The features and aspects of the foreign markets that we have been discussing so far indeed lead us to this point where we will be consider the most important aspect of any stock market, i.e. the capital cost of these corporate projects in the international level. If you compare the capital costs of local projects to that of the international projects, there lies a considerable amount of difference. Hence, in the event that you actually wish to exploit the foreign markets, it is extremely important that you have a solid foundation at least as far as you capital is concerned. If you don’t have one, it is strongly recommended for you not to go into this market. The first and foremost things that the representatives of a particular firm must consider is the manner in which they can reduce the risk of their projects at least as far as the international markets are concerned. In the event that the risk involved for a project in the international market is comparatively high, then one thing is for certain that not all firms will be able to cope up with the return rates quoted by the investors. Hence, it is imperative to reduce the risk factor for projects or at least to conceal them.

Considering the risk factor, the projects budgeting must be carried out. Firstly, the capital cost ought to be determined using the CAPM formula or any other standard algorithm. Another thing that the executives must do is stay updated with the latest version of the portfolio for a particular stock market. Irrespective of whether an individual is looking forward to investing in a stock market or he or she is looking for investors, the individual must without fail have a firm idea as far as the portfolio of the stock market is concerned. This provides individuals with all the information they need as far as a particular stock market is concerned. If you are looking for investors in the global market, you must also figure out the risk involved as far as the market index at the international platform is concerned.

25.3 A the General Perspective: Certain and Uncertain Cash Flows

If you consider the budgeting process of the domestic and the global projects, you ought to come across the fact that the process involved in case of the domestic projects is a lot easier than the global ones. All an individual needs to be aware of is the various rates such as discount rates, expected rates, quoted rates, etc. and the flow of cash. This will without a doubt enable you to figure out the current worth of a particular project. In the event that you are considering a global project, determining the cash flow can turn out to be quite difficult a task. It is the most important step as far as determining the value of a project is concerned. However, once you are certain about this, calculating the value of the project ought to be extremely easy. Let us take an example, what would be the worth of the rights to television in the year 2003 if it promised hundred million in 2004. Let us now consider this example thoroughly:

- Here, it is imperative that you are aware of the treasury rate in the currency euro which is about 0.0209. Hence, at such a rate implied on the promised hundred million, the current worth of the project, the television rights in this case would be about ninety seven million. Then, you must apply the exchange rate on ninety seven million euros which would amount to about hundred and six million dollars. Any sort of errors need to be rounded off for the purpose of simplicity.

- Suppose you want a currency exchange rate of 1.0783 on dollars : euros for the year 2004, all you need to do is issue a currency contract in the forward direction at present. The treasury rates are also applicable here and an individual ought to end up with hundred and six million dollars.

If you consider the parity of the interest rates then, you will definitely come across two other methods that are equally effective as far as the problems discussed above are concerned. In the event that any sort of uncertainty gets involved as far as the flow of cash is concerned, then one thing is for certain that the entire affair ought to become a lot more complex and as a result, things will become a lot more cumbersome. This is something that individuals in the field of finance try to avoid at all costs as it will only lead to their downfall. In the event that these aspects are dealt with in a suitable manner, then one thing is for certain that you are the one who will stand to gain. However, in the event that these issues aren’t dealt with appropriately, then your firm or company might as well end up getting closed. Hence, it is strongly recommended for individuals to take these aspects seriously as they could play a huge role as far as the prosperity of a particular company is concerned.

