There is a completely different valuation problem that is significant than the externalities. This we can say is a tough nut to crack. If you know how to create the value from the current economic situation, you can change the future course as per the benefit of your company. This type of flexibility is known as a strategic option or real option.

If you to figure out real option, via its valuation you can state that it is just another form of complicated NPV problem. In this, the area of priority is an evaluation of capital cost and expected cash flows. Being difficult, there is an entire book dedicated to real options and the problems related to it. Here an idea of what this option is all about and how its valuation can be marked out.

12.6A Detailed Real Options Example

Suppose there is a factory whose building cost is $3 million.With $2 million input worth this factory can manufacture gadgets (1 million) in number. Selling of such gadgets is entirely dependent on its demand. If it is strong, the selling price of each gadget will be $9. In case the demand is not that strong, $1 can be the minimum amount for selling of per gadget. Calculation of it can be made keeping 10% as the rate of discount. So, for the factory, expected value in millions will be:

Keeping this in consideration you need to make up your mind if you wish to be in this project or not

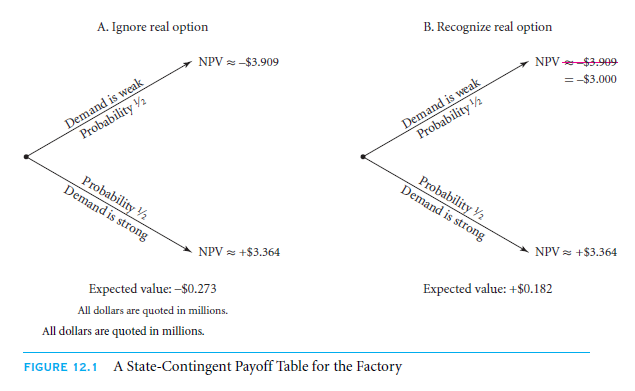

If we do not consider real options, possible outcomes, in this case, will be:

Strong demand

In case of net sales, yield for that running factory will be $7 million. Turnover for it will be approximately +$3.364 million. This can be considered as value for total net present worth.

Weak demand

In case of net sales, the yield for that running factory will be (-) $1 million. Turnover for it will be approximately (-)$3.364 million. This can be considered as value for total net present worth.

If you see the outcome, you will find similarities in both cases. On calculation, the lost amount stands to be at$0.273 million.

In case the demands for your factory is weak, optimum chances will be to sell that factory. The upside, in this case,will be the worth of your factory whose current value will be $3.364 million. Again that factory’s upfront costing will be $3 million. Because of such decision, you will not have to suffer for the loss of −$3.909 million. Even with the upfront value, while running that factory, earning additional $1 million loss is not something that you will have to see.

The worth of your company in case of low demand and with real option calculation will be at the least 50%.

So it can be computed with the help of,

(−$3) x50%+ ($3.364) x50%

The final worth will be +$0.182 million

Again to simplify this fact, we will use another example.

To begin, let us go through the question regarding a project valuation and how can we evaluate the sales change from $1 to $9. The same goes for the sales change from $0 to $10. In case the situation is adverse, monetary change will not affect you the most. The highest that can happen is you lose an amount near to $3 million.

Nevertheless, if you consider the good state, in the upcoming year your earning worth in place of $7 million will be $8 million. So, as per NPV formula, the final amount will be 0.637 million. Calculation of it will be,

(−$3) x50% + ($4.273) x 50%

If you see contingent equity claim, companies having real options will be similar. If you are an owner, you will not face the complete lash of downside. However, the upside is something you can definitely hope for yourself. It is just because of the managerial flexibility from your side that can help you created such payoff pattern and not limited liability. This will also enhance the expected cash flow of your company. If the condition of your company state of it being worth building, you can consider this due to your flexibility.

Solve it

12.6 B Difficulty and Importance

In most cases, the difficulty in case of real options is basically because of working with expected value. This helps in getting incorrect answers.

Suppose expected gross sales are worth $5 million. Calculation of it is made via,

$1 x 50% + $9 x 50%

Here input costs were $2 million. When you start working, the expected net sale for the upcoming year will be considered as $3 million. We have to keep this in mind that in the present, keeping up with the latter cost or earning it is not possible. This can easily state the outcome as being a mistake in undertaking the company.

One of the best ways to rectify this mistake is a correct evaluation of real value. If you consider all the demand scenarios of the future and then evaluate your optimal behavior, its results will be constant cash flows. For a better analyzation and decision making process, it is better to work with a decision tree. This as a totality can be stated as scenario analysis.

