It was already pointed out that discounting an amount from the tax shelter when a company does the valuation is a common practice. In this section, you will get the explanation why is it being applied.

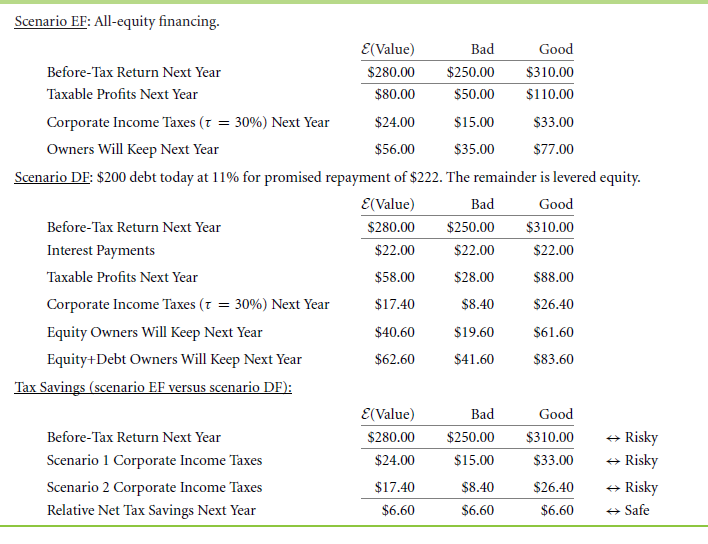

If we go back to the beginning of this chapter, we will come to a table.

As per this table which is taken to highlighted the fact, this is to make the complete comprehension process easy. From this table,you can see risk free debt. Just for this case, it is essential that the equity, in this case, should be risky. The motto for this requirement is obtaining appropriate discount rates which are different and also has variation in risk level.

In accordance with the company that is under scrutiny here, assumptions regarding its beta are positive.Because of this, equity capital cost of that company surpasses to its debt capital cost.

2 financing ratios related to a risky company which is 1 year old

It is via this table that you can see the revised picture related to financing scenario. There are 2 important questions that come up from this table representation.

- When it comes to future tax obligation, what should you consider to utilise as capital cost or appropriate discount rate? In this case, the DF will be $17.40, and EF will be $24.

- Suppose there is a differential amount between the 2 points highlighted above, say of $6.60; again how will you make use of capital cost to find out the value of relative tax shelter?

You can consider the company value to be of a certain amount, say $280. On that very amount, the earned interest amount can be either $310 if the condition is extremely good. Otherwise it may be $250 if the scenario directs towards the bad condition. The probability of being any of the situations is equivalent. As per this consideration, if the debt amount is $200, the interest imposed on it is risk free. The provided rate of interest, in this case, is 11%. Being the construct in such a particular way, cost capital related to debt is risk free,and its utilisation is made with 11% taken as interest percentage. This interest percent is related to cash flow,and the resultant from it does not cover the valuation of that company. Due to this, for cash flow, you can also use a higher rate of discount. This will give you the resultant on the positive side of the company.

A closer look at the last section of the table that is highlighted above depicts obligations related to income tax. It is clearly stated of the tax to be of a risky aspect. As per the yield regarding the firm in relation with the coveries, it is under any of the financial circumstances.

Let us take an example of an investor whose name is Uncle Sam. From the provided information, we can state that he is also a co-owner of a company X. now as he is actively involved in the business;he will be partaking in both the bad and good times of that company.Now, when you are seeing the entire fact, you need to remember to using rate of discount on tax obligation has higher consequences that that of risk free rate.

Again in this context question arise in the case of capital cost over tax shelter. Due to debt, you can clearly see it in the table that tax shelter has the same value, i.e., $6.60.Whatever be the performance of the company, this value remains constant.

Construction of this example was purely based on making the comprehension of debt payment simple. It also maintains the information about tax shelter with the help of debt presence of owner regarding company fortune.When it comes to the aspect of company safety, debt is one of the important and secure aspects. Another of the safer aspect, in this case, is a tax shelter. So it is always advised that on tax shelter it is better to use a discount rate. Its process will be similar to that of using on debt amount taken by a company.

Another of the common practices that are prevalent in business is debt capital cost instead of using capital cost when it is about the fulfillment of tax obligation of that company. It can be considered to be a deliberate invitation that in most cases lead to question formation why is such mistaken discount factors are offered in general.

