If you take a closer look at the 2nd market assumption, you will find it has many sellers and buyers. This makes these markets deep. Suppose there is a single lender in the entire market. In this case, you will not have the upper hand over him. As a show of power exploitation, you will find that lender offering you less rate of interest in deposit amount and more on rate of borrowing. Even if there are milder power formats, this, in particular, is known as a monopoly.

This can be easily comprehended with the example of milk. Suppose you visit a super market. There the cost of a milk carton is 3 cents more than the usual rate. You may buy it at that price itself as it saves your time going to another grocery store for that same product.

Another instance can be taken in the form of ATM. If you require money, you can easily approach to any of the banks to get it. But in closer vicinity, you will find ATMs to provide you money at that very instance. This concept of quick monetary acquisition is unique.

Apart from these 2, another of the important examples is transaction costs. This is mostly considered as a barrier that creates a barrier between lending and borrowing rates. If you wish to administer loans, you have to keep in mind that it is both costly and tough. Primary reason of it is charges made by investors are to inculcate fewer deposit rates in comparison to borrowing rates.

In this section, you will come to know how huge firms should properly handle transaction costs.

10.3 A. Real Estate- Classic Costs When It Is About Trading Real Commodities

Facing cost is normal when you engage in various transactions. It may be for sales, or it may be for buying anything. One of the simple ways with which you can get a clear idea of transaction cost’s magnitude is by analyzing your loss. It is immediately comprehensible when you buy anything with an amount more than it’s worth. This mistake can be clarified if you resell that product. An instance of such mistakes is real estate with which transaction costs highlighted. Here an important question is how you will analyze the price of a house on both grounds- selling or buying?

- Brokerage commissions which come under direct costs

If you check the house transaction cost, you will find it to be sky high. For this reason itself, this commission is worth diversion. Let us take the example of USA where you have a house that you wish to sell. The broker, in this case, will receive a brokerage percentage of 6% on the commissioned amount. That broker who is responsible for selling your place will then divide commission amount with the agent of the new buyer.

We will consider the selling price to be $300,000. 6% on it will give the brokerage amount to be$18,000. So both the agent and the broker will split this $18,000 among themselves. Even if you see that the broker gets the money directly from the seller, i.e., you, will be taken as round trip cost. It occurs in scenarios where you buy a house and due to some issues you have to sell it immediately.

In case you think that when you are buying a property or a house without any transaction cost, you may be mistaken. This amount is always added to the total cost so that it can be used and acquired when you resell that property again. This being an asset is considered for future selling and also to compute the required transaction cost using NPV formula.

Assume that you are taking a loan for the purpose of investment. In this case, you will find transaction cost to be more in comparison to other times. 6% that you have seen taken by the brokers is not on the investment money in the house. This percentage is basically of the real house valuation amount.

For example-

You take a loan on the purchase price of a house which is $500, 000. The rate here is 80%. For that, you keep $100,000(equity), and $400,000 as purchase price. If you sell the house just 2days after you buy the house, value of your property will probably reduce by $100,000. So as per the commission percentage, you will have to cough up $30, 000 on the new house value. So after complete computation, you can see that return rate on your total amount will be 30%. This entirely is transaction cost and not a component of risk.

Now an important in this context arises. How can you consider your purchase to be well enough if there is a decline or growth in the house price by 10%?

- Decline

While selling the house if you make an over payment of 10% on $500, 000, you will be actually receiving $450,000. After paying agent commission, you will be left with $423, 000. When evaluated on equity, you will finally be having $23, 000.

- Hike

10% increase in the net value will enable you to gain $50, 000. So, on the new amount even after giving away brokerage amount, you will have for yourself $517,000. Her return rate on the amount will be 17%.

On considering a hike and decline of both 10% each, 30% will be the expected loss rate. Even if you minus direct agent commission from your calculation, other transactions types are also present. Few of them are payments for:

- Land registry

- Advertisement

- House inspection

- Insurance company payments

- Postage

- Opportunity costs which come under indirect costs

In order to accumulate proper information of that house, both buyer and seller required to give ample time. One cannot expect to rely completely on the judgment of agents or brokers. This is because of the significant costs that are associated with the property. Suppose it does not have any cash outlay, you need to know more about the costs involved in it.

