If you see the example of tax implementations in textbooks, it would seem that those were made for a perfect world where there was no difference between equity and debt. But as this is a real world, both general public as well organisations have to pay interest. The payments from subsidised companies have to be relative with respect to other organisations. Few factors that these subsidised companies will have,

- Repurchase share

- Dividend payment

- Retaining their earning

Because of these 3 reasons and also standing on the grounds of corporate tax grounds, debt is usually preferred by companies.

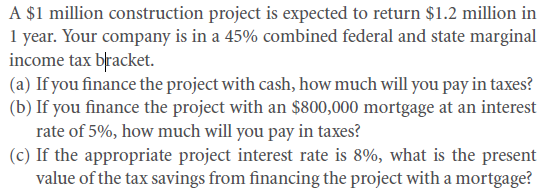

This leads to rising in a question in this context. When it comes to debt interest payments related tax subsidy, what will be the valuation of a company before it?

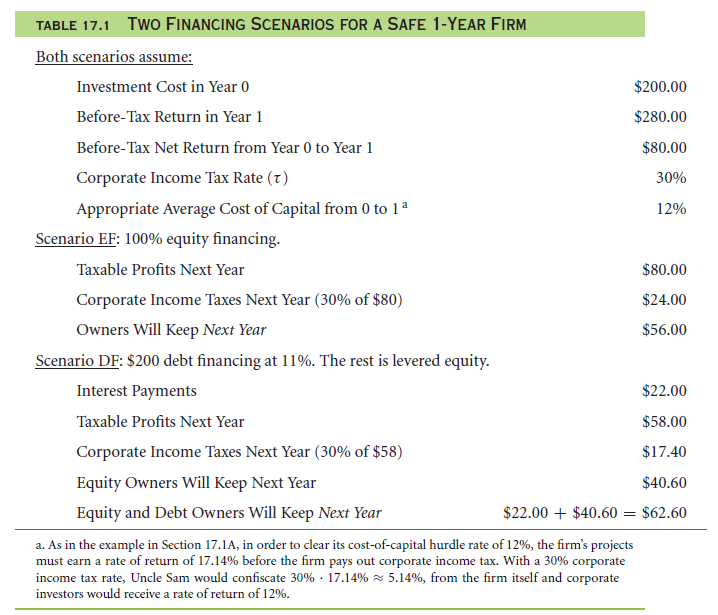

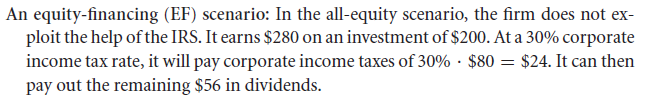

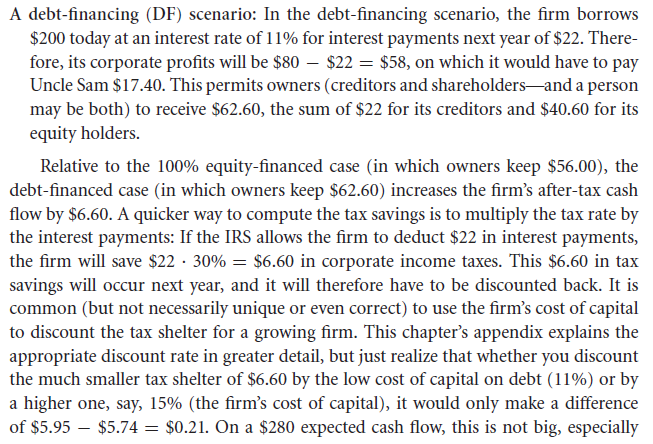

This question’s answer can be given with the help of a specific table.

Problem to solve

ANECDOTE

The RJR Buyout Tax Loophole

Increase in indebtedness of a company can be seen in the case of LBO or leveraged buyout. This drastic hike acts as a catalyst for corporate income tax reduction. It was on the grounds of esoteric tax loophole where the takeover of RJR Nabisco as per Boston’s plan, which is near to closure. A fancy method of indebtedness growth, food operation, was used for deferring taxes. According to that, RJR expected savings of nearly $3 billion to $4 billion as corporate income tax. If it had worked, federal U.S. deficit in yearly basis would have seen a growth of a minimum of 2%.

However, this situation never came to existence because of Boston’s lose in this huge bid.

Links of Previous Main Topic:-

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

- Corporate claims

- Capital structure and capital budgeting in a perfect market

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

- Relative taxation of debt and equity

Links of Next Financial Accounting Topics:-

- Formulaic valuation methods apv and wacc

- A sample application of tax adjusted valuation techniques

- The tax subsidy on pepsicos financial statement

- Contemplating corporate taxes

- The discount factor on tax obligations and tax shelters

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management