There are two things here that must definitely be focused on, the first is the flow of cash that is expected. This comprises of two aspects if you classify them broadly, namely, cash in and cash out. Cash in refers to the total amount of cash that your firm or company earns as revenue leaving aside the expenses that the company has to endure. On the other hand, cash out is the total amount of cash that the firm or the company spends as far as several expenses are concerned. These expenses include cost for raw materials, salary of employees, and other expenses. The cash in and cash out together are referred to as flow of cash. In the event that the manager of a particular company isn’t able to keep tract of these aspects of the company, then it is for certain that the company is not going to thrive. This flow of cash must be calculated depending on the currency of the country that a particular individual belongs to. It will definitely play a huge role in ensuring that your company thrives. The second thing that the individuals must consider is the fact that they need to provide their potential clients with incentives so as to ensure that the clients turn back to them as and when the need arises. This is where the concept of discount comes into play. There are various forms of discounts that the retailers or the shopkeepers place on their products so as to ensure that their clients are satisfied to the maximum possible extent. The type of discount that a firm ought to provide solely depends on the type of products that the firm is dealing with. In the event that the firm deals with jewellery product, then it’s for certain that the owner of the firm won’t be able to place discounts on the price of the metal that is being used to manufacture a particular item. The discounts that are to be applied in this case ought to be applied on the making charges. Hence, you can see that the manner in which the discounts are provided by the managers of the firms is greatly dependent on the type of product that the firm deals with. In the event that you have any sort of queries as far as the various forms of discounts are concerned, all you need to do is refer to chapter 6.4A of this book. It contains all the information that you may possibly need. In the event that there exist any form of shortcoming as far as the alternative methods are concerned, you might as well go ahead and check out the standard method. These method discussed in details earlier ought to suffice under any sort of circumstances.

The task that individuals need to focus on now is the manner in which they can calculate the rate of discount that would be accurate. In the event that the rate of discount is higher than what it should be, then the company isn’t going to profit much, i.e. a direct impact on the profit margin of a particular company. On the other hand, if the rate of discount is lower than what is expected or what the competitors are providing, then your firm will definitely fair as far as attracting potential clients are concerned. This is solely due to the fact that the clients under most circumstances will opt for the option where they ought to receive more benefits. These are some of the reasons why determining an appropriate discount rate is so crucial. The consequences of an inappropriate discount rate on the company’s reputation will without a doubt be adverse. The need for finding appropriate measures for computing the rate of discount is highlighted all the more. One thing that must definitely be consider while doing so is the current status of the stock market which in turn can be determined by the portfolio of a particular stock market.

25.3 B Valuing a Foreign Project with Uncertain Cash Flows

In the event that an individual is looking forward to investing in foreign projects, he or she must without fail focus on figuring out the value of the project that they are looking forward to investing in. This is something that every investor must do irrespective of whether he or she is investing in local projects or international ones. This valuation is perhaps the key in the event that an individual is looking forward succeed as an investor. If however, the individual fails to figure out the value of the project he or she is investing it, then this scenario is quite similar to leaving it up to fate to decide as to whether or not an investment is going to pay off.

This valuation can be carried out in various ways. The ways of finding the valuation of a particular project varies with the type of project an individual is dealing with. In the event that an individual is able to figure out the value of a particular project appropriately, he or she will without fail be able to determine as to what rate of return would be appropriate. In the event that the rate of return that the firm is offering doesn’t meet up with the rate of return that you have calculated, then you might as well look for other investment opportunities. As far as the foreign market is concerned, there isn’t much of a lacking as far as the investment opportunities are concerned, provided the investor is ready to lend the desired sum of money. However, the return rates charged must not be too over the top. This is due to the fact that there is a lot of competition among the investors as well. If a particular investor placed return rates that are too high, it is for certain that he or she most come across much of investment opportunities. These opportunities are something from which the investors make their living and it won’t be a wise decision to turn back most of them.

The return rate that is to be placed by the investor should be determined keeping in mind that the amount of risk involved as far as the project is concerned. In the event that there is a lot of risk involved in a particular project, the investors often end up placing considerably high return rates. On the other hand, if the risk involved isn’t that high, the investors are quite reasonable as far as placing the expected return rates are concerned.

So now, it is imperative for the investors to first consider the risk factor. Now, the question remains how to estimate the risk factor. Well, risk is often considered to be the degree of uncertainty in a particular project. In the event that a particular project’s outcome isn’t quite certain, then the project is often considered to be a risky one. On the other hand, if there is little or no adverse conditions involved as far as the project is concerned, then the risk involved in the project is a lot lesser. These factors indeed play a key role as far as determining the value of a particular project is concerned.

