If you consider the security of the finance in a market that is perfect as far as the financial background is concerned, then it certainly doesn’t undergo any sort of increments or decrements. What M & M emphasized on the most is the fact that the total value of a particular firm or security remains unchanged as far as a perfect market is concerned. This theorem holds irrespective of the manner in which a particular firm has collected its funds.

IMPORTANT: According to the perfect market assumed in the propositions of M & M, the value of a particular company doesn’t depend on the manner of financing in any way. It depends of the various projects that the firm has.

M & M have proved this in their articles by taking several analogies. These analogies have without a doubt played a huge role as far as explaining these concepts are concerned. They stated that the equation would become a lot more complex in the event that the value of a particular business relied on how it was financed. This is due to the fact that there are no such cases as far as the various real life scenarios are concerned. The company should be able to opt for any financing option and in turn these options must not be interdependent with the various values. M & M took several assumptions into account at the time of putting forth their propositions. Some of the major assumptions are discussed in details below:

- If you consider bankruptcy, there a no costs involved as far as the various transactions are concerned. This is one of the major assumptions of the propositions laid down by the two.

- Information and opinions are considered to be on the same platforms.

- As far as the perfect world is concerned, it doesn’t give way for any sort of taxes.

- If you consider the capital structure of the various markets in the perfect world, you ought to figure out that a lot of competition exists between the various markets. This competition is predominantly amongst the various investors.

Even though these assumptions don’t hold as far as real world scenarios are concerned, it is for certain that they are an absolute must as far as any sort of education in the field of finance is concerned. These assumptions are made due to the fact that once an individual gets acquainted with the various aspects of these assumptions, they can very well relate to the real world scenarios, i.e. when these assumptions are not in play. The chapters that are to follow will be focusing on the various things that may happen in the event that the assumptions made are removed, i.e. in a real life environment. A major thing that individuals must focus on as far as this chapter goes is the manner in which the articles prove work. Let’s consider a scenario, where in a particular company has taken up or decided to take up a couple of projects. Though this was one of the major assumptions as far as M & M were concerned, but in reality, they don’t exist and their absence doesn’t effective the end result by a considerable margin. Before taking any project up, the major goal that the firm must look into is to find financers for a particular project. This is due to the fact that one thing is for certain. In the even that a particular project lacks appropriate financers, it will not be possible to carry out with the project for long. Hence, this is one of the most important things to do at the time of picking up a particular project. The various expenses that ought to be encountered must be calculated and the best present value must be determined. If all these steps aren’t carried out properly, then the entire project might meet up with an abrupt halt.

In short, it refers to the fact that the value of the claims issued by the company for a particular project must be equal to the projects PV. This is extremely important for every project that is taken up. If the firm doesn’t take any loans, i.e. cent percent equity, the firm definitely stands to benefit in the long run as it is going to earn the profits of the investors as well. If however, the ratio of the debt to equity is 1 : 1, the summation of the two must be equivalent to the present value of the firm. From perspective, let the claims issued by a firm be x %, then the equity will be (100 – x) %. The summation of the two once again must be equivalent to the current PV. Though the concept of M & M was defined under the scope of this chapter, it has already been used in the previous chapters, especially in the scenario where a building had to be sold. Hence, these propositions certainly shouldn’t get you surprise in the event that you have gone through the previous chapters thoroughly. It is the very same propositions that you followed in the previous chapters. In this chapter it has been put forth in a simpler manner. The following formula provides individuals with another version of the theories proposed by M & M:

The NPV amounts to nothing as far as the financing of projects in a market that is perfect is concerned. Any sort of funds that are collected for projects is collected only from the major investors. No value of the equity or debt can have an impact on the PV. In the event that a certain scheme of finance has the capability of increasing or decreasing the net PV, then the propositions laid down by M & M can very well be nullified. As you progress with this chapter, you ought to realize that these theories are put to test under various adverse conditions as well. Suppose an individual opts for a structure for his or her capital that reduces the worth of his or her firm by about a dollar, i.e. the value of firm is no longer same as that of the PV. This is the new argument that has been fully restructured from the old one. To elaborate this theory further, let us consider a firm or a company whose current worth is about hundred dollars with a return rate of about ten percent for all the claims. This in turn refers to an environment that is risk neutral. This ought to be elaborated even further under the scope of chapter 16.4 A. Another thing about this risk neutral work is that it is only assumed for the sole purpose of making the various calculation a lot easier. The assumptions don’t actually vary as far as the manner of financing is concerned, be it equity or deb. We already began discussing the first, the argument restructuring process. Let us take up an example where the present value of a particular firm is hundred dollars. Here the ratio of equity to debt is taken as 4 : 1 which is often considered to be an optimal situation. Under such circumstances, it can be calculated theoretically that if the ratio of the financing on the basis of debt and equity is taken as 1 : 1, then the worth of the firm will come down by a dollar. Under such a scenario, the person owning the firm must buy the various equites and debts that were previously decided. This will definitely play a big role in ensuring that the number of digits in your bank balance goes up considerably. After buying them, the claims must be issued following the optimum structure. You will in turn be able to sell these for hundred dollar which in turn brings you a dollar profit for each transaction which isn’t bad.

