Among all the market perfection violations, taxes come in the 4th category. Being prevalent, they are taken as project returns with large economic component. There is a change in info each year as for the complexity of actual tax code. However, constant thing in it is the basics of it.

10.4 A.Federal Income Taxes and its Basics

On both companies and individuals, there is imposition of IRS (Internal Revenue Service). As per this, adjustment of gross income is applied with the help of 2 things.

- Progressive tax rate

- Allowable deductions that are taken into account in taxable income

If comparisons are made between taxpayers of after-tax expenses and before-tax expenses, the latter option is considered as best.

Suppose, on your earnings, there is a 40% bracket. Here your income is $100,000. So, with before-tax expenses, the amount you will have is $50,000.

One of the essential deductible items in case of both individuals and corporations is interest payment. Deduction of it is only possible in case of mortgages. Again, one of the notable deductions in general sense is pension contributions. In addition to it, entirely tax-exempt option is for certain nonprofit investors too.

There are basically4categories which divide tax codes. They are:

- Capital gains

- Dividend income

- Interest income

- Ordinary income

There are variations on all 4 of these classes. It mainly comprises of the rate of taxes. In addition to it, deduction application ability for income tax burden reduction can also be seen with the difference here.

If there is no financial investment, application of ordinary income is not possible. Here such investments comprise of wages or salary. The rate of tax is high due to the ability to apply fewer deductions. In 2008, highest rate of ordinary federal income tax (marginal) was somewhere around 35%. In such case, ordinary income and interest income were considered and treated similarly. At a significantly less rate was dividend income taxed from U.S. companies. In most cases, it came ½ of the actual original income.

Under 2008 tax code, if a company holds an asset for a year or more, capital gains on those used to be at lower rates. These values were near to similar with taxed dividends. However, when the same asset is calculated (hold for less than a year), rates were similar with ordinary income. Only after realization was long-term and, short-term capital gains were taxed. This is not the scenario for other income types. With the help of this info was deductions were an easy work to calculate gains.

Amongst capital gains and dividend income, the latter was mildly preferable to an investor. It was only in case of interest income when both of them were preferred. Marginal tax rate is higher that of average tax rate. This is because on 1st few income dollars application of the lower rate of marginal tax is possible. It can be seen in progressive tax system of U.S.

An instance of it can be highlighted via the taxation in 2008. 10% of tax was imposed on 1st$8,025, whereas 15% was imposed on the latter half or next $24,525. In this case, even if you leave behind subsequent adjustments on the income amount of $20,000, tax payment by you will be,

So, on your income’s last dollar the applicable 13% will be average tax rate, whereas 15% will be the rate of marginal tax. Earning relevance can be seen in marginal tax rates. Because of this reason, you will find most economists working at this rate. Differentiation can be tough if you wish to see in huge companies. If you considered tax rates in 2008, you will find federal tax rate on a certain income amount, say $75,000to be 34%. There will be average tax rate on any huge firm whose loss or profit is around $10 million.

In addition to this, there are also other taxes that require to be considered. Some of the essential taxes are:

- Sales taxes

- Property taxes

- Medicare taxes

- Social Security

- State income taxes

We are already aware how important standard federal income tax systems are. However, another tax system is also of prominence- AMT (alternative minimum tax). One of the essential factors of this system is that it does not make any differentiation between alternative minimum tax and standard income tax. It can be highly complicated if you wish to file information in multiple states and countries. In such case, it is always suggested to stay away from double taxation.

Important facts to remember

- It is nest if your basics about tax calculation are clear. Even if you have confusions regarding details, clarity should be there in principle. Basically, the areas of prominence should be in how to find out:

- Average tax rate

- Marginal tax rate

- You should also know why marginal tax rate is higher than average tax rate, and the method of calculating average tax rate.

- It is important to keep in mind that pension funds are a type of tax-exempt investments.

- Income related to capital gains is benefited via recipient’s preferential tax treatment. This is relative to ordinary income and interest.

- Expense payment from after-tax income is not that good when compared with expense payment from before-tax income. Here interest expenditure favors taxpayers as they are tax-deductible.

Solve it

1.

3.

10.4 B.Tax effects on return rates

There have always been questions on presence of income taxes and its presence affecting in the workings of finance. Id comparisons are made, then it can be seen that there is no stark difference between transaction costs and taxes. However, a minuscule change can be seen in the form of income rates which can be considered better than profitable transactions.

- There are certain distinctions when it comes to taxes.

- The magnitude of tax orders is probably bigger than the other expenses.

- If you don’t consider the exemplifications in textbooks, taxes are necessary for comparison to ordinary transaction costs.

It can be rightfully said that one of the first-order problems is tax planning that corporations and investors can see easily.

