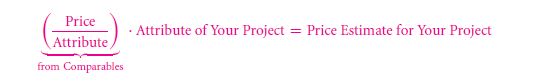

After understanding the total concept, there is no need for you to run in head deep in the concept. Sort of ratio structures make up for the ultimate value that you get on supplying the net interest. There is a good reason why the price ratio index makes up for an estimate that is counted.

There will be many ratio discussions for the P/E to make it a comparable value measure.

14.2A DEFINITION

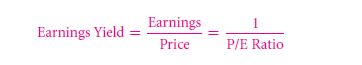

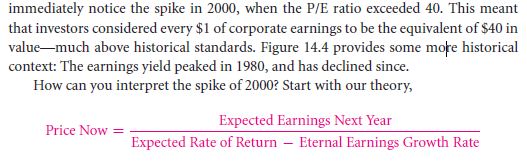

Generally the 1 year annual earnings are used as a proxy. It is supposed to suffice the stock value. The future discounted earning flows are used as a base here. Also one must understand that the price here is the stock earnings, whereas the net income is a flow measure here.

The P/E ratio is often that is not always used as the current price. This happens in the practical world only. The analysts usually estimates nest year’s earnings. This price is divides the current market price.

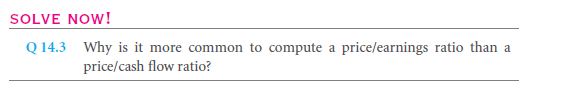

The entire chapter is about the use of cash flows that are attributed as earnings, and yet cannot be used. As a step of reverting the earnings there can be multiple ways that are you are about to learn.

Many people may wonder that why more than necessary attention is provided to the cash earnings? Especially when the cash flows are already present. Well the truth is that the cash earnings actually help with the future cash flows. And it does this far better than the cash flows in itself.

Usually the cash flows can vary in huge ranges. One particular year it can be hugely negative while in the nest year it may be positive. Now this may not be the problem in NPV, yet, the cash earnings do a better job.

Firstly it is spread over a short period of times. And also, people can expect that it has a good record of inflow an outflow with it of course. This is absolutely why it gives better results.

The earning yield usually stands out to be victorious. Of course it provides with positive as well as negative results. But then again these are much more logical and explainable as well.

14.2B WHY P/E RATIOS DIFFER

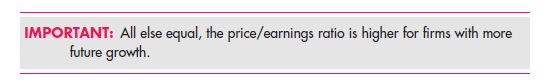

The future is definitely not certain. The earnings which have value today may not have the same effect for future firms. This can be one reason no doubt. You cannot get great value per dollar estimate if you think that today’s value matter. That is you imagine that the future firms will produce this in future as well. You will get the least value through this.

As you may have learned on the chapter 3 there is a distinct relation that single earnings hold up to. There is hence a set parameter that these ratios hold up on. As for the cost of capitals, they get lower every time such a ratio is incurred.

ILLUSTRATION OF DIFFERENCES IN EXPECTED EARNINGS GROWTH RATES.

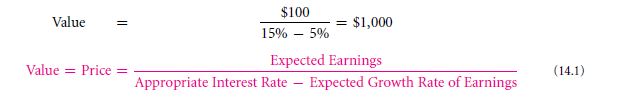

Assuming that there is an expectant cash return that your firm encounters, there is to be a cash of $100 change by the coming year. This is mostly undertaken by the income return that is of 5%. As the formula 3.1 determines, the value that is to be gotten of this firm is,

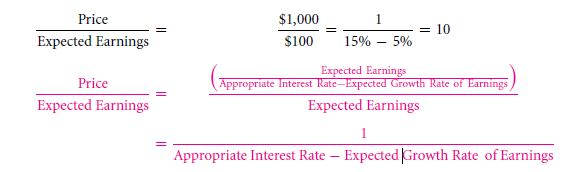

A price value of $1000 along with an expectant earning of $100 the P/E ratio stands to be,

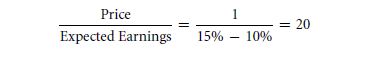

Computing another value for this example,

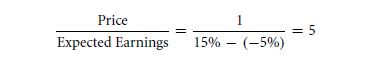

The market value of P/E earnings will be 5% if?

The conclusion is quite simple. The market may expect that by when a firm will progress in its earning. The high P/E ratios are reflections of this only.