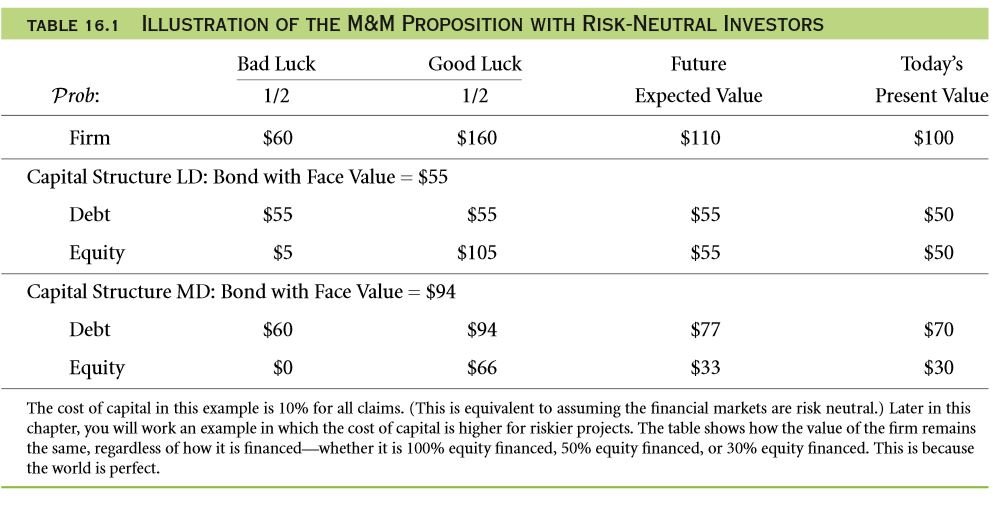

There problem here is that there ought to be several other individuals that ought to figure out the very same thing. This is due to the fact that there ought to be millions of other individuals all across the globe who are reading this book right now. However, one thing is for certain, if you are willing to bid till hundred dollars, there won’t be any one who would be able to challenge you but let me tell you, it is quite a risky move to make and can very well lead to bankruptcy at times. Hence, while taking such high bids, individuals must take every step cautiously. This is due to the fact that the maximum selling price of the claims would be hundred dollars and no one would look forward to make a loss. In the table given below, the major possible selling prices of a particular firm are sixty dollars and hundred and sixty dollars with an expected value for the future to be around $ 110. In the scenario that has been taken up in this case, the PV is equal to about a hundred dollars. The FV or face value of the various bonds issues by the firm are about fifty five dollars. As a result that dilemma that the holders of most of the bonds face is completely nullified. This is perhaps something that most owners look forward to as an incentive. The buyers of the bonds will have to pay fifty dollars which comes from $ 55 / (0.1 + 1). Moving on to the holders of the equity. They are in quite a dilemma as they stand to receive either $ 105 or $ 5 which is without a doubt a considerable margin for separation. However, they are mostly prepared with a value of fifty dollars that is calculated using the same formula as used above. Under circumstances where the debt is more, the FV may be about ninety four dollars. On the other hand, what the holders of the bond will be prepared to clear is only seventy dollars which is all right if the receive the ninety four dollars. However, on the contrary that the receive sixty dollars, the situation may become worse. Let us now consider the holders of the equity. They are having the maximum risk has they will either get sixty six dollars or will get absolutely nothing. The maximum value that they ought to be ok with is sixty six dollars.

