Many projects are already at their places and managers don’t have to take decisions for all projects at the same time. The projects which are in use must be continuously evaluated and taken care of, managers may frequently has to take decisions on whether to add new project to it or not.

Practically, the projects which are old are often unalterable but the new projects may have progressive or destructive impact on the existing projects. The question arise here is how one can elect whether to accept the project or not.

Also will the new project add to the value of the existing project or not. In such cases, economists practice the conception of taking judgment on the edge i.e., holding the old project as it is and find out the extra input of the fresh project.

Let’s take the example of aquarium again using the technique of influences on the sideline. It’s natural to arrive on the following inference-

- If you by this time have octopus in the container (with NPV – $125,000), would you also keep the shark in the same container? If yes, you have to pay an extra (incremental otherwise marginal) $50,000 also get nothing — since the shark becomes the food of the octopus, which will lead to no extra ticket sales. Consequently, the marginal benefit of keeping the shark will be−$50,000. As a result, you should ignore adding the shark.

- If you by this time have shark in the container using its NPV – $70,000, would you also keep the octopus in the same container? Marginal cost of adding octopus is $75,000. In ticket deals, you would fail to receive $120,000 in case of shark but expansion of $200,000 in octopus earnings. Therefore, we can say the net benefit will be $200,000 − $120,000 − $75,000 =+$5,000. Consequently, you should keep the octopus, after knowing the fact that shark will turn out to be the food.

- If you keep the shark into your own aquarium or else you decide to sell it, the calculations would alter. Then also you have to take marginal price of selling shark and getting a different aquarium.

IMPORTANT:

- The choice on whether to accept one extra project should be made centered on the following rule:

- This means that the single new project should be attributed with any value rise or value decline that it deliberates on other projects.

- When allowing for a project on the margin (i.e., extra), credit/charge to this project all externalities that this project expresses onto the present firm.

- Entirety else equivalent, projects with positive externalities on the rest of the firm have higher marginal benefits than do projects with negative externalities.

Even if the marginal viewpoint on costs and benefits has also functioned for our separate “affirmative or not at all” projects, it turn out to be a lot additional beneficial when you reflect assignments of which can be taken a slight extra or a slight less. (At point, computing all likely arrangements is not stretched practicably.)

Marginal thinking too assists you to know economies of scales, sunk cost, overhead distribution, as well as space dimensions. The marginal standpoint on costs besides benefits is predominantly valuable when it arises to projects which are to accept or reject but are assignments which keep on fluctuating.

With occasional exemptions, the incremental technique of discerning is the merely technique to create a logic out of practical world difficulties.

12.5 A Economies of scale

Let’s take an instance in which present are the economies of scale—additional airplanes you build, the lesser will be the average per-airplane manufacture cost will be (figures in millions):

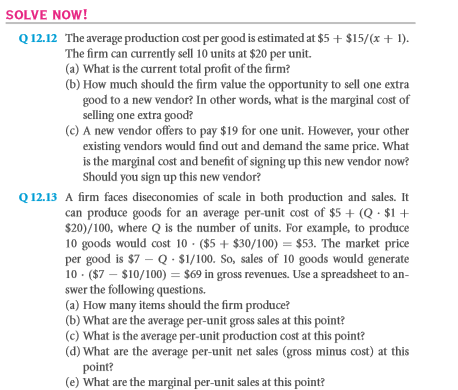

This proves that it out lays $4 + $10/ (1+ 1) = $9 million to create 1 airplane. Manufacturing 100 airplanes will cost $4 + $10/ (100 + 1) ≈ $4.10 million per airplane. Yet again, let’s take up the interest rate as nil, so that discount cannot be provided.

Currently say that presently you have sold 4 airplanes locally, each for $8 million. Firm’s net worth will be-

Your huge decision at the present is whether international enlargement should be preferred or not.It would charge $16 million to invest for foreign sales office, nevertheless doing so will lead to sell additional 5 airplanes with $8 million per-airplane value. Should you develop or grow?

By way of 9 airplanes in making, your average price would drop to $4 + $10/10 = $5 million each airplane. These simply mean 5 airplanes would charge only $25 million to construct at the moment, besides bring in 5. $8 = $40 million. The price of the foreign office would therefore be

Value = Gross Sales − Average Cost − Start-Up Cost

This calculation advises that you must not enlarge internationally.

Inappropriately, this calculation can be taken incorrect. To understand this, compute the total net worth if foreign office will be opened. The 9 airplanes make sales of $72 million. Deduct your manufacture costs of 9. $5 = $45million also your opening overheads of $16 million. This says that the firm would be worth

This is greater than the $8 million which can be earned avoiding an office internationally. This is an accurate calculation. It states that whether to expand internationally or not, as this extension can increase the net worth by $3 million.

The difference concerning the correct calculation plus the incorrect calculation is – your foreign office has one extra marginal benefit that the first calculation unnoticed: Foreign sales too decrease the usual production charges of your national production. This price reduction is progressive externality which must be credited to the foreign office. If don’t, you are wasting $3 million.

It is frequently more instinctive to consider ing ventures as per airplanes in relationship of marginal costs and benefits. The additional marginal cost for every airplane variations airplane via airplane—it is variance in the total costs related to all airplanes:

Going from 4 planes to 9 planes, your manufacture generates additional charges of $4.333 + $4.238 + $4.179 + $4.139 + $4.111= $21(million). There is an extra marginal price of $16 million for opening an office internationally. The overall marginal cost- $37 million. Marginal benefit of 5 additional airplanes will be $40 million.

Consequently, foreign ales office generates marginal cost of $40 − $37 = $3million. This is accurately the variance among $8 million as of Formula 12.1 besides $11 million as of Formula 12.2. Thinking in expressions of marginal costs and benefits is just altered and occasionally more suitable way to associate inclusive project values.

Declining marginal costs stand frequently accountable for the success of the corporates. For instance, Wal-Mart as well as Dell have coped timescales to transfer substantial supplier deductions, and also generated inventory plus distribution schemes that permit to supper their fixed costs very efficiently over the huge amount of belongings they vend to benefit from the economies of scale.

Here two factors can be taken into consideration- lowest costs as well as highest trade inventory in comings rates. The same way Microsoft revels in economies with a huge fixed price and nearly nil variable prices. Microsoft always drops down its price to eliminate its competitors from the scenario; no one can compete with Microsoft. Functioning systems software corporations are very few or just one which is simply called monopoly by the economists. If you treat the economy by way of one firm then you don’t want to sustain software development cost two times.

The alike applies to our day to day life. Nobody wants two kinds of cable connection at home, two kinds of power supplies and two kinds of telephone lines. In case of monopoly, the monopolist upset the economy and exploits customers by charging higher prices. There is no solution for the same.

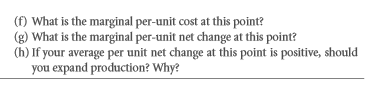

Obviously, there are too amply of instances like marginal costs are growing but not declining with the amount of items produced. In such circumstances, you must take the responsibility of dis economies to the different partition you are accumulating. If don’t, it will be tending to over expand and in that way lessen your firm’s total value.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Capital budgeting applications and pitfalls

Links of Next Financial Accounting Topics:-

- Behavioral biases

- Incentive agency biases

- An npv checklist

- Decision trees one set of parameters

- Projects with different parameters

- Appendix valuing some more real options