In chapter 9 and in 6, you have come up with the terms like time premium and return rates related to decomposed quotes, risk premium, and also about default premium. In fact, extra premiums are the result of market imperfections.

It is extremely difficult to quantify premiums related market imperfections. Still, we have tried our best to come close to giving you a good idea on it. Taking on the disadvantage ousness, it can be said that there aren’t anything highly useful details for premiums on the imperfect market. Such premiums recoup mostly on opinion differences. If we talk about the nature of these premium info disagreements, it comes in the category of idiosyncratic. However, in no sense can it be considered unimportant.

There are certain situations where you will find these to hold a large proportion that can capture a certain portion of financial market and literally destroy its viability.To counter such situation, there are indeed3 imperfections for premium creation. They are:

- Shallow markets

- Transaction costs

- Taxes

Combination of 3 of these or at the very max, individually, they are able enough so that they can quantify. This is better than premium which is calculated with the help of disagreements.

If you consider the same class, differentiation related to tax can come out to be modest. Treatment of various assets, when done via tax perspective, do offer return rate of a higher percentage. Even if it is worse, you can get the near precise resultant.The example of municipal or muni bonds is an excellent one which you can see excluded from taxations related to federal state.In this case, higher return rate has to be proffered by non-municipal bonds, which finally has to be given to tax-exempt bonds.

In the same way, you will find that state income tax is imposed on corporate bond holders. This case is not implied on federal Treasury bonds. It highlights the fact that these bond holders do require to pay tax premiums. These premiums can be simplified to be an amount that is relative to Treasury or Treasuries. Amongst all of these, there are also 2 factors playing prominent roles with the premium payment. They are deep markets and transaction costs. Generalized terms that that helps in giving premium outcomes do form a term known as ‘liquidity premium.’

Idea related to this is to explain the difference between choosing illiquid and liquid security. Where liquid security can be easily converted and be used instantly, illiquid securities are tough to convert. Any corporation who are offered highly illiquid security demands additional return rate to purchase less liquid securities.

So the analysis related to the earlier premiums is given with the help of a formula:

There are variations in these premiums which can be an alternative in this formula. It may be bond contract feature premiums or information premiums. Additions of these are not highlighted here because of less empirical evidence of those. Addition to this fact, you can see for yourself how tough these calculations related to premium decomposition are which makes the entire comprehension a little complicated. This is mainly due to overlapping of premiums.

One of the instances that you can see under the aspect of liquidity is co variance-risk. We explained in simple words; it can be stated as an increased spread in liquidity resulting in positive market beta when there is a decline in the market. So it is clear via this statement that liquidity premium or risk premium are quoted spread’s parts. But if you see the formula given above, it is highly useful for basic decomposition.

If you look back at chapter 6, you can see the significance of default risk on corporate bonds. This in totality gives the idea of default premium that such bonds proffer. What you can find from these to be relative to Treasuries.

Let us make notes about credit ratings where market betas are between junk bonds and investment-grade bonds. Ratings for the former are 0.5 where 0.1 is for the latter. So a large premium (probably meaningful) has to be offered to investors in accordance to junk bonds. We also have to keep the fact in mind that this takes place in market risks. However, any type of beta premium is not that important when it is about investment grade bond.

Again,there is also an important fact that there are many corporate bonds which do not get sold easily. Sidelining those from organized exchange, these are traded over the counter in most cases. Hence, liquid premiums are what asked by buyers. In addition to it, state income taxes are also subjected to these corporate bonds. So, if you wish to purchase these, you need to proffer tax premium on the bonds.

In chapter 6 you have already seen Ed Altman study where average return rates (historical) are added on corporate bonds. Duration of those was between1971 and 2003. Rate calculation for it is explained in the following ways.

The promise of typical junk bonds is related to 500 basis point spread on a yearly basis. The considered Treasury bond duration is 10 years. But the spread that theinvest or ends up with is only of fewer basis points- 220. So here it is clear that 280 is the default premium basis points.

Promise related to typical investment-grade bond has Treasury bond equivalent to 200 basis points. But when it comes to investors, they are left with only 20 to 40 basis points that are calculated above the Treasury. Here default premium is of basis points 170.

Now you can understand how important corporate bond yields are and the role of default premium. An explanation for totality of junk bonds is given here which has basis points of 220. For investment grade, the points are from 20 to 40. It also includes premium variations, liquidity, and risks.

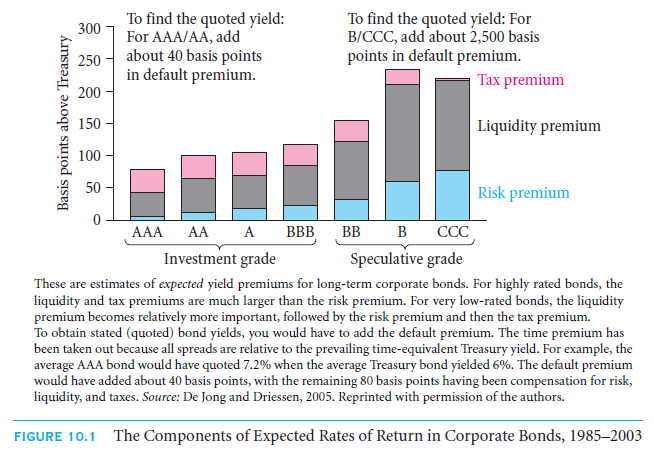

It was between 1985 and 2003 at University of Amsterdam where Professor Frank de Jong presented bond study similar to that what we have discussed earlier. His explanation was based on average return rate of decomposition that can be seen in liquidity risk premium. Aside to this, he also showed for the same in tax premium and market risk premium. This was a completely innovative way to explain all about it than the study produced by Altman.

With the help of this figure you can see that for CCC bonds, there are 250 basis points and for AAA the basis points are 40. There is another figure to give better comprehension.

It is clear that these were defaulted premiums which were not possible to be earned averagely. There was extremely small rating level when comparisons were made for market risk premiums between AA and AAA bonds. The number was nearly 0.1. However, when this same rating was again compared with rated bonds (CCC), it was seen higher with an annual yield of 1%. Fir high rated bonds, basis points related to liquidity premium was 50. But when it came to junk bonds, the points were between 100 and 150.

Now if you consider about institutional investors, you will find most holding bonds of investment-grade. Here you can fairly have an idea that a sudden shift to speculative grade from investment grade does have some penalty. This is mainly on liquidity on a larger scale. Take a close look at B and BB bonds, and you can see arise in return or yield on a sudden note.

For now, do not consider CCC bonds. Leaving this, all other bonds had imposition of income tax premium (state). Basis points on all of those (except CCC) are around 20 to 30.

Solve it

Links of Previous Main Topic:-

- Market imperfections

- Causes and consequences of imperfect markets

- Opinions disagreements and insider information

- Market depth and transaction costs

- Taxes

- Entrepreneurial finance

Links of Next Financial Accounting Topics:-

- Multiple effects how to work novel problems

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management