18.3 Operating Policy: Behavior in Bad Times (Financial Distress)

There are lots of reasons involved behind why firm owners shall restrict debt other than personal income taxes even under all corporate incomes taxes which are saved by now. If the firm is in too much debt, it might reflect that firm in future might not be able to repay all the obligations against them which in turn will result into bankruptcy as well. And hence, the owner of the firm must realize that debts must be limited into action in order to avoid big problems in the future.

PD_13

18.3 A the Trade-off in The Presence of Financial Distress Costs

A situation of bankruptcy and distress in finance is experience in general when debt is realized in the structure of capital of a firm. In the mentioned table, one can experience the distress in finance which will really matter in the firm. Consider an example of a firm with its capital structure LDadding on $55 s the face value, the firm is entitled with fewer debts and can easily meet the obligations of its debts. And hence, the firm will be free from financial distress.

But considering another example where the firm is facing more debts, which means the firm is experiencing capital structure MD and $94 is the entitled face value of the firm. Under such a case, firm will face financial distress and ultimately will not be able to pat creditors, as they might have promised.

If we consider a perfect world, such a situation will not lead to bankruptcy but rather will experience changes only in the payoff schedule and patterns. The bondholders will take over the firm and the firm will be liquidated by $60. The value of the firm will reach $100, which means that there will be no financial distress experienced by the firm.

Talking about bankruptcy, it will occur in a situation when dead weight losses will be realized, legal fees, for example. Considering the lower section of the table, $10 is considered as the legal fees. Considering the same, let’s discuss two cases:

Choosing LD: Under this case, one will borrow $50 and promise to give $55 which means that 10% is the qualified capital cost which results in 100$ as the current firm value.

Choosing MD: Under this case, one will borrow $65.45 and promise to give $94 which means the interest is 43.6 and 10% qualified capital cost. This will state that if you are willing to sell your firm, the cost of the same will be $95.45 and not $100.

Now, the solution here is to reduce the loss of dead weight from the taxes as well as from distress of finances in the firm:

- So if the debt is too less, then a firm will lose the capital in too high taxes.

- And if the debt is too much, then a firm will lose the capital on the costs of bankruptcy

- And hence, considering the debt which is not too low and not too high will help in realizing the current firm value.

Talking about the dead weight losses, they are in fact more impactful than any legal fees that a firm bears. For an instance:

- Too much cost of expenditure to avoid bankrupt situation

- Loss of NPV projects from the firm leading to dead weight losses

- Different terms by the suppliers and customers.

2 and 3 are considered as indirect bankruptcy cost as it does not include direct outlays of cash.

18.3 B Direct Losses of Firm Value

The Process

The entire detail on the bankruptcy is available in the legal forms of chapter 7 and chapter 11 in the United States.

Chapter 11 is a stage where the firm is eligible to reorganize their business only if the creditors vote to do so.

Chapter 7, on the other hand leads to liquidation.

If we see the scenario in real life, in chapter 11, the legal fees and other regulations are generally paid by the firm and have to pay the compensation as asked by creditors.

Direct and Indirect Costs

Direct costs: It includes legal fees which are generally involved in the process consumption of bankruptcy.

Indirect costs: these are cost which are not related directly but affects the firm capital in an outlay that cannot be gained back. Hours dedicated y employees and management is one such example. Let understand indirect costs which following instances:

- Considering an investment plan for customers where they have to invest their capital in order to judge the quality of the product even after knowing that the firm might realize losses or bankruptcy situation further.

- When the sale of the product is dependent on the contact that firm must pay in future, customers might face reluctance knowing the fact that the contact as promised might not be realized in future.

- When it becomes difficult to judge the quality of the product and customer eventually realize the fact that firm might compromise on the quality in order to avoid distress in their finances.

- The trade credit may not get extended by the suppliers when they realize that they their retailers might face bankruptcy issues.

- Buyers will decide on not buying any goods from the seller if the sellers are realized as bankruptcy.

Financial Distress Costs as Transaction Costs?

However, one must understand that significance of costs of bankruptcy have their own limitations. But one can covert the same into transaction costs. How? Purchasing all the debts and equities related to the firm will automatically remove the financial distress costs which are generally developed by too much of debt.