Section of Importance

- Real option related to a project’s expected value can’t be calculated with expected value.

- Expected value cannot be expressed as a valuation for a project.

- It is imperative to analyze possible scenarios to earn cash flow. Personal behavior also adds to it.

When we consider scenario analysis, a close relative of it is sensitivity analysis. This can be clearly denoted as utilizing various assumptions and checking NPV’s sensitivity. In the generalized sense, it can be stated as calculating the value in a spreadsheet. There is also variation in managerial responses which influences scenario analysis.If you consider the automated form of scenario analysis or sensitivity analysis, it is known as Monte Carlo simulation or Simulation analysis. This analysis was also utilized for evaluating real options.

Considering these from the prospect of textual knowledge is a mistake as it may be easy r difficult. It is entirely based on real world scenario. Real options valuation is extremely difficult, so in most cases, you will find the working or computation following NPV formula. If you look back at Chapter 4, in the 5th section you will find real options value for surveyed CFOs to be 27%. In addition to it, you can also see simulation analyses to be 14%, and sensitivity analyses to be 52%.

Real options and its economic importance and universality are found similar only in the context of difficulty in value estimation comparison. The importance of both of them increases when the lasting duration of the project seems higher. The decision, in this case, is entirely on what you plan for a possible future circumstance. In case of a singular variable, the situation is highly feasible. This also evaluates the optimum plan of action in this case. Huge issues can be broken down by holding the prices of the products.

In case of unrealistic situations, decisions of yours should not be made on the foundation of a single variable. Even if you continue working with 1 variable, dealing with the arising difficulties can be tiresome.

Example

Suppose you make your decision on the basis of money when it comes to running or closing your factory. In the similar way, it should also be your concern to evaluate the recovering amount that can be acquired fast. In case of your factory reopening or closing process which you may find expensive, you can take a look at your recovery chances. If it is good, you may move forward and risk the chances of using that opportunity. There may be certain chances of you facing nominal losses; however, it will not matter when your company will start running successfully.

If you look back at financial history, you will see many an instances where most corporations have to undergo losses before they earn a profit.

Now one important thing that is definitely required to be known is the effect of real options on both capital costs and expected cash flows.

12.6CREAL OPTIONS-EMBEDDED

There are certain embedded real options which most projects usually teams with. Some of the important ones are:

- Delay and Acceleration

In comparison to the expected turns, if the turnover’s for the future turns out to be worse or better, the speed of those projects can be increased or decreased ads per requirement. In most cases, the option that is used to achieve this hiring extra contractors and consultants, or firing them.

- Contractions or Expansion

Expansion of contracts or companies depends on the expected future turns that can be bad or good. As a highest extremity that you can see is a project is being abandoned by a company.

- Spinoffs

If accidentally a new technology is discovered, a company can take it as a foundation and begin a business on that.

- Switching

If you consider variation in a future scenario, variation in technology can be considered a profitable aspect. This increases the chances of those projects which do work on multiple technologies.

Now when we have come across real options, you will be amazed to see many of the projects to be nothing more than such options. With the help of an example, you can clearly get an idea why few projects are called as real options. Suppose there is a certain piece of land that is not used for a certain period in the city. This can be considered an option where the government can sanction to area expansion so that another building can be made. It makes the land or area economically worthwhile.

In this situation,there are instances where even R&D cannot also be counted to be of huge help. However, discovery to high profitable yield is also a possibility. If you wish to calculate expected cash flow, you should not underestimate valuation of your project.

One of the tantalizing facts, when it is about real options, is not considering it for a specific project. Most corporations do consider this for using it on multiple projects. But what they forget that real options are used for different projects, they change as per the requirement.

What can be a better example than comparing working with workers and technically advanced robots? Where utilization of robots does make the operation easy and cheaper, it cannot guarantee similar preciseness or change the technique as per requirement. So, where does the valuation of both the aspects stand?

If you know the correct valuations and types of real options, it will help in gaining better opportunities. But as this is not possible, thinking to put it in practice is not possible. So the next thing that you can do is concentration on those real options with which you can operate your business.

If you take a closer look, then you can find out that in most companies’ managers fail to identify that there are real options already present. Even if you cannot utilize its complete beneficiaries, recognizing those can help you to look for an intuitive value adjustment.This on simplification means that real value with your flexibility can help in augmenting the value of the project.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Capital budgeting applications and pitfalls

- Evaluating projects incrementally

- Real options

Links of Next Financial Accounting Topics:-