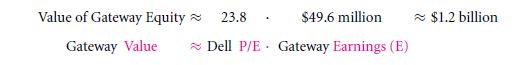

Assuming that there can be a common view task that is used as a task notification, all that you need to hold on to is a good market value that is a former gateway. All the methods that form a gate away can be very interesting. Valuation comparable that is very common and good is the price by earnings ratio. Let us focus on such an example of dell and gateway firms.

Comparables often have one particular problem. These are really easy to calculate. It is absolutely why people find this to be absolutely attractive. But as like any other method, this also sports some weaknesses, people must be aware of the same.

Of course one cannot expect to succeed in this method without knowing the disadvantages.

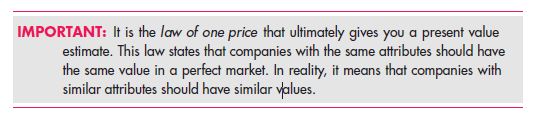

14.1 A THE LAW OF ONE PRICE

The “estimated NPV” method and the comparables analysis method are quite similar to one another. Both has one particular aim, and that is to find the true net value present. Also, both these compare your project relative to the other projects.

Both of these methods practically work but only through the law of one price.

There is though one difference in the both that is quite recognizable. The NPV method usually takes the opportunity costs to be the main comparison of two projects. These opportunity costs are