If you think about it, options are nothing but another form of a contingent claim & a pretty strong one at that. The most prominent one that you will have at your disposal is the choice of walking away from any such option which does not suit your requirements. There is also an option called ‘call’ which allows the person to buy a certain level of security for a fixed sum of money. Another option defined as ‘put’ gives the holder the right to sell some form of security. Obviously, the amount of money for each of these things depends on the basic asset which is being taken into consideration. It can of course, change over time depending on other factors.

Call Options

The table below shows a list of the options which were traded on the day of 31st May 2002. For instance, you had the ability to get yourself an IBM at a price tag of around $85 in total which in turn, gave you the opportunity to purchase this product between the time period of 31st May and 20th July 2002. As mentioned before, the value of these options increase from time to time depending on a ton of factors that need to be taken into consideration. For example, if a price of any share related to the July IBM was anywhere below $85 on the date of 20th July 2002, your right to this option would be as good as useless.

Purchasing a share at say $70 wouldn’t be the smartest thing to do for anyone. But as mentioned before, the brilliance of having an option at your disposal is the choice of walking away from it in the first place. If on the other hand, the price was higher than $85, you would be making a profit equal to the difference in between these 2 prices. It would be wise for you try and make a profit if the said price level is that high. If you still have not understood the whole math, then here is something that will definitely help you out.

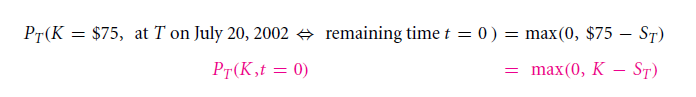

It goes something like this:

CT(K = $85, on the day of 20th July 2002 <=> Time remaining t = 0 ) = Max( 0, ST – $85)

Therefore, CT(K, t = 0 ) = Max( 0, ST – $85)

Here, CT is basically the value given to the option to call on the finale. The stock price of the whole thing at the expiration date is given by ST and also K. If the former is lower than the latter, it means that the person in charge will not choose to exercise his option to do anything and will thus earn a total of zero dollars. If you observe closely, you will soon realize that this option resembles something close to a an alternate bet between 2 external observers. No one has to own the stock itself and no one has to buy it if he doesn’t want to.

Now you may be wondering in what kind of scenario a person needs to sell his option right? Well, the answer to that is in pretty much any scenario with an exception to a few special cases. After all, there is money lying on the table for whomsoever is willing to sell his or her options. If the price offered for selling is fair enough, there will be buyers willing to give you the money you seek. Obviously, these buyers intend to sell these shares later on at an even higher price. One side of the financial agreement will pay the money to the other and the result is, one of them ends up with more money while the other ends up the opposite.

There are certain motivations that drive both the parties to do their bidding in this business. You should be aware of some most basic things involved. For example:

The Buyer:

Now you may be wondering why someone would want to buy someone else’s call option right? It simply acts as a method to say that prices will rise up in the future in which case, the person buying can sell it for a greater amount of money. All of this can of course take place only within the expiration date of the share itself and if the buying price is greater than the set standard.

The Seller:

So what is in it for the seller you ask? Let’s just say that you are an owner at IBM and want to keep hold of a share until it reaches $90. Once it exceeds that point, you want to sell it at a profit even if that is as meagre as it gets. You will of course get an immediate pay back of the upside that you from selling your part of the share. Of course, there are a lot of things to consider for the seller before deciding on whether or not to sell it at all. There are good shares and bad shares all around the market and some have more potential than others. As such, it is wise to let those type of shares grow to their maximum size and then have them sold. This will also maximize your profit margins.

If you want to have something written on the option of a certain stock you own, it will be termed as “writing an option which is covered”. This is a position where you have a bigger hand in your stock and a shorter one in case of a call. If you manage to arrange it properly, the risk involved is not too high. But there are people who make some silly mistakes. Make sure you do not make such mistakes when doing the same for yourself. Sometimes, people write naked options for themselves. It can be profitable but it poses a huge amount of risk.

Put Options

The put option which is available for you is somewhat of a coin flip. It will give you the opportunity to sell a security until a certain time period but that is of course for a price that has been settled before. The difference between this option and a call one is that in this case, it is assumed that the security lying underneath will reduce in terms of price. If the given cost of a certain share increased above its base price before the expiration date, it would be useless to say the least. However, if in case the same happens before the date, the difference amongst the base price and the stock price is definitely worth looking at.

Most of the times, these options for ‘put’ are usually purchased as simply a means of insurance. If you own a number of several shares from IBM, when being exchanged around for $80.5 per single share on the 31st of May, you will probably have been okay with dealing with a bit of a loss but at the same time, not too much. However, if somehow IBM ended up with $60 per single share, the gain would have to make up for a bit for the losses. As such, you can guess, buying this share will definitely cost you a lot of money.

26.1 B: More Institutional Stock Option Arrangements

You will also find a ton of other features when it comes to the business of these options. An option of American nature will allow the person holding the share to make use of their right at any time until the arrival of the expiratory date. There is a huge trading market for such financial options when it comes to the American market. It goes by the name of CBOE or the Chicago Board Options Exchange which is extremely popular and one of the best index options to have which in the European archetype.

So you may be wondering what will happen to a CBOE stock when the stock lying underneath is executed or split apart? Well, the company then decides to alter the meaning of the shares but not its overall value. The act of splitting does not have any effect on the value of the shareholder, nor will it change the capitalization taking place in the company underneath.

