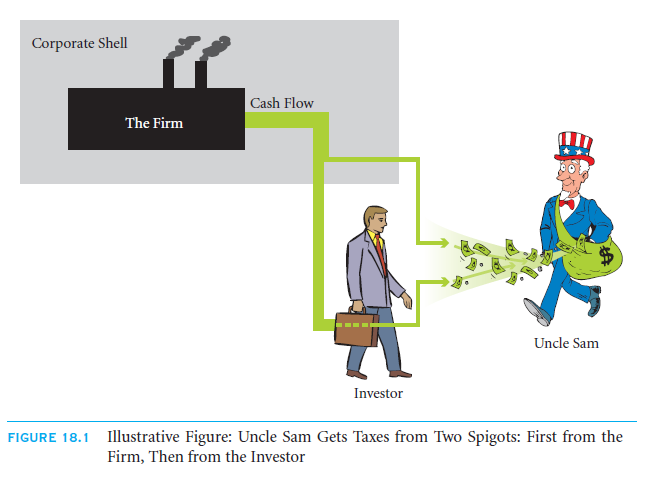

Let’s continue the example of Uncle Sam as discussed before. Uncle Sam receives corporate income taxes which are just one side of the receiving figure. Uncle Sam also expect some share from the income of the investors which means that he needs to keep a note upon the personal income taxes of the investors too. Hence, the owner of the corporate is the one who handles the payment from both corporate income taxes as well income taxes of their personal. Let’s understand this scenario with an example:

Consider that 99% is the personal income tax on the interest, 40% is the corporate income taxes and 0% is the dividend of the personal taxes. If you are the CFO of the firm, your duty is to pay out the earnings: as dividends or interest is a big question here!

You have a choice of making the payment of 100$ as the payment in interest. Such type of payment will help you avoid other income taxes like corporate and the entire payment of 100$ can be succeeded can be done in interest before earnings of the tax. Though as a CFO you will feel that this payment option is beneficial as you will involve all the income taxes of corporate. But the problem will be faced by your investors as they have to pay 99% in terms of taxes, which means all they have is 1$.

Now let’s consider the payment option in the dividend form which means you will 40$ in the income tax of the corporate. Such a transfer will allow your investors to receive the dividend in the tax free mode, and they will receive exact 60$ after deducting the taxes. Such a method is more beneficial and will help you become a better CFO.

The first strategy of paying through interest is a terrible decision as you will upset your investors and the value of your firm will suffer eventually. The duty of a CFO is crucial, and therefore you must learn and understand the various actors that can affect the structure of the capital of the firm and how income taxes which are personal can badly influence the same. The firm and the investor share different strategies and profiles on respective taxes, which means this chapter will help you understand the sensitivity of these relationships and how to tackle them all in order to decrease the overall payment against taxes.

In the real complex world, one must understand and follow the following points:

Clienteles of the firm: Firms which are smaller must carry more equities than those of large firms.

Investor Clienteles: Investors carrying heavy taxes must invest in the firms which are financed through equities whereas; investors titled under tax-exempt must invest against bonds.

18.2 A Background: The Tax Code For Security Owners

First we will discuss about the investors point of view where they are concerned about the payment type they receive after investment.

Income which is ordinary: This type of income is difficult from tax shelter and is comparatively high taxed under incomes taxes of ordinary which is around 35%

Income in terms of interest: This income is based on taxes similar to income which is ordinary.

Income in terms of dividend: this income is taxed based but under lower rate. This income is only possible when the corporate has paid their earning taxes. Under such a scenario, the dividends are titles as qualified and thus decrease the taxes rate which is personal forced on to the recipients of the dividend. So for people who are paying between 10-15% of income tax which is ordinary, they are eligible to pay 5% of the tax in terms of dividend. For individuals paying more 15% of ordinary tax, have to pay 15% of dividend tax.

Income based on capital gaining: This type of payment is the most beneficial payment in terms of taxes. But with capital gains at short term, the income tax rate will be higher. But the capital gains at long term are feasible as the income tax rate is taxed under dividend tax which is 15%. There are two other advantages of the same:

There is no annual basis restriction on the capital gains, but can be incurred at the time of realization. Secondly, the capital gains of the firm are eligible for offset under losses of capital.

