There are many other ratios of just like the P/E ratio. It is something though most people fail to realize. But these can give excellent results if people choose to use these properly of course.

These can help people understand about the firm characteristics as well. Here there are two important financial ratios that people can absolutely discuss.

14.4 A VALUATION RATIOS

The best of these ratios is the P/E ratio in itself. Of course these have a numerator which is a price. They also have a denominator that is an attribute that one can measure. The attributes can be anything even in smaller quantities.

EARNINGS-BASED MULTIPLES

This is very necessary. It helps evaluate a measure that is proportional to the value. There are different forms of earnings and people can use the same of course. There is absolutely no way that can be termed as right or as wrong when it comes valuation.

It is simply because an earning has various definitions. One must understand that their only aim is to find a particular ratio. This ratio must help them reduce the differences of your as well as the comparable firm.

EBITDA was one alternative earning. But it also has many problems with it. It no wonder fails to note the capital expenditures at all. This is problematic without any doubt at all. The earning-based multiples often work better than the cash-flow based multiples no doubt.

But not always of course. Then again there is the PEG ratio as well. This is simply the P/E ratio that is further divided by the growth of the earnings. If the P/E ratios are high and the growth rate of earnings are not.

Then there are chances that the PEG will scatter out absolutely. It is better to avoid this ratio thus.

There can be a calculative approach that is made for the already used and termed association that is used in the chapter 13. The capital evaluation that is made in the ratio product is a given condition. There is a good amount of earning that is portrayed. Most effective calculation way is used while making a definite calculation. With the most qualification that is included and bounded to give a certain reformed measurement of the PEG ratio.

It gives the calculation process the equity bond that is certain of the earnings that are made.

MULTIPLES BASED ON BOOK EQUITY: BEWARE!

The market value of equity can have a great attribute in the form of the book value (BV). The stock value is always divided by the valuation measures of course. Financial accounting flow is usually related to the accurate flow values. But one simply cannot choose a stock number from balance sheet. It will definitely be a doubtful affair to deal with.

The book value of equity balances the right hand side and the left hand side of a balance sheet. It happens after the accountants have totally completed their book keeping book. At times the book value of debt or assets can be used. The book value of debt is much more acceptable in these situations.

This is the market equity ratio that stands by and makes a dipper connection to the solution that is to be found. As per the sources, there can be many conversions of these equity earned profits. On knowing and understanding how the entire deal works, you can get a direct idea to make your project more valuable.

On comparing the book keeping values, it can be called for a certain that is possible to trace the flow of cash that you earn on profits. The debt that remains however makes a distinguishing factor. There will be a noted change hence.

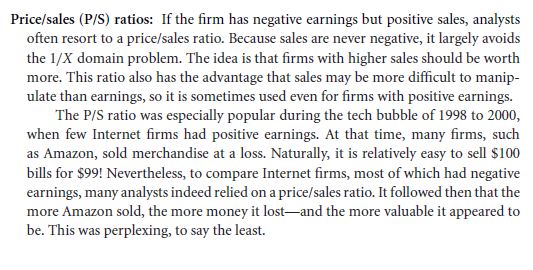

MORE ESOTERIC OR SPECIALIZED MULTIPLES

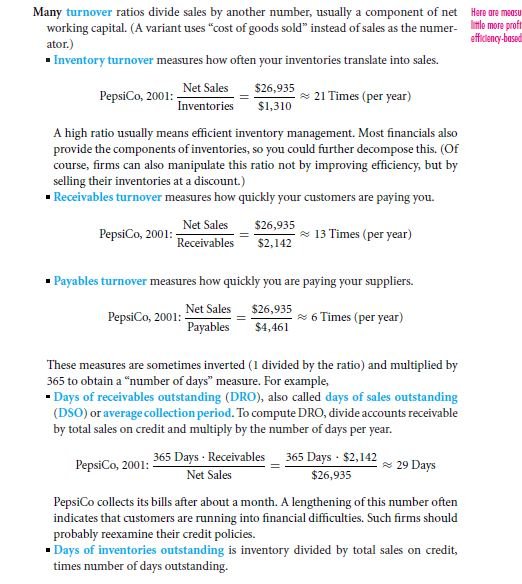

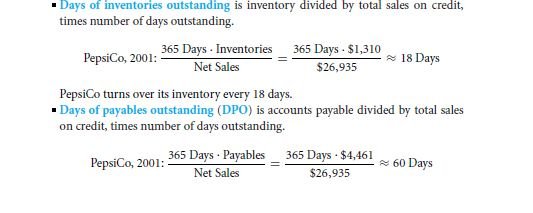

14.4 B NON-VALUATION DIAGNOSTIC FINANCIAL RATIOS

Every ratio is different. Some helps find a value of a firm while there are some that helps evaluate the financial health. These ratios help in various ways. They can help people know about the economy of a firm.

These can simply be a part of the ratio and do nothing as well. These also are different in various business cycles as well. This is absolutely why they must be compared to the similar firms only.

Measures Of Leverage And Financial Precariousness

The main use of the conversion cycle is to give a clear view to the flow of the cash that you are to receive. There are so many options that give a good view.

