It is almost difficult to enhance importance by joining liberated ventures in actual practice. The problem arises when capital’s cost are divided into multiple projects. There are certain mistakes manager make and they don’t even realize. The reason is simple but people fail to point that. There are ways to reduce this risk of committing this mistake. Let’s find it out.

12.3 A Does risk reduction create value?

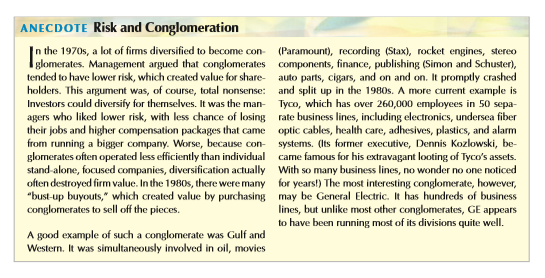

In 1960s as well as 1970s, many firms became corporations this simply means companies with modification reduce risk, doesn’t create worth. Here, a question arises that if a firm adds value by going through such diversion or not. The solution is no. we can say that diversification decreases the risk factor. In a market which is considered to be a perfect one, investors can create threat meant for them only.

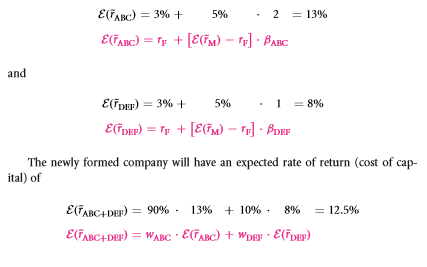

Let’s explain this by taking an instance, if you have a firm named ABC worth $900 million (say using a beta of 2 besides a risk of say 20%). Firm ABC is thinking of taking over a firm named DEF and worth $100 million (say using a beta of 1 besides a risk of say 20%), the consequential firm is cost $1 billion.

Both the firms certainly has a characteristic threat not greater than 20% if both the firms are not seamlessly linked, nevertheless your venture capitalist (or a mutual fund) possibly will just acquire 90% of the firm ABC plus 10% of the firm DEF and in that way attain the exactly same diversification benefits.

If no matter what, you have deprived from a venture capitalist of a unit of liberty here: They no lengthier have the capacity to obtain, roughly, 50% in the firm named ABC plus 50% in the firm named DEF.

The CAPM styles it obvious that the capital’s cost does not transform-overly. Say two firms monitor the CAPM estimating formula, also say that rate of risk-free is 3% besides 5% is considered to be an equity premium amount.

ABC+DEF have a threat not more than 20% per year which its two components had as well. In the next section, we will study that selected fusions can enhance worth in line for collaborations. But one thing must be noted that collaborations will not be an outcome of diversification.

It is believed that most understood validation for mergers is not collaborations;the fact is managers are used to capture different firms and they like it. Managers generally prefer individual firm with higher salaries. It can be categorized as agency battle, which we will discuss later.

It has been proved many times that stand-alone firms operate efficiently as compared to diversified firms. This happens because of the lack of attention by the management and additional bureaucratization. Various mergers destroy the value of the firm.

Does Corporate Risk Management Create Value?

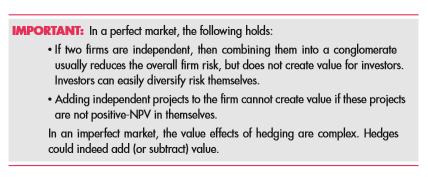

Risk management will be discussed in details later, for now let me introduce you to it briefly. Hedging is something which a firm can use to reduce its risk. Let’s take an example for this. A refinery could procure crude oil nowadays in direction of not to undergo problems if the upcoming oil charge were to rise.

Curiously, a firm using an extraordinary market beta possibly will even alter the a fore mentioned interested in a firm using a truncated market beta. Firm can evade the risk of the market by marketing the stock themselves. S & P 500 forth coming contracts create shorting stock market remarkably relaxed. It works in this way that when the market rises, the future agreement too upsurges. In case of seller, future agreement goes downcast.

Put inversely, the firm’s verge agreement has a destructive market beta. Thus, we can say that hedged firm’s market beta will be lower than the unmerged firm’s market beta. Many firms are evaded against other kind of threats. For instance, Southwest Airlines procures jet fuel extreme in advance (over and done with futures agreements), which lessens its acquaintance to succeeding up swings in the worth of airplane fuel.

