Let us now turn into the other portion of such a problem of a future value. If you are to know the entire money you are to have by the coming year, this will be that of the value hold for today? The value will be very important in the context of corporate where will the regular question will be “if a project X is to return the value of $1 million at a time period of 5 years, then how much must you will pay to take under the project at the present time?” the process of capital budgeting, is the process that will tend as the answer to this question. It is the important decision making that must be followed. (the term originated from the very idea that business brands mostly have a certain “capital budget” which allocates into the projects in that budget.)

Here is the rates of returns formula,

All that you need to get the answer from this formula is to give an answer for the following questions:

- If the remaining interest rates of the existing economy isr1, what will be the project’s worth today, given that the future value will be C1?

For example, if you are thus looking for a present value, the amount of the future value, what will that be at this rates of return? Let us, take an example, supposedly if the given interest rate is that of 10%, then what amount must you save to receive a sum of $100 the coming year? If the project is worth $100 the next coming year, what will the project valued of on the current market? The answer will be left upon the decision making as to who will be translating the money, i.e., the present money. So, you will have to simply supply with a rearranged rate of returns formula.

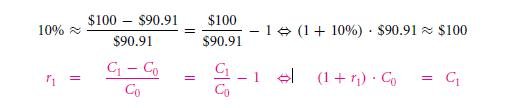

Check this out – investment that you make is that of $90.91 with the interest rates that are of 10% and will return in the upcoming period:

The entire present value formula that uses discounting is known as division operation. ‘Discounting’ is the term which indicates a reason that we must be on the right path in reducing the value and are doing it when the future cash is being translated into a current cash value. In case if you want to, then all can wonder about ‘discounting’ as a conversion that is of all the future cash flowing amount to the present current value of sum which is equivalent. Hence the term discounting will be accounted for as reverse accounting.

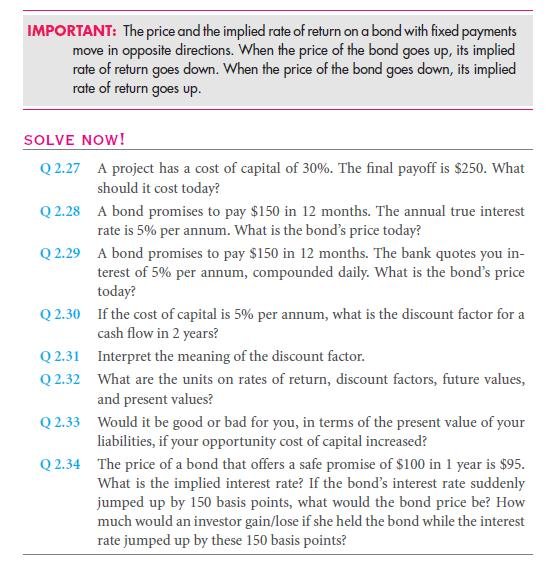

Therefore the current present value for all the upcoming year is $90.91 this is the value of today’s future in cash flows. If the value is that of the project will cost, and if you borrow an amount at interest rates- 10% from somewhere else, then there will be no difference in receiving $100 the coming year, and the receiving of $90.91 presently. In contrast to this situation, if the rate is standardized in an economy as 12% for your project and that it will be a great deal to grasp. The present value of the project will be,

This will be lesser valuable than the previous value $90.91. If the rate of return was 8%, this project will be a stupendous one. At the current present value, the future value will pay off,

This will be lesser valuable than the previous value $90.91. If the rate of return was 8%, this project will be a stupendous one. At the current present value, the future value will pay off,

This should exceed the cost will be that of $90.91. The existing present value for the remaining project will weigh off against the cost and will determine the course as to whether you must take any project at today or not. The present occurring value will be “the number of prevailing interest rates that you wanted, how much of it will be saved by the next year?

This should exceed the cost will be that of $90.91. The existing present value for the remaining project will weigh off against the cost and will determine the course as to whether you must take any project at today or not. The present occurring value will be “the number of prevailing interest rates that you wanted, how much of it will be saved by the next year?

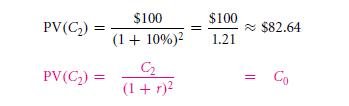

Let us do the exact same calculation, but this time with the time extension. In case the interests rate was 10% for a period, then what would be the value that is of $100 in the duration of 2 periods? The main value of this is,

In the periods, you can earn such rate of returns for (1 + 10%) * (1 + 10%) − 1 = 1.12 − 1 = 21% from somewhere else. Thus, this is an appropriate comparison rate of returns.