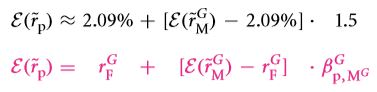

To understand the idea a lot better, let us first consider a project for a particular football league. For instance, the German League. The initial expenses as far as thing project is concerned ought to be something about a hundred million euros. This value is often considered to be the beta value when evaluated against the foreign stock market. Under the circumstances that are stated above, can you guess what the expected return rate shall be? Well, it has been calculated below:

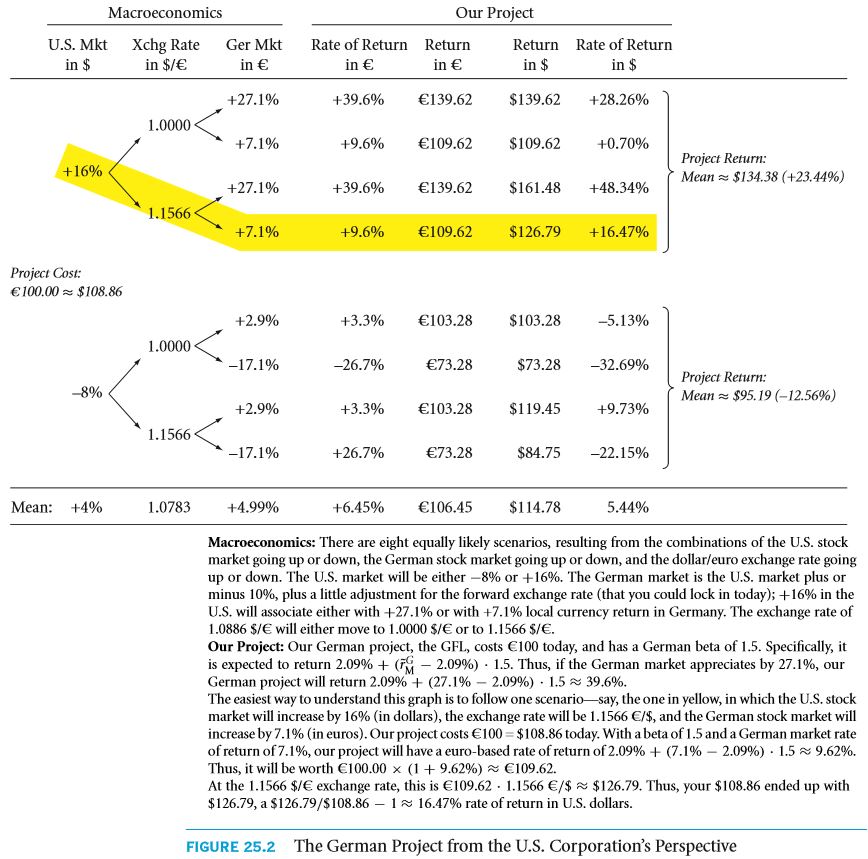

Doesn’t this formula look similar to you? Well, it should. Since you are so far into this chapter, it is for certain that you must have gone through the section discussing the CAPM formula. This is just a form of the very same formula that you have come across that several places throughout this book. The only difference lies in the fact that the German market is taken into consideration at the time of deriving this version of the formula. In the event that you are not comfortable with this version of the formula, you might as well make use of the original CAPM formula. The end result ought to be the same. All you need to do is consider the Football League of Germany in order to come down to this version of the formula. This is something that may not appear to be easy at the first look but as an individual moves ahead with placing the various parameters correctly, he or she eventually ought to come down to the formula that is given above. Let us take another example. If you consider the expected return rates of the GFL and the DAX, they ought to place an expected return rate of 0.0209 and 0.071 respectively. All an individual needs to know as far as these return rates are considered is the fact that the first is in dollars and the second is in euros.

Let us consider the statistics that are provided in figure 25.2. These statistics have been taken over the last couple of years and are based on the international stock market. Hence, in the event that an individual needs to carry out any sort of calculations that is related to the international stock market, it is imperative for him or her to take this table into consideration. It contains all the information that an individual may possibly need in order to secure a sure foot in the international stock market. The project of the Football League of the German origin that was taken into consideration earlier was worth a hundred million euros. However, at present the value of the project ought to be about hundred and eight million euros. This is something that ought to appear a bit too complex in the event that you are a beginner. However, as you make progress, you will definitely realize that the projects are not always what they appear to be! The reason behind this is that the stock market increases at the rate of 1.16 every years. This is something that must definitely be considered in the event that an individual is looking forward to exploiting the various sectors of the online foreign stock market. If these aspects are clear to an individual, it is for certain that he or she won’t be facing much of a difficulty as far as getting returns that are worth the investment are concerned.

