As you are aware of the basic details of company valuation, are you confident enough to apply the knowledge now? Or precisely to be considered, can you incorporate this information into actual world when it comes to handling corporate income tax? A good example canbe given in the form of PepsiCo Company. At the end of the previous chapter, you can see a table highlighting this company’s income statement. So with that, how will you calculate its tax subsidy?

Looking back to the year 2000, operating income of this company was near $3.818 billion. However, the income tax on this amount that this company has to pay was like to be somewhere near $3.761 billion. The rate of corporate income tax on an average is nearly 32.4% of this company. This makes the income rate amount of PepsiCoto be somewhere near to be $1.218 billion.

This amount is payable by this company as it is not completely equity financed. In case if it would have been then PepsiCo’s operating tax would be near about $1.237 billion. This calculation is on the basis of the amount of $3.818 billion. So if taken on a hypothetical aspect where this company’s dividend payout is about $57 million, it would have earned $57 million as an amount of interest.

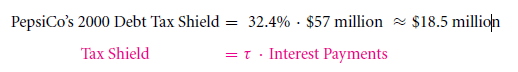

Now, PepsiCo has already imposed tax shield to its name in the year 2000. So interest in its prospect will be calculated via the formula:

It is not required that you have to compute the debt equivalent value with this formula. This is because of the already applied tax shield. Also because payment related to interest is directly visible in the financial statement.

One of the speculations related to this model is that a constant value is a marginal value. In this case, the formulation sits perfectly. In the case of huge corporations rate of average tax and marginal tax usually remain similar. From this information, it is clearly comprehensible that PepsiCo at an average rate of interest as 32.4%. This on calculation showcases dividend of $57 million. You cannot be completely dependent on this model as it ignores many aspects. Those are like deferred taxes that come as complicated tax problem category.

Links of Previous Main Topic:-

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

- Corporate claims

- Capital structure and capital budgeting in a perfect market

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

- Relative taxation of debt and equity

- Firm value under different capital structures

- Formulaic valuation methods apv and wacc

- A sample application of tax adjusted valuation techniques

Links of Next Financial Accounting Topics:-

- Contemplating corporate taxes

- The discount factor on tax obligations and tax shelters

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management