These rate of returns, which is used to finance the project, is the discount rate or cost of capital. Thus, this will be a rate of returns that is used to raise the money. In a hypothetical market, the opportunity cost is also moreover cost of capital. Remember, that you need to invest money, at such a rate that it will be an investment elsewhere. Better alternative investment routes will give rise to higher cost of capitals and low value of specific investment projects. Any investment that will promise to give $1000 on the coming year is less worthy if you are earning the 50% instead of 5% which is in some other place. A nice rule that you can develop to your advantage is that of “opportunity” in front of “cost of capitals” – that will give, opportunity cost of capital. This book, we will discuss about what economy popular rate is. And the 10% that is needed for investing or borrowing in future investments. In the upcoming chapter, you will also learn how the rate of return is hence determined.

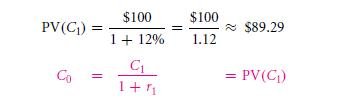

When you are multiplying the future true cash flow with the right discount factor, one get the end product of the present value. Thus looking at the formula 2.2, pupil will see that the discount factor is quantity.

When you are multiplying the future true cash flow with the right discount factor, one get the end product of the present value. Thus looking at the formula 2.2, pupil will see that the discount factor is quantity.

Thus, this states that, discount factor changes $1 in this future to an equivalent cost of dollars that it is of today. Taking this as an example, 2-year with 21% of rate of return and this dollar in two years will be worth 83 cents at the present date. (Many times people calls this discount rate which is incorrect and is used as r1)

Thus, this states that, discount factor changes $1 in this future to an equivalent cost of dollars that it is of today. Taking this as an example, 2-year with 21% of rate of return and this dollar in two years will be worth 83 cents at the present date. (Many times people calls this discount rate which is incorrect and is used as r1)

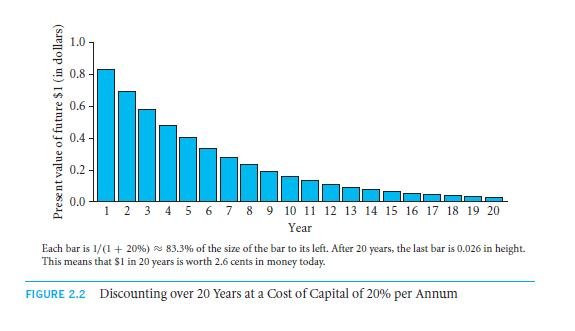

The figures 2.2, below, will show the only discount factor which will decline the costs of capital is 20% for a year. After a decade passes, the dollar in the project might earn lesser than twenty cents as of today. You can compare the figures 2.1 and 2.2 and notice that both are ‘flip side’ to each other.

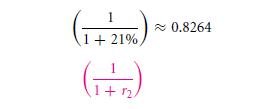

Always remember that the bonds that are different form the savings accounts. Then this will be first one is lowered by the promise of fixed off future payments. However, the later one is paid when the interest rates are daily. This makes up for a very little form of important relationship among the many value of such bonds and these remaining interest rates as they will move in totally opposite directions.

Always remember that the bonds that are different form the savings accounts. Then this will be first one is lowered by the promise of fixed off future payments. However, the later one is paid when the interest rates are daily. This makes up for a very little form of important relationship among the many value of such bonds and these remaining interest rates as they will move in totally opposite directions.

If for example, the bond that you made a promise to pay for $1000 in duration of 1 year, then the interest rate will be that of 5%. Thus the bond will have a present value of $1,000/1.05 ≈ $952.38. If these remaining interest rate increases all of a sudden to 6%, then it will become the new of opportunity well cost of capital. This present value will become $1,000/1.06 ≈ $943.40. You will certainly lose $8.98. This is further about that 0.9% of the official authentic $952.38 of investment. All the value that you have saved as your full fixed-bond deposit payment that has been in the upcoming future will go down as all the investors can do much better than 5% that too by purchasing new bonds. These will have a better opportunity to make up for the lost economy. These bonds can further earn a specific rate of return which is 6% rather than 5%. Thus if you are planning of selling your bonds right now, then you will get to selling it at a discounted rate and leave the buyer with a close rate of such return of 6%. In case you delay the investment, then there will be a sudden change of 6% and will have nothing to do with the investment. Looking at the other hand side, the interest rate if drops suddenly, then rate will drop to 4%. The bond will rise in value. Trying to make a gain of $9.16, the investors will willingly pay off $1,000/1.04 ≈ $961.54. The relationship that you will get a prevailing interest rate and many bond prices which are simply general and nothing else.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Basic scenario perfect markets certainty constant interest rates

- Loans and bonds

- Returns net returns and rates of return

- The time value of money future value and compounding

Links of Next Financial Accounting Topics:-

- Net present value

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

- Corporate claims

- Capital structure and capital budgeting in a perfect market

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

- What matters

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management