On the note to the previous value, CAPM is merely one of the asset price models that make an estimation of the total deal. The representation is not made in the value of any sort of term of rate or on the prices. In the case that you wish to learn the investment assets to be involved with a very certified rate of return. Let me put this in a different way, if someone asked you the total amount of cash that you would like to share up, there is only one accepted thing to say. There will be a massive difficulty in the completing of the CAPM values.

There is a great amount of question format that is jotted down along with the basic turn or adversaries. There is a price index that is set dead on by the CAPM formula. You are asked to get a good look at the right value that you will get when you use it. Hence, the certainty equivalent will give off a registered price that will mostly remain constant.

The basic fact that you face to learn the idea to not invest in the option gets the best solution possible.

9.6 A Valuing Goods Not Priced At Fair Value

Starting off with the puzzle that you have in your mind, how is it possible to get a hand on the artifacts that are used to calculate the variances and differences in it? The stock market will not even make an effort to get their hands on the value factor. The rate of return that you make up for the cash flow gets the absolute intuition for the project that you need to work on. The total of $100 will be laid specific to the gift of a cash flow and will cover everything about the stock market.

So, how will you compute the total value? The perfect solution to this trouble would be such that there is a price value of $0. If you are to focus of the fixed value, then you can get the returns and the beta value of the CAPM.

In a whole and very perfect world, there is this efficiency in the market that you make a payment of. This is to make sure that no such vile instances ever arise again. There might be a comeback of a poor judgment, hence, making this factor to be very poor. The expectant value is to measure by calculating the total value on a later date and then subtracting it to the former one.

In a rate of return that you create, there will be a gifting of the total value. The main problem is to make a specific calculation. This is the one to rate of return that you get a hold of. The cash of flow is not to be restricted at all. The discount rate remains and translates into the factor. The cash value return is made into a more specific way.

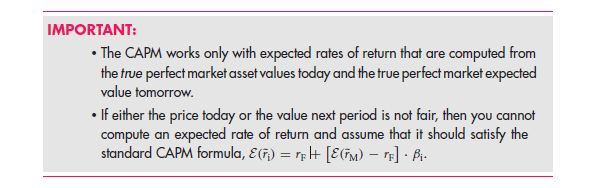

The only way to solve and escape this dilemma is to make use of the alternate formula form of CAPM.

In case if there was a single cash flow future value at that time which is 1, then the new cash flow would be ascertain to the rates of return that flows from the time period of 0 to 1. For this we will need a non-risky method and rate to estimate the total premium value of the equity or project.

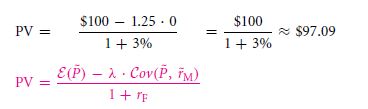

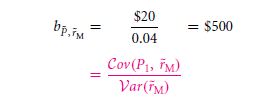

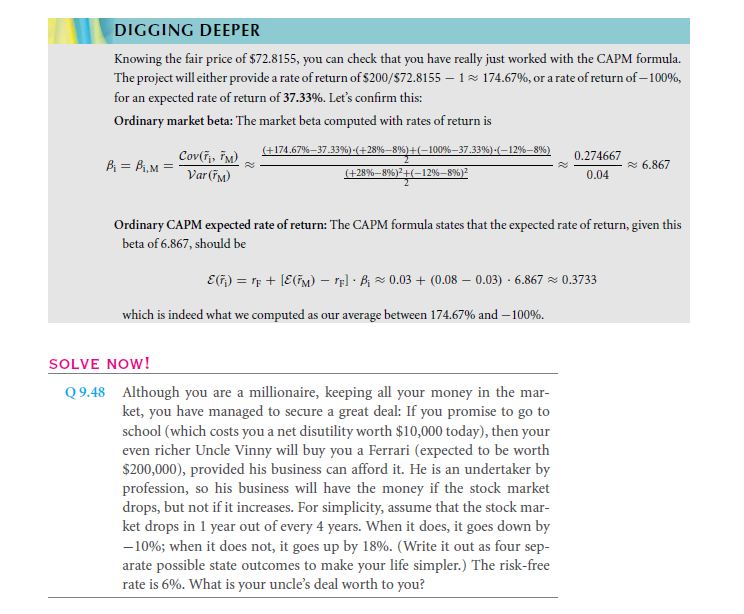

So working with the value of risk less 3% and along with a 5% premium value, let us calculate the value. The standard deviation that you get for the total variance that is offered with 20% * 20% will be 0.04. Hence the lambda value will be 0.05/ 0.04 giving a total of 1.25.