And hence, we can say that investors can earn in the best form by income based on capital gaining at long term. This procedure and selection is simple and beneficial. Let’s understand the same with an example:

As per the U.S code of taxes, there are various essential regulations and rules that are applied on the type of income which depends on the recipient and the person paying. Talking about securities in corporation, the holders have to pay 35% of the tax rate under capital gaining Ad furthermore, there are some additional rules related to intricate taxes which explains the computation between income of interest and capital gaining on respective bonds. This rule is essential in order to prevent the owner of the firm to pay off in cash which is counted generally as payment of interest for the firm and capital gains for the investors. Not only that, but there are value added clauses in the book of tax codes under which few are subsidies of pure corporate and some are just there to penalize the financial situation.

One needs to note here that these rules of tax codes are not static and are bound to change with every year with current situation in order to ignore the taxes which are local along with contributions towards medications and securities related to social terms.

18.2 B The Principle Should Be “Joint Tax Avoidance”

Managers generally work on representing the best owners of the corporate and therefore must consider the issues faced by the investors along with the income taxes of their own corporate. In order to understand this concept, consider an example where you are the owner of the shop as well as the manager. So will you care if the cash coming into the accounts of the firm goes directly into your pocket?

Or will you care about the amount that will eventually come in your pocket? So basically at the end, what matters is the money you have in your hand which is basically a left over from the amount dipped by Uncle Sam first. But do you care about the taxes which need to be paid in the form of corporate as well as personal taxes?

Of course you do! Well, the same is true about the corporate investors which are very similar to your shop. And it is said that they should not be bothered about the earnings in the corporation. And at the end, they are bothered about after-tax income which is personal and hence these figures will translate to the same. And at the end, it will not matter whether the taxes are paid by the corporation or by themselves.

18.2 C Tax Clienteles

Your Problem: How Can You Minimize Total IRS Receipts?

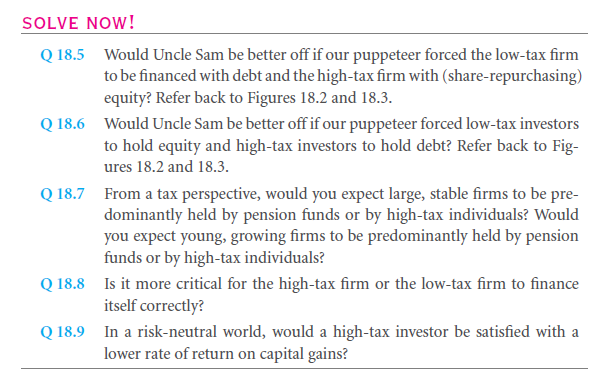

The duty of the managers, who is an acting corporate owner, is to minimize the paid overall taxes which include corporate taxes as well. In order to do the same, managers can also introduce policies of payout and financing of corporate which means that managers can move their taxes to their investors. As we discussed earlier, the investors are only interested in sheltering taxes like capital gains and dividend income, and therefore one can trade off the same:

So let say that trade off is in terms of interest income, this way you will save a lot on the part of income tax of corporate. But when it comes to your investors, they will not be happy with your decision as they will feel burdened with payments of interest. And hence, the demand by your bond holders for a higher return rate will be realized.

So let’s say you plan the reinvestment plan of your earnings which are retained and therefore, it will be considered as capital gaining for the investors. This means that you might have to pay a lot in terms of income of corporate taxes, but at least your investors will receive the payment which will be untaxed gain of capital and not the interest income which will be taxable. This step is beneficial in order to avoid the income taxes which are personal.

One must understand that in the complex world, the tax rates which are faced by the investors are not similar every time. There is one category which is known as investors with low tax status which comes in the category of pension funds as well as charities which are exempt of tax as they very less and sometimes no income taxes on personal basis at all. The other category is the list of investors that pays higher interest income taxes along with dividends on medium taxes and high and lastly, the investors with capital gains on taxes which are lower.

So the question here is what to do now!

Let’s solve this query as a puppeteer which can monitor the private economy. And let’s say that IRS is your competitor. So now, you can play the following games:

- High tax corporations: These are those firms which has high earnings and that cannot avoid taxes.

