There are some alternative classifications for an efficient market. And depending on their beliefs market prices reflect some values:

True believer: This portion believes that a financial price helps in estimating present values for every future cash flow. And, when fundamental news appears, then only stock prices could change correctly.

Firm believer: When financial price sets may not always predict the accurate value for future cash flows. Due to high transaction costs, investors may not also get good bets.

Mild believer: They believe that when the financial prices do not reflect the accurate values, there are possibilities to exploit this misevaluation. This may make scope for some good bets.

Nonbeliever: It states that financial values fail to give the accurate price every time and so the investors always end up getting the fair bets.

But, these believes are weaker. A true believer may not be a firm believer and also the stock prices may change because of unrelated news. Similarly, a mild believer may not be a firm one, as transaction costs may run low to make opportunities for great deals.

For instance: In the year 2000, a network company spun off a PDA company. They were 3COM and Palm respectively. The former retained 95% of Palm’s stocks and declared that each shareholder will receive 1.525 shares of Palm. The shares were closed at $95.06. 3COM should have earned approximately $145 but, the prices of Palm’s share went down by $2 by 2003. And 3COM ended up with $81.81.

This example shows that financial markets are just in between mildly and firmly efficient.

Often it is seen that investors believe it is predictable if the price of stocks will go up or down. Some calls in investor psychology.

11.3 The Random Walk and the Signal-To-Noise Ratio

It is a fact that the signal to noise ratio in financial returns are low. That is, appropriate expected change in price is low compared to ever changing volatility of prices.

October 4, 2007 was not a favorable day for financial markets. Treasuries of ten-year stood at 4.523%, down by two points that is, -0.44%. Thirteen week T-bills were traded at 3.84% down by -0.13%. 37% of NYSE stocks were declined, while 59% were advanced. Dow Jones rose by 0.04% from 6.26 to 13,974.31. S & P by, +0.21%. All volume leaders had a fall. But two companies had no big news on this day; PepsiCo earned 0.54% and IBM lost 0.61%. What can be the conclusion?

11.3 A The Signal

If the cost of a share of a company is $50 today, what can be the expected rate of return? Now suppose, if the stock price changes is considered +1% or -1% daily, the rate of return on this particular stock will me more than 1000% within 255 trading days. Hence, according to this theory, the $50 stock will cost $600 the next year.

Likewise, the same goes if the rice decline by 1% per day. And so, that $50 can shrink to $5 by the coming year.

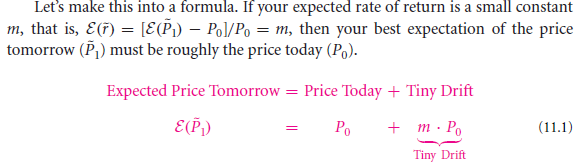

So, in United States stock markets the average acceptable range of return rates lies between- 0% to 40% per year. And according to basis points, it ranges from 0 to 15. One basis point of return each day signifies 3% return rate per year. So, the formula to calculate the expected rate of return is given in

The tiny drift in the formula may range from 5 to 10. This is referred as random walk with the drift.

So, it can be concluded that random walk is an important step toward achieving an efficient market. But the other way round is not possible.

A Complication Transaction Costs

A crucial point for perfect and efficient market is that no signal can be appropriate even after all the information is available. It is impossible to predict price changes. In real world it is completely different. There are transaction costs which prevents for exploiting the wrongly valued stocks specially those for short runs. Even nominal transaction costs can turn the trading strategies and make high expected return rates unprofitable.

There are two ways to view an imperfect market with transaction cost. The hypotheses are:

You may work with post-transaction costs. So, the EMH may hold on. With round trip transaction charges the daily basis points should never exceed 30 points and should me more than 10. So, according to 255 working days, 1% per day turns out to be high. Even 0.7% is way too large.

If certain investors have lower transaction costs, the EMH can hold off. Sometimes, the signal to buy a stock for one day may be very strong. But, you have to pay the transport cost. While, the investors who are planning to sell the stocks has to wait for one day to take advantage of the misevaluation.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

Links of Next Financial Accounting Topics:-

- The noise

- Investment consequences

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management