Let us now move on to the second method, the argument restructuring method that is homemade. The best part about this approach is that it gives individuals the ability to lever the claims once again by himself or herself. Though most individuals would believe that they need complete ownership of the firm in order to this. However, that’s certainly not the case. Even in the event that an individual purchases about a percent of the entire company, then he or she can very well opt for this option. Purchasing a percent of the claims will definitely yield a percent of the profit which is what individuals mostly look forward to. Once an individual has received a percentage of profit he or she can very well move ahead and get the claims sold. This is without a doubt an extremely profitable transaction. In the event that a particular firm choses the ID structure, then it is for certain that the individuals who are interested in investing the projects of that firm will be very much comfortable with the MD structure which is quite predominant. For instance, a claim may yield $ 0.94 and $ 0.60 under favorable and unfavorable conditions respectively. You will without a doubt be quite happy about owning such claims. The best part about these approaches is that it costs individuals only about a percent of the bond value which is nothing compared to what an individual’s stands to receive.

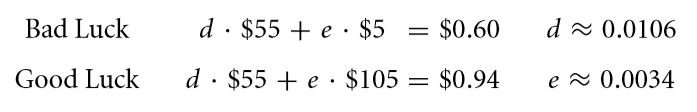

Under such circumstances, the first and foremost thing that an individual must do is figure out the claims in the event that he or she buys e number of stocks and d number of bonds in a firm that follows the LD structure. The basic formulas for the same are discussed in details below:

Let’s consider a scenario where in an individual buys 0.0034 and 0.0106 of the LD equity and bond respectively, net gain under extremely adverse conditions would be about 0.6 dollars. However, under favorable conditions it ought to be about 0.94 dollars. This is quite similar to the firms that follows the MD structure as well. The net amount that an individual would have to give in the event that he or she is looking forward to getting these options is ![]() which is same as what individuals would ordinarily expect. It may so happen that an individual has decided the capital structure as far as a particular company is concerned without the concern of the company itself. All an individual needs to do under such scenarios is carried out the processes that are discussed above repeatedly. You will definitely get the results that you desire. Now if you want to deduce it to the various propositions made by M & M, the procedure is extremely easy. All you need to do is consider the MD and LD capital structures for a particular firm. Whichever one gives a higher result, go for the other. When you have followed this approach, you will always have the option to sell open in front of you.

which is same as what individuals would ordinarily expect. It may so happen that an individual has decided the capital structure as far as a particular company is concerned without the concern of the company itself. All an individual needs to do under such scenarios is carried out the processes that are discussed above repeatedly. You will definitely get the results that you desire. Now if you want to deduce it to the various propositions made by M & M, the procedure is extremely easy. All you need to do is consider the MD and LD capital structures for a particular firm. Whichever one gives a higher result, go for the other. When you have followed this approach, you will always have the option to sell open in front of you.

However, when it comes to the second procedure, there is an extremely important aspect. Under various arbitration’s, the various leverages in a homemade structure lets individuals get the cash flows that they need. As a result, these will play a huge role as far as the present worth of a company is taken into consideration. This in turn could bring in a considerable amount of profit for you in the near future. However, the dependencies amount he firm value with the capital structure should not exist as far as the various real life scenarios are concerned. IN the event that it does, then one thing is for certain that the scenario is not optimal. However, owning a percent of the bonds doesn’t give an individual complete control over a particular firm. Under certain circumstances, it can even end up getting you disappointed. The only means by virtue of which an individual can obtain more value is in the event that he or she gets the maximum possible votes which is a big thing as far as the various real life scenarios are concerned. However, in the event that you actually do, there are various advantages that you can obtain out of it. The first and foremost thing that you must do is to get rid of the management team. You might as well consider changing the various policies of a particular firm.

IMPORTANT:

If you consider the world as described by M & M, you ought to come across the fact that the market that they assumed was an idealized capital market. Some of the major consequences of these market are as follows:

- Managers are given complete authority.

- On coming across a capital structure that is not up to the mark, the managers have the complete authority to get rid of that structure so as to ensure that the company thrives.

- In the real world, a manager may come across a situation where in he or she comes across a project that is not at all standard. Under such circumstances, the manager can very well eliminate such projects.

However, this scenario isn’t ideal as the structure of the capital may in turn effect the value. The fact that the propositions of M & M takes into account real life scenarios, the fact remains that these real life scenarios have their very own pros and cons. However, these propositions do tell the owners of firms as to where they must concentrate on. This is extremely important from the perspective that time shouldn’t be wasted on affairs that aren’t of much important. All the manager needs to do is plan out the structure in such a way that it increases the worth of the projects that his or her firm is currently holding. However, as far as wasting time and making value out of it is concerned, it can’t continue for long as far as the real life scenarios are concerned.

SOLVE NOW

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Capital structure and capital budgeting in a perfect market

Links of Next Financial Accounting Topics:-

- The weighted average cost of capital wacc

- The big picture how to think of debt and equity

- Non financial and operational liabilities and the marginal cost of capital

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management