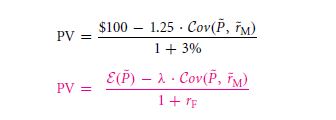

The term certainty equivalence is justifiable. The formula 9.2 depicts that there is a reduction in the expectant value related to the cash flow. There are many rates that are included. The risk lessens of the free value is worth a try to derive by the discount rate.

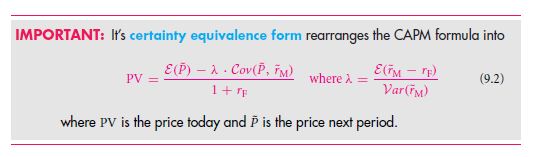

Formula 9.3 depicts that the way that you compose the price that exists in the market, makes up for the risk free rates. The value is limited and very top notch with a great coverage for any risks that the project endures in the market.

The rate of return and the future value is related to each other. The value of those are however, not covered in the market of return. There is a huge difference among the project values and the coverage that is provided along with the rates of return.

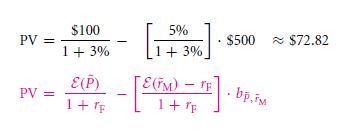

Assuming the gift value to be $100, with the rate of no-risk being 3% every year, the formula that can be jotted down is,

In case you are one of those who trusts the gift that is returned to obey the rules set along with rate of return, it would be,

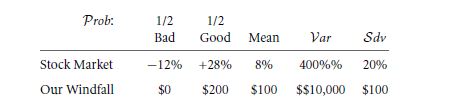

All that you require is to make a note of all the scenarios that are included and act drastically to make the point of creating the most perfect solution. So let us look at an example, supposing that there is a market value that starts going up till 28%, then what would the gift percentage be? That too if the gift value remains to be $200. There can be two possible outcomes that you can look up to,

A stock market value is chosen to make the characteristics of the example that was portrayed above. The expectant rate of returns that you get in the market gives you a total of 8% and the variance is covered by [(28% − 8%)2 +(−12% − 8%)2]/2 = 0.04.

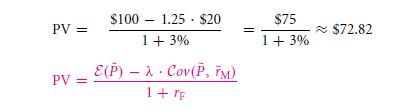

Computing the values, you will get,

As you can see, the lambda value happens to be 1.25, so, what you learn to get a direct use of is the formula of certainty equivalence.

This stands to be a much lesser value than that of $97.09. Thus, you may say that it is in fact worth the market standards.

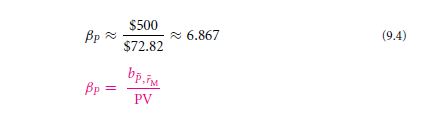

There happens to be 2 more ways which you can use to make a transition to the old school certainty equivalence. The first one comes by changing the cash flow into that of the regression beta formula,

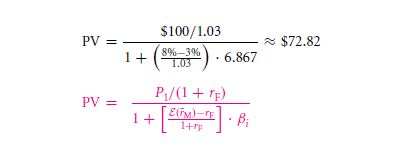

A variance in the above formula can be found too, this is by using the third certainty equivalence,

The final form of CAPM translates the regression beta of the cash flow. This is in fact the ordinary variation that is easy to apply.

This is usually the most contradictory formula. The $72.82 value is the one to begin conceptualizing. The most important formula would be,

In the fight to find the CAPM formula, you can say that it is pretty useful. As for the risk, there can be a project that is on hand. There is a formula that you can use for obtaining the formula that is going to give you completely risk less rate. remains to be that of the secondary rate of interest. You can find the most exclusive beta value for a market.

9.6 B Application: The CAPM Hurdle Rate For A Project With Cash Flow History Only

There are many assignment changes that require your attention. There is a definite change in the gripping of the cost of capital. The owners of the firms keep their portfolio intact. This makes it a more realistic approach on the subject matter. There is a need for the incorporation of the values. The task is difficult to undertake all on your own realistically.

