IMPORTANT:

Let us consider the claim values in a world as proposed by M & M which deals with financial equity and debt only.

- According to the claims, the probable states of the future are used at the time of partitioning the payoffs.

- Summation of the various claims ought to be equal to the net value of the projects.

- The control right and the flow of cash don’t have any role to play as far as the firms current value is concerned.

Each claim comes with a set of risk parameters. As far as any sort of residual claims are concerned, it is nothing but the equity that has been levered. If you consider this option along with compete ownership, you ought to figure out that it is a more risk approach.

Capital COST

- The capital cost involved rises with the debt amount. If a claim is more risky than another, then the first must come with return rates that are higher as well. This is nothing but a compensation for the extra bit of risk involved. If you compare ownership that is outright and levered equity, the latter’s expected return rate must be higher.

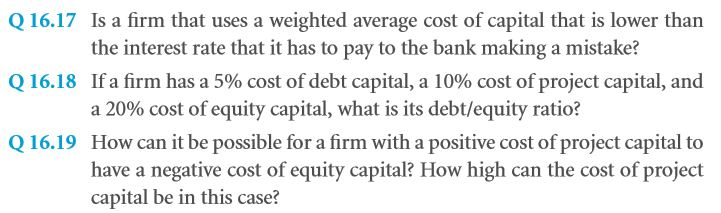

- Considering the source of financing of a firm to be either equity or debt or both, the WACC is as mentioned above.

- The WACC is independent of the manner in which the various projects are financed.

- The quoted rate may be higher than the return rate of equity that is expected as well as the return rate.

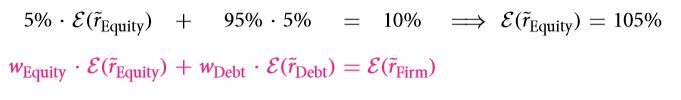

In the event that the ratio of debt of a particular firm is comparatively high and the firm has a considerable amount of property or collateral involved. Then it is for certain that such a debt is free from any form of risk. Under such circumstances, even the rate of return falls. If the capital cost of a firm is ten percent and the rate that is free from risks is five percent, then equity that remains will be:

SOLVE NOW

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Capital structure and capital budgeting in a perfect market

- Conceptual basics maximization of equity value or firm value

- Modigliani and miller the informal way

- Modigliani and miller the formal way

- The weighted average cost of capital wacc

- The big picture how to think of debt and equity

Links of Next Financial Accounting Topics:-

- The weighted average cost of capital wacc

- The big picture how to think of debt and equity

- Non financial and operational liabilities and the marginal cost of capital

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management