However, when it is in a specific context that describes tax shelter discounts, this deliberate methodology is taken to be a convenient method.

Here is an explanation why is it a good technique.

- If it is about the higher amount, it is imperative that you get the correct rate of discount. It is considered a mistake if you wish to obtain discount rates on singular cash flow components. Why singular discount rates can’t be applied to various companies like:

- SG & A

- Advertising

- Paper clips

- Marketing

- Taxes

- Furniture

- Depreciation

There are many more of such companies that fall under this category. Now this aspect is both beyond the capability of anyone and also impractical. It will be a modest assumption that you will have to add the precise valuation so that the possibility of having incorrect resultant because of a wrong discount factor is absent.

When it is about cash flow, how big can it be from the aspect of tax shelter? Now the given debt value be $200 and value of cash flow be $280. As you can see this value to be huge, this in itself is an unusual fact.This is because in general cases 30% is the highest percentage that a company has as its debt ratios. So an interest of 11% on the total amount ($200) will give the resultant to be of $22.

The next step will be to multiply the percentage of corporate income tax with the valuation of 30% so that it becomes easy to acquire $6.60. This amount can be stated as a tax shelter. After you obtain the value, one of the main questions is to understand, or better said, to analyse wit which value should you make the discount amount. Whether it should be debt capital cost of the company or should it be with a capital cost of the company? In both the prospects, the value of the former one is 11% whereas in the latter case the percentage value is 15%.

On computation of both the percentage value, the outcome will be $5.74 and $5.95. Differential aspects between both the amounts are just 21 cents. This answer is taken into consideration in the case of cash flow which will be calculated in the upcoming year.

It is a noteworthy aspect that you need to consider to be careful with the value of correct discount rate on $280, which is the cash capital of a company. Also with this fact in consideration, you require to use tax shelter. However, this additional value wills not much difference in the calculations relate to debt capital cost in consideration to tax shelter and capital cost of the company.

- The overall capital cost of a company can be accurate when compared with debt capital cost. This is due to the fact that it is not a simple process to generalise intuitions related to tax-shelter which is risk-free. The duration of it may be from a single period to many other periods. One of the main reasons for it is that in case value of your company increases 2 fold, and then you have the liberty to borrow twice the amount in the upcoming year. This is an advantageous factor that will help you in saving more tax. If you follow this strategy for your company regarding dynamic borrowing, you can see a positive change. This is because the tax shelter that you will be able to acquire with the help of debt financing will make your company value to grow in place of making it remain constant.

Intelligent policies related to the capital structure should be previously considered so that calculations related to tax shelter for a lifetime becomes affordable for your company. This policy following step induces in the debt ensures the addition of dollar leading to the implementation in valuation also in a tax shelter. In addition to this, the positive changes in the company can be seen via covery. It is because of this reason which initiates tax shelter discount to be with the company’s cost capital instead of being calculated with debt capital cost.

Now, this is a theoretical expression. When going through numerical aspect,we need to consider an enterprise whose age is 1year. As per real world assumption, this company will either vanish from the market, or it will have its operational value doubled. This company in case follows a dynamic debt policy then its yearly tax shelter and debt will be risk free. You need to consider the fact that 10% is risk free debt rate.Aside to it, it requires to be assumed that expected tax shelter of that company in the upcoming year is $22. In case it doubles, tax shelter and risk-free debt will be two folds too. Its disappearance will ensure the absence of tax shelters.

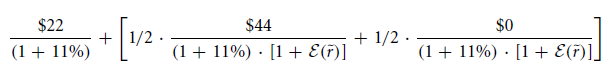

An important question in this aspect is how such dynamic aspect can affect discount rate 2 years from the present when accounted for a tax shelter. It will be an incorrect technique if risk free rate is discounted. Calculation on the basis of this fact will be,

$22 ÷ 1.112 +$22 ÷1.11 = $37.68

But in reality, the computation will somewhat be:

In this case, E(˜r) is capital cost of that company. As shelter cash flow is dependent on the performance of that company, the assumption of it having risk free rate is a mistake. Also, it needs to be kept in consideration that value of cash flow will either be $44 or $0.

