In the previous sections we understood that debts are generally worse than equities. The reason is being served by the fact that debt in the company will introduce financial distress in the entire management. Too little debt is equally harmful as too much of debt in the company. Under too much debt, the firm generally goes under financial distress which is a resultant element of poor decision under operations. In the same way, too little debt in the company can also lead to poor decisions of operations knowing that firm is doing really well.

Let’s talk about conflict of interest, or in a better academic manner, “moral hazard”. This word is commonly used in insurance agencies as well as it plays a very significant role in the theories of capital structures.

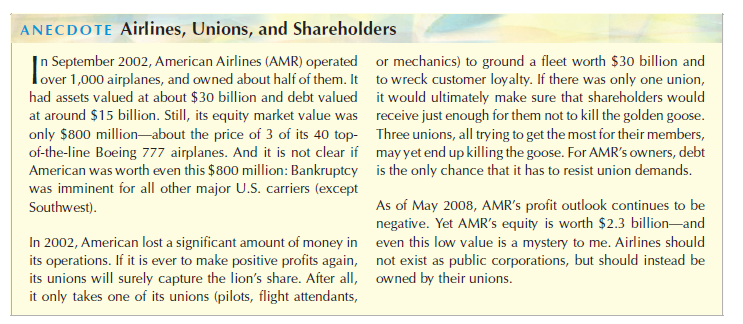

Free Cash Flow: Talking about the managerial behavior, one can say that managers in a company are more likely to invest their money in their project rather than returning the same to the respective shareholders. We can understand the same with an instance from 1980s in regards to oil business. It was said then that oil companies can be introduces to the stock exchanges markets under a very less costing as compared to finding reserves of the oil. But large oil based companies were busy exploring oil back then. Free cash flows, therefore, is a problematic issues as managers desperately look for essential searches in terms of investment alternate to the existing resources, when all they had to do is return back the capital to their respective owners. The question here is can capital structure counter weight such a tendency in the firm? Debts need to be paid under regular coupons. Managers, therefore, need to generate enough capital in order to pay these coupons. And those who fail to do so then are resulted into bankrupts who lose their jobs ultimately. And therefore, managers with more debts spend wisely and wastefully. And these managers are possible worthies in the market today.

Theft: Explicit and implicit thefts are major issues in a corporate even when corporate has more equity than debts. Passive partners of the company are generally dependent on the profit reports of the company. Active partners, on the other hand, avoid showing maximum profits on the sheets. They try to manage their expenses and compensations from the corporate cash which results into lesser profit sheets for the passive partners. This phenomenon is generally known as theft or just outright stealing from the partner. And therefore, debt enjoys an advantage from the creditor by not telling the exact profit figure to the creditor. And if the regular agreed payments are not made to the creditor, the creditor can call or force bankruptcy on the debt.

Stakeholder Hold-Up: hold up costs which carries higher potential is also a disturbing drawback of the equity share. A company, public firm in particular, when rolling cash; the authorized manager that holds the business shares and profits, try to extort the same under his/her profits which is generally known as rent seeking. We can see such a scenario under an important supplier, a distributor or an important employee who plays a vital role in the production of sales and profits of the company. Such parties pressure the corporate by renegotiating on their profits and deals which are generally gained from the figures of the riches. But these parties are bound not to renegotiate when the firm is financed by debts rather than equities as they will recognize and monitor that the cash flow in the company is less to expropriate from. And if forced more, the company can go bankrupt which is not favorable for any parties. And hence, we can say that a company which is raised on debts, the earnings of the equities is quite smaller.

Higher Effective managerial stake:When the debt is higher, it increases the effects of equity holding of managerial. We can understand the same with an example. So let’s say a manager owns a wealth of 5$ in the firm worth 100$. This means that the manager owns 5% of the company. But if the company goes in the debt, managers will not be inclined of that 5% wealth anymore. If the debt of the company increases, managers are likely to face the consequences of the same. And hence, managers chose the projects wisely and decline those that brings the value of the company from 100$ to 70$.

The conflicts of agencies play a vital role especially in large firms. But one needs to be careful with the statement. Though agency conflicts are an important deal in the firm and the present debts of the company helps in controlling the conflictions of agencies, but they are not entirely true for the company in real world that they will suffer more debt. So let’s say managers are the existing agents who are agents in charge and effectively controls the corporate board. Under such a situation they will act under the interest of their self and therefore will maintain a capital structure which will carry more equities than debts.

When we talk about the real world, the whole point is whether the corporate governance of the firm is good or bad. Although, it can be seen in the external equity owners which are large, or potential acquirers which are external playing games on the management and forcing them to introduce or issue more debt when it is introduced optimal in the company to do the same. But the exception is introduced when the corporate governance of the shareholders is stronger over the management. That becomes an unfortunate condition in fortune 500 firms.

Links of Previous Main Topic:-

- What matters

- The role of personal income taxes and clientele effects

- Operating policy behavior in bad times financial distress

Links of Next Financial Accounting Topics:-

- Bondholder expropriation

- Inside information and adverse selection

- Transaction costs and behavioural issues

- Static capital structure summary

- The effect of leverage on costs of capital and quoted bond yields

- Valuation formulas with many market imperfections

- Capital structure dynamics