If you have got projects which are liberated or self-governing, you got the freedom to take it them in segregation. To take a decision of accepting or rejecting the project, you can calculate the costs as well as benefits of each project separately. Practically, projects remain not necessarily to be independent always.

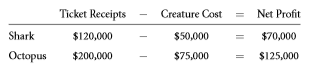

Let’s undertake zero interest level and consider an example of handling an aquarium, in which you have an option of adding a huge shark in the exhibition tank costing $50,000 for expected additional ticket earnings of $120,000. Or else you can think of adding a huge octopus costing $75,000 for expected additional ticket earnings of $200,000.

Adding both would not raise the project worth by $195,000 as we can see above. Octopuses will have to face a negative situation as they can be eaten up by the same sized sharks. As a result, the best project worth is merely $125,000 by skipping the shark. Keeping some lobsters in the aquarium using an octopus would cost $75000 which will permit octopus in the direction of surviving.

Not adding lobsters would result an octopus with shortage of food and octopus would expire and which will end up with declining sales of tickets. So, adding both octopus and lobster could help otherwise neither of them. The question here arises is how should one deal with ventures which influences each other and how one should store the aquarium with?

12.4 A The ultimate project selection rule

IMPORTANT: The ultimate project selection rule: the project which gives highest overall NPV is to be selected which can be found out by comparing all project’s combination.

For dual projects it is easy to make a choice since there are merely four choices to study: accept neither, accept one, accept the other, and otherwise accept both. It becomes difficult when you have many options to consider and think upon. Say when there are three projects, eight options are there. Four projects come with 16 choices.

For 10 ventures, near about thousand options are there. For 20, there are million choices. And it goes on this way. By this we can say that even simple projects can have many options and have many decisions to take. Say if you want to choose fishes for a small sized aquarium, you possibly will consider different species of fishes which might act together with others well. Again, in future you may consider that how many fish to add to it. But honestly it is not possible to get a flawless combination.

To take a decision on which project to accept, it is essential to follow some rules. These rules will help you taking the right conclusion. Such guidelines or thumb rules are named heuristics–which is, instructions that make things easier and make your decisions also if they stand not right always.

The best way to consider the combinations of project is to start by the project which gives the maximum NPV if two projects are to be considered. Let’s take an instance- Start with the two fishes which you love the most. Then take such pair as fixed, that is, take it as one project. Then just see which fish adds more value than the other to the project. Carry on till adding the more lasting project not stretched raises price.

Computer scientists take this action as grasping algorithm. It can be said as a noble experiment, since it extremely cuts the likely project arrangements to reflect and frequently offers a worthy set of assignments. There are present several conceivable improvements to this procedure, like forward as well as backward repetitions, in which an individual considers swapping one project with all other choice.

Full-fledged algorithms plus combinatorial improvements that promise best choice are actually the area of computer science besides operations research, not finance. By chance, finance is a part of economics, also economics can support in simplifying the project choices problem.

12.4 B Project pairs

To clarify the economic issues, it is better to consider projects in pairs. With two ventures, one can spoil the entire net present worth into three expressions:

For instance, if you have to stock together the shark as well as the octopus, you will be getting ticket revenues of $200,000 (octopus) then recompense $125,000 (octopus plus shark), intended for a after deductions of $75,000. As a result, net receipts are

$75,000 = $70,000 + $125,000 + (−$120,000)

The aforesaid data reflects the connection between the double projects. This simply means that one can categorize project arrangements into any of the mentioned three different classifications-

- Projects by way of zero interactions

- Projects using positive interactions

- Projects by means of negative interactions

Connections are also occasionally called externalities in the subject named economics, since one venture has external in fluenceson further projects—occasionally striking external costs, besides from time to time providing external benefits. Let’s deliberate these three circumstances individually.

Zero Project Relations

Furthermost the projects now-a-days are self-governing. They don’t have any common relations. You can make decisions easily with these projects. For instance, a mall located in Maine possibly has no influence on Oregon which is also a mall.

It neither steals customers from the other location nor fascinates additional customers. Self-governing project bribes authority the distinct estimation of every project.

- Taking some positive-NPV venture increases firm worth.

- Captivating a zero-NPV venture leaves firm worth unchanged.

- Taking some negative-NPV venture decreases firm price.

If projects remain self-regulating, then the venture contact term is nil. Project freedom makes conclusions a lot stress-free:For20projects, merely 20 independent conclusions (agree to take or refuse) should be prepared, not million.

IMPORTANT: You can evaluate zero-interaction projects independently.In this case, you can simply add project NPVs.

Positive Project Interactions

Positive interactions simply mean the sun of part of the projects is value supplementary than the individual parts. Say if single venture has an encouraging influence over NPV of an alternative project, you will be not permitted to value it in short of considering this progressive influence.

