So long whatever has been discussed under the scope of this chapter has been said keeping in mind that we are taking a firm of US origin into consideration. The CAPM formula that has been used in various places is used taking into account the various adverse situations that may arise in the event that you own a firm or company in the US. When it comes to any activity in the field of finance, one thing that individuals must always keep in mind is for whom they are working. This is something that is of utmost important as far as a single individual in the field of finance and the stock market is concerned. These individuals need to keep in mind that they don’t own a corporation so, in the event that things don’t turn out to be what they had expected, then it might not end up to be pleasurable for them.

On the other hand, if you are the owner of a firm, you certainly have a capital backup which will in turn give you an extra amount of courage as far as investing in the stock market is concerned. These are certain aspects that the manager of a firm or the owner should be well aware of. In the event that the manager or the owner isn’t responsible enough and he or she doesn’t take all these aspects into consideration, then a scenario may arise where in the firm may sink to the ground. In order to avoid such scenarios, it is imperative for the owner of the firm to be well acquainted with the various aspects of the international stock market. In addition to this, the owner of the firm must also keep in mind that he or she must not leave everything up to the employees. In the event that they do, then one thing is for certain that if anything goes wrong, no employees is going to take the blame for it. This is perhaps one of the major reasons as to why it is always recommended for owners of the firm to have a firm idea regarding the various employees in his or her firm. If the owner doesn’t monitor all his employees on a regular basis, then he or she might as well come across instances in future wherein he or she figures out that a particular employees isn’t functional at all and he or she has not done anything in the company’s favor over the last couple of years. Hence, in order to ensure that such scenarios may be avoided, the owner must also stay in touch with his or her firm or at least he or she must monitor the various activities that go on in his or her firm in order to ensure that the firm’s fullest potential can be reached. This is something that you must definitely do as an owner.

The next thing that the owner or the manger must take into consideration is the portfolio of the stock market. As you must know, in the event that you wish to make sure that your investments in the foreign market turn out to be profitable ones, you must without a doubt keep updated as far as the portfolio of the current international stock market is concerned. It ought to give you all the information that you may possibly need as far as the various return rates of various countries are concerned. In the event that you fail to do so, then you won’t be aware of the various aspects of the international market and as a result, the decisions you take may not turn out to be wise ones. In the event that you do want your decisions to pay off, you must without fail be updated as far as the various events in the international stock market are concerned. This will definitely help in ensuring that your company prospers in the long run.

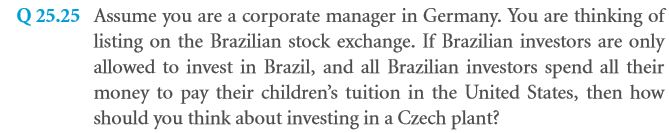

Lastly, once you are well aware of your position, i.e. you are aware of who you work for, then you must identify the various aspects of the CAPM formula. Well, it doesn’t end there, once you are done with that, you must also seek the aid of the portfolio of the stock market, fill in the various parameters and then he or she must apply the data that he or she get in the CAPM formula relative to the currency of where he or she resides and the currency of the country the bond belongs to. The exchange factor is of utmost importance here if you wish to make the most out of your investment and hard work.

SOLVE NOW!

SUMMARY

If you have gone through this chapter, then you would have definitely come across various terms that you did not understand. Hence, in order to ensure that you don’t forget these terms and facts, here’s a small summary of what all has been discussed in the chapter above:

- The first and foremost thing to have been discussed under the scope of this chapter is the idea of exchange rate. In the event that you are investing in the international stock market, then exchange rate in the ratio of the value two single units of the currencies of two different countries. These rates are applicable every time there is some sort of transaction between investors and firms residing in separate countries.

- If you consider various real life instances, you ought to come across the fact that the price tag varies of country to country irrespective of the item you are purchasing. This is something that has a direct relation with the rate of exchange of currency.

- If the investors follow the framework as provided by the CAPM formula, then it is for certain that they will be able to analyses the various forms of risks that are involved.

- If you are well aware of the idea of PPP, it is for certain that you know how the PPP theory can be used to derive the hypothesis as made by Fisher.

- The capital cost of a particular company can be computed in various ways. One of the major ways of doing so is by figuring out the market and the currency of that market and the exchange rate that must be charge in accordance with the amount of risk involved in the market.

- Exchange rates may occur in various forms. Even rates that are forwarded by the various states of the IRP can be thought of as exchange rates. This is something that must be made clear here and now else you are going to face a lot of problems with the chapters that are to follow.

- If you consider the market of the future and that of the spot currency, you will definitely come to the conclusion that these markets are interlinked in various ways and some of the major ways have already been discussed in details under the scope of this chapter. So, in the event that you have any sort of further doubts or queries, you might as well go back to the previous subheads.

- Currency contracts in the forward direction are often used by various managers at the corporate level for the sole purpose of hedging. This is in turn an approach that is adopted by manager and owners of firms all across the globe in order to deal with the risk factor that is involved as far as the various forms of investments that are concerned. Applying the concept of hedging in your firm might as well save your firm from critical disaster in the upcoming years.

