Until now there has not been any source of distinction related to capital cost. This cost is essential when it is considered for fund borrowing and using it to finance any project. The return rate is similar helping you to save a certain amount. Again when you are considering perfect market, you will find that rates in both the cases are similar.

In the same way, all the 4assumptions relate to perfect market is for accomplishing a single fact.

Consequences related to this can be far reaching. Moving out and in of any investment can be difficult if there is inequality in rates. It may be also in case if the project does not remain distinct from the others. In this case, that project may be projected in any range that has different possible values. Now, in this case, that single project’s value may become worthless.

There are 3 things on which project values is dependent.

- Project owner

- Individual taste

- Time of the day

Solve it

10.1 A. Determining market perfection related to PepsiCo Houses and Shares

We will begin with explanations related to all the 4assumptions related to the perfect market. In this case, we will take the example of PepsiCo stocks.

- No transaction cost

There are few transaction costs when it comes to the trading of PepsiCo shares. However, these are modest. If you consider the transaction to be typically about round-trip cost, then on every $50 share price there will be an addition of 5 cents. This makes it a total of 10 points. Now, if you are an institutional trader, there are chances that you can beat it. As NYSE makes the share postings, searching costs are nada to identify PepsiCo’s proper price. In the case of locating a seller or a buyer, costs, in this case, are extremely less.

- Inestimable companies and investors

In the year 2006, PepsiCo shares of nearly $250 million were exchanged. With so many sellers and buyer, this makes the shares to be transacted in a highly competitive market. In such a platform, it is not possible that a single seller or buyer can affect share prices. So, it can be easily seen that many potential sellers and buyers who wish to sell or buy those shares at similar prices or even at a little higher (sell) or lower (buy).

- No opinion distinction

When such perfect market assumptions are made, it does not state that there are any uncertainties or even any investor has doubt on this. In case of PepsiCo’s value, similar conclusions are drawn accessing of rational traders and the objectives related to it. Agreement should be there when it is about the price distribution of PepsiCo’s shares. This will make sure that those shares will sell on the upcoming date, helping to increase share values.

Also, it is a fact that there is a lesser chance of rational traders to disagree on the first hand. This is because prices related to shares are not forecasted in the market earlier. Even if there are disagreements, chances of it are to be minor. Now in some cases, few traders do have inside sources who can give them better price prediction. But this makes the entire process as well as the market illegal.

- No taxes

This assumption is considered highly problematic as per perfect market. However, it is important that we consider this assumption without the inhibition of any taxes. The reason for this is a single purpose. The return rate that a seller has the PepsiCo’s shares should be similar to the return rate of a buyer who wishes to purchase those.

To make this simple, let us take an example.

Let us consider the fact that the beginning price of PepsiCo’s share is $20. After 2 years, the value increases to $80. With this, we will also assume that 55% is its risk free rate of discount and 20% is tax rate for capital gains.

As these units are given, you can clearly analyse that if you sell these shares in the midway or after 2 years what will be your savings. Tax rate for capital gains on keeping those shares will be $60 [$ (80 – 20)]. Now the collection from the company will be $12 if the tax rate for capital gains is 20%. After the initial year, if you trade them at $50 to me, consequences on capital gain will be $30. This amount will be for initial year for you. But on the final year, that same amount will be for me.

Calculation of that amount will be,

$30 x 20% = $6

This initiates in the violation of assumptions that were for a perfect market. This is due to share holding for 2 years, making the present tax obligation value to be,

$12 ÷ 1.052 = $10.88

In case I purchase those from you, the value will be:

$6 ÷ 1.052 + $6 ÷1.05 = $11.16

So, in this case, you can see the value being quite higher if you do not trade them but hold those.

However, share value differentiation is based on interim taxation and the interest on it.So, on $60, the gain will be 28 cents. This example is based on a scenario that is considered on worst-case taxation. In addition to it, you on calculation will find that the return rate, in this case, is 300%.