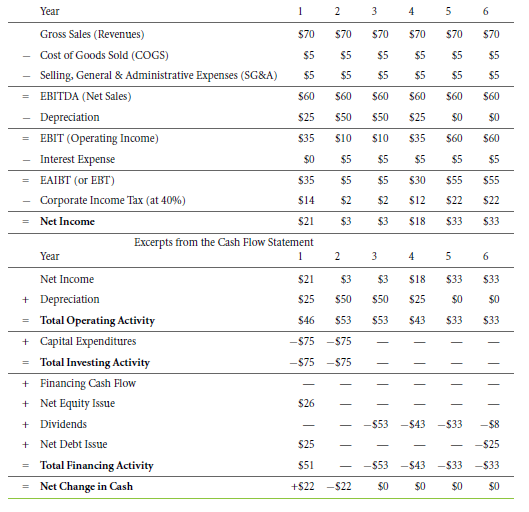

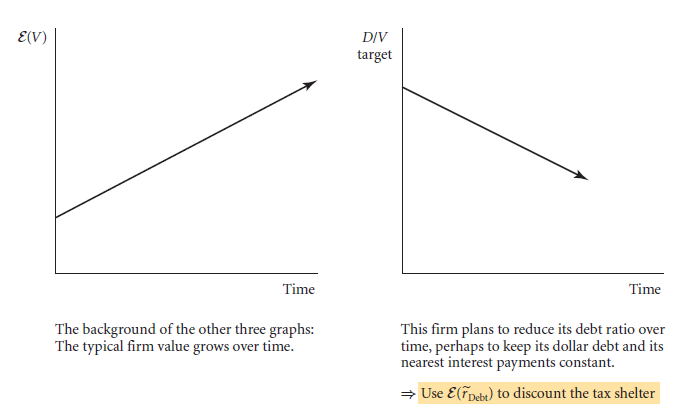

As per this table, you can get an idea of the reasonable choices that that you need to use as the rate of discount and implemented on shelter taxes. Again based on the chart, you are required to assume the fact regarding a specific company which has positive growth overtime.

Focusing on this assumption and taking the help of the provided graph, there are few aspects that you need to consider.

- Increasing debt target

You need to consider the graph on the right side in the second image to analyse this debt target. As per this graph, the depiction is regarding 2 companies whose debt target is increasing. In the real world, such debt policy is uncommon. When consideration is about the usual research and development projects, those companies whose debt flow is in consistence or they do not follow the continuous target. These types of companies are not able to sufficiently produce net debt capacity at the beginning of the startup.

But after this research and development project takes off, cash flow regarding this company will initiate a positive side which can be clearly seen in the debt financing of that company. You will be able to see a constant blue line in the graph. With time, this line will try to gain a higher aggressive measure when it comes to debt policy. Correlations of these tax shelter valuations are higher when compared with the firm’s value. This aspect can be only considered and taken into practical use if there had been consistency in the target or it might have been constant.

So in the case of calculation, it is important that discount in the total valuation of the company should be maintained with more aggressiveness.To achieve that, it is important to use certain rate of percentage on the overall capital cost of the company. To obtain its resultant, the computation should be with the value closer to that of equity capital cost. Valuation of equity can be denoted by E (˜r Equity).

- Constant debt target

In the very second image, you have to take into consideration the left graph. As per this graph,you can understand the planning what a company targets and prepares so that its debt target remains constant. An effective targeting methodology that most CFOs use for keeping their company’s debt ratios to be constant is paying for lip services.

The increase and translation surrounding the growth of a company is higher in the case of debt. This follows by interest payment in higher quantity, that too in dollars. Resultant for this change results in growth and shrinkage of tax shelter which ultimately affects the company valuation.

This gives the meaning that in certain situations it is better to use the values (especially that of percentage rate) which are near to that of the overall capital cost of a company. E (˜r Firm) denotes capital cost in overall valuation of a company.

- Decreasing debt target

As per the first graph image, this decrease in the target can be seen on the right side one.A closer look at this graph highlights that fact that the company in discussion here that is considering and taking proper steps to decrease its debt ration when consideration is taken for a certain period of time.

This graph relays the fact that if a company which is growing over time wishes retention of their interest payment in the form of the similar absolute dollar. This type of company would have its expectation of saving similar dollar amount when it comes to tax submission in per year basis. This anticipation is based irrespective of the performance of that company. So, for calculation, it is advised to use the rate that is near to that of debt capital cost. E (˜r Debt)is used for representing debt capital cost.

