After discussing by far, we can say that we have all the estimated and elements we require to determine the pro forms which include the value of the market like forecast of the economic flow of cash, value of terminal, factors of discounts and rate of eternal growth

So let’s add them all for the professional pro forma

20.6 A an Unbiased Pro Forma

Let’s use assumptions set as detailed in the Table 20.7. The asset flows of cash are: $1,712, $1,883, $2,071, and $2,278 (in millions) from the year 2002 to 2005. The market value of terminal will be based on the capital cost of eternal which 7% and growth rate of 3% of cash flow to be $2,278 million from the base year of 2005. This means that the value of terminal of flow of cash from the year 2005 to $57 million of the year 2004.

Adding the $2.1 billion from 2004, the value will be $59 billion. We will get the present value as $50 billion after deducting 7% of the capital costs from the same. And there can be much other estimation too for different value of possibility.

20.6 B A Calibration Pro Forma

Now let’s talk about someone who needs to analyze the publicly traded Pepsi Co. Most of the people question here on why to creating pro forma for a company which is already running the market value in public? Well, there are two scenarios:

- One is considering buying the shares of Pepsi Co and wants to inquire if the market value of the company is less than underlying value of fundamental.

- If you are an investment banker and your duty to be suggest the structure of capital change in the company.

And thus we can say that pro formas are generated to propose corporate changes which are necessary for the firm. Since the information sis public, estimating the value of the pro forma if it’s in line with the value of actual market will be easy. Considering Pepsi CO, the stock value of the market was generated as $87.4 billion for Pepsi Co which means that the total value of the asset was about $100 billion which is way too higher than the estimated pro forma value of $50 billion.

So under this case, if you present your Pro Forma to the management of Pepsi Co, you might have to return back disappointed as they have better value than you have estimated for them.

So before you reach them, you need to do some calibration in your pro forma which must include the reasons on why you are increasing the figure in your model. In order to do so, you have three tools to help you increase the figure in your model: changing the flow of the cash, changing the capital cost, changing the growth rate.

- Detailed Projection: This means that you might have to change the estimated or projected cash flow of Pepsi Co in your model. In your model, you assumed the growth rate as 10% to 15%, so if you alter the same, there were two effects of the same: you can change the projection of initial period of flow of cash and you change the projection of cash flow of $2,278 million which was used as a baseline.

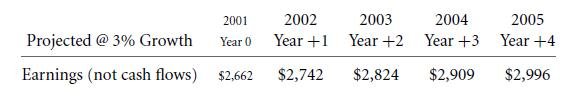

Now keep the projection at 3% for previous year before 2005, which means:

- Cost of capital projections: You can also try to reduce the estimated capital cost from 7% to a lower number which will results into two effects:

The cash flow of future will be valuable

Increase in the value of estimated terminal market

- Eternal Earnings growth projections: One can change the growth profile of the company by increasing the rate of eternal growth of Pepsi Co, which means that the firm will be categorized as growth firm than a value firm.

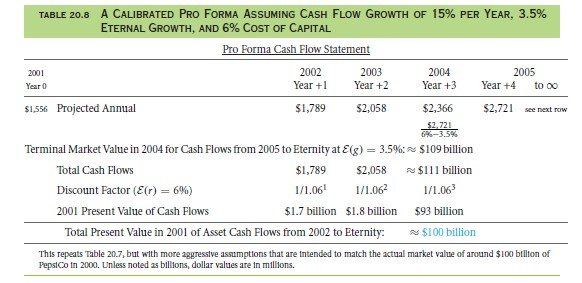

Talking about the real world, one will choose the combination of all the tools mentioned. The table 200.8 illustrates the adjustments that one can make in their model to a successful presentation:

- Increase the rate of growth in the initial flow of cash by from 10 % to 15%.

- Decrease the capital cost to 6% from 7%

- Increase the growth rate of eternal cash flow to 5% from 3%

And hence, all these changes will lead to $100 billion value of market for Pepsi Co. And hence, it is important to remain practical and conceptual with the calibration of pro forma in order to a resultant expected market value of any firm.

Links of Previous Main Topic:-

- For value financial structure and corporate strategy analysis

- The goal and logic

- The template

- The length of the detailed projection period

- The detailed projection phase

- The terminal value

- Some pro formas

Links of Next Financial Accounting Topics:-