Now think that this contract of hedging creates value of the firm? The answer is No. we can say this because the firm’s investors has not grew a fresh progressive NPV project. If investors want not as much of disclosure to the market, they can easily undersized the market of stocks themselves. Or else they can undo hedging a firm.

To do so they should purchase the contracts of financial markets that is sold by the firm. We can conclude that hedging contracts cannot add a value as well as subtracts value. In case of imperfect market, hedging gives an opportunity to the firm to function well and extra proficiently.

For instance, the additional cash from a verge agreement possibly will support the firm to evade keen on a liquidity critical point in circumstances in which extra backing would be difficult in growing. Or the firm may have exclusive evidence regarding about the future that what it holds and if the get around good is understated or not.

Summary

Solve now!

Q12.6 when two unlike firms with uncorrelated rates of return merge, is the causing firm riskier or harmless? Does this add value?

12.3 B How to misuse the CAPM

Mishandling of CAPM and NPV is common. Managers often commit mistake of ignoring the NPVs of projects which are independent. NPV can be preserved only if we use capital’s cost of the individual projects. One must not use the complete capital’s cost for its separate projects. This way the details get lost.

When acquiring another company-

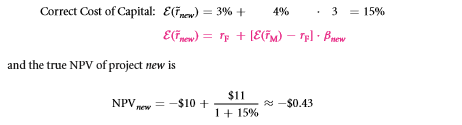

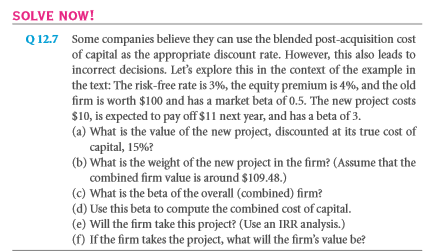

Assume that 3% is the risk-free rate besides premium is say 4%. Say your firm (old) has cost$100 and partakes a beta of market as 0.5. New project prices$10plusisestimatedtopayoff $11 subsequent year. (Therefore, the rate can be 10% as return). Beta of the aforesaid fresh project is 3.

The modest methods to calculate the worth of attaining project new depend on information which the NPV so self-governing assignments are preservative. You can assess the fresh project via its specific expected cash flows besides its specific capital’s cost. Consequently, fresh should propose a predictable return rate of

We can say that if old firm accepts new project, new possessors amount to be 43 cents that is not as good as they can be uncertainly their managers do not accept the same. (Say $100 as opposed to $99.57).

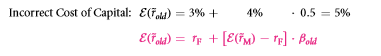

Inappropriately, in many firms, it is usual guiding principle to estimate entire ventures by means of the firm’s whole capital’s cost. Would the fore said firm agree to take fresh project at this time? Estimated with a market beta of 0.5, the hurdle rate for the project would be

With its IRR of $11/$10 − 1= 10%, which is superior as compared to the 5% in appropriate capital’s cost, a manager who is immoral would certainly accepts this project. Now the question arises, if old firm accepts the new project then how the value changes?

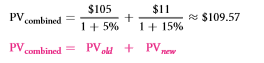

By means of a beta of 0.5, the firm which is old par taken a probable return rate of 3% + 4% 0.5= 5%. The a fore mentioned expected value next year would be $105. Using PV, we see that the present value of the combined firm would be

We can see that 43 cents fewer than the unusual value of $100 also the $10 procurement charge of the fresh project. Accepting the assignment has made the former proprietors 43 cents inferior.

Entire fusions are not obsessed by such errors. In contrast to the CAPM world which is perfect, the a fore mentioned is not continuously happen that mergers don’t add value to the capital’s cost. It is easy for the large firms to create value as capital arcades stay not competent for small firms.

For instance, if an objective until the time had no right of entry to a seamless capital market, then the capital’s cost to an objective can transform as soon as it is managed. The accurate capital’s cost for achieving a target, though, is still not the capital’s cost of neither the purchaser nor the amalgamated after purchase cost of center of the firm.

As an alternative, the accurate capital’s cost formerly is that degree that is appropriate for the objective’s projects.

When acquiring another project-

It is crucial to know that firms are to remain developed also smaller projects consisting different markets betas and consequently have diverse capital’s cost. Let’s explain this with an example, when a firm has cash in treasuries, the beta of such is lesser than other firm which is called zero market betas.

These bonds need not to gross the returns which are expected from them. Cash present in the concern take down the usual beta and accordingly the typical capital’s cost is just appropriate.