Here you need to understand that if your house has been empty for a certain time without any rent or hasn’t been used for any purpose, the forgone in this case is transaction costs. When you do not use the house for any purpose, the amount used at that time will be taken as opportunity cost. In as implesense, it can be said that as actual real cost is, so is opportunity costs.

10.3 B. Stocks —Typical Costs When It Is About Trading Financial Goods

Transactional cost can also be seen in financial market. As you have seen above, in this case too, if you wish to sell or buy any share, you have to pay the broker a certain amount as a brokerage fee. Another of similar fee is also paid by stock exchange to that broker. From an investor’s side, it requires ample communication time to acquire the services of a broker so that he or she can start with the sale or purchase of a stock. This can also be seen as opportunity cost.

Market maker commissions and brokerage–Direct costs

Selling price of financial instruments is not so high if you compare those with other commodities. You may have your queries on why is it so. Here are few of the reasons.

Suppose you want to sell your stock over online portal rather than approaching directly. In digital platform too you will find the presence of brokers who will charge you a small sum. It may be as less as $10. Now if you consider round trip commission, the amount will be $20. Also with this, you will have to make payments for spread. This is the amount that is between quoted price and bid price.

Let us take an example of PepsiCo who has publically posted their shares at $50 per unit. However at this price, neither can it be purchased nor be sold. This amount is just an average price detail between bid amount $49.92, and asked price, which is $50.08. The former value is what market makers are ready to buy and the latter is what investors wish to sell at.

This makes the entire calculation process simple where the differential amount between the 2 amounts- $49.92 and $50.08 is 16 cents. You can consider this amount to be that of round trip. Now, if you looking for the interest rate on this account, computation on this aspect will be,

($50.08−$49.92)÷$50.08 = −0.32%.

As you can see that the resultant in this case is negative, this is because of taking the bid amount in the first place and then considering the asked amount.

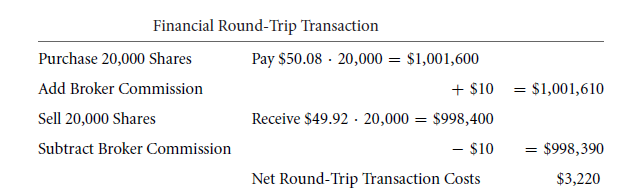

If in real market (typical) you try to analyze PepsiCo share prices, you will find the price to be extremely less. If in totality there are 20000 PepsiCo shares, whose net worth is $1,000,000, selling or purchase of those can be calculated as:

One of the important things to consider in this case is that this amount is not precisely correct. Reason for this is dependent on asked and bid price which revolves around 100 shares. There may be certain transactions that may take place in ask – bid spread. However, here are chances of you to be paying a higher amount than the usual $50.08 due to round-trip orders (huge). Again it has also to be taken into account that the receiving amount may be less than the expected $42.92.

In here 0.32% may seem like a small amount, but if you can analyze a bigger picture, you can see in totality a huge interest rate for a huge trade. So as per assumption, latest amounts can be either $49.85 or it may be $50.20. As per PepsiCo shares of $1 million, transaction cost on round-trip basis will show minimal basic points of 50.

Another illustration of a lower transaction cost can be seen if we take the example of liquid security. The incident dates back to 2006 (30th November, Thursday). A billionaire investor, Kirk Kerkorian sold a block of shares, GM at just 5%. Here GM can be considered as 28 million shares. This makes value of per shares to be $29.25. In totality, the net amount will be $820 million. So, if this trading amount of shares is seen through NYSE, this price will relative to a penny.

When this news got out, share prices dropped from $29.25 to $28.49. However, this change did not remain long as after an hour the price rose to $29.50. Isn’t it a remarkable move where the share prices fluctuated so suddenly?

Opportunity costs – Indirect costs

In order to find the current share price an investor does not require giving extra time on it. One can easily get it from online portal (search engines like Google, Bing, or Yahoo). Research cost for this purpose is extremely low. If you compare the price of a house and that of a share, the latter can be found out sooner. For this purpose too, you can easily and immediately get buyers.

Stock Transaction Costs Comparison to Transaction Costs Related To Housing

Again to get a better comprehension, we will take the example of a house and financial securities. In the previous section you have already witnessed that value of a house is $500,000. After deducting brokerage fee the amount for that stands to be $30, 000 (6%). This also includes monetary split and round-trip transaction.

There are chances that you may have to shell out another $10, 000 for other types of transaction costs. Those may be in form of labour services or as physical commodities.

