Almost 75% of all the professors of finance would recommend the use of CAPM. That too in the use of the capital budgeting that is corporate in nature. There are many disapproving formulas to use in the calculation of the value worth and the risks that you can encounter in the world. However, there is the formula of CAPM that gives right and unnerving calculation that is simply flawless.

9.8 A The Arbitrage Pricing Theory (Apt) And Inter-temporal CAPM (ICAPM)

There are a couple of alternatives that you as well as any finance student can use. It is known as the inter-temporal CAPM or ICAPM. The other value that you can incorporate easily is APT ore the arbitrage pricing theory. This theory is used and is not at all distinguishable from the CAPM.

Recalling the entire project that you had encountered,

- CAPM makes you measure the rates of returns for every stock holding department. The market value would be a beta.

- The investors that are in the use of the stocks that gets the better hold of the stock market.

- In understanding the stock market, you get the CAPM formula that is based on the average market and is based on the rate of returns that you get.

Assuming that the stocks do not differ vastly but simply from one another in the existing stock market, there can be a conclusive terminology that suggests that CAPM is a great value formation. As the framework for the rates of returns goes, there is a making terminology that is included in the substitute. Many prices fluctuate hence the CAPM and the rate of returns is subjected to many changes over short periods of time.

The CAPM framework decides the main ventures that are to be made. You will get a good amount of insurance if the CAPM formula is the one that you calculated with.

Supposing for the CAPM is to be found for the price of the oil changes,

This calculation is going to give you the value of the beta there is applicable for the current market. There is a clear calculation for the stock price changes.

So, would you think about putting your money without making a definite calculation that is guaranteed for the stock clearance? The changes that you can implement in the oil price changes will make the perfect picture analysis.

On the contradictory, if the CAPM formula is changed or altered by the APT formula, there is a good evaluation, and you can get a good rate of return,

The APT formula works in an ecstatic manner. The beta value makes up for the best summarized form. The CAPM formula allows the better rates than this one.

The APT is a measurement that is realized into the factor that is gone in respect to the investing area. There hence is the formula that is on the verge of certain exposure. This is hence the bad term file for the uprising market. And this in fact makes it an factor that determines the factor for the market.

What Are the APT Factors?

These are the most common sort of models that APT formula mostly uses. There are common in ground factors that make the calculation of APT a very cruelly unpredictable process.

Factors like,

- Interest rate changing

- GDP changing

- Risk of bankruptcy

- Growth stock returns

- Small firm returns,

all contribute in making the calculation process a determining one.

APT is harder than the calculation that is with CAPM. The best news however is that it works specifically in the interest of serving the investors. There is a certain level of in discrepancy that is involved along with it.

There is no certain guarantee that is hooked on with the third party that works with everyone to give the subject. The models that are used in the APT values are mostly informatory.

9.8 B The Fama-French-Momentum (-And-More) Model

The ICAPM and the APT models are all developed with multiple traditional modular ways. These are governed by the empirical formula applications. The empirical formulas give many suggestions that are given off to the many methods of regularities.

The momentum and the stocks work alongside with each other to give off the best of the 12 month calculations. A firms momentum is dead set on the value of the positive decision making position.

There are many growth and calculation firms that are being governed by the Fama French factors. This is maintained regular structure. There will be more than a million activities that are worth noting about. This is why there is a good amount of factor emphasis in it.

Use of the Model in a Corporate Context

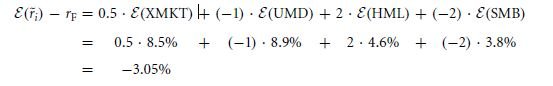

There are 3 sorts of rates of return in the world which make up a greater version for the work that is done on the equity premium. They are,

XMKT: this is the one where there is an average rate of return that revolves around the artifact. It provides an absolute risk free market rate.

UMD (up-minus-down): this is the average rate of return that is offered by the firms and is well done for. 8.9% proves to be the most common average rate of return.

HML (high-minus-low): this is relative to the stock’s value all of the total. It has absolutely opposite strategy.

SMB (small-minus-big): this is only relative to the smaller firms. Hence it makes a lower rate of return at the most.

The maximum rates of return stay to be,

Now, supposedly the rates value up to be that of, coefficients,

- a = 3%

- b = 2

- c = 0

- d = 0

- e = 0

Then the CAPM formula would be that of,

As the risk free rate gets the better hold on the left hand side, there is an intercept of total 3%.

The rate would form to be, the value that is determined by the formula on the lower half.

With the future equity being 5%, there is a need for the formula to be a good value that makes and keeps the market value intact. The rate of return would be 4% + 2 * 8.5% that is equivalent to 21%.

So, let us follow another example that takes and works with a different project. With such premium values it would contribute up to a total of,

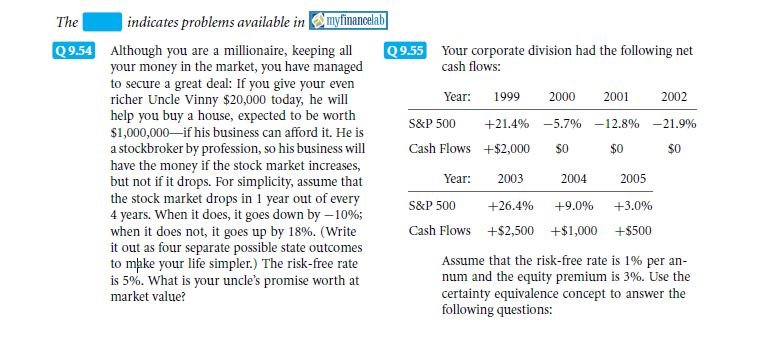

With the risk of rates being sop high no one would invest randomly on a business venture. Therefore not only is the APT or the CAPM value important, but even the premium value of the equity matters heavily.

Key terms

Solve now! Solutions

Problems

Links of Previous Main Topic:-

- The capital asset pricing model

- What you already know and what you want to know

- The capital asset pricing model capm a cookbook recipe approach

- The capm cost of capital in the present value formula

- Estimating the capm inputs

- Empirical evidence is the capm the right model

- Application certainty equivalence

- Theory the capm basis

- Theory capm alternatives

Links of Next Financial Accounting Topics:-

- Capital structure and capital budgeting in a perfect market

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

- What matters

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management