Appendix

In-a-Pinch Advice: Fixed versus Variable Components

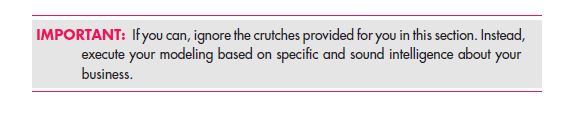

If you claim that there is a possibility that the firms that are generally encountered can be seen and the cash flows can be used, then the statements are all wrong. There is a certainty that the variable components are all very different from each other.

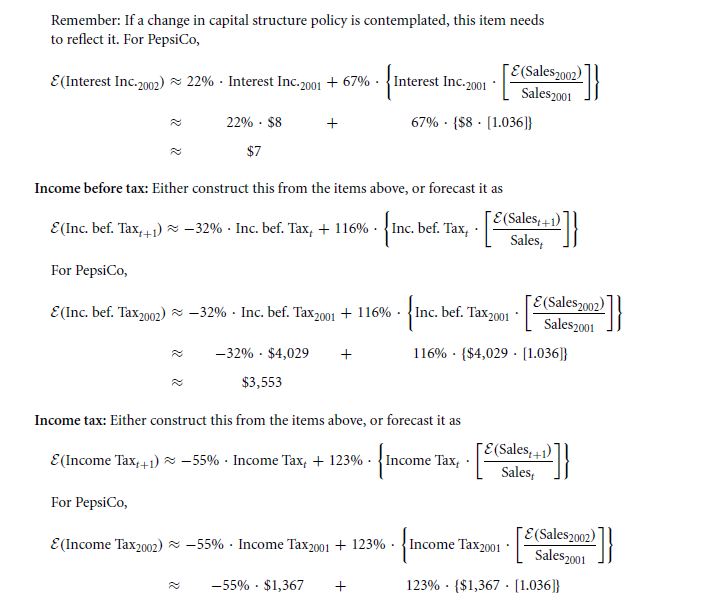

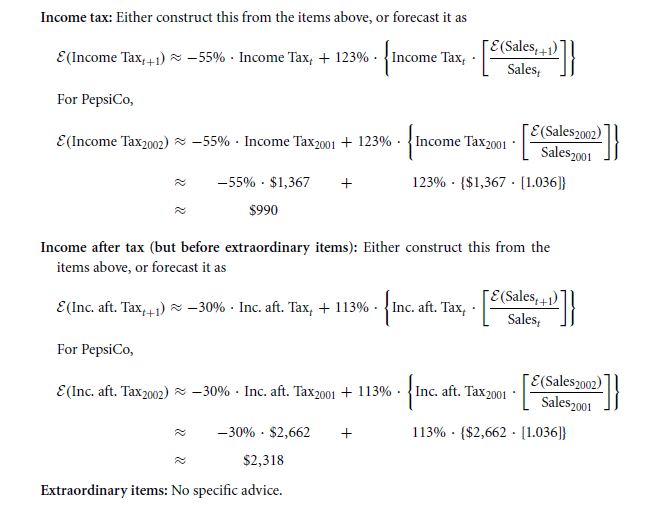

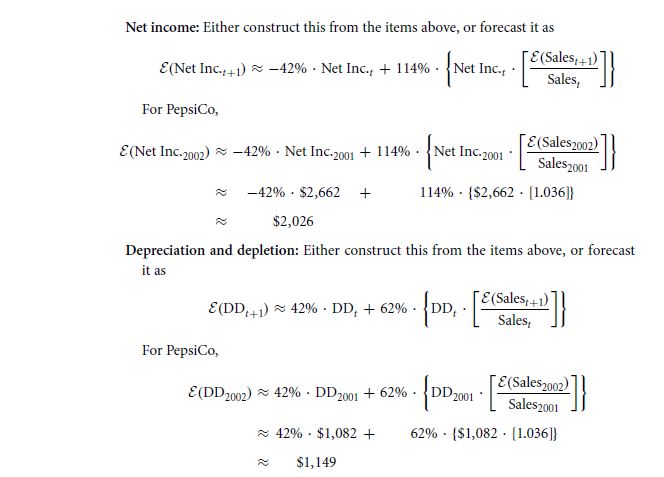

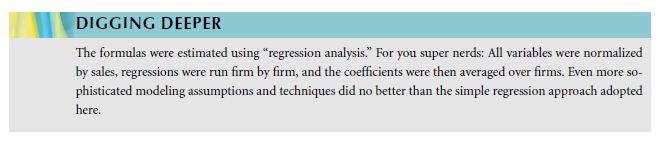

There can be many specifications that underline the value that is formed. The specific formulas are used and also revised on an average scale. This is bound to give a jump start to the specific cost technologies. This is in fact how the calculation works.

On a more notable basic view point,

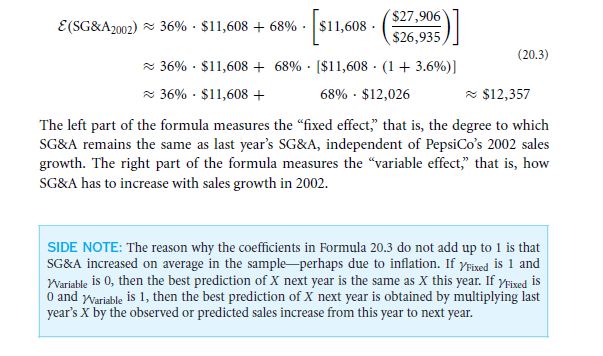

This is in fact a very important decision that needs top be sorted and made in accordance to the values that are kept. The coefficient works to give the value of 36% and also 68% which are always righteous to your value.

