issue that you will see ignored is tax issues. Some of the problems are:

- The likelihood of default when it comes to income tax payments

- Special tax incentives

- Foreign taxes

- Outright tax fraud and evasion

- Transfer pricing

- Tax loss carry forwards

- Overdue income tax payment

- Dissimilar rate of marginal corporate income tax at diverse income levels

- Recapturing of past tax payments

- State taxes

Many times these models do not show accurate answer or even near to a decimal point. And there are scenarios when you can see perfect functioning of these models.

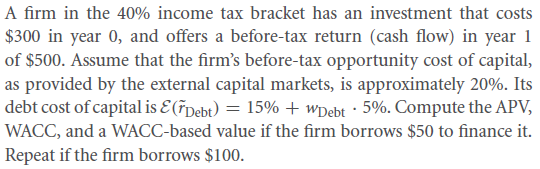

17.3 A. Theory Related To APV or Adjusted Present Value

There are 2 components when it comes to breaking down of Adjusted Present Value.

- For every dollar, there is tax subsidy as an addition. In place of dividend, we generally call it interest.

- A company’s value, as if it is fully taxed and its equity finance is complete.

Going back to the previous section, you can take a look at the table. That table showcases a company’s expected cash flow whose equity financed state is 100%. As the given amount was $240 and corporate tax in totality is $24, the net amount after its deduction is $256. On using the APV methodology, tax subsidy gets added with a debt ratio of that company.

Zero interest payments

Tax subsidy will be considered null and void if a company is fully equity financed.

High interest payments

Belief of IRS on company earning is extremely strange. If an organisation pays $80 as interest amount, IRS will consider it as zero earning. So, it is always advised to company owners to keep at least a certain amount (basic assumption is $24) as an extra from its all equity $254 situation for the upcoming year.

Normal interest payments

Suppose a company requires to pay interest of $19. The return that IRS will see is $261 which is obtained by deducting $240 with $19. Again it will see an investment cost of another $200 from the outcome. This deduction will make the return amount to be $61.

As per fixed collection percentage, IRS will take 30%. So, 30% on $61 gives $18.30. As in case of high interest payment, there was an extra of $24. Difference of both the outcomes will give an amount of $5.70.

Now, if a company is not completely equity-financed, then IRS would have collected this differential amount too.

As another method, your calculation for expected tax saving would have been,

You can consider this amount as tax subsidy (APV) for the upcoming year.

From this given method, we only need to take out a specific formula. The basic formulation that you need to consider at a general platform is the incorporation of debt amount of present, corporate income tax, and upcoming year’s interest payment.

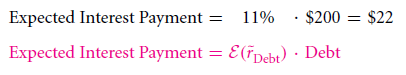

Here we will incorporate another example in the existing example. Suppose you are borrowing an amount. Let it be $200. The rate of interest on that amount is charged at 11%.

So, interest payment as per expectation is:

It is highly suggested that you should not consider rate of interest that is quoted by bank. For a correct outcome, you should consider that 11% to be rate of expected debt interest.

In case you have a small company or if it is highly indebted, this consideration is definitely of concern. For huge enterprises, or even if it has some debt amount, then it does not matter.

When it comes to corporate income tax amount, all-equity-financed company can be said relative to future tax savings. As per this, that company will not require any interest payment.

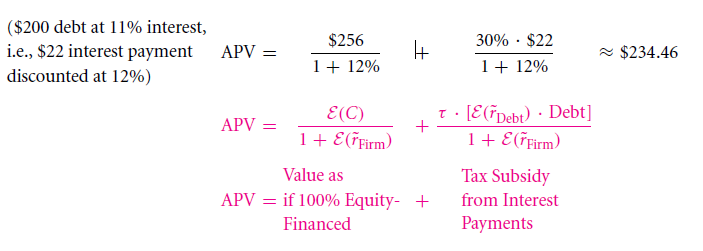

Formulation for this will be:

Suppose Mr X is the project’s owners. So when you are involved in the business, out of the total amount, you can assume to receive an amount with $6.60 less than that of project owner. This is because designated interest in the form of profit repatriation is $22.

As tax deduction will occur in the upcoming year, it becomes mandatory to deduct $6.60. This amount will be calculated as tax savings. After calculating this discounted value with the help of APV formula, it become easier to compute discounted tax savings that adds up to this value.