- Low tax corporations: these are firms which are small but have a high growth potential.

- High Tax investors: These are investors that earn 100,000$ over annually.

- Low Tax investors: these are investors which are into pension funds and charitable funds.

So now, we have to answer these questions: To have the financing through high-tax corporation under equity or debt? Will you prefer investors with low tax to own the corporation under high tax or low tax?

Your Solution: Arrange Clienteles

If the investors are tax exempt, the corporation will be happy with no issues at all. Under this situation, the taxes will not owned by the corporation as well as investor with tax exempt. Corporations in this case will be offering bonds in the yield which is equivalent to the entities of tax exempt.

But the problem is that investors with low taxes are not available and convinced that easy. The fact book of the NYSE reflects the outstanding equities of 11$ trillion in the year 2002. 11% of which was entitled by investors who were foreigners, 36% was by retail investors, and 49.8% was of institutional investors under which half from this category was held by pension funds and tax-exempt. That’s the reason why tax exempt investors are limited.

Now the question here is how will you entitle the best strategy? As a puppeteer you must take care of the following:

- Reduce the intake of Uncle Sam

- And increase your take in private sector

And therefore, the following list of clienteles will help you with the best decision:

- Profitable firms with high taxes: In order to avoid corporate income taxes which are high, the firms with the higher taxes must issue under debt. This step will help the flow of the cash to be paid in the form of interest.

- Investors under Low-Tax: The investors with tax exempt must monitor towards the debt of the corporate in order to keep the receipts of the interest untaxed at the level of recipient. Under the mentioned two conditions, Uncle Sam will snatch a little cash in both of the cases. But how will you allocate the investors which are high tax and firms which are low tax.

- High-tax investors: Investors with high taxes must hold onto stocks rather than bonds. It is important for your investors to face lower taxes and it will be possible as they will receive the dividends or capital gains.

- Firms with Low-Taxes: The growing firms must work onto lower the taxes of the corporate which is possible by financing under equities and not through debt. This is an important step to convince the investors at high end taxes. Firms which are lower in taxes must use their cash flow as a reinvestment in the corporate as well as repurchasing procedure of their shares or sometimes just pay the dividends.