The important thing that investors should consider in the very 1st place is returns on after-tax. It is not important that $100 is the amount that you will receive after taxation of 50% is applied. Analogous recommendation for transaction cost is admirable in the form of a quote:

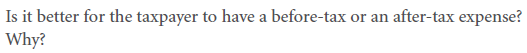

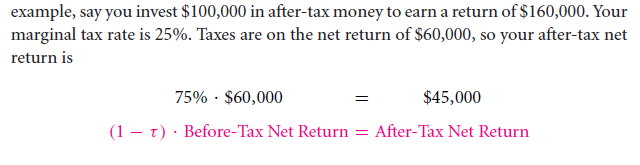

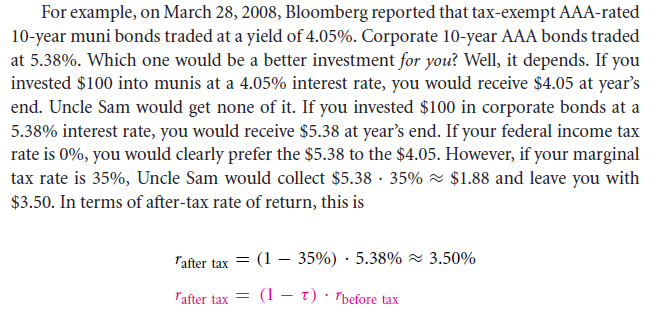

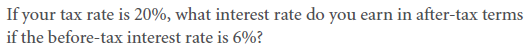

Tau or τ is used for representing tax rates. So, after getting back your original investment, return rate for after tax will be,

The Marginal Investor and the Tax-Exempt Bonds

Smaller governmental entities in U. S. usually issues bonds on which interest is paid. These bonds have tax exemptions on a legal note. Interest declaration is not required on federal income tax forms if you possess one of such bonds. In certain cases, it has also been seen that in certain income tax forms like that of the state need not require interest declaration. Mun is, muni bond, or municipal bonds are one of the tax-exempt bonds of prominence. City of Canton or City of Los Angeles’ municipalities issues these. Being federal income tax exempted, under muni bonds state bonds are also considered.

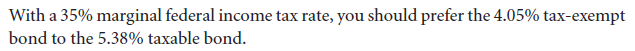

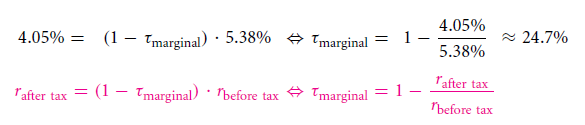

There are cases where you can see bankruptcy in a municipality which you swill seldom find in case of U.S. Treasury. This only happens when there isn’t completion of payment in the former case. In December 1994, Orange County saw such faulty aspect. However, in AAA credit, the municipal bonds are secure. It is best to consider that comparisons related to bond ratings are similar when it is seen in between taxable corporate bonds and tax-exempt bonds. The rate of interest in the differential aspect is on both tax-exempt bonds as well as on those who are risky taxable. It helps to evaluate economy and analyze effective tax rate.

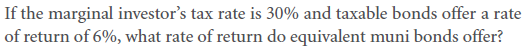

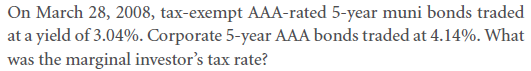

It is a hypothetical marginal investor with which most economists wish to research. It becomes easy to calculate tax rate on marginal investor with the computation,

Any retail investor having a higher income (such as 24.7%) can opt for tax-exempt bonds. But if that same investor does have a rate of income tax beneath 24.7%, the profitable option for him will be going for taxable bonds. Asset price is not only the factor that economists consider the most. Another of the essential aspects for an effective economy is tax rates.

Solve it

2.

3.

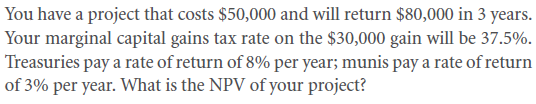

10.4 C.Net Present Values and Taxes in It

To analyze and to make calculations for transaction cost sit is essential that the entire calculation is made with same units. If your concerned formula utilization is NPV, you need to calculate the total on the basis of after-tax dollars. Irrespective of outflow or inflow, or related to upcoming date or present day; there is the inclusion of cash flow.

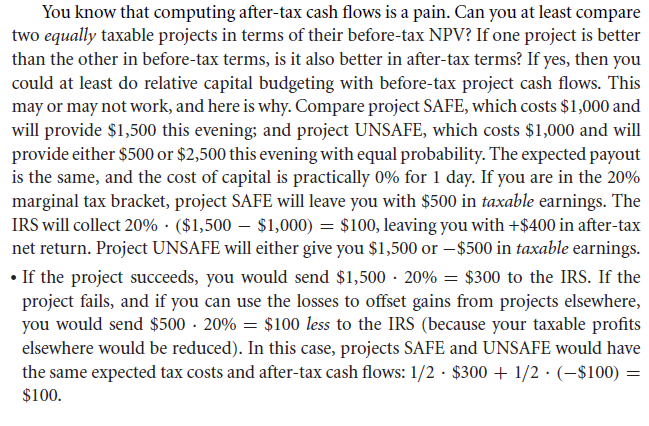

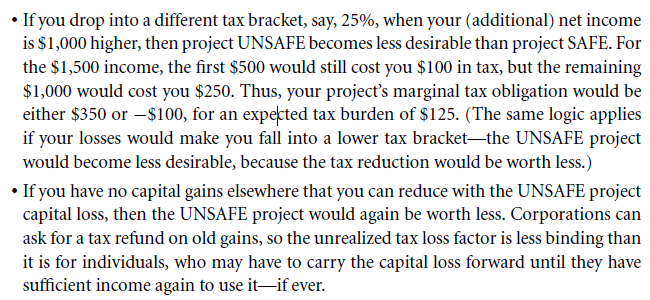

Discounting before tax capital cost with cash flow related to before tax is a mistaken step that you must avoid. This happens in most cases as investors who do not have a proper idea of it can expect to get similar results.