Another application of this can be figured which shows the decay assignments into different categories: Suppose you want to buy a rocket which you need to show a telecom satellite the subsequent year.

You will need almost a year to build the rocket and then you have to pay $80 million. After that you launch it. There is 50% chance of rocket fail and it happens you will have to face a loss in your investment and if the rocket be successful, there will be a beta of 2, that will be used for producing a revenue stream formation. The expected cash flow of the telecom will remain forever as $20 million. If 3% is risk free rate and 5% is what equity premium at market rate.

Solution to this problem is to think that the rocket as one project and the telecom revenues as another project. There is only a distinctive risk in this rocket project. The rocket value (in millions of dollars today) is

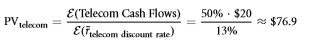

You can think of this as the cost of storage $80 million in Treasuries until you are prepared to carry on to your second project. The telecom revenues, nevertheless, are a risky perpetuity. With a beta of 2, their cash flows should be discounted at 3% + 5% . 2 = 13%—and these flows seem with a 50-50 probability only. Accordingly,

12.3 C Differential costs of capital—theory and practice

The situation is clear that the projects are discounted by its specific cost of capital. Despite of this fact, in 2001 Graham as well as Harvey discovered in their survey that most CFOs use firm’s whole capital’s cost instead of using capital’s cost which is specific to a project. In addition rest CFOs use the correct method by discounting cash flows correctly. So we can conclude that CFOs remain uninformed plus various CFOs use the incorrect cost of capital.

Some CFOs are intelligent enough to use similar discount rate for different kind of projects. The reason is as we know is not easy to guess the suitable capital’s cost in a proper way. In theory, CAPM works flawlessly but not in actual practice.

This is because in practice you guess the equity premium input but in theory you know it. Basically, conceptually you are familiar with beta of market of total projects but in actual practice you are not.

The basic points to note:

- The past betas of openly traded firms remain not wholly dependable and analytical. Different methods to estimate can derive by means of diverse numbers. This can be the reason why the use of regular betas (market) of comparable, openly traded firms is supported. The problem which can arise here is the projects may not be similar and cannot be considered suitable to compare because of their distinctive nature.

- One can also calculate its identifiable market beta by considering the time sequence of past project standards. Keep one thing in mind that historical value variation is important and cannot be substituted with past cash flow variant.

As we at present identify that market standards themselves be situated the existing cut-rate values of whole upcoming cash flows, not just existing discounted cost of only one phase’s cash flow. Let’s take an example to clear this. Consider a firm whose cash flows are effortlessly identified. Consequently, its suitable real discount amount would be near to the rate which is free from risk.Still, its cash flows take place merely all extra month, this firm would have infinite monthly cash flow instability (−100% followed by +∞ %).

The out of a hundred variations in cash flows will not suggest of its return rates. Plus, nearly confidently, we can say a risky market beta evaluation, representing an incorrect cost of capital. In order to evaluate beta of your market, it would be required to one way or another get a time sequences of projected market standards from the identified time sequences of cash flows. We already know the fact that it’s very difficult to calculate single market worth for a firm but calculating changes in the time sequences of market value is outside anyone’s ability.

- Various firms are not experienced enough to use market values and cash flows. You even cannot verify and use the estimations. Even these conditions cannot be considered for the tax premiums and impact of liquidity of capital’s cost. To conclude we can say that it is a painful fact to accept that the methods which we use to calculate capital’s cost are not healthy as we think they are.

As a result, the difficulty with allocating unlike capital’s cost to different ventures may at present turn out to be one of divergence. Division managers possibly can debate limitlessly about why projects must be allotted a lesser capital’s cost. Is this just how you need your managers on the way to devote their time?

Plus do you need your managers to play profits game? Managers may perhaps transfer profits on or after weeks of which the performance of market is good into the weeks of not so good performances to create lesser market beta.

The capital’s cost evaluate itself then turn out to be a poker chip which is a part of agency game conflict plus response—every managers would prefer to persuade themselves besides others that little capital’s cost aimed at their specific divisions is finest. What the largely business would prefer to require in order on the way to over powering such gaming would be unchallengeable. Thus, then oblee valuations of the capital are cost for every division as well as probable venture that no individual can debate about.

In certainty of business politics, though, it possibly will be tranquil to obligate to similar unchallengeable capital’s cost for entire projects than the situation would be of having diverse capital’s cost fore very division as well as project.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Capital budgeting applications and pitfalls

Links of Next Financial Accounting Topics:-