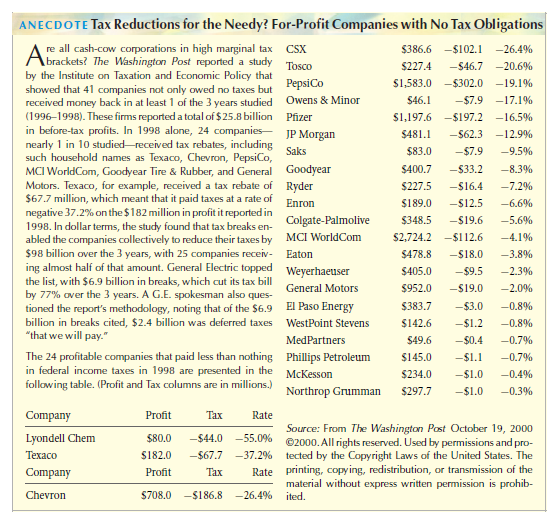

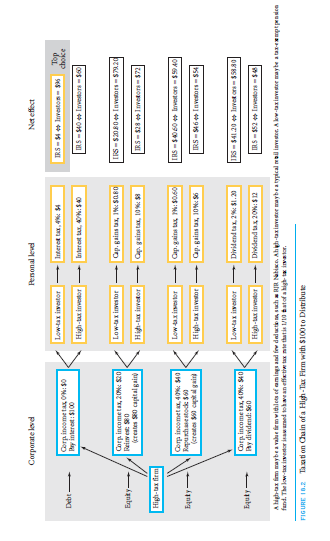

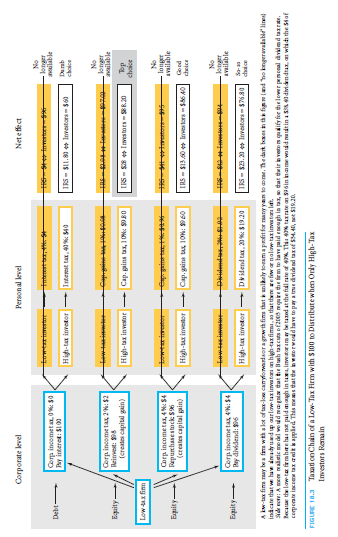

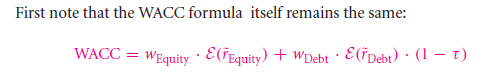

The two figures 18.2 and 18.3 are the perfect illustrations of the role of puppeteer and his/her choices on the investors as well as firms. The figure shows the numbers and the related rates of tax which are not exact. Let’s consider this situation in the world which is neutral and risk free where you don’t have to be bothered about the high costing of equity capital than that of debts. Talking about the assumptions related to tax rates, the U.S. tax code follows the following procedures:

- Prior tax earnings are the best way to pay the interest from the corporations which are high-taxed.

- 40% is the rate on earnings which are paid taxes by the corporation at high taxed. The earnings which are after-tax are used by the firm to purchase the shares or for the payment against dividend.

- When the earnings are titled in the list of reinvestment, the corporations at high axes pay the interest at the rate of 20% against the earnings. The reason behind the same is served by tax credits of some form of investment.

- The firms which are low taxed pay 2% on the earnings which are reinvested and 4% on the earnings. This situation reflects that carry forwards of tax losses are not free!

- Interest receipts are paid by the investors who are high end at the rate of 40%

- Dividend receipts are paid by the investors who are high end at the rate of 20%

- Capital gains are paid by the investors who are high end at the rate of 10%. This explains that dividends are not better than capital gains as they can be offset by the losses.

- As compared to the investors at high tax, the investors at low tax are titled to pay one-tenth of the income tax which are personally effective: which means tax rates are of 1%, 2% and 4% entitled on capital gains, dividends and respective interest this means that tax rates are not null as all the investors which are low tax are not entirely pension funds and nonprofit organizations.

18.2 D How to Think about Different Tax Codes

A very important point which is to be noted from this chapter is that the concept, as followed by the U.S. tax codes remains the same for many other countries who follows the U.S. tax system. But to give you a more clear view on this subject, it is important to know how the taxes shape the optimal capital structure. In any way, it is not assured whether the U.S. tax codes will not be fundamentally different in the coming 10 years, or you might be working in the U.S. in coming 5 years. Therefore, the changes in the tax codes can consider the following effects:

- The tax changes from the effect of the Bush tax cuts in the year 2003 lowered the tax rates on qualified dividends.

- What would have been German firms’ behavior after being informant about no-tax exempt investors?

The Effects of a Reduction in Individual Dividend Taxes— Bush 2003

One can understand here that if you lower the dividend rate of tax, it is similar to lowering equity rate of income tax which is effectively personal. One can realize the same for the concept of abstract structure of capital. But let’s talk about perspective which can touch down extreme conditions, which is:

- If 6% is the demanded rate of return on after personal income by your investors

- Let’s assume here the situation after 2003 which means, taxation was effective to 25% from 50% reduction. We are not considering the assumption of facts before 2003 which stated that income tax on personal level can be avoided just by purchasing the shares again, or we can say re investing on your earnings.

So here the question is, in 2003, what were expected return of tax rates on the corporations in order to finance their project after 2002?

As a fact says, your investors hold the property on the shares if the rate of return on the equity was 12%, which then got converted to 6% after reaching investors. As per the new rules launches in 2003, the rate of return on equities went down to 8% before cutting down the rate of return on personal income taxes which are 6%. So we can see here, that the cost of capital associated with equities went down from 12 to 8% here. Such a scenario will lead to a decision for the firms that they must move their financing strategies from debts to equities, which in turn realize to the fact that corporate, must focus on seeking more projects as the cost of equity is lower in such a case.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- What matters

Links of Next Financial Accounting Topics:-

- Operating policy behavior in bad times financial distress

- Operating policy agency issues and behaviour in good times

- Bondholder expropriation

- Inside information and adverse selection

- Transaction costs and behavioural issues

- Static capital structure summary

- The effect of leverage on costs of capital and quoted bond yields

- Valuation formulas with many market imperfections

- Capital structure dynamics

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management