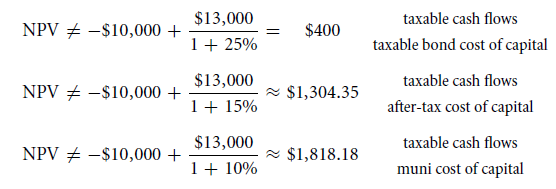

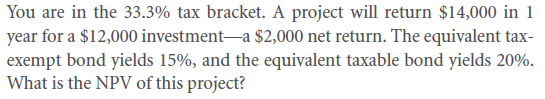

Consider the value of your project to be $10,000. Return amount for the upcoming year is estimated to be $13, 000. 40% is normal tax rate whereas return rate on risky bonds on a single year’s equivalently risky bonds is 25%. This is a considered without additional 10% as taxable income rate. In this case, the foremost thing that you should consider is determining opportunity cost on your capital. The section before this highlights taxable amount that you are investing.

Le that amount be $100. In addition to interest, the received amount that you will have is $125. However, some amount will be confiscated by IRS.

40% x $(125 – 100)

This resultant amount will be $10.

So after application of this formula, after-tax wealth that you will own is $115. Growth of tax exemption is only until $110. Here preferential choice will be taxable bonds. This risky bond can help you analyze opportunity capital cost. As per this, 15% will be your return for after tax.

Now we were discussing about your project where taxable project returns of yours will be 30%. Here return rate for taxable bonds will be 25%, making that amount on $10, 000 to be $2, 500. In accordance with such calculation, NPV will encourage you to choose this project. So, confiscated amount, in this case, will be $11, 800. This can be calculated via,

As you can see that you are left with $11, 800 where you should have $11, 500 if your invested money were on bonds. This additional $300 can be seen occurring in the upcoming year. The intuitively correct discount amount will be $261. It is a fact that there are a number of methodologies on whose utilization you can get the wrong answer. But you also have to see that in every calculation expected cash flows related to before-tax were not used. So, it decreases the chance to get the wrong answers.

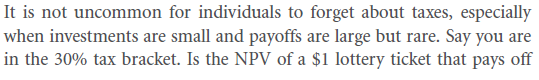

Keeping this phrase in mind, you need to manually follow the calculating process related to cash flow after tax, and then from the resultant, you have to deduct opportunity capital cost for after tax. Cash flow for after tax is a calculation that is difficult as well as complicated.

Project comparison on the basis of before tax can be made if there is symmetrical perfection to marginal tax rates. By now you will be aware of the correct calculation method with which you can discount income taxes on projects. This also includes the ones with equity and debt financed. The main idea of this is to identify and compute with different tax consequences. For handling various corporate securities, WACC and APV methods are considered the best option.

Solve it

2.

3.

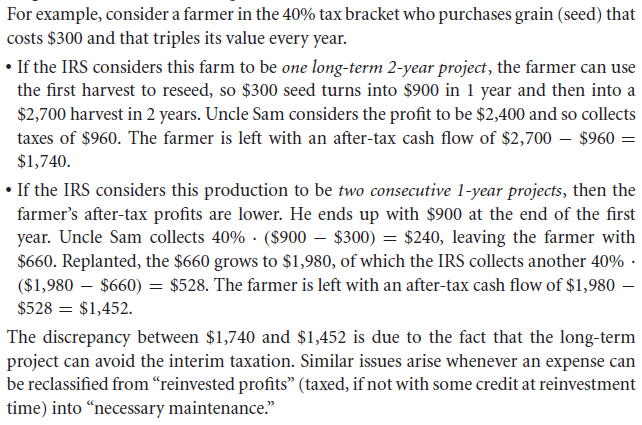

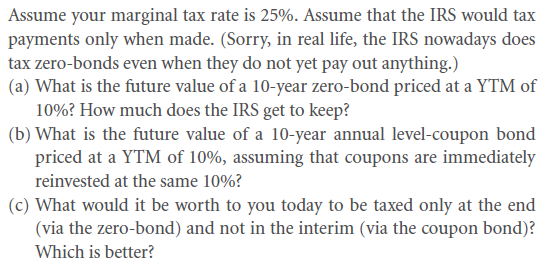

10.4 D. Tax timings

If your project has started off without payment of interim tax penalty, you can see that reinvestment will not be allowed by IRS. The comparison is extremely essential between many short-term investments with that of an individual long-term investment.

Solve it

Links of Previous Main Topic:-

- Market imperfections

- Causes and consequences of imperfect markets

- Opinions disagreements and insider information

- Market depth and transaction costs

Links of Next Financial Accounting Topics:-