Another thing that is evident as far as these statistics are concerned is the fact that the DAX value goes down every year by a considerable margin. Hence, in the event that you are looking forward to making an investment in DAX today, it is imperative that you consider all the future aspects that lie in front of you. This will without a doubt turn out to be exceedingly effective in the long run.

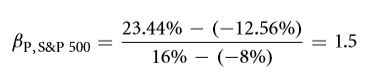

The formula given above gives us the slope of the line joining the points ( 16, 0.2344 ) and ( – 0.08, – 0.1256 ). That however isn’t what I am trying to explain here. The point here is that the beta value of a particular project irrespective of where it is of American origin or German origin with respect to the Se P and the DAX ought to be quite similar to each other. This however isn’t something that ought to be followed all the time. This is only valid in the event that the US stock market and the German Stock market go hand in hand. This refers to the fact that the effect of stock movements on the value of a particular firm in both the German and the American market should be comparable. In the event that they aren’t, then the theory stated above will definitely not hold.

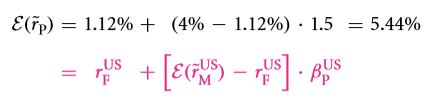

Now, let us consider an extremely common query. In the example that was referred to in the earlier example, the project of the Football league of the German origin will definitely follow the CAPM formula in accordance with the German currency. However, the question that arises now is whether or not it will satisfy the CAPM formula as per the currency of the United States or not. If you consider the implementation of the CAPM formula as per the currency of the United States, you will realize that it is pretty much similar to what individuals would usually expect in the event that the made use of the CAPM formula with respect to the German currency.

Recap of the Decomposition

This example is something that can be used to explain various aspects as far as the field of finance is concerned. To think of it, have you wondered what all can be concluded from the example that had been taken up in the previous paragraphs? Well, there are various things that an individual can concluded from the example that has been discussed above. One of the primary things is the idea of decomposition of the prospects of a foreign project. Well, what does this mean? This refers to the idea that the valuation of any international project can be carried out from the point of view of the local investors. In this case, the investors of the stock market of the United States. This will in turn play a huge role as far as figuring out how attractive these projects ought to appear to the local investors is concerned. This can be done by considering three predominant factors. These factors are discussed in details below:

- The amount and the quality of the exposure that the project has received as far as the international stock market is concerned. This is one of the primary things that the individuals considering the idea of investing in foreign markets must do. If you consider the example that has been taken up in the previous subhead, i.e. the project concerning the football league of the German origin. This is the value of the beta of this project in accordance with the DAX of the international stock market. For this, the first and foremost thing that you must do is figure out the local beta value of that project. Once you are done with that, calculating the beta value with respect to the DAX of the international stock market isn’t that difficult a task, provided you are well aware of the various aspects of the DAX and the CAPM formula. If you are then the effort needed to be put in is reduced by about fifty percent. An example of this would be the stock market for various electronic gadgets. The beta value of these projects in the United States in their very own stock market might as well be similar to the beta value of the very same project in the stock market at the international level. There are a few minute aspects that must be taken into consideration in the event that an individual isn’t willing to consider the option of allowing his or her investments to go in vain.

- The exposure the project has received in the international market with respect to the exposure it has received in the stock market of the United States is another aspect that must be considered up close. This is something that has already been discussed while discussing the beta value of a project in the stock market of Germany in comparison to its beta vale in the stock market of the United States. In the event that these concepts are clear to an individuals, he or she might as well move to the following point. However, in the event that they aren’t, then reading the remainder to this point is of utmost importance. The 500 of S and P is often considered to be a benchmark. In the event that the index value of a particular stock market is higher than this, then under most circumstances, the stock market of the United States might as well migrate. This is something that may appear to be absurd but this is what actually happens, especially if you consider the online platforms on which these markets are based.

