If you are an investor, does EMH matter to you? There is no availability of signals in an efficient market if you expect to outperform the expected rate of return on day-to-day basis. So, the possibilities to exploit arbitrage opportunities get limited. So, the main question is which among the both a good signal is; the past return or the future one?

11.5 A Weak-Form Efficiency and Technical Analysis

As, we know there are three strengths of market efficiency. The key feature which defines the weak version of a traditionally classified efficient market is- it is impossible to become rich just by relying on historical prices for trading strategies.

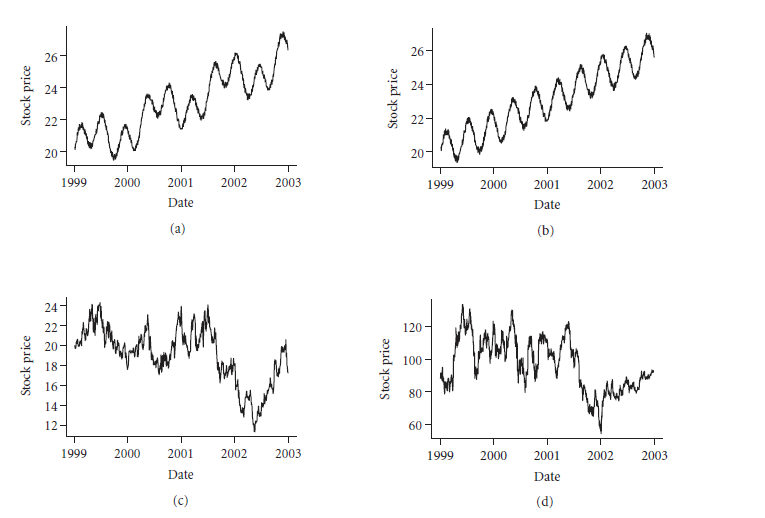

Graphs a and b shows the regular strong cyclic patter. If it had shown the future patterns, one will easily become a rich technical analyst. This stock shows a monthly pattern where their price may fall by $2. This will allow you to get rich. But is this possible in real time?

Yes it is possible. For example like, among 10,000 stocks purchased one or two may behave in such a cyclic pattern. But these are very hard to notice. So, these patterns may never represent the futuristic stock characteristics but are just only historical references of stock price movement.

Now, apart from graph a and b; c and d can represent. May be, the price may be higher than the previous. But the expected rate of return remains positive. But, the non-negligible con of the graphs c and d is, it contains lot of noise. This increases the chances of unpredictability and one can easily miss out the opportunities or outsmart the market strategies.

The Empirical Evidence

Now, it is the main motive of the traders to be wealthy and for that they try out every sort of strategies. They rely on technical analysis and use the graphs to find coincidences with historical stock prices. But does that help?

There is a belief that stocks that are rising one day have most tendencies to fall the coming day or next day.

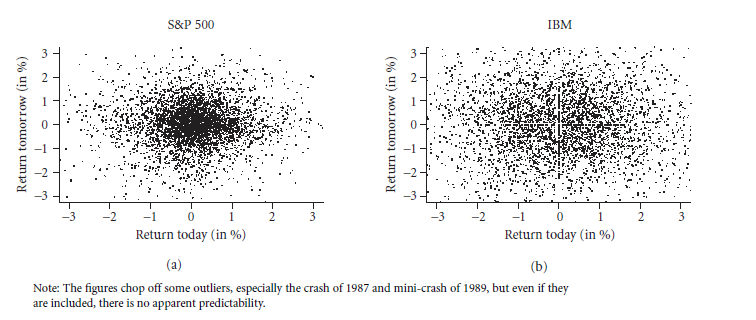

These graphs represent market status for S&P 500 and IBM. They show the expected rate of return for tomorrow date as a function of today’s expected rate of return. The year ranges from 1985 to 2003.

This graph does not help in predicting tomorrow’s performance of the stocks solely depending on today’s values. So, it cannot make you rich as a trader.

Bid-ask bounce: It is data illusion concept which stated that, if the closing price of a stock is higher than the asked price; chances are that it falls back the coming day. While if its closing price is lower than the bid price- on average basis it will gain the next day.

Now, if the firm has momentum effect, that is- if it has been performing well in the past and according to last one month log, it will continue to perform better. Then there is a tendency of the stocks to repeat or continue their patterns. But to a small extent.

11.5 B INVESTMENT MANAGER PERFORMANCE EVALUATION

Three questions pop up in our minds when we detect a low signal-to-noise ratio but the strategies of trading have high earning. It is difficult to determine why it happened:

- Was it random luck? What if it was just a lucky earning and it will never repeat again?

- Have you performed any flaw in measuring the performance? Maybe you unknowingly took some risk.

- Or maybe, you are proficient every stock skills like detecting good signal, trading ability, good measuring techniques. But the market was inefficient!