After seeing the part of house expenses, we will consider transaction costs related to shares. Let us assume there are 100 Microsoft shares. As yours is a low transaction cost, you either wish to sell those to make purchase. In this case, financial transaction costs of yours will be little because of the presence of numerous sellers and buyers. Typical transaction costs for medium-sized company’s shares can be near $300 or $500. This assumption is on the grounds of equity investment which is for the amount $100,000.

Although these assumptions are made taking in consideration a perfect market, the resultant cannot be accurate. However, it can be speculated to be near accurate. One of the convenient things to speculate is taking zero (0) as transaction costs. This is a reasonable assumption when the consideration is regarding an investor who deals with ordinary stocks (selling and buying).

In case you do not come in this category but are day trader (traders who trader on per day basis), it would be inappropriate to consider assumptions based on perfect market.

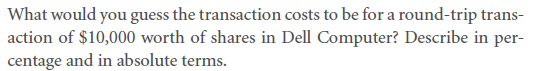

Solve it

10.3 C. Net Present Values and Transaction Costs In Case Of Returns

After the entire transaction cost is taken care of, being an investor you will consider more about return rates. You will worry less about the return rate related to pre-transaction costs. In this section we will take our time to understand the working on both sides regarding transaction costs. From both side it implies selling and buying.

We will again take the example of house.

If the value of a house is $1,000,000 and then you sell it with an additional $100,000. This amount is basically the brokerage amount which combines to give $1,100,000. Here 6% is broker charges rate which you can see when selling the house. This does not make the return rate 10%.

You also need to remember that there are other expenses added with the total amount, making those opportunity costs. We can assume those to be somewhere near $70, 000. Additional costs may be like escrow transfer fee that can be less ($5, 000) or more ($1,000,000).

So, computation for return rate will be,

(1,100,000$÷ 1,000,000$) – 1

This will give 10% as answer.

You can clearly see that instead of deducting that $5, 000, it is added to the total. The paid amount will be more than $1,000,000. In this came, the former amount will not work for you.

On a close look you will find that professional fund managers do not quote their fees but prefer highlighting interest rates to their investors. Addition of footnotes is a satisfactory section for lawyers in case you wish to sue that professional fund manager to mislead you. It is better that you know the entire thing actually work.

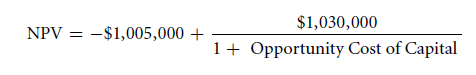

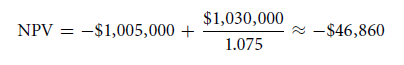

So when it is about present value calculations, how transaction costs is taken care of? Calculation in this case is simple where your investment amount is $1,005,000 and $1,030,000 will be the amount which you will receive after a year.

After taking care of ‘after-transaction cost terms’, you also need to care for opportunity capital cost. It will be difficult to attain 10% as return rate as you may have to spend a lot in the form of transaction costs.

Here you will find financial markets characteristics equivalent to that of alternative investment. The earning return rate annually in this case is 8%. However, their transaction cost is based on 50 basis points. so, appropriate NPV’s calculation will be,

Solve it

10.3 D. Value of Liquidity

Proper pricing may get complicated yet interesting when future transaction costs affects the will to buy. Expectation to recover transaction costs can be difficult as there is no assurance of the same property to be sold with ease or not. This is because it is known fact to you by now that buying a bond or a share is tough where transaction costs is low.

Would you really care to take the risk of selling a house which has been sitting unused for quite sometime? If the seller wants you to buy that property, to make the deal seem more profitable he will propose you with a liquidity premium. This is basically additional expected return rate that he will propose you as compensation from his side so that you can make the purchase. Analogy related to liquidity comes from the subject of physics. Similar to obstruction of physical movement by friction, you can also see transaction costs hindering economic transactions.

This example is an excellent method to showcase the influence of liquidity which initiates low transaction costs in financial markets. You will even find certain financial markets which are stated to be either frictionless or having low-friction. The entireties of liquidity premiums are confusing that most fund managers or finance professors have vague idea.

Here are few liquidity premiums examples which play significant roles in financial market.

- Market Making – Liquidity Provision As form of Business

Market maker on exchange can be considered as a person who is liquidity provider. It is an instantaneous work of selling securities in the market. This is only possible if you are a retail investor and the buyer is a person who wishes to hold those over long term. As an importantly quality premium section, you will find market makers will offer liquidity with the help of earning via Bid – Ask spread.