To deduct tax savings from cost capital of a company,

In actual world, 6 cents does not make any difference.

Quick generalisation related to multiple years can be seen by APV. Tax savings calculation is the first thing which then is followed by addition of present values.

Application related to 60/40 Debt-Financing Case via APV

Let us take an example of a company whose present worth is $234.46. It is also required to keep in consideration that debt attached to that company is $200. Now, on calculation of debt ratio, you can see the percentage to be of 85% ($200 ÷$234.46).

Again, let us assume that this same company has a revised capital structured and they have borrowed or taken $139.16 (new amount). Determining to keep in check of their debt capital structure, which they intend to keep low, they plan reduction of debt capital cost to 9% per year. This intention is to curb and reduce expected return rate that risk-averse investors highly prefer. They also like to associate with companies where there is risk free and lower level of debt. So, what will be the expected firm valuation?

The answer is easily achievable with the help of AVP formulation. Initial step is to start with complete equity firm whose calculative formulation is,

($256 ÷1.12)

To its resultant, you need to add tax subsidy. So the total calculation after this showcases 9% of debt on interest payment of $139.16. Therefore, in the upcoming year, ratio will be $139.16 ≈ $12.52. So the calculated percentage will be 30%. This again makes the net year tax saving calculation to be $12.52 ≈ $3.76.

Now if you will consider the current worth, it will stand to be $3.45 after deduction of 9%. So,

For preference of expected tax shelter related to cost capital of a company, the calculation will be,

Here differentiation on capital cost over tax shelter will be as low as $0.09 [$3.45 − $3.36]. So as per APV formula, fully financed company in debt of $139.16 will have the worth of $232 in total.

17.3 B. Theory related to WACC (Weighted Average Cost of Capital with tax adjustment)

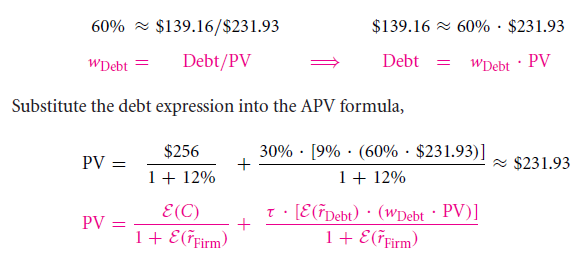

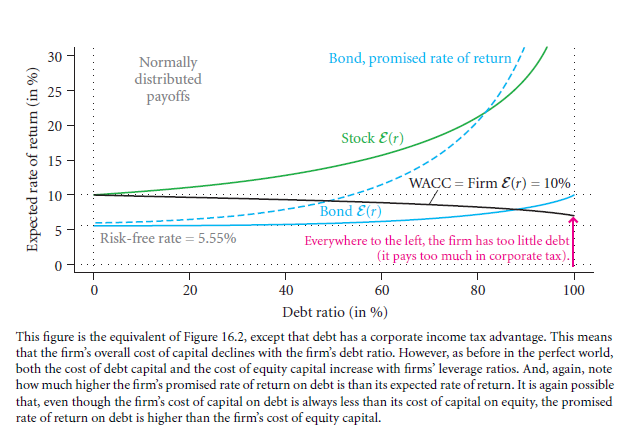

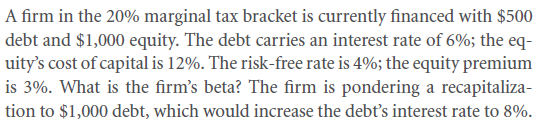

This is the second most advantageous methods that are required for calculation of a company’s weighted average cost of capital with tax adjustment. There will be apparently 2 methodologies if you use the formulation of APV. This you can get from the above calculated computed table.

So it is better to choose 60/40 debt/equity financing where debt capital cost is 9%, rate of corporate income tax, and before tax return is $280. You will also find that after tax return is $256. Now like how that company was borrowing money, it again is taking a loan of $139.16. As per this, its net payment in the form of interest is $12.52 because of 9% rate of interest.

Tax shield percentage when is 30% gives value in 2 configurations. It may be either $3.76 or $12.52.