These aspects, when explained with examples and with simplified graphical technique,can help in understanding the valuation of the complete project. This will also help you get a grip on the robust flow of work when it comes to the variations in moderate aspect. It will also help you to analyse the mistakes when it comes to making choices with respect to that of the rate of discount that in most cases are implemented on the tax shelter.

Now most companies will try to use the highly convenient methods to monitor and keep in track the expenditure of their business. Their speculations are more or less towards the underestimate or overestimate regarding the value of true company worth.

One of the prominent areas that you require to consider and worry about is tax shelter and what should be the value or amount that you require to pay for it. Apart from this, the other factors are indeed the secondary aspects. 2 of those can be stated and highlighted in this context are:

- Debt capital cost

- Capital cost of a company

Now for the latter one, the precise consideration is the discount factor in the accurate level of capital cost utilisation for company valuation. Computation on both the facets is important, but as said earlier, these are just secondary facts that can be taken care only later in the calculation process.

In this entire chapter, there are sections where it has been advised to use values very carefully in order to avoid mistakes in results. But it is also a fact described in the context that there are certain sections where you are given free reign to calculate values with considering the consequences in the calculation. It is basically giving a lax in areas like value input in case of discount factor.

Another of the factors that is not of much importance is a tax shelter. In a precise way of delivering the calculation, the concept of lax is on expected amount that is considered to be put on tax shelter.

Now, this is also applicable to certain distinctive risk factors that you can see in the tax shelter. This valuation is based on expectation related to the value.As per the certain figure (on the basis of quantity) hat is implemented on the current numerator value that is showcased in a tax shelter. But it also has to be considered that the calculation should never be made with a discount rate which is also taken as the denominator.

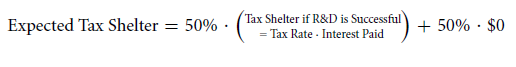

One of the excellent examples that will help you get a better idea of it is taking research and development project.In accordance with such project, the generalised image of it is not to be a good aspect when beginning as a source of business. This is because such projects are expected not be efficient ones and is not a good choice for tax shelter generation. This if taken or calculated on the facet of timely basis, will show the profitability of the project (that too expected) half the time.

Now in this context, the PV numerator or said in a simplified method, expected tax shelter; on discounting the value, you can get the assumed result as:

Important factors to consider

One of the common or the generalised reasons regarding tax liabilities and its valuation is dependent on the rate of discount. It is to be kept in mind that overall capital cost of a company is equivalent to the tax liabilities after the implementation of the rate of discount.

If you take tax obligations,you need to consider the fact that it is imperative to apply the rate of discount. These rates are basically a necessity that is also essential to be put in tax shelters too. In case the rates are not precise, the resultant obtained after calculation can be taken as a reasonable answer for company valuation. In addition to it, you can consider this approximation to be convenient. When the consequences are seen or taken for the value, these mistakes being of minor importance can be taken as a reasonable answer.

There are certain additional aspects that you need to follow when computing to get the value of a company.

In case if a company is planning to increase the ratio of its debt, it is imperative that it uses capital cost related to that of equity. It can be represented with the help of E (˜r Equity).

In case if a company is planning to keep their ratio of debt at a constant level, it is a must follow a fact. The company needs to use capital cost related to that of the company. It can be represented with the help of E (˜r company).

In a certain case, if a company is planning to keep their ratio of debt to lower level or trying to decrease it, they should follow this. It is a definite measure where it is a requirement to use capital cost related to that of debt. It can be represented with the help of E (˜r debt).

The 3 points that are given above is based on the speculation related to the evident growth of a company. This growth is considered to be directly proportional to tax shelter with its valuation increase overtime. This is a common factor that you have already seen in this chapter.

Important Questions to Solve

- Can you consider a risky debt which is acquired from a tax saving an asset? You have to consider that company to be a default.

- Suppose you want to obtain the discount rate in appropriate value to be precise. This you want to achieve by using APV formula (mainly implied on tax shelter). State the type of discount rate that that would help reduce debt target when applied to any company. Also, state what you would use for hiking that same company’s debt target.

- Assume that there is a company that does not have any default. State whether in a debt amount tax obligation is considered an asset of prominent risk.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

- Corporate claims

- Capital structure and capital budgeting in a perfect market

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

Links of Next Financial Accounting Topics:-