For instance, think of one new item as one venture plus an advertising operation as an additional project. The promotion campaign venture is of less important use devoid of the product,and the product is of less significant use minus the promotion campaign. One must think through producing a product besides an advertising operation collectively.

Such optimistic externalities are further abundant in minor decisions. Let’s take an example to clear this. As we know that the computer’s keyboard can be said as less advantageous minus the computer, in addition a computer can be said as less beneficial lacking a keyboard. In fact, some projects or products only make logic if you purchase them together. In such case, producers of these products pack them together as well as purchasers buy them together.

In the business framework, dealing in infrastructure can be said as one more classical example of helpful project connections. For instance, building a road, acquisition of a security firm, or arranging fast Internet association could improve the standards of many dissections at the same time. The firm should influence in the upsurge in assessment to all partitions when determining by what means infrastructure to be added.

Positive externalities should not be taken too casually. On a logical basis, positive venture communications are the purpose why firms be in the first place.

IMPORTANT: At the time of deciding whether to accept the project or not, all positive interactions must be taken care of. The over all NPV is higher than the individual project NPVs alone.

Internal conflict as well as cost allocation processes (talk over more as “agency conflicts” under) frequently deter firms from taking benefit of numerous optimistic externalities. For instance, in actual life, the division managers may debate that they must not be accused for Internet connection; as they have not requested it besides do not actually want it. After all, division managers prefer receiving the Internet free of cost by the company rather paying for it using their own budgets.

Currently, managers who need to purchase other companies generally claim the existence of huge progressive externalities. Interactions are the administrative term for progressive externalities among an acquirer as well as a potential acquisition objective. It has developed a significant professionals log an.

Negative Project Interactions

Negative interactions can be defined as the totality of the portions not as much of the parts separately. In such cases ventures have negative influence on each another besides they decrease each other’s value as well. Economists at times appeal destructive externalities dis economies. Let’s consider certain examples to prove the same.

Pollution and congestion:

Take Airline Company as an example and think of two divisions of it. And there is only one division which provides repairing facility. One division controls the cargo and other one the passenger. If the consignment partition desires to grow, it will practice further of the repairs capability.

This will lead to more waiting time for the passengers.In extreme situations, the further delays may charge the passenger extra than the additional profits that the extended cargo setup adds.

Cannibalization:

Imagine if a fresh Apple computer produces $100,000 in NPV associated to an not new Windows machine which produces only $70,000 in NPV, in what way should the Apple machine is credited? The solution is that Apple would put an end to the progressive cash flows created by the surviving Windows machine, consequently the cash flow replaces Windows by way of Apple is merely $30,000, which is $100,000 minus $70,000. Be alert what you reflect cannibalization, and yet.

For instance, inearly 70s, IBM was not producing personal computers, dreadful of cannibalizing the business was centered to mainframe computers. IBM’s fault was not realizing that the other manufacturers of computers were competent enough to enter the market and eat up the computer business.

Bureaucratization and in-house conflict:

When additional projects are taken, the difficulty level of taking decisions increases. Important decisions cannot be made within the time edge. This may need more awkward administration plus reduce cash flowsforentirelyotherdetachments. A noble instance of bureaucratic damage of assignments can be originated on Moishe Lettvin’s blog named ‘Google is your friend’.

A computer programmer, who worked at Microsoft for around 7 years, described how it has taken in the middle of 24 and 43 persons, parted by six stratums of management, above a year on the way to chat about Windows list of options—besides no one actually knew who took the authority to mark the final judgment.

Resource collapse:

Possibly the utmost collective source of destructive externalities— plus often under projected as well. Management can pay attention to limited issues, not each one of them. Extra projects will divide their attention and distracts them. Let’s take some examples. Here are some subjective examples of over strained attention extents.

The utmost recent instance of unsuccessful attention management possibly will be 2007 collapse of credit, which left various investment banks through huge losses,also which eventually charges the CEOs (Merrill Lynch), Citigroup, besides their jobs. Furthermost of the CEOs don’t know their firm’s assets and acquaintances even.

They will have to precise their own evaluations numerous times, because they themselves erudite only later the fact about their own firms in which actually investment is done.

Although costs at all times consist of opportunity overheads, in case of destructive project externalities the aforementioned costs are apparent. If your assignment requires more care and consideration, we can say it as opportunity cost.

IMPORTANT: When deciding whether to take a project, charge all negative interactions to the project. Because of these negative interactions, the overall NPV will be lower than the individual project NPVs alone.

Again, recalling the instance of progressive externalities, agency problems as well as cost distribution systems frequently avoid appropriate accounting for destructive externalities in actual world. Of any kind division formed the destructive externality will claim that this issue is not a major one besides that the testy division exaggerates the problem. Evidently, companies which are good at overcoming their problems and issues will earn profit.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Capital budgeting applications and pitfalls

Links of Next Financial Accounting Topics:-