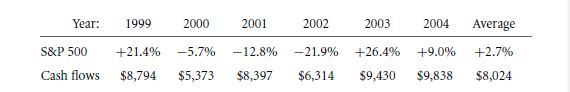

A firm is kept on the market top give a priority value. There are many substitutes that are inclusive of the rates. The annual cash flows are showcased as,

There is this thing about the perfect world, it is full of many problems. There is this need for getting hold of the right variatrion of the formula of CAPM. The main drive that you get by assessing the main formation. The cost of capital is attractive to look at if the calculative value comes as a proper assuring measures the current rate of the capital sum.

When you learn the way the [percentages change in a sum, you can start calculating the rates that n4eed to be taken into account in the real market. With the rate of capital expanding at every moment, it is important to know the changes and the flexibility measures to calculate the right exact amount.

All that you know for now is that the cash flow can be changed and directed to a more profitable project if you can calculate. The risk that you take to satisfy your willingness, can make you look stunning as an investor.

The first thing that you need to do is take a good look at the cash flow history chart of a company and only then invest in it. The rates of return are implicative and make a great relative terminology for all getting medium. The CEV depends on the strategy that you follow on the sole path and get a good rate of change, the one that you wish.

Here I will give you a big warning to work along with the measurements. There are many long term components that are involved in the flowing of cash. To represent all the data even for a simple company would be difficult. This is why we choose to omit the information, or else we will end up representing a huge computer prints.

There are many indicative formulas that have a strong correlation among themselves. Hence, there are no short comings in the worldly techniques. The most common remedy that you can locate on is the space gaping that they have among themselves.

Here is an assumption of cash flows that can be done by incorporating the data of the beta values that are surrounded in a firm. The S&P 500 will be in the regard of all these.

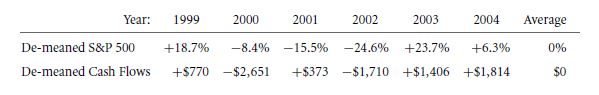

Now, let us input the variations that are required with these cash flows. We will multiply these values as,

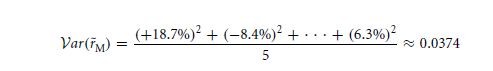

Computing the value with,

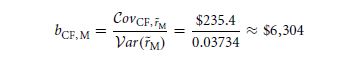

Cash flow beta valuation will be,

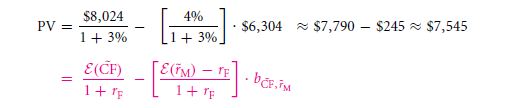

Historical mean of the cash flow have stood up as $8,024. Thus, adopting the right equity premium value, we will adopt a 4%,

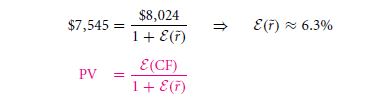

Whatever be the value, there will be a good appropriate cash value of the firm which is correlated into the existing market. So, should the discount rate be valued as what?

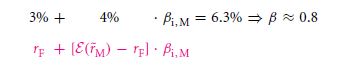

Having an estimate value that is relative to the cash flow value, there can be an assumption of the ones distinguished on the coming year. This particular formula is equivalent to the market beta value that is,

The formula 9.4 can also be used in the value formation. The beta yield is depicted out to be an 0.8.

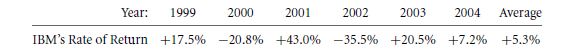

The firm that we took the values and calculated is none other than IBM. Now that you know that this composition was for IBM, you can get a determined assistance in working with your own formula.

On calculating the beta value that exists in the market, the estimated value would be that of 0.7. This value is very close to that of the estimated value that was obtained from the cash flows.

Links of Previous Main Topic:-

- The capital asset pricing model

- What you already know and what you want to know

- The capital asset pricing model capm a cookbook recipe approach

- The capm cost of capital in the present value formula

- Estimating the capm inputs

- Empirical evidence is the capm the right model

Links of Next Financial Accounting Topics:-

- Theory the capm basis

- Theory capm alternatives

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management