In the real world, if the bankruptcy cost of the firm is less than $100, the transaction costs must be either 100$ or more in order to realize the same as a firm free from debts. In this case, the creditor will act like a shareholder by claiming the financial costs in units. Under this situation the creditors will be ready to compromise to prevent distress in finance in order to collect assets as a reason of bankruptcy.

Under this situation the future expropriation risk will be eliminated and the firm value will not be affected further.

Assessing the Magnitude of Direct Bankruptcy Costs

Talking about the small or startup firms, future distress in finance will always be a possibility where the fees associated with legal work will be consumed by the assets.

But talking about the fortune 500 companies, one must calculate the estimate value of bankruptcy cost. So for an instance, you own a fortunate 500 company worth $10 billion. The estimate of the bankruptcy cost will be

4% x 30% x 20%

This is equivalent to 24 basis points

Where 4% is the distress probability

30% is the value of the financial distress

20% is the dead weight loss

And 24 points is the expected distress cost estimate

Please note that will calculation may not apply for every firm who enters bankruptcy. But such a calculation will help in understanding the importance of bankruptcy costs in order to maintain the capital structure to be a secure level. In this matter, such a cost of bankruptcy will matter to the companies especially in the financial year is declared as recession. In general, such a cost will very large but is considered to be small for the fortunate 500 companies.

18.3 C Operational Distortions of Incentives

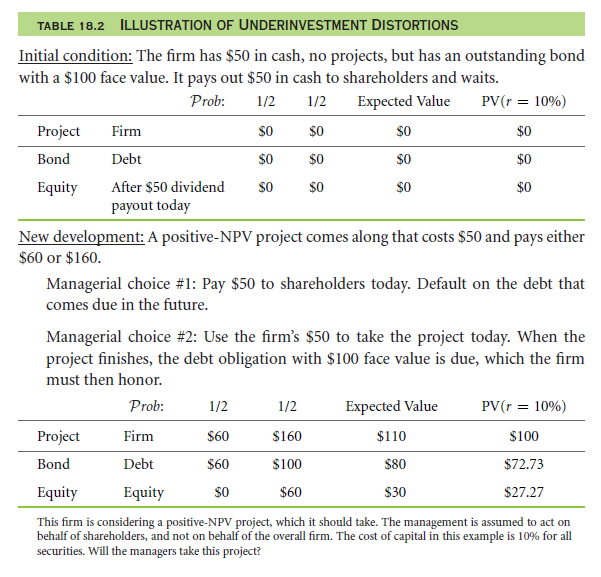

Under investment

Under investment happens in the case when the bondholders do not trust the manager’s decisions on taking a right step when the payment of debt becomes too large. Under such a case, the owner will pay in cash to the shareholder which means they will not put the money into maintenance of repair of any sort.

Under such a situation, what matters is the debt cost towards the firm. Such under investment is not ignorable if the company chooses a zero debt structure of capital ex-ante. This investment is very profitable in the future which will increase the current and future firm value eventually.

Reluctance to Liquidate

Reluctance to liquidate is generally a problem faced by the managers who are acting equity holders in the company. They do not accept liquidation as they consider their equity as an option in the future. I order to save the same; they might want to act on risky pay off procedures and structures as well. They will be ready to take chances on improvement before settling for liquidation.

18.3 D Strategic Considerations

Debt is known as the strategic device of commitment and the same can be understood by analogy of not giving up. Having debts will invite competitors to play in the product market. The industry type will of course matter in this game. For an instance, the finance corporate is relied on too much of debt. But managers following the same strategy when thinking of changing the pattern in structure of capital might not be clear which means that one cannot commit if the price war strategy will be conducted.

And thus is it said that when a firm is carrying too much debt, they lose focus from product strategy and focus more on taking more debts in the presence of cash constraints. And it is true for major companies who are facing too much debt situation and end up in a confusing scenario of price war strategy which may or may not be fruitful.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- What matters

- The role of personal income taxes and clientele effects

Links of Next Financial Accounting Topics:-

- Operating policy agency issues and behaviour in good times

- Bondholder expropriation

- Inside information and adverse selection

- Transaction costs and behavioural issues

- Static capital structure summary

- The effect of leverage on costs of capital and quoted bond yields

- Valuation formulas with many market imperfections

- Capital structure dynamics

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management