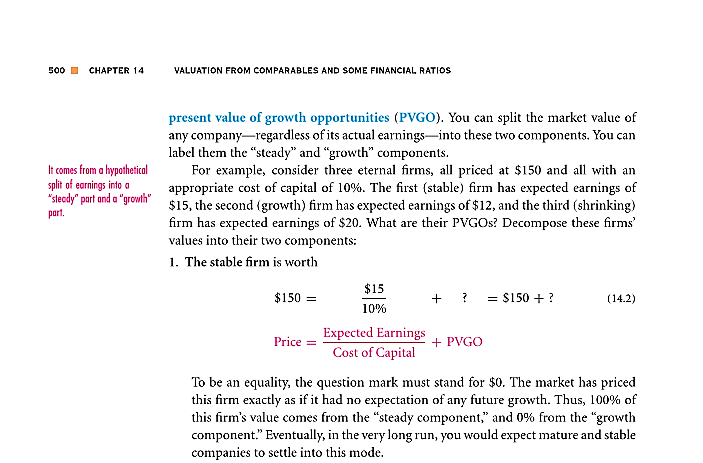

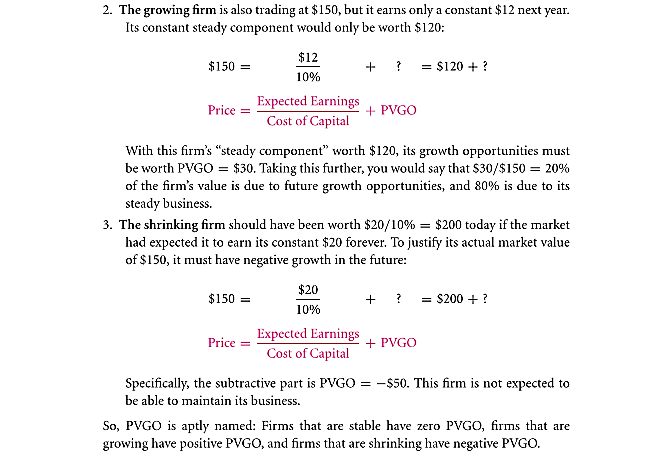

THE PRESENT VALUE OF GROWTH OPPORTUNITIES (PVGO)

The cash flows of a firm can at times be decomposed. Usually it is then spilt into two parts. The first is the hypothetical firm that has zero earnings but has an immense growth opportunity. This is known as the PVGO.

While the other is the firm that has an earning equal to ours, yet it has stopped growing. This theory gives a perspective to the growth in P/E ratios of course.

Taking the example of the firm that works its way up to a market, we can input the values that are all in the stable formula that is making a direct point. There will be many component that works along with the substitute.

14.2C EMPIRICAL EVIDENCE

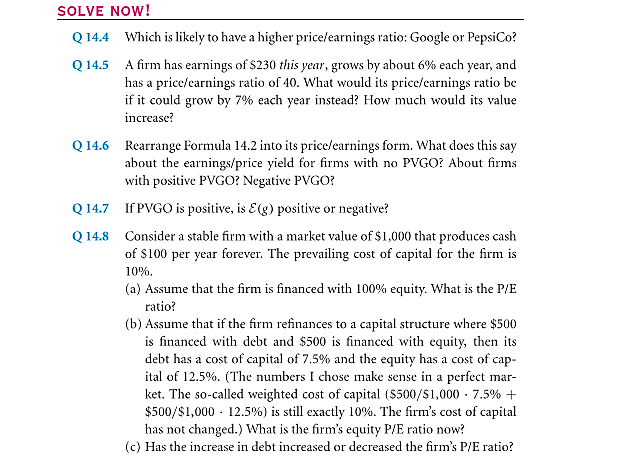

Looking at the data that is given, you can take a look at the way that the relationship is explored. As the P/E ratio makes a varied form in the stock market, there is a need for the casual relationship that buds over between an investor and a market analyst.

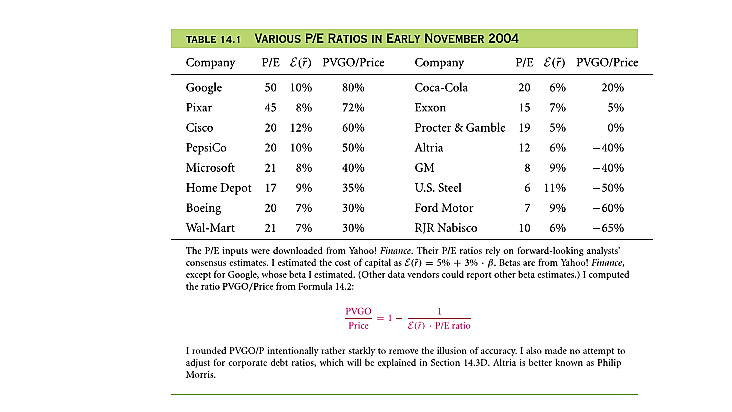

P/E Ratios and Earnings Growth Rates for Selected Firmsin November 2004

The table that is given here that is 14.1, gives a PVGO calculation summary that stands for absolute real firm bodies. As for the market beta rate, there is always the market assumption that can be made. As far as the inputs are concerned, there is a fine accurate currency that is needed. When you get to compute the factors in the formulas, you can look at the major difference that it creates.