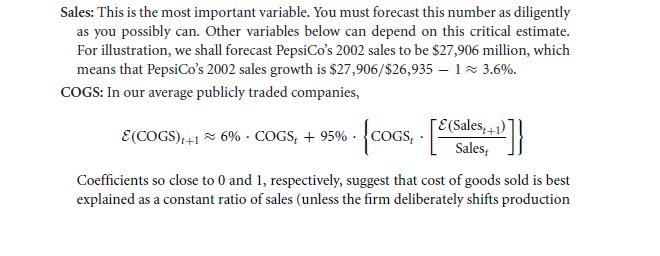

All the coefficient form a basic value that is made in the constructed nature that refers to the values that needs to be put down. COGS are always publicly traded to make the linking a valued sum. With all the notifications that are possible and can be made as a prime value, these beta values measure up to be a positive one. This is hence followed to make up a grand value that is cleared.

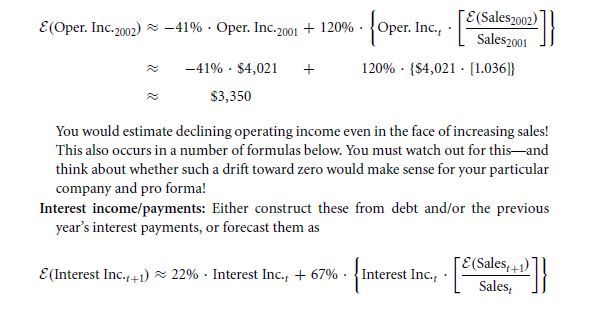

Always make a note of the growth value that is made and the rates that are vouched for an extra fact. The margin borderline that is formed is best to consider on.

Deferred taxes: this is the extremely determining component that is used in the calculation of the capital investment solutions.

Non-cash items: a total of the negative growth curve is formed by this.

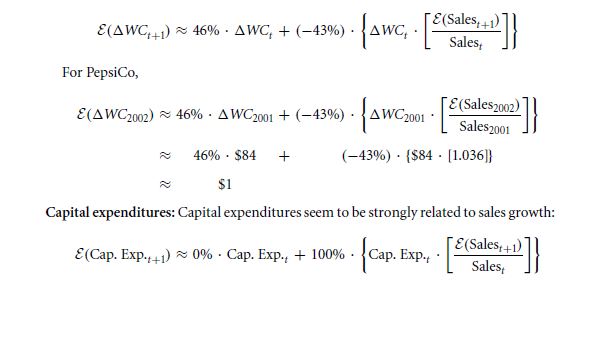

Changes in working capital: as you can notice, in the section that is marked 13.4, all that we have discussed about are the variations that are possible to get in case of a working capital. This is of course if the firm is growing at a fast pace.

The values of such are adjusted to be:

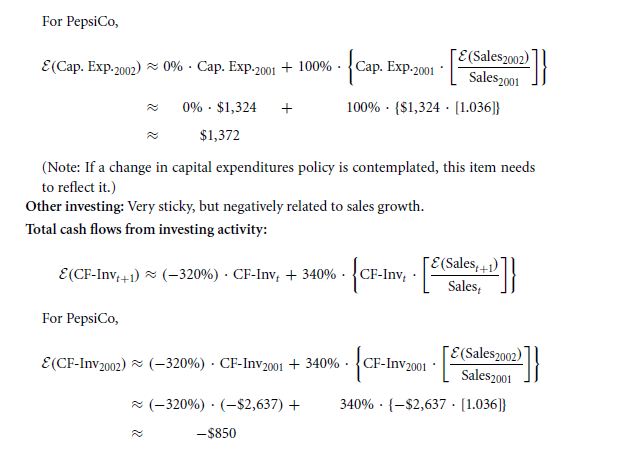

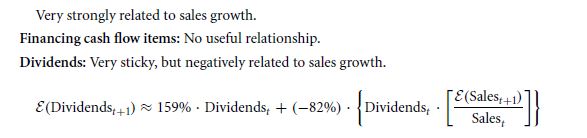

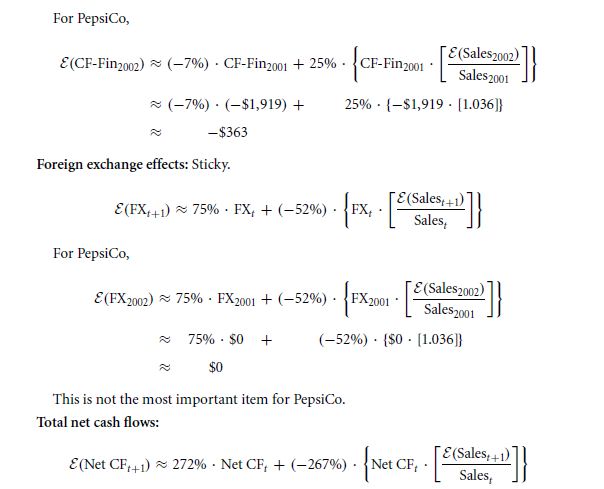

This is all nothing but a right about estimation of the capital that is made by the formula. Now what happens if the value of the sales rate fluctuates? There can be many other investing bodies where you can and will submit all the regards.

Getting hold of the calculative index, here is the entire pro forma for your use.

However, one thing that you need to keep in your mind is that no matter what you do always take a good look at the blueprint validation.

Problems

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

- Corporate claims

- Capital structure and capital budgeting in a perfect market

- For value financial structure and corporate strategy analysis

- The goal and logic

- The template

- The length of the detailed projection period

- The detailed projection phase

- The terminal value

- Some pro formas

- Alternative assumptions and sensitivity and scenario analyses

- Proposing capital structure change

- Our pro forma in hindsight

Links of Next Financial Accounting Topics:-