As you will be moving forward in this chapter, you will understand offset due to capital losses and also about various capital gains. Again you will find explanations for low taxes and investor discretion related to tax timing.

Moreover, many institutions hold more shares in the form of pension funds. This is because they are tax exempted and on trading, they do not have any repercussions.

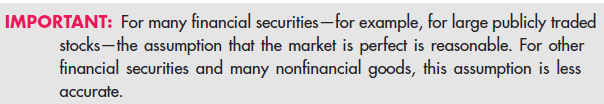

Now from the above example, you can designate the fact that the assumptions related to PepsiCo’s shares may be near perfection. However, there are fewer chances of commodities to be sold in the perfect market.

Consider 2008’s huge real estate slump. Keeping that in mind, you may wish to sell your house. So what will be its value in this case?

It is mainly dependent on 4 scenarios.

- If potential buyers come infrequently

- Your house is situated in a remote part

- If property taxes are higher on buyers (Government imposed)

- Other houses on that area are having similar residential characteristics as that of your house

You can see the last case in cities like California. Basically, you can say that it is mostly on luck that you can trade your house at a reasonable rate. Now if all these conditions are taken into consideration, determining your property value can be extremely difficult as per the requirements set by the perfect market.

Again it is also to be reflected that valuation range of your house depends on a certain degree.

Suppose, as per the project value 2% or 3% is rates related to transaction costs or taxes. The value is not unique but at least near to perfection. In another case, you can think that there really are potential buyers who may wish to buy your property. There are chances that they may pay you high after seeing excellent condition of your property or on the basis of the area surrounding the house. It may also happen that few buyers may quote less amount for the purchase. In both the scenarios, it is up to you if you prefer to choose any of the options.

It is again a fact that there most financial markets are not perfect. The factors that influence this are:

Power of huge sellers or buyers in market

- Special taxes

- Information differences

- Transaction costs

You will be surprised to know that there are certain corporate bonds which still prefer ‘over the counter’ trade. There are only particular companies who abide by the regulations of market. To sell or purchase corporate bonds, you need to contact their in house desk trader. Being the only venue (market), they will try negotiation with you (for price). There may be chances that you may invest more money in its purchase than what you can ask for selling it off.

Solve it

10.1 B. Assumptions and Violations of Perfect Market

You are already aware of the 4 assumptions of a perfect market. Suppose those are violated. In that case, the new assumptions will be:

No transaction cost

Described in a broad sense, transaction cost comprises direct cost. This may be about money and time that is effective in cracking a deal. Now you do not have to pay any sort of cost when you are considering it for a perfect market.

So in this case, how is a violation even possible?

Let us discuss it here.

Suppose you take a loan and you have to invest $1000 in paperwork procedure. Cost will not be implied if you wish to save and not borrow. In case it takes a maximum of 3 days to get an appropriate lender, then the borrowing rate will be less than that rate that you wish to save. In this case, borrowing rate of interest will be higher in comparison to the saving rate of interest.

So the assertion in this case to avoid such violations is having ‘zero transaction costs.’

Inestimable companies and investors

This aspect clears the fact that markets do have some depth of its own. As perfect market is seen as a competitive market, still sellers and buyers do not have any power over the market. There will be a slight modification in this case if both sellers and buyers are heterogeneous.

Suppose you are a golf pro, owning a golf range. If you decide to sell it, the potential buyers will actually be golf pros too.

In another case, let us assume that there is a single bank that can fulfil your company’s banking facilities. Being the only available option, if they want, they can charge you less rate of interest on monetary deposit. Or as per their wish, they can charge you with a higher rate of interest when you want to take a loan.

No information or opinion distinction

Every uncertainty is interpreted in the same way on the assumption in a perfect market. So, how is assumption violation possible?

Imagine that you require a loan. If your bank can analyse that there is 10% chance of your company to go bankrupt they will give you a loan with a certain rate of interest. In case, that percentage increases to 50, rate of interest imposed on loan amount will be higher. Here you will not see equality in interest rate. The resultant based on the entire example showcases the fact that the rate of interest rate is more when you take a loan than what you keep as a deposit.