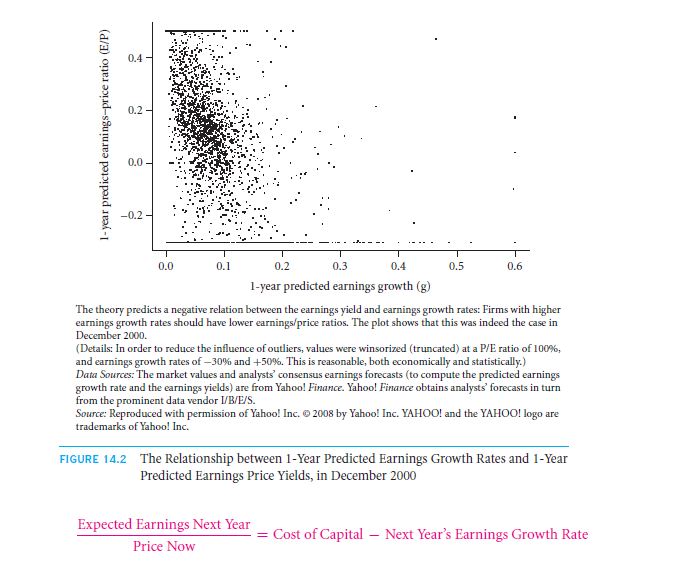

P/E Ratios and Earnings Growth Rates for All Firmsin December 2000

This is a certain theory that works only on a piece of paper. There is ought to be a handful of the numbers that can be included in the table numbered 14.1.

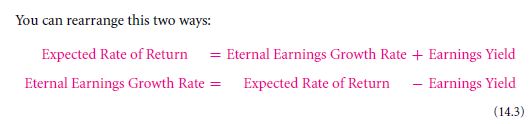

The External Earnings Growth: If there are better ways absent then we can of course use the 1 year’s proxy. We can make our own assumption. We can subtract the current earnings from the future earnings very well. As for the eternal growth rates that are deduced for the earnings, there is a chance to get the well pained approximate value.

The cost of capital: we can always estimate the value that is served on a rate of return by the CAPM formula. This is done to avoid all sort of testing theory that is possible.

There will be definite fractioning point where there is a great change in the earnings rate. Thus, this relation is doomed.

As the total fact alters into the entire diversity of the perilous manner, there is a high chance of getting the ultimate P/E ratio. There is a rolling comparable that you can get a hold of and learn of.

The most unfortunate deal is that there cannot be a specified limit to the 2000 December figuring that is needed to acknowledge of.

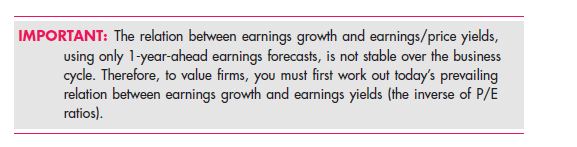

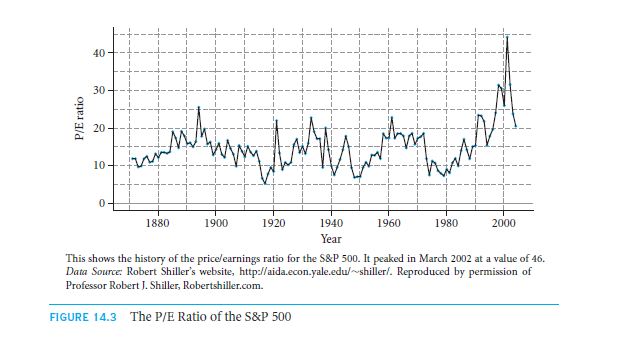

Interpreting (Historical) P/E Ratios for the S&P 500

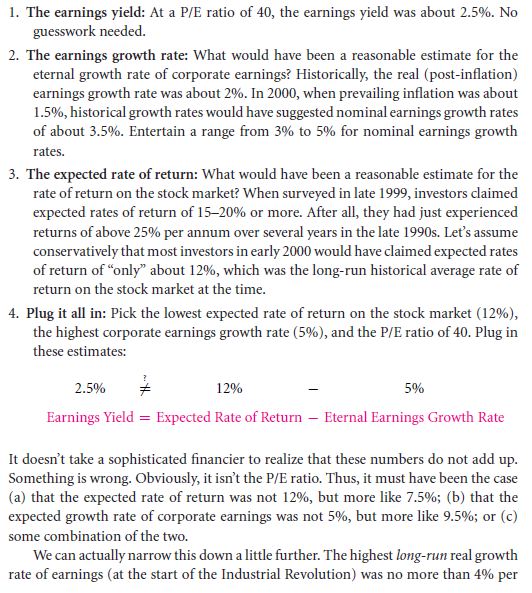

Applying the P/E ratio insights, to the stock market, there can be a simple explanation to the use of S&P 5000. The figure 14.3 shows the graphical representation of this.

There is always a possibility to get a hand on the substitute that is to be of the authorial value. The most highly acclaimed 2000 view is that of the revised version that you are landed with.

Putting the value into testing, we get a healthy ratio,

As depicted on the section 9.4 A, you can get a good substantial equity premium. This is in fact the new economy that is being talked about. There will be a treasury bond that will allow everyone to get an estimate of the yield factor in particular.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Valuation comparables financial ratios

- Capital structure payout policy

- Comparables and net present value

- The price or earnings p or e ratio

- Problems with price or earnings ratios

- Other financial ratios

Links of Next Financial Accounting Topics:-

- Problems with price or earnings ratios

- Other financial ratios

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management