Though we have discussed many tactics regarding capital structure, but the complexity in the real world is considerably more than what we discussed. The forces that we discussed before are not entirely similar as discussed before, as the isolation of the same can change and differ in different intervals.

On a second count, we discussed the static situation in the perfect world where forces are the key factors to determine the structure of the capital while management focuses on their projects. Well, the same is not true in the real world as they world is not static since managers face lot of issues every year. Under the presence of any single problem or issue, the attempts to reduce such an issue can create lot more issues in return.

Let’s understand the same with an example where we include the costs which are required to shift the sub optimal situation to a perfectly optimized structure of capital. Let’s consider a trade off scenario with the simple structure of capital:

So you own a firm, and you need to settle activities to monitor the distress of finance against the motions of tax benefits under debt of corporate. Talking about a situation which is static, the firm owner will choose the level which reflects intermediate debt level. But the question here is why not to solve the situation with a dynamic structure? Well, let’s understand it this way: Why not the owner of the firm keep the ratio of the debt higher when the firm is working fine and lower it when the firm faces any finance distress. Considering this step, the firm owner can enjoy the benefit of reduce taxes when the firm is earning good profits and will also avoid the cost of financial distress in case of losses. And this way, the realistic world can turn into perfect world!

At the time of bankruptcy, if the firm owner issue better ratio of equity, it might increase the value of the firm. But such a situation is beneficial for the bond holders which means that equity holder may not agree to these terms. This situation explains that even when the firm owner likes to include new start, he/she will be facing many problems to initiate the same as it will only be accepted considering the current structure of capital of the firm.

Talking about the optimal rearrangements that happen automatically that unable the firm to arrange ex-ante contract, let’s discuss few preventions. For an instance, the firm can monitor equity automatically under the potency of bond of ex-ante which will in turn lead to no reluctance by the holders of equity of ex-post. Under such a situation, the firm can also introduce arbitrage of simple tax as it will benefit the major owners of the equities under the switch of shares. Such a step will introduce a forwards contract which means that the shares will be re-switched against the shared under the span of one year. Under such a contract, the payments to the equity owners will be considered as payment of interest which will be deductible from the taxes as well, when considered from the view point of the corporate. Under this period, the occurrence of extra tax savings of corporate is the only possibility. Under these two mechanisms, the securities paid by bondholders as well as shareholders will be higher in value as the firm has increased the tax savings without the cost of financial distress raised at any point. And that is the reason why few of the firms are practicing this phenomenon.

But few firms cannot stand on this practice because it is not applicable to the. The crust is to maximize the value of the firm and shaving off financial distress cost but with bankruptcy to shave off from the infusion of equity may not result appropriate. Let’s understand with an instance, let’s consider that infusions of equity allows the corporate to burn their assets continuously without liquidating them optimally. Such a situation of raising the equity standards to reduce the financial distress might actually lead to a set of managerial behavior which will turn out to be wrong for the firm.

Under this cycle, one more important aspect here is reputation of the firm too. The reputation can cause the financial costing to go low which will result into improvement of incentive cycles and increase in the value of the firm. Considering the previous example of ex-ante, if we consider that managers sustain a reputation in the firm of not accepting bad project, well it can lead to a successful scenario where one can avoid covenants which are overly restricted and perhaps it will lower the ex-ant financial cost.

Talking about investors, it will be wrong to ask if investors trust the managers. Because the question here CAN and SHOULD they really trust managers? Well, managers must be aware of the situations where they can really build that trust towards them and how to accomplish the same. Though the answers are quite difficult, but carry an important hold in the real complex world. Managers, ultimately can create a good reputation, only when they can be good judges of marginal benefits and marginal costs of a given project.

They need be have a good judgment sense of combinations of equity and debts along with other costs involved in the project. Choosing a beneficial and excellent structure of capital is a sign of good managers who can possibly retain a good reputation for a long time. The choices of capital structure are tough to make, and only good managers are sensible enough to monitor the same.

Summary

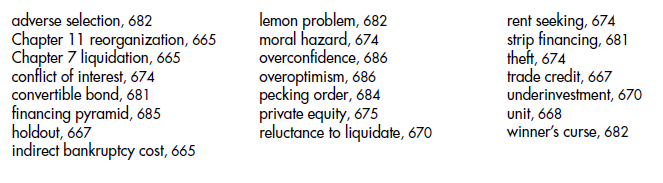

Key Terms

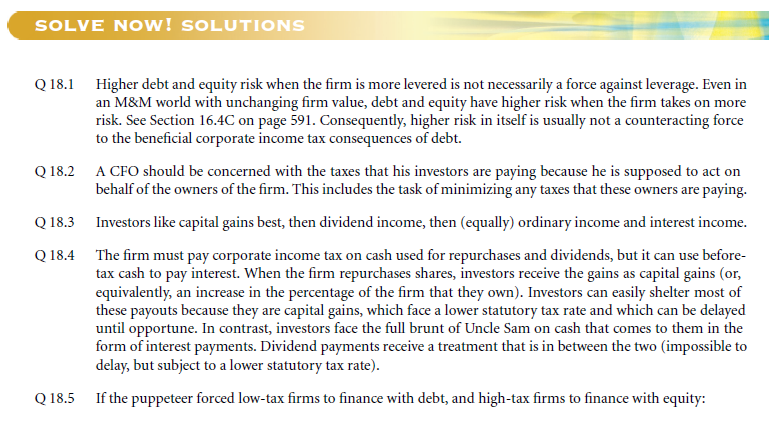

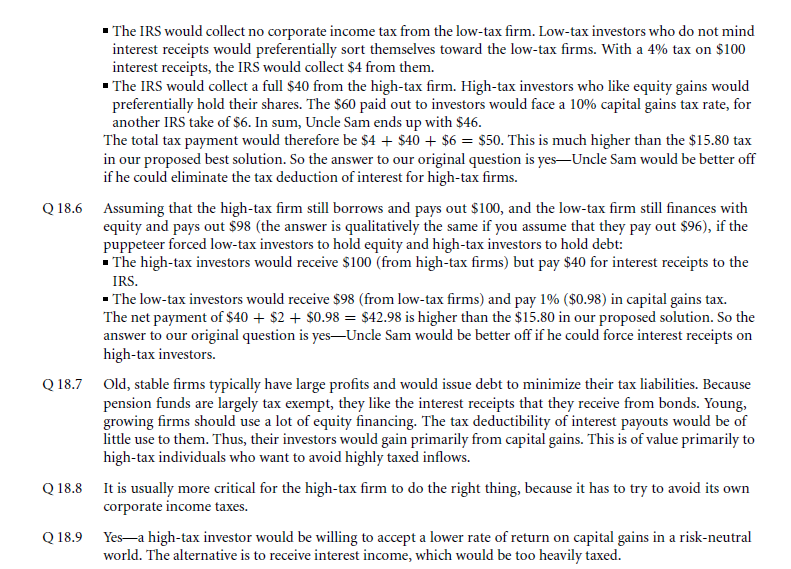

Solve Now! Solution

Problems

Links of Previous Main Topic:-

- What matters

- The role of personal income taxes and clientele effects

- Operating policy behavior in bad times financial distress

- Operating policy agency issues and behaviour in good times

- Bondholder expropriation

- Inside information and adverse selection

- Transaction costs and behavioural issues

- Static capital structure summary

Links of Next Financial Accounting Topics:-