In market, liquidity provision is a generalized business. One of the good examples can be car dealership owning antique stores. You can consider them to be liquidity providers who tryto sell their items in as high priced possible but make purchase at the least possible amount. If you wish to be a liquidity provider, it is important to have huge capital outlays and big risks too. This process is complex and tough. If it were easy, everybody can go for it, resulting in no money in case of liquidity provision.

- Treasury Bonds

There are differentiation in treasuries too when it comes to liquidity. ‘On the run’ is a term stated for currently issued Treasury that has a particular type of maturity. This specific bond is kept in consideration by bond traders who wish to trade with this maturity. Buying this bond is easier than its counterpart bond, ‘off the run’.

To understand this in a simple way let us take an example of Treasury bond transaction which took place in the year 2000 (November). Trade of on the run treasury of 10years yielded a maturity of yearly 5.6%. The difference of maturity were literally few days apart when the consideration was made for ‘off the run’ treasury maturity. In this case, the rate on yearly basis was 5.75%.

This is the sole reason why it is better to opt for bonds of ‘on the run’ despite of those being in high price category. If you want, you can sell them immediately. In case of bonds related to ‘off the run’, it takes extra effort and time to get sold. This instance s purely based on perfect world market.

Now, if we consider a market in the imperfect world, there will hardly or difference at all. In case of 2 years bond on both the cases, basis point on bonds with ‘off the run’ will be 1 point higher than its counterpart. Yielding point on an average will be 0.6. In case the bond is dependent on 10 year treasury (‘on the run’); basis point will be 3 in this case.

- Liquidity Runs

Related to liquidity, one of the outstanding empirical regularity is the preference of liquid securities by investors. This in a general sense is either called as run on liquidity or as flight to quality. European, Latin American or resident of any country, mortgage is related to bond spreads. This is a relative that seems to widen Treasuries at similar time.

When run on liquidity was witnessed in U. S. economy in the year 2008, highly affected sector in this case was of mortgage. It did even escalate to other bond types to. There was a constant fear in the minds of banks and funds related to pulling off credit lines that investors can make at any instant. In order to get saved from the worst scenario of liquidity run, even at lower prices were the highly rated securities sold. Pricing oddities at that year were very strange for liquidity run. Arbitrageur exploits became really tough as lending money was a high risk at that time.

GNMA, federal government agency, issued 2-year bonds. Traded at a basis point of 200, it had complete federal government backup. It was equivalent to that of treasuries.

If you consider the companies of Wall Street, you will find liquidity premium to be of a common strategy for money making. Think that you are aware of the fact that the requirement of bond holding till maturity or immediate liquidity is not at the top of your list. In this case, liquidity premium earning by buying less liquid securities can be a sensible step.

One of the methodologies can be cheaper borrowed money financed with illiquid corporate bonds purchase. Not all time but on maximum accounts too, this methods can be helpful in acquiring money. Loophole in this case is widening of liquidity spread when the transition is from flight to liquidity.

This exactly was the case which occurred in 1998 for LTCM (Long-Term Capital Management) which was a renowned hedge fund company. The spread covered nearly all bonds after default debt was from Russia. From wide to wider, this spread of average corporate bond increased to 8% from 4% in U.S. in just a week. For non-Treasury bonds, it became a difficult task to find buyers by LTCM. Those funds held on to their respective positions in the entire situation. When the situation or liquidity became normal, the prices for illiquid securities also turned normal.

Solve it

ANECDOTE

Real Estate Agents: Who Works for Whom?

In most cases words are conflicted when it comes from real estate agents. An immediate sell from then gives them ample time to concentrate on different properties. For a swift sale, agent of the potential seller will negotiate to the last for a cheaper deal. In the same way, an agent from the purchaser’s side will try to bring down to price for a high profit. With this scenario, it is clear that seller’s agent is makes the deal from the side of the purchaser and purchaser’s agent does his work from the seller’s side.

Steve Levitt, who rose to fame with Freak onomics pointed the fact that the houses of such agents tends to survive in the market nearly 10 days more than others, fetching them an extra 2%.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Market imperfections

- Causes and consequences of imperfect markets

- Opinions disagreements and insider information

Links of Next Financial Accounting Topics:-

- Taxes

- Entrepreneurial finance

- Deconstructing quoted rates of return liquidity and tax premiums

- Multiple effects how to work novel problems

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management