Looking at the factors that are used in the formula of Black Scholes, we can get hold of this

26.4 A Obtaining The Black-Scholes Formula Inputs

There are basically 4 factor values that are inputted in the formula that get an option of being found simply online. This you can easily with the value that is made to collect a certain factors. We can sum up 2 methods to follow up this,

- Traditional method uses a duration of 3 to five years on the stock return values and puts down the deviation to be a standard one that gives a rate of return such as,

On the verge of being right on the mark, the rate of returns must be used not as the simple rate of return but in the compounded version. The number that you land up with here gives a straight value.

- The second option price method of calculation is the widely used version that effectively calculates all the estimations that are made for the Black Scholes formula.

Let us look at an example,

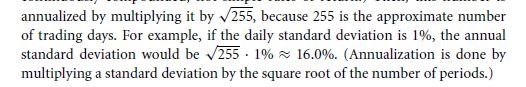

Assuming that the price given by stock prices is $80.5, the strike price to be $4.15 to that of $80,

There will be a volatility that is implied and the estimate gives the best options price with this certain formula. The historical estimation falls short of the value that is discovered and it is eventually the market guess that is formed.

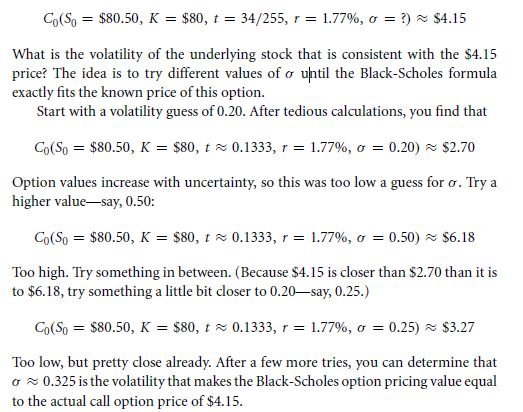

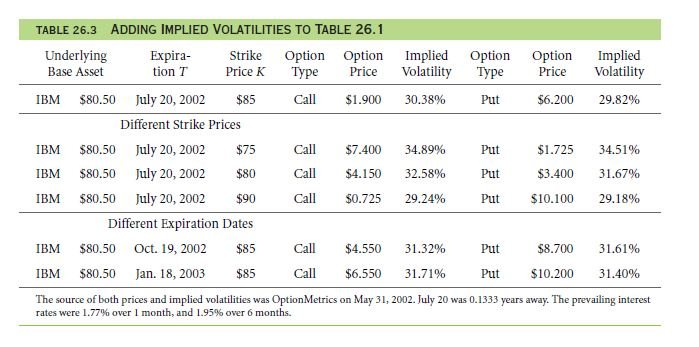

The option metrics makes a valued assumption that is clearly the change that can be found in the computed values. As for the table marked as 26.3, you can get a close call that suggests the valuation that can be found in the month of July. The volatility shows a percent of 32.5%. hence the factors go on to be,

So how about making a comparison of both the volatile values? 34.89% vs. 31.40%?

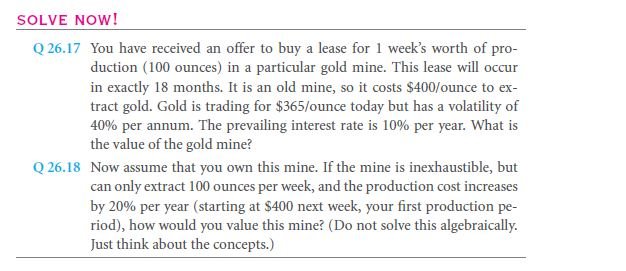

The ideal strategy of this formula is to make and gives an option of pricing to the formula. Though this is the most far gone explanation that is worth, there can be a better value summation. As for the tool mechanism that is used, there can be a real good financial method that is the CAPM which gives a risk free derivative to the altered decision. The discounting that you take up makes it a very simple method to vouch the term for. If you look at the simple version to use, this simply has to be the most easy one to use. On the continuation that is met, there is a simple explanation that you get hold of once you are able to understand the concept of how the module works.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

- Corporate claims

- Capital structure and capital budgeting in a perfect market

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

- What matters

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management

- A call and put options on stock