- The last thing that needs to be considered under the scope of this chapter is the fact that the currency exchange rate often tends to vary. As a result, rate of currency exchange in accordance with the stock market of the United States is something that is extremely important as far as making any sort of investments in the foreign market is concerned. In the event that this exchange rate increases or drops even by a fraction, the stock market might as well get flooded as far as the United States are concerned. Hence, keeping track with this exchange rate with respect to the currency of the United States is something that the investors need to be concerned about 24 x 7. This is due to the fact that if their estimations don’t fall in place, they might as well come across heavy losses. This is something that no investor would ever want. However, in the event that this rise and fall can be estimated, i.e. even if there is a thin line of possibility that the currency exchange rate may rise or fall, then the investors can without a doubt take appropriate precautions. However, in order to estimate this correctly, it is imperative for the investors to be updated with the latest statistics as far as the stock market is concerned. To do so, the investors must have the portfolio of the stock market of the major countries with them. These will definitely play a huge role as far as an investor’s success in the field is concerned.

The conversion factor between the German currency Euros and the American Currency dollars has already been used in the previous chapters in order to explain the idea of currency exchange a lot better. In the event that the examples and the proofs provided under the scope of this chapter don’t suffice, all you need to do is scroll back a couple of chapters and you ought to come across what you actually need.

Start thinking in depth

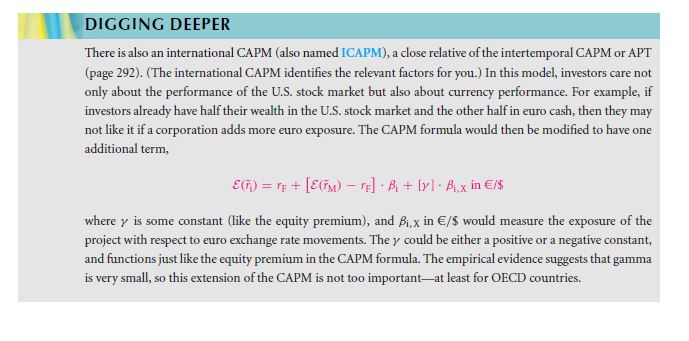

In the event that you are looking forward to pursuing a career in the field of finance, it is imperative for you to be well aware of the several pros and cons that are related to this chapter. In the event that you are to succeed, the basic concepts of finance must without a doubt be clear to you. All along we have been using several versions of the CAPM formula but are you aware of the fact that there exists another version of this formula from the perspective of the international stock market. This version of the CAPM formula is often referred to as ICAPM where I stands for international. This formula is not only similar to the various versions of the CAPM formula that we have been discussing, but in addition to that, it also has its roots in the APT. To know more about APT, you might as well refer to chapter 7. It contains all the information you need at least as far as APT is concerned. This formula takes various parameters into consideration. The first is the local stock market, i.e. the stock market of the United States in this case. In addition to this, another parameter that needed to be introduced is the currency factor. The performance of a particular currency in the stock market. The ICAPM formula is given below:

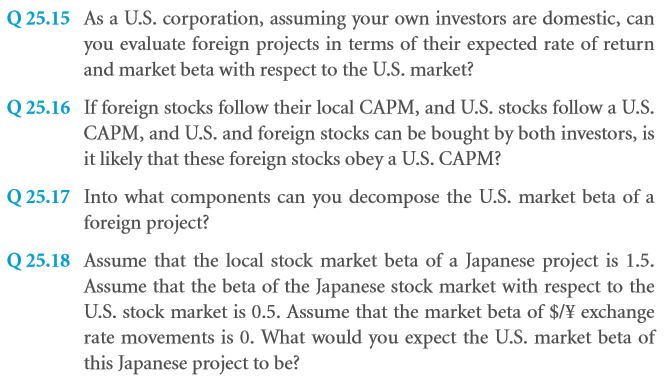

SOLVE NOW!

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

- Corporate claims

- Capital structure and capital budgeting in a perfect market

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

- What matters

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- International finance

- Investments in foreign financial markets

Links of Next Financial Accounting Topics:-