No taxes

As per this, it simply implies no interference from the side of government on issues like selling or purchasing securities or any pros and cons on those. There should not be any changes on the consequences of total tax changes, especially in the context of trading or possession of any commodities by a particular owner.

Here, assumption violation is simple to understand. On earned interest, you have to pay taxes, but on interest payment, there will not be any tax deduction. In instances like this, de-facto rate of borrowing will be higher than that of savings. Another instance under this point will be legal document filing related to every individual transaction.

Even if these 4 assumptions are excessive to handle, you can be rest assured to be on the safer side if you hold them. With these, you can get a clear analyzation that even after violation you can get those near to the perfect market model. You should consider its usefulness, not on the aspect of being used in the actual world. What you need to consider is that they come to assistance by helping you to get better comprehension about the tools and methodologies for commodity valuation.

Now, as per real world circumstance, these violated assumptions are nothing when compared to real life circumstance. In case you try to force it, the resultant may induce functionality halt.

Let is suppose that you wish to transact with a certain company but refrain from doing so. This may be out of fear of your opponents on the basis of the extra info that they may have. In this case, you will be on the losing end as you are giving your opponents the perfect opportunity to obtain the business benefit. So the best solution in accordance to this will be avoiding trade. You can see such situations in case of retail investors for whom market may have collapsed.

Another of the alternatives is the option of getting the bonds from over the counter. This is because most Wall Street traders try to gauge and analyse over the phone about the bond valuation in present market from ordinary retail investors. These investors were in a systematically disadvantaged zone don’t find it beneficial to make a direct trade for corporate bonds. In place of that, they prefer to make the purchase of those bonds via people who are well aware of the disadvantages and buy those after seeing the pro side.

Now, there won’t be any market where anyone can sell or purchase is transaction costs are humongous. Collapse of market is only possible in case violations in perfect market model are also huge. Transaction advantage ousness can only supersede seller and buyer initiated cost when a violation is modest and the market functioning.

Solve Now

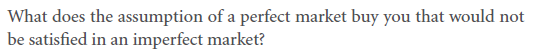

10.1 C. Imperfect Markets and Doubtful Values in It

Have you ever considered why it lending and borrowing rates is complex? The answer to this is simple- a project’s “unique value aspect.”Seeing from the point of view of perfect market, value of a project is not dependent on you or your cash position. Its base is the project itself. In simplified term, it can be stated as concept of value and ownership. This also helps to make different decisions related to financing and investment. Financing options and personal value takes a backseat, highlighting only on project quality.

If you look for the involvement of NPV formula on current wealth or identity, you will find it to be absent. Its presence is only visible in an investment’s return rate or cash flow of a project.

Suppose you are transacting in a perfect market. Here you can lend and borrow money together at 4% interest rate. Depending on that, what should be your project’s net current value and return amount on next period? Here it is given that $1050 is the return amount and $1000 is currently invested fund. The final amount will stand to be $9.62.

Now it is not necessary that you must have that $1000 at present. You can also take a loan of $1,009.62 and continue with the transaction. And in the upcoming year, you can give away the lender $1050.

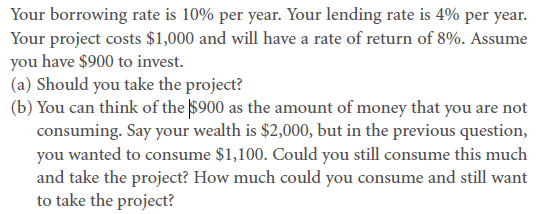

In case you are making the transaction in the imperfect market, then this assumed monetary detail will not be similar. This is because lending and borrowing rates will be independent and the value of the project will rely on cash holding.

Let us take an example where you can loan an amount at 7%, and at 3%, you can make the investment. Keeping the question same as stated above, what should be your project’s net current value and return amount on upcoming period? It is given that $1050 is the return amount and $1000 is current invested fund.

