We already know that promised numbers and expected numbers are two different things and we must know the difference. The model of anticipated return rates are called CAPM model, it will not give you an idea of credit risks. When we apply the formula of resent value, it must be taken care of using flow of cash in the numerator (expected), not the assured cash flow.

The returns: expected and promised

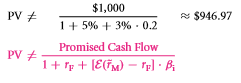

Let us revise it again. For example- there is a zero coupon bond that assures $1,000 following year with beta of 0.2. It is believed the rate of risk-free is 5% besides the rate of equity premium is said as 3%, you cannot calculate the price of the bond as-

Yes, in a seamless CAPM scenario, the predictable rate of return of the aforesaid bond ought to be 5% + 3%. 0.2= 5.6%. (In a deficient scenario, you may require to complement the liquidity plus tax percentages). To find out the price, we need expected cash flow. Promised bond cash flow will not be enough to know. Probable cash flow must be a number which is at all times not greater than $1000.

Not only here, but the aforesaid problem also arises in corporate projects. Expected cash flow of the project can be discounted but you cannot do the same thing in the case of good cash flows. There is a rule called IRR rule of capital budgeting, which says that if the IRR of the project is exceeding the rate (hurdle) then it should be accepted.

The difficulties faced by this rule are the cash flow which is used to calculate such IRR are from probable cash flows not from the promised cash flows. Comparison of promised IRR and expected hurdle rate should not be done. Remember, the assured IRR must not be considered for the purpose of capital budgeting.

Solve now-

Q.13 An IRR of a bond of Amozon.com is 8%. If we assume that it is a perfect market then is that is its capital’s cost?

The scenarios of predictable, distinctive and utmost possible

There is a common error which is often committed by the managers when it comes to application of NPV.Generally the values are confused with distinctive or most probable.Statistically, it means confusing mean with mode or may be median.

Let’s take an example.

If you continue the above business hundred times, you would get $1.2 million 46 times, $1 million 44 times, and fail to get $10 million 10 times. Fortuitously, if the geometric dissemination is symmetric—as same as we see in the bell like shapes distribution—we can say that the center can be mean, mode also median.

Regrettably, limited trades are protected to low probability jolts, frequently undesirable, so you must consider approximately the applicability of mean, median and mode in your business.

Solve now-

- Zero-bond assures $100,000withbetaof0.3.Take the risk free rate as %5, premium (equity) as 3% also the CAPM is present, find out the bond price.

- Machine which costs $900,000 is to be expected to break down by way of 10% possibility at the finish of every single year, also assume that the machine worked last year as well. (Several electrical appliances minus affecting portions have same kind of collapse features.) Though, the controlling agency has decided to quit using it for five years and also not to replace it. The machine has capability of producing $300,000 in profit each year. Discount rate should be taken as 12% for each annum. (This simply means the machine has capability of producing any value amid $0.3/1.12 ≈ $0.268 million [if disrupts instantly]and$1.081million[ifcontinuesforwholly5years] in current value).

(a) What will be the best possible operational time? What will be the value if it is true?

(b)What is the duration of operating such machine? (Clue: consider case to case for two years and formerly for three years. Think “D,” “WD,” “WWD,” “WWWD,” and “WWWWD,” where W stands for working besides D stands for dead). What will be the present value if it works till it is expected from the machine?

(c) Find the present value of the project as well.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Capital budgeting applications and pitfalls

Links of Next Financial Accounting Topics:-