KEY TERMS

966 – > Yankee bond

967 – > bulldog bond

947 – > covered interest rate parity

967 – > Eurobond

950 – > Fisher effect

966 – > foreign bond

945 – > exchange rate

950 – > Fisher hypothesis

949 – > forward premium

946 – > futures contract

945 – > forward contract

966 – > matador bond

964 – > hedge

967 – > issue-and-swap market

953 – > home bias

949 – > purchasing power parity

945 – > spot currency rate

966 – > political risk

962 – > ICAPM

966 – > samurai bond

949 – > uncovered interest rate parity

945 – > spot contract

949 – > PPP

947 – > IRP

SOLVE NOW! SOLUTIONS

PROBLEMS

CHAPTER 25 APPENDIX

Prominent International Institutions

If you are willing to jump into the stock market, then you might as well get familiar with the various Companies at an international level that provide funds for projects. Listed below are some of the most prominent institutions at the international level:

- The first and foremost agency that provides funds for various projects all across the globe is the World Bank which is also referred to as the Non Profit agency of the United Nations. This bank comprises of 185 countries as its members and it dates way back. It was established in the year 1946. The sole objective of setting up such a bank was to ensure that the level of poverty in the various developing countries is reduced to the maximum possible extent. Over the years, it has indeed tried its level best in order to keep up with its objective. Till date, it funds projects in various developing countries so as to ensure that they are able to get out of their poverty. It makes use of its bonds in order to raise the money for the developing countries. These bonds are usually funded by the countries that are developing. With its HQ at DC, Washington, funded various grants to poor cities all across the globe in 2006. While trying to do so, it consumed about twenty percent of the twenty three billion dollars that it had raised over the years.

- Second in the Monetary Fund at the international level. Just like the World Bank, this institution too was established in 1946. When it was first proposed, only 38 nations gave their consent. However, today it engulfs about 185 nations which is indeed a great achievement. The major role of this institution is to ensure that the currency balance between the various countries are maintained, i.e. it proposed the idea of currency stability and till date, it has been trying its level best to do so. This is something that various other institutions tried but only this one succeeded. In 2002, when Brazil was on the verge of defaulting the various debts when this institution lend thirty billion dollars to Brazil. The heads of the central bank and the ministers of finance make up the governors board of IMF. It is represented by eight permanent countries and the other sixteen rotate their seats. Hence, you can understand that the board consists of 24 members.

- Economic Development and Cooperation Organization is another major institution as far as world trade is concerned. It was establish more than fifty years ago in the year 1961. After the 2nd World War, this institution grew to become the essence of reconstruction in the form of a Marshall Plan. This is a platform where various agencies can meet at a common platform and discuss the imbalance in the various economic sectors. This is one of the major reasons why OECD countries is analogous to developed countries.

- The institution that is next in our list is quite popular. The World Trade Organization which was established in recent years, i.e. 1995 to be precise. This institution was basically established in order to ensure that certain rules are maintained as far as the trade between the various nations are concerned. This institution has a hundred and fifty countries under its jurisdiction and without a doubt has played a huge role as far as settling trade conflicts between the various nations are concerned. The budget of the WTO is the year 2007 was about a hundred and eighty two in terms of Swiss francs. The institution even provide a platform wherein the various trade oriented issues can be sorted. This is something that is extremely important as far as the trade among the various countries is concerned. Its HQs are based at Geneva. This institution over views about ninety seven percent of the total trade that is carried out in this world.

ANECDOTE

Free Trade – Where Convenient

The nations of the 3rd world are often punished by the various OECD countries. This only happens if the 3rd World countries cause any sort of obstruction as far as the trade between the various countries are concerned. The US demands other nations not be charge any sort of taxes on their cigarette and tobacco companies. The thing about these nations is that no other country can place taxes on their goods. An example has already been provided above. However, in comparison with the competitors of the 3rd world countries, the OECD countries have the full authority to place taxes which is considered to be unfair under most circumstances.

ANECDOTE

Protesting World Bank Policies

Yes, these institutions have indeed worked towards making this world a better place to live in. However, a lot of criticism has been raised against them as well. The accusations made by the critics are not only on political ground but also on economic grounds. Well, there are various reasons behind these accusations. One of the primary examples is the dominance of the OECD countries over the countries of the 3rd world which in no manner can be considered to be fair. The choices made by these organization have a direct impact on the lives of thousands of individuals all across the globe. As a result, it is important for these organizations to take all aspects into consideration before making any call. This will definitely ensure that the things are carried out in a smooth and efficient manner. However, the question remains who is right? The critics or the various international nations, well, each have their valid points of arguments and as a result, the argument rages on.

KEY TERMS

976 – > W T O or World Trade Organization

976 – > Monetary Fund at the International Level

976 – > Non Profit Agency of the United States or the World Bank

976 – > Development and eration.

976 – > Economic Cooperation Organization

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

- Corporate claims

- Capital structure and capital budgeting in a perfect market

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

- What matters

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- International finance

- Currencies and exchange rates

- Investments in foreign financial markets

- Capital budgeting with foreign cash flows

- Corporate currency hedging

Links of Next Financial Accounting Topics:-