In this chapter, one must have learned the responsibilities of a corporate manager which includes:

- Taking care of income taxes of corporate

- Taking care of personal income taxes of the investors

- How the expected bankruptcies cost can be raised

- How can managers be leading equity on their pet project?

So the question now is how to work upon the NPV that is net present value of the firm under the presence of such mentioned issues along with capital structure that has an ability to change the same. How will capital structure and firm value be determined under the working of imperfections of capital market?

In order to answer all the questions, one must recall a fact about the perfect market which states that average capital cost is not equal to marginal capital that can be compared in any internal return rate of a new project. A significant difference can be seen in a scenario raising cost of one more dollar and that of billion dollars.

And hence, the current capital cost is just considered as a number in the balance sheet which is of no use. On the other hand, the average capital cost is more useful if the forces that influenced the average capital cost are likely to repeat influence the marginal capital cost currently as well. In fact, the average capital cost is somewhere near to the marginal capital cost of today in majorly large firms.

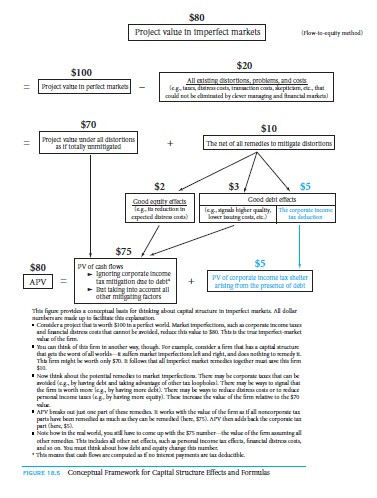

The figure 18.5 is a demonstration of the value of the firm considering various perspectives in the market. The value of the firm can be 100$ but it is considered 80$ under imperfections of market. In addition to tax shelter which is created under tax deductibility, other factors can equally significant under the algebraic formula of APV as well as WACC. One can see in the extreme row where income tax corporate mitigation is broken down with worth value of 5$.

And under such a situation, corporate income taxes were not a significant factor in the same because only 5$ reduction is noticed under 20$ of reduction because of income taxes of corporate. The rest of 15$ reduction due to market imperfection is more significant in such a case where it enters the value of the firm by directly associating with 75$ of the Net present value of the firm. Under such a case, one can think of an approach of APV related to other imperfections but such methods would be rarely useful. Why, if you ask?

18.10 A Do You Need Other Valuation (APV or WACC) Formulas?

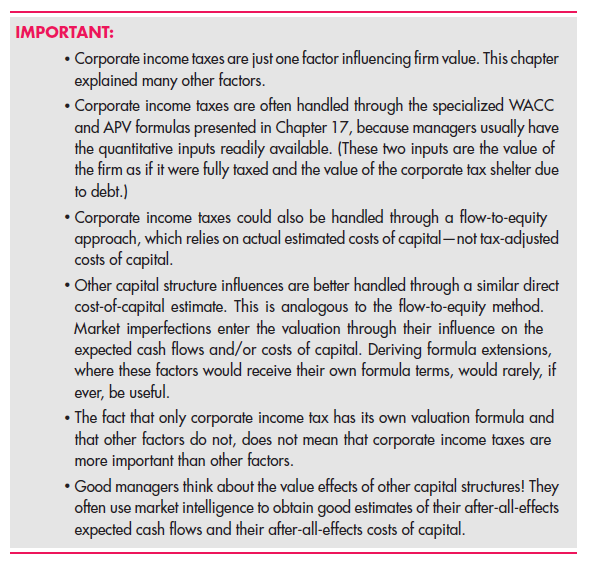

There are certain methods with which you can understand proper income tax handling technique.

If fully taxed, capital cost and expected cash flows could help in corporate income tax reduction and also inducing extra debt shelter.

Expected cash flow and working with it is easy because of corporate income taxes (actual) that is reflected. This can also be stated as a flow to equity methodology.

- In case your company is facing situations of bankruptcy, determining the financial losses is tough. Adjustments cannot be made with only debt details. Here we can see that reduction in bankruptcy costs can be attained with the help of equity financing.

- In case, the investors of you company receive fully taxed interest, evaluating those amount on a personal level will ensure difficulty in the process. Remedy of correcting those personal taxes is utilizing equity financing adjustment.

- Suppose a company has financial stability on the foundation of equity amount. Now, it is up to you to determine how much funds you should allocate on a favored project of yours. This will also include the handling of debt financing.

In order to have a direct equivalent related to methodologies like flow to equity, capital cost and expected cash flows will be reflecting the following factors.

- Suppose you have a pet project. In order to finance it, the best thing that you can do is hiking the expected cash flow. This can be attained by debt addition.

- This hike in expected cash flow also proves to be beneficial in bankruptcy probability reduction.

- There are specific claims basing on which you can decrease personal income taxes of investors.

You can easily optimize your company by considering these facts. This can be a handy option which can definitely give you and your company protection from market imperfection.

Links of Previous Main Topic:-

- What matters

- The role of personal income taxes and clientele effects

- Operating policy behavior in bad times financial distress

- Operating policy agency issues and behaviour in good times

- Bondholder expropriation

- Inside information and adverse selection

- Transaction costs and behavioural issues

- Static capital structure summary

Links of Next Financial Accounting Topics:-

- Capital structure dynamics

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management