ANECDOTE: Geography & Options

The terms known as “European” & “American” and their origin have a slight history to them. It does not reflect on the type of options which are available for you for trading. And though no one remembers what the true birth of these things were, one theory holds that these were traded off in France under the name given to them, which was ‘primes’. Of course, you could only exercise them at the time of maturity but things are pretty different from what we have now.

So at the end of it all, the owner of the option did either of two things: to exercise the option given to them or to not do it. Of course, there is no cost involved in it all and because you could only deal with them at the time of maturity, the terminology used back then may have just stuck throughout the ages. Similar terms which arose in the same period include ‘Bermuda options’, ‘Atlantic Options’ and thing similar to this. There weren’t named according to place of origin but because they lied in between the continents of Europe and that of America.

ANECDOTE: Environmental Options

The range for options which are publicly traded go far and beyond that of stocks. For instance, you will find a huge market when it comes to options in pollution that gives owners the full right to emit harmful substances such as Carbon Dioxide into the environment. It is generally agreed upon that the introduction of trading options in environmental pollution has eventually led to the making of a better ecosystem overall. It has made things so that people are no longer given an incentive to increase pollution. In today’s times, selling plants and industries is far more profitable compared to running it in the first place.

One of the more rarer strategies used is known as the calendar spread; it basically offers you with a longer option as well as a short one all of which are associated with the same kind of stocks. Usually, the variety of options provided for this field is similar to one another. They have similar prices for striking as well but the only difference is that in the expiration dates. As such, they are not very easy to graph out since the date of expiration is taken as constant.

Solve The Following

Q 26.4: If there is a portfolio which consists of a single call option and has a striking price that amounts to $60 along with a single put option added to a striking price at around $80, write the payoff table along with the corresponding diagram.

Q 26.5: Also find payoff table & diagram for a certain portfolio which consists of a single short option at $60 along with a put option which has a striking price of a total of about $80.

Q 26.6: Draw the payout diagram for given the kind of spread below:

- A single long call at a striking price = $50

- Two options for short call at a striking price = $55

- A single long call at a striking price = $60

26.1 C Option Pay-Offs At Expiration

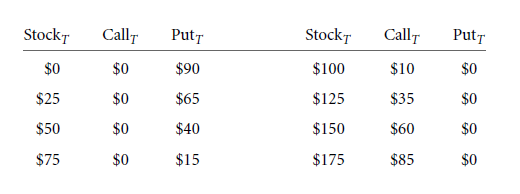

It is far easier to get more information about a certain option with the help of studying the payoff diagram than it is by observing anything else. These help signify the exact value of the given option at the single moment before it expires into nothingness. The table below gives an exact idea regarding these 2 things where the strike price for each of them is $90. There is always a kink when it comes to the strike price of the given option. It is lesser than the striking price and can also be a bit above it, around a 45 degrees straight line to be exact. In case of the put, it is below the normal strike price with a -45 degrees line going through.

Optional: More Complex Option Strategies

These diagrams also assist you to get a better idea regarding the basic and advanced strategies involved in the Wall Street. These strategies can help you to go either long or short depending on what you need. They give you the freedom to speculate any kind of development that may take place in the future. For instance, you can guess if a certain stock price is in between a certain price range at a certain time. As such, it is justified why a person should want to get involved in such activities to begin with.

The 2 most important things that you need to take care of when dealing with these strategies are known as spreads and/or combinations. The spread helps you to deal with the long as well as short options while the combinations are a different ball game altogether.

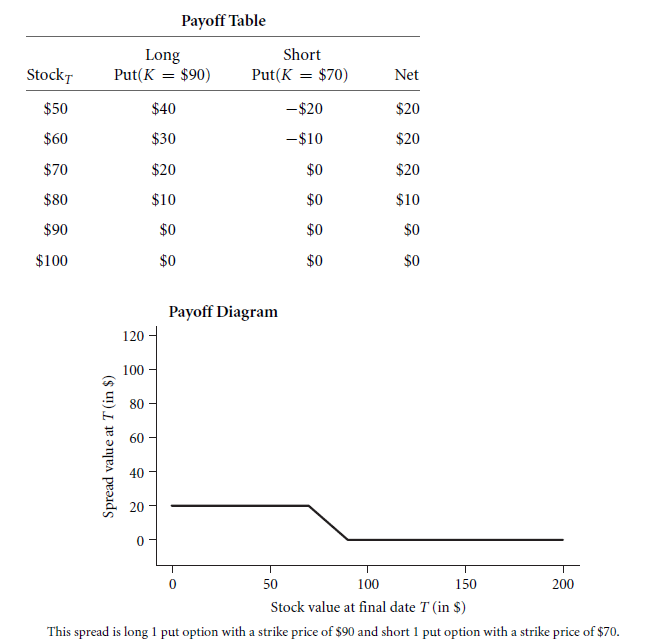

Simple Spread: It is basically a long position which can also be a short one depending on the stock and what it is to be used for. The options available to you in here are pretty much the same and will offer different dates of expiration on the different striking prices. For instance, purchasing a spread might allow you to get a striking price of around $90 and a selling price which amounts to near about $70. The table will help you understand that in greater detail.

Complex Spread: It is basically composed of a multitude of different options, some of which are short and some of which are long. Analyzing the payoff diagram for both of these will get you a better understanding of it all.

Straddle: It is probably the most well known combination there is to know about. It takes a combination of a single put call along with a one call, which can both be either long as well as short and will nearly always give you the same amount of strike price. This also means that the expiration date will more often than not be the same as well. The graph given below should clear it out even better.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

- Corporate claims

- Capital structure and capital budgeting in a perfect market

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

- What matters

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management

Links of Next Financial Accounting Topics:-