From the above formula, company value can be calculated by,

Differentiation between WACC and APV can be made simply. Debt ratio of a company is expressed by WACC, whereas APV denotes payment related to interest and debt value expressed in dollar.

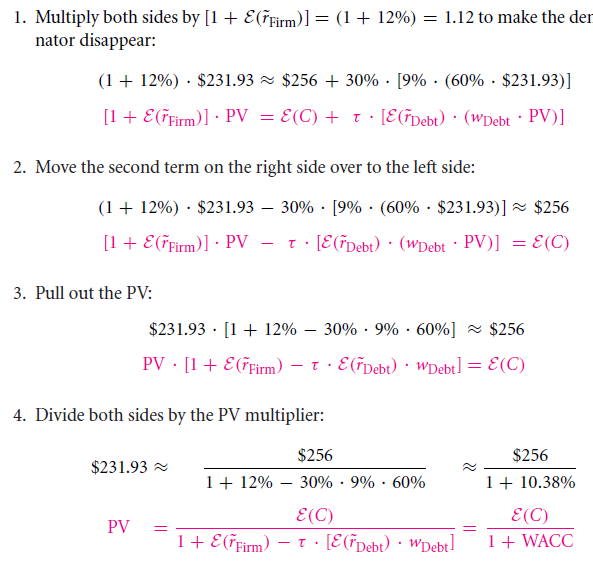

With the help of this formula, you can calculate PV which is visible on both sides. Here the detailed steps:

Again we can say that,

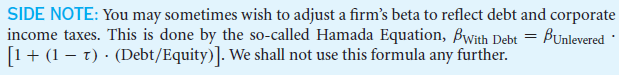

Looking back to the previous chapter, you will find M&M WACC old formula that we will generalise with the new WACC formulation. As per this, you can consider tax subsidy to be of no use if corporate tax rate is 0. Here ‘τ’ is used for denoting corporate tax rate. Current WACC formula with tax adjustment simplifies the work.

Most companies which are publically traded in U. S., do use this formula to achieve zero as their marginal tax rate. Tax shelter is not helpful for such companies taking debt. This simple WACC formula does not consider interest and its tax subsidy. N case if new companies there are no choices as this of WACC formula, giving a positive rate of corporate income tax.

Utilisation of a company’s capital cost, debt ratio and rate of tax are constant in a multi-period setting. So current will look like:

It would become highly difficult to calculate WACC in a proper way if these elements were not constant. Most companies do not plan on taking to debt financing on a higher ratio which they may find difficult to repay. In this case, WACC cannot handle and find utilisation difficulty when it comes to managing nonfinancial liabilities. WACC confronts this difficulty with marginal capital cost.

In case of real life scenarios, this formula is used for swift assumption. So, we can conclude to the fact that WACC is not an efficient choice as that of APV.

Important thing to note

WACC formula which is tax adjusted with less capital cost reduces future cash flow. You can see it clearly in corporate tax shelter (income). It is highlighted as:

Capital Cost in Corporate Tax imaginary World

Questions to solve

2.

3.

4.

5.

6.

7.

Additional Info

How Bad Are Mistakes?

Application of WACC and APV related to Current Cash Flows

In most cases, you will find that APV and WACC are used in an incorrect way. There are also times when major mistakes are made by analysts on minor grounds. It is like not considering the fact that a company requires completely taxed and equity financed when it comes to current numerator value with correct cash flow.

You can comprehend with the example in this chapter, in the previous section explaining about projects with cash flow having before tax of $280.

That section will help you realise the areas of mistake that are higher in probability aspect. Modest errors can be considered when mistakes are made in case of tax shelters whose application in seen via rate of discount. However, error in case of mistaken cash flow won’t give you the correct answer.

You need to consider the fact that APV and WACC can only work correctly if after corporate income tax and equity finance is complete for a company. This is not mandatory that the current or present cash value of that organization is dependent on both these aspect highlighted in the ahead.

Links of Previous Main Topic:-

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

- Corporate claims

- Capital structure and capital budgeting in a perfect market

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

- Relative taxation of debt and equity

- Firm value under different capital structures

Links of Next Financial Accounting Topics:-

- A sample application of tax adjusted valuation techniques

- The tax subsidy on pepsicos financial statement

- Contemplating corporate taxes

- The discount factor on tax obligations and tax shelters

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management