These are the topics of arguments in academic fields. But, the real situations remain unsolved; where you cannot distinguish between: A good or bad signal-to-noise ratio, if it was just luck or your skills. Explicit ideologies in these matters help you in picking up a fund manager when it comes to investing.

Features to consider in an investing manager, if you want him to make you money from an inefficient market.

- Evidence: Some investors try to stay off the radar. They perform their selection privately and secretly. Neither they want to teach their skills to anyone nor do they want to come out to help publicly. So, it becomes difficult to find such talented investors and it becomes impossible to even test their abilities.

- Adequate data: A great deal of practice for decades can improve your performance and then only one can conclude on your realistic techniques which work when it comes to investing.

Measuring the recent three years of performance of an industry in the stock market, can help in accurate evaluation of funds.Though it is evident that the three years information is completely filled with noise. So, it proves that most investors shift their fund holdings based on these noise.

Either they do not understand the way these strategically techniques work

or they have been just doing it casually without minding too much about reality.

- Efficient employees:

Among all the investors available; how many do you think can outperform the market the coming year? Suppose there are 10,000 mutual funds. Considered if none of them has explicit capabilities of investing; 5000 among this batch will out-smart the market the next year. And half of that, like near about 2,500 the coming next year. So, it stands out that without any skills in investing, among the batch of random employees 10 will keep on outperforming the market for decades. So, with adequate candidates it becomes easier to taste profits.

- Sustaining the market:

Funds which has been underperforming in the market for several years in a row will eventually disappear from the market. While, those who have been outperforming for consecutive years they start boasting about their talents, advertising their success and hence collect more investments. They appear as professionals and they and their managers are supported by their own research teams. But, do they really have the talent?

Now, when you have a look of all the mutual funds offered on a single day- you do not get to notice the ill funds as they have already disappeared. Large sums of funds with better performance will grab your eye. So, you conclude that; these available funds are enough to make you money from the market though its possibility maybe way low in the real market.

This phenomenon is known as Survivorship bias.

In the hierarchy of business the fund managers charge high fees to take all the advantages. This is because this manager has the scarce skill but not the investor. The investors take the money to the fund manager to pick up stocks for higher returns.

In short; past performance plays a significant role in predicting the manager’s future performance. But it is advisable to not dwell in the recent past, as it will prove to be a poor judge.

The Empirical Evidence

The luck of a fund manager is far more crucial than his ability to pick investments. When there is a search for better performing analysts or proficient managers they found little chances of future performances. This proves that, when some fund manager has the capability of better earning through systematic concepts and corrects picking; there is high possibility that the very manager will perform well in the future too. Study says that about 54% of all the mutual funds who has a history of outperforming in the recent one to three years will keep on outperforming the market for the coming years.

Now this percentage is more than 50% but not by much. After deducting the additional fees like fund fees, the performance rate drops drastically below 50%. Thus this evidence shows that past performance is not a good predictor of future performances.

Even considering all examples of great investors, professors come to believe that if an investor earns a high amount of money even if it is over the few years; luck plays a significant role in that more than ability.

11.6 Corporate Consequences

A perfect market is the initiation of an efficient market. But there are three different possibilities:

- A market is both perfect and efficient.

- The market maybe efficient but not perfect.

- A market is imperfect and inefficient.

11.6 A IF THE FINANCIAL MARKET IS (CLOSE TO) PERFECT

The one and only thing that matters in a firm is; the present values on the underlying projects. Other than that- earnings of investors, number of shares, dividend payments, capital nothing were that crucial.

Earnings reporting: If you combine your foreign earning with your main earning, the net increase in your earning for the firm will indeed grow high. These change should not affect that is must not add or subtract the value of the firm.

Capital Structure: Suppose, your firm is involved in equity of $100 value. And there is a 50-50 debt to equity ratio. So its final worth is $102. Now, if a company wants to buy your firm and issue $51 for both debt and equity. Thus the capital worth of the firm to be $100 turns out to be absurd.

Stock splits: Old shares become new ones and each becomes multiple.

Dividends: In the scenario where the market is perfect; $100 worth firm pays $10 dividend but it’s worth should be $90.

11.6 D COMPARISON AND SUMMARY

Efficient versus inefficient: You can easily learn from the prices from an efficient market. If the you have an inefficient market; you can easily recognize the under-priced firms and take over them. And you can set prices which can manipulate the information of your firm.

Perfect versus imperfect: In perfect market you can ignore every price like reported earning and much more to focus on the net values of present projects. While in case of imperfect market; you can reduce the imperfections by creating your own value.

Event study: It is the study of how the price sets affect the set of events.

11.7 C Capital-Structure-Related and Other Event Study Results

Event study helps us in understanding the situation of the events and if the taken decisions are the appropriate one.

Limitations for Event study:

- You need many and various occurrences of big events.

- It is important to keep taps on upcoming news.

There may be many simultaneous occurring events.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

Links of Next Financial Accounting Topics:-

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

- Corporate claims

- Capital structure and capital budgeting in a perfect market

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

- What matters

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management