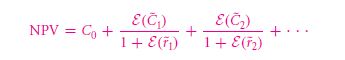

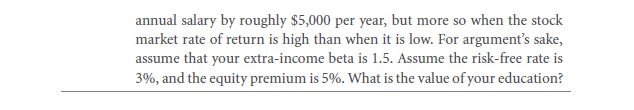

CAPM proves to be the most important deal for a corporate manager. The denominator forms to be of a NPV formula that is:

This further provides the informants with a budding estimate value which is formed for all the costs of capital E(˜r). The value that is collaborated in the CAPM along with the formula of NPV, the cash flow line emerges. On the correlate relation, the total market will get a lesser market exposure to all the investors. Requiring of the rates of returns that are expected, you can speed up the total hurdle rate.

9.3A Deconstructing quoted rates of return — risk premiums

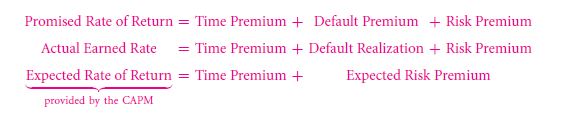

Making a comeback to the section 6.2C, you will get to learn about the perfecto world, where there are no risks in life. The rate of returns covers premium aspects such as time and default.

The most average accountability, the value for the default premium rate accounting is of ‘0’. The expectant rate that is of return will just simply stick to a premium aspect of only time.

In the world filled with investors who love to dive in with risks all around, the CAPM will extend up to a certain rate of return that is expectant. Adding to the premium risk, the rate of return that is expected from a reward is basically very time sensitive and is attributed to the term time premium.

In a world where there is a stability in the field of risks there are absolutely no differences of the assets. The only point of difference being the selected rate of return can be challenged by the CAPM. The other types of assets that you get in the world are different rates of return.

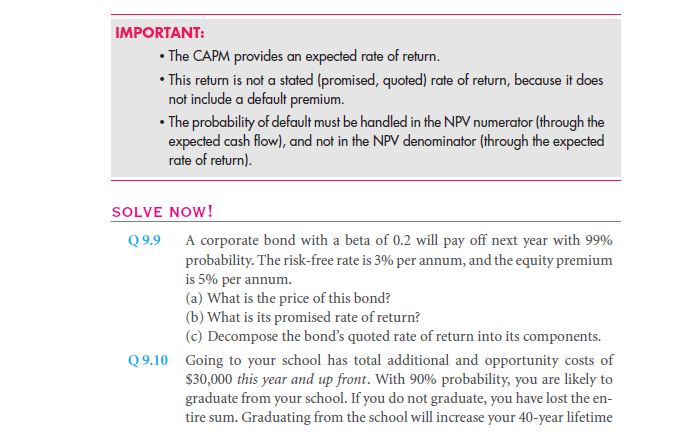

CAPM value does not tolerate any risks with an account. Lesser given a proper rate of return, you can get a direct idea. You must wonder as to how the appropriateness is measured on the rate of return calculation. This is a statement rate that is most commonly posted in the quote stabilized rate of the return that’s governing the real world. What is the risk that you put forward in the learning of the CAPM method? If this is accounted as an official risk, then what is the right decision to take and make?

To put it in the example here is a depiction:

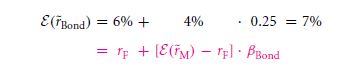

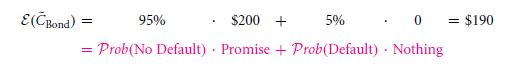

Let us suppose that you wish to determine the present value of the zero bond that you made long time ago. The bond that you get to create is having a beta value of 0.25 and it goes on to give off a value of $200 on the coming year. The bond will pay a value that is 95% of the allotted time. Only a 5% of the time will say that the bond will truly hurt. With the rate of return 6% that promises to give a compete risk free venture, the market will be hit by 10%. Thus, to state out the CAPM value as a rate of return on the suggested bond at hand, it must be of:

On the account of taking risks that too premium and of time, the default risk that one gets for bond is on the account and it’s still a numerator. What you cannot make use of is the to be paid value. What you need to adjust to is the possibility for a default value.

Hence, the value that is stated for the bond is attained by the PV. And is,

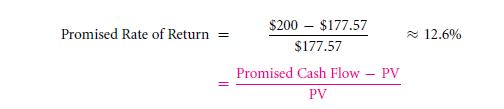

Now, all that you need to do is place the rate of return that was promised with the bond:

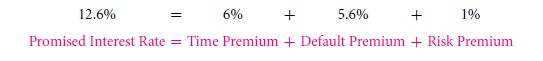

On making the incorporation of the major 3 components, you can get hold of the right example. On account of this bond, the time of premium money, it stands to be of 6% on a yearly basis. The term that you can casually use for the rate of return is that of treasury offers. The premium term value added on to the risk premium will be generally provided as that of CAPM. The percentage of such will be 7% every year. Hence, the 1% yearly discretion is mostly acclaimed compensation for the risky bond holding time period and is thus mostly the risk omitting value percentage. The remaining percentage will be that of 5.6 [12.6% − 7%] on a yearly basis. What you will get accredited as is the non-default value.

Mainly all the bonds that are available are all of the smaller markets having a good beta value. The value stands to be lesser than 0.25. This makes the risk premium to be very less or a lower version. There are some imperfect market structures that will give you a premium value at all time. You will learn about this in 10th chapter. As for all the corporate projects, the risk premium jumps on to a great lump.

Links of Previous Main Topic:-

- The capital asset pricing model

- What you already know and what you want to know

- The capital asset pricing model capm a cookbook recipe approach

Links of Next Financial Accounting Topics:-