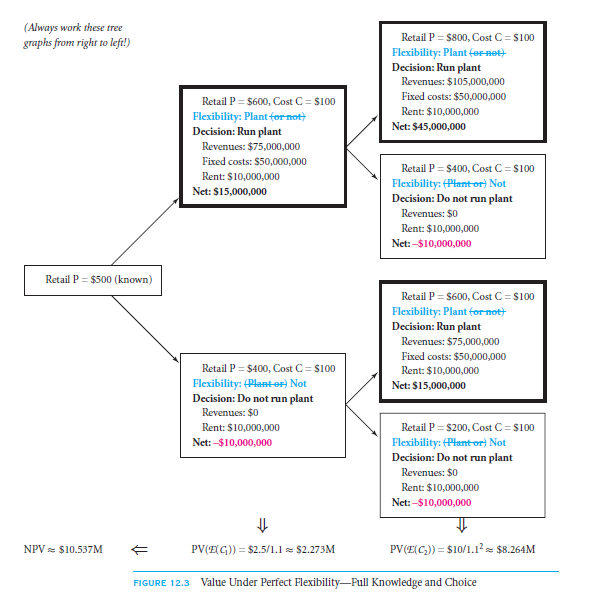

We cannot relate this example with the real one as all the required parameters were similar in the entire context. This symmetry made the option comparison and explanation a much easier task. With this, you can easily evaluate the parameters which self-assess how far your flexibility can go. Here is an example that will help you get a clear idea.

Flexible versus Fixed technology choice

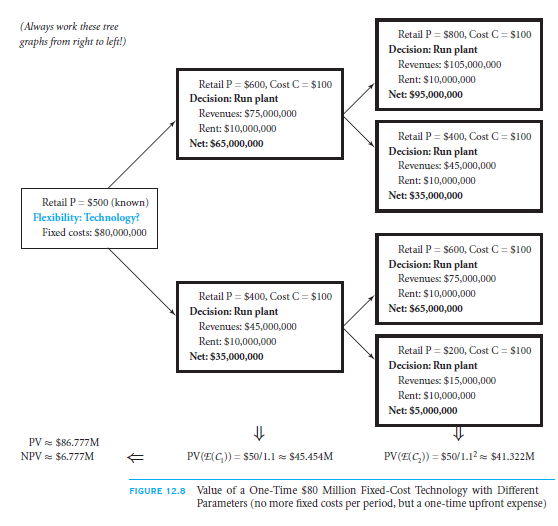

If you look at this figure, here you will find a company which is equipped with a technology that is completely flexible. Here I’m going to show a technology that will help to eliminate from that $5 million, its fixed operating cost. However, there is a catch in this total procedure. In order to enjoy this benefit, you need to make a one-time upfront investment of $80 million. This is mainly for purchasing those robots which will reduce the workload but accelerate the total working procedure.

It definitely is an excellent idea as you don’t have to make the first investment of $100 million. On calculating the discount amount from it, an amount that you will be having at present is $86.777 million. This can be calculated with the help of,

$50÷1.12+$50 ÷1.1

Still, there is a question that you need to ask before investing in this idea. Is it really a money saving method?

Well, the answer will certainly be no as it does not really work in accordance with the flexibility that you can expect from human workers. If need be, you can either fire workers or hire extra as per requirement. But in case of robots, if you buy them once and don’t require a certain number, you will have to put those down. Addition to it, you cannot buy new sets of robots anytime the previous one goes faulty. In this case, the best option will be to have human workers who can adjust as per the situation and requirement.

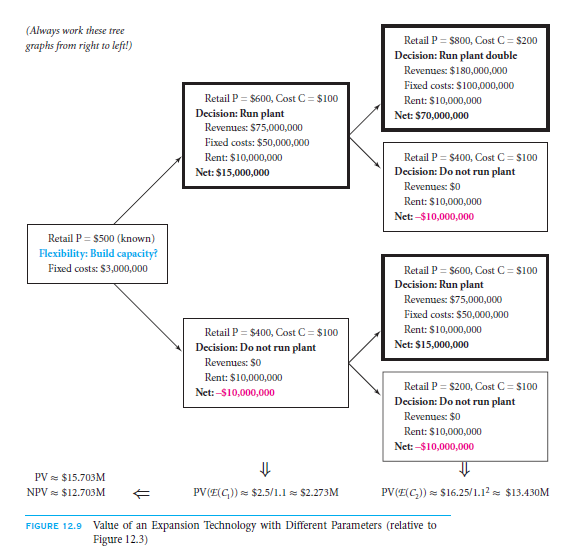

Addition to plan capacity

Suppose your present production technology, which no doubt is flexible, can manufacture 150,000 units. Here, worth of every unit is $100.

Again there is a different production technology that can also produce the same number of units with a similar unit price. The thing that is different in this case is if you want to make the production range twice as that of the provided unit number, you can get it with $200 for an individual unit. In this case to you need to remember the fact that equipment cost in this scenario is $100,000.

This hike in price is just not limited to unit prices, but to the prices that are added during manufacturing operations. Costs related to production costs will be $60 million instead of $15 million. As per this, fixed costs in place of $50 million will be two-fold, giving $100 million. So if you combine the entire amount, an additional amount in this will be $95 million. Are you willing to invest so much of money on a single project? Won’t an upgrade of $3 million for such technology type quite a lot expensive?

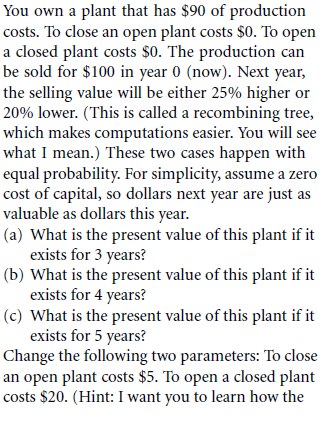

One of the best ways to highlight this is the calculation tree made for this.

The above figure represents the value of a company and the limit of expansion related to its options. Let us assume that the retail price of a commodity that is produced in your company meets a sudden hike, where the price of per unit is $800, amount for this unused capacity is very high. Because of this, if $10.5 million were its previous optimal value, at present it will be $15.7 million. In this case, you can state that those estimated $3 million is an amount you can use as an investment of the second option given above.

Solve it

Solve Now! Solutions

Problems

Links of Previous Main Topic:-

- Capital budgeting applications and pitfalls

- Promised expected typical or most likely

- Badly blended costs of capital

- The economics of project interactions

- Evaluating projects incrementally

- Real options

- Behavioral biases

- Incentive agency biases

- An npv checklist

Links of Next Financial Accounting Topics:-

- Appendix valuing some more real options

- What matters

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management