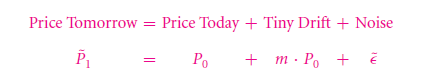

On the formula of calculating the expected price; noise is a variable. Check out the image

There is no theoretical explanation that why the standard deviation for daily basis should not be 10%, 50% or 100%. So, we simply rely on the empirical dataset. Though there are suggestions like:

Depending on the scale of the firm, the daily base standard deviation varies from 2% to 3%. For high ranked port folios, this may vary from 1% to 2%. For instance; on October 4, 2007 when the volatile market was lowest, the noise movement ranged between 200 to 300 basis points, which is indeed too much higher that 5 or 10.

11.3C DETECTING AN INTERESTING SIGNAL IN THE NOISE

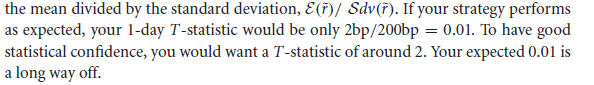

It is known that the drift in the formula ranges between 5 to 10 basis points per day. And the noise varies from 100 to 300 points. Now, is it simple to determine if a stock is of 5 basis points or 7? You earn 7 points per day which is extra; when the signal allows you to earn an extra 5% expected return per year. So, one must be able to distinguish between a real signals or an illusion between 5 and 7 basis points for the average daily return.

But, it is not always easy to detect the signal of extra to points hidden under a noise of 200 basis points. If it is told, that you happen to earn an investment pick of 50 points per days, one can quickly conclude that it is noise.

So, to conclude you need to observe daily. But, you cannot use signal of many stocks. For independent observation, you have to consider signal for single stock. As, all stocks have a tendency to move along other on a same day, so independent observation may be a problem.

Suppose; the rate of return over a period of time is sum of rate of returns on daily basis. So, for N days your expected return will be N times of the return over one day.

If your T-statistics for one day be 0.01, how many days do you require getting a 2? You need square of 200 that is 40,000 days. This results up to 157 years worth of information. So, we see that, we get a chance to learn only when we see that a diversified strategy perform well for decades.

Two concepts:

- The performance of a strategy increases with square root of time.

- Sometimes, a stock may move up and down by 20 to 50 times on average days. So, for reliable conclusion it may need decades or centuries of information.

11.4 TRUE ARBITRAGE AND RISK(Y) ARBITRAGE

Hypothetically some investment opportunities are great, and they are so huge that hardly anyone can find them. These great opportunities are called Arbitrage. And investors want to exploit these scopes to make the market efficient.

11.4A THE DEFINITION OF ARBITRAGE

Law of one price stated that, every identical item on the same time and same location should bear the same price. Either the market is perfect or not; this stays true for all identical items. Despite of taxes, transaction costs, future price, and market marker one identical share should have the price like another.

So, the law must hold in case perfect market. If it does not remain same; potential purchasers or buyers can exploit these arbitrage opportunities.

Arbitrage is a pre-concept that is it has to be applied beforehand not after the fact. It explains ‘no-negative-cash-flow’ conditions. They are:

- It is not similar to earning money without facing any risks. As, you have to pay cash to buy treasuries; it is a negative net cash flow for today.

- When you take up risks, you often receive cash today. So, it is not like receiving today’s money without any obligation of repayment.

True Arbitrage: It refers o a business transaction with positive net financial flow. It is risk free which means that either today or in the future there is no negative net cash flow.

Risky Arbitrage: This type of transaction includes risk in it. And so the expected rates of return from these transactions are also high. It is also referred as a great bet. For instance; there is a chance to will $1,000,000 with 99% probability. While there is a chance to lose $1 with 1% probability.

Now comparing these examples, we see that we can lose $1 in a risky arbitrage so it is not a true arbitrage but it is indeed a great bet. Every investor avoids the risky arbitrage and prefers to take on true arbitrage opportunities. But a less risk adverse investor may prefer a risky one to the true arbitrage.

But, these bets are never this extreme or great. A very good bet is like a blue moon. And including all the risks in imperfect market, most people scale up for true arbitrage opportunities.

11.4 B MORE HYPOTHETICAL ARBITRAGE EXAMPLES

Arbitrage is a theoretical concept. So, it is difficult to find real world examples on it.

Suppose, you get to buy an item at $1 today and get an interest of 9% including all your time and costs. The next day you sell the item for $.10 and so you earn 1 cent for a day. This type of flow is not negative. So, people should take these opportunities when they get it as these are positive-NPV project.

Moreover, it is an example of true arbitrage without any risks. So, they tend to lose money is less? And if there is an opportunity to repeat this 1 cent arbitrages for 1 billion times, you earn $10 million.

But, these scopes are scarce and even if you get, you do not get to repeat it for billion times. So, it is difficult to find such arbitrage in a competitive market.

Another hypothetical example is: Some arbitrage opportunities involve identical stocks but their prices are not synchronized. If PEP stocks are charges $51 in Frankfurt Stock exchange and the same is listed $50 in New York. You can buy the stock from New York stock exchange and sell the same in Frankfurt. Hence, you end up earning $1 for one day. If you repeat this for 20,000 PEP shares worth $1 million, you earn a risk free $20,000.

But, these examples are all theoretical and devoid of all risk factors and extra charges.

Some usual issues:

- Timing risks: It is the matter of seconds when the prices of the stocks keep changing. The moment you buy the stocks from New York and plan to sell them in Frankfurt, within seconds the price may fall and the possibility for negative net cash flow increases.

- Situations: What is the amount of commission you have to pay? Is $51 the bid price? Will you be able to sell the stocks in Frankfurt at $51? And are you buying them at $50 from New York Stock Exchange? Did you consider the indirect and direct transaction costs? Can you ship the stocks quickly to the destination? So many questions are asked and so many situations are to be handled to exploit the arbitrage opportunity.

- Costs: The share prices may move when you want to transact. Maybe among all the shares you plan to buy at $50, you may get only 100 at $50 and the rest at $50.50. So, the scale of your expected profit will remain same for the first 100 but fall for the rest.

- Operations: There is a cost for setting up that business. These are fixed costs. So, you do not actually get to take the advantage of the arbitrage if you have to spend millions to set up your business. So, you must check your expenses too.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- The fundamentals based classification and behavioral finance

Links of Next Financial Accounting Topics:-

- Investment consequences

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management