Measures of Profitability

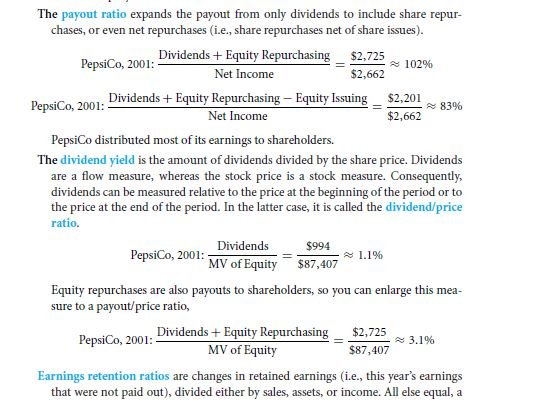

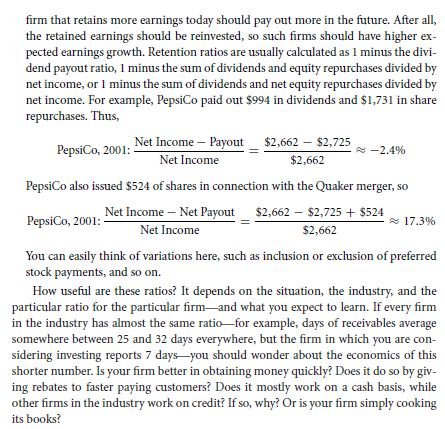

Measures Related to Stock Market Capitalization

There is a book equity ratio that governs all the properties that are to be added and calculated.

Summary

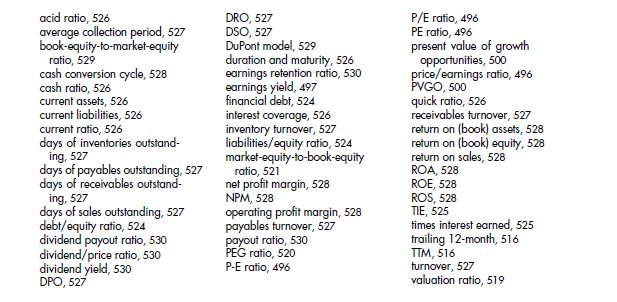

Key terms

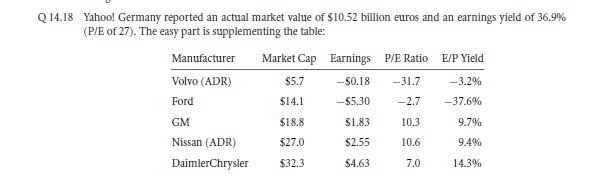

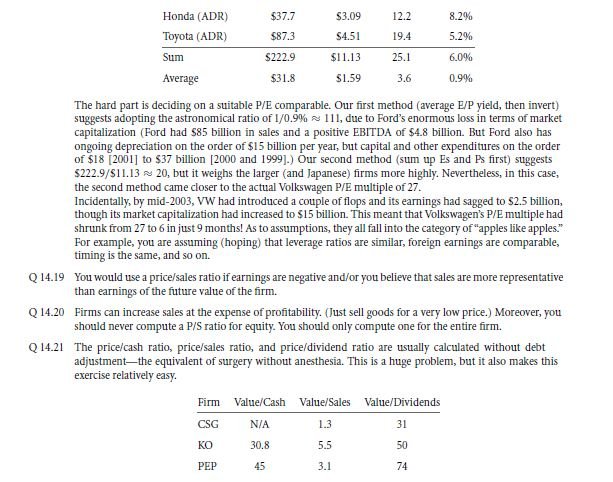

Solve now! Solutions

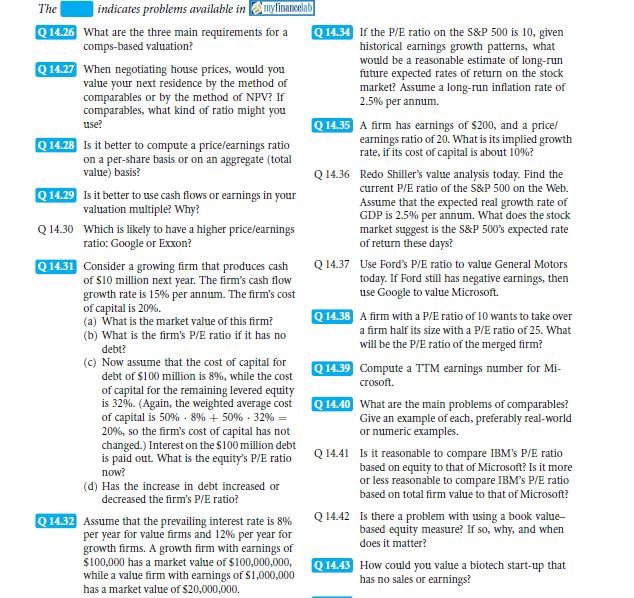

Problems

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

Links of Next Financial Accounting Topics:-

- Corporate claims

- Capital structure and capital budgeting in a perfect market

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

- What matters

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management