In case you invest your $1000 in bank, the latter will after adding interest will give you $1030. So the best option, in this case, is to refrain investing in bank and utilise it in a project. This decision will help you acquire additional $20.

Assume that you take a loan of $1000 from bank (if you do not have at present) and invest in project; you will receive a yield of $1050.But now, you will have to return $20 extra to bank as the amount that you need to pay back will be $1070. This being a loss, it is better to avoid taking the project.

As per the availability of cash in your account, decisions related to total project valuation can be made. In here, decisions related to financial decision and project selection breaks down. Complexity of decision related to capital budgeting takes place when investment choices related to present cash holdings are to be made.

It is better to take up a project if you are sure to have ample funds for it. Decisions related to taking a project should be dependent on the fact how cash outflows and inflows will work in future. You need to also keep in consideration that your decision will ensure future wealth position. This is both difficult as well as not of a unique nature if we try to see it via imperfect market.

The value can be anything if we take the example from above and use it here. At 7% interest on $1050, the outcome will be (-) $18.69. And at 3% on $1000, resultant will be (+) $19.42. It is also applicable in case of ownership. Again decisions related to capital budgeting is dependent on the fact whether you are planning to buy a project or are already working on it.

Important

Break down between value and ownership is evident if market is imperfect. This makes sure that project valuation does not remain distinct. It finally becomes dependent on project owner.

Is it guaranteed that you will receive for what you have made payments?

When you continue reading from here, you need to fix this in your mind that there are extremely fewer chances of projects to be distinct. Most people readily invest money where they can see a profit for themselves. Even in those cases when they have chances to earn more than what they have invested in acquiring in the first place.So, which deal sounds good? Well, both of them.

In case of a person’s wish to pay for something of its worth, it can be seen perfect market. Worth of second claim stands well only in case of an imperfect market. In this case, commodities do not have any distinct value. So, any person can quote any price of the commodities available in imperfect market.

Assume that a person is claiming a certain value of a company. There are few explanations associated with such statement.

- The decision to buy that company may be completely personal instead of a profession. It is mostly in lieu of a helping hand. (Just for the assumption as it is likely not to take place.)

- It is a perfect market, and it is a mistake from seller’s end to sell his goods at a less price.

- It is a perfect market, but for the seller this market is inaccessible. So that seller is ready to sell his commodities at lower rates despite of knowing the actual worth of his items.

- There is also a possibility of the seller using specific selling tactics to sell his items under falsetto.

Solve it

10.1 D. Excess and Social Value

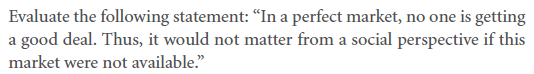

Perfect markets are useful in both social and private aspects. Sellers and buyers are not required to think about any specific deal if it takes place in perfect market.

Let us take an example of gasoline. We cannot compare the worth of gasoline with any commodity. In a certain place, the worth of gasoline can be less because of higher availability, while in some other place due to its shortage prices of gasoline can be high. Again if you consider a populated area, you will find its market to be competitive.

To understand it in a simple way, let us go the same via monetary method. There is a reasonable price set for gasoline in a certain fuel pump. Suppose you are the owner. You will be spending a minimum of $3 on advertisement which you will wish to collect from your service. In nearby areas, there will be negligible chances of gasoline to be either $4 or $2 for per gallon. So in this case, your fixed price will be taken as a fair price.

This example is for applicable not only for gasoline but also for mortgage types, treasury bonds, stocks, and even in financial markets. Deals in all of these sections will be considered fair only if that market is competitive.

Solve now

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

Links of Next Financial Accounting Topics:-

- Opinions disagreements and insider information

- Market depth and transaction costs

- Taxes

- Entrepreneurial finance

- Deconstructing quoted rates of return liquidity and tax premiums

- Multiple effects how to work novel problems

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management