In the prior section, you got an idea of assumption violation as their respective outcome (a hint perhaps). Here you will come to know their handling procedure. It is essential that you are well acquired to learn about correct judgment when it in case of an imperfect market. In addition to it, you also require facing and using them efficiently the way managers and real-world investors uses those.

You need to have an idea to handling them to increase your wealth even if there are no distinctiveness in it. While going through this chapter, you will have an insight of few things.

- How vast is a market extension?

- How to resolve those?

- If they are unavoidable, how to use and work with those?

If we consider disagreement influences in the first place, in a perfect market, opinions related to assumption violation will be same by everyone. Now, it can be a valid point in some cases whereas it may not work at all at other places.

10.2 A. Promised Return Differences or Expected Return Differences?

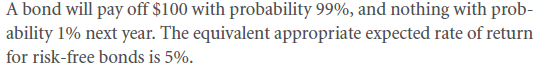

Only in a certain world clouding uncertainty, you will find no disagreement assumptions. In such place presence of options or facts related to its differentiation seems really absurd. Do you have an idea what can happen if a borrower or lender does have variation in judgment or details regarding similar fact? One of the highly important conditions where major disagreement can take place is default risk.

Let us assume that you do have any kind of credit history. Seeing this factor, there are high chances that no lender will feel safe to give you money. This is because of repayments that are not promised, leading to the entire transaction to be in high risk zone. There may be also chances that the person from whom you are taking a loan may analyze your default probability. It can be somewhere around 30%. Now on the basis of that, imposed rate of interest on premium may be 10%. A closer look will help you realize that credit card vendors and the lender are basically taking the same interest rate from you.

When you are taking an amount as a loan, you will have to return it. However, as per your opinion, appropriate default premium on fair grounds should be 0%.

Now expected the rate of interest might vary when there is a difference of opinion in the mind of a potential lender. This is on both the grounds of borrowing or saving money. If you go back to chapter 6, you will get a better clarity on imperfect and perfect market situation.

Nevertheless, here is a brief description between the 2.

Imperfect Markets

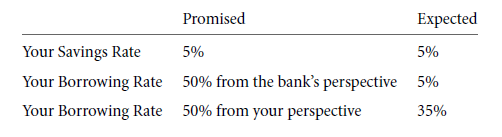

Suppose you are planning to take a loan from a bank. Again let us assume that you fail to agree to bank’s default probability. As per the belief of bank, it is 30%. But when it comes to your opinion, it should have been 10%.

Rate of interest that is probable to be quoted by that bank will be,

30% + r x 70% x (-100%)

This will give the answer as 5%. A quick calculation will give the value of ‘r’ as 50%.

On the basis of this, the expected return rate on 50% may stand to be 35%.

Calculation for this will be,

Let the total be 100%,

Your assumed % = 10%

So, (100% -10%) = 90%

Now,

50% x 90% + 10% x (-100%)

This calculation gives resultant as 35%.

This difference of information or opinion is a major cause that leads to changes in expected returns. So, expected rates for both lending and borrowing will also behaving variations. The dependency of capital cost directly relies on expected rates in case the bank is proved to be wrong. Again, if you are wrong and not your bank, in that case too there are different lending rates and borrowing rates.

Perfect Markets

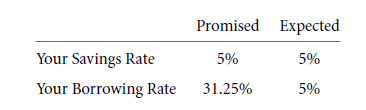

Suppose, you and your bank have come on a similar term where default probability is fixed at 20% without any repayment. Appropriate rate of interest with risk neutrality is taken as 5%.

Computing on the basis of the given points,

100% – 20% = 80%

r x 80% + 20% x (-100%)

Its resultant will be 5%

Therefore, promised a rate of yield, in this case,will be 31.25%.

The above highlighted 5% will be the expected return rate of bank. As most banks are insured by government, as default, money deposit will be free of charges.

On comparison, if you find that credit spread is less than that of quoted rate of interest, capital costs related to loan amount will still be 5%.

Important aspects to remember

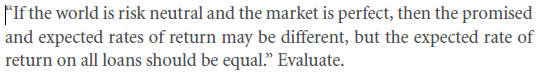

- Credit spreads highlights opinion variation that you can see between lender and borrower. This is mainly about the expected rate of interest that is calculated between the 2 sides in the imperfect market.

- Market imperfection cannot be termed for expected return rate or promised return rate and the variations in between both. Default premium is reflected in credit spread.

10.2 B. Credit Rating, Collateral, and Covenants Agencies

Suppose you wish to start an organization. Being an entrepreneur what should be your plan of action for capital cost reduction? A simple answer to this query is to make sure to let your lender have the complete info about your new company plan. In addition to it, you need to make him accept the fact that you will be returning the loan amount.

This reduces doubt (if any) from the mind of the lender so that you can use repayment in future (if required). Now, this is just a theory as your lender does not have complete trust on any of their borrowers. Even if you are providing him necessary details like collateral, credit history and other info as doubt reduction, there are high chances of having opinion difference. On continuing this for relaying information, you can see less capital cost.

On the worst case, it can happen that your lender may have some confusion about your new business. For this, you will concentrate more on better communication.

To reduce such information differences, there are 3 essential mechanisms.

- Collateral

These are the assets that can be repossessed by creditors in case the borrower cannot pay the loan amount.

If you take the example from the 19th century, you can see that creditors use to inflict the fear of sending the borrowers to prison if they do not repay the amount they had taken as loan. To get away from such punishment, debtors would even promise to pay more as interest rate.

- Covenants

This is a form of agreement on a contract stating all the necessary steps that a borrower should follow for credit maintenance. Minimum corporate value can be taken as one of the forms that can be mentioned in the agreement papers.

- Credit rating

This mechanism mainly deals with removal of uncertainties related to repayment issues. This is extremely helpful in evaluating future default probability. Now you can understand why you are required to provide your social security number if you wish to take a personal loan.

It is easier to judge default risk, especially in case of huge corporations who take loans for their projects. However, this will surely cost money and time of such corporations. In case if company situations see any changes, bond rating agencies make sure to update that in their ratings. But if you consider the information from empirical evidence, their suggestions will state that these ratings are that helpful with whose help investors can earn higher return rates.

If you consider these ratings, you will find them more responsive to declining underlying bond value. The same is applicable to the other side too. So with it, you can get a clear idea that agencies dealing with such rating are less proactive and highly reactive.

Now let me give you a simple overview regarding money lending and borrowing. Have you ever considered the fact that you are afraid to loan a small amount to your neighbor or your friend, fear of not getting the amount back? Of course, you would certainly have. But if the same condition is seen from the perspective of anonymous market, you will be more confident of lending money to strangers.

Even if there is uncertainty in such markets, risk spreading and repayment governance has helped a lot for this market to grow and develop.

Solve it

Anecdote

Sumerian Debt Contracts

Collateralized debt contracts are well known to everyone in the present time. However, its occurrence has been found way back to the Mesopotamian civilization, or basically in Sumeria. That promised repayment was to be in silver that borrower or his son has to make. Now, these contracts are considered illegal as debt repayment system. It is taken as ‘de facto “debt slavery.”’This information was published by National Geographic in September 2003, and you can see the tablet and read more about it

Links of Previous Main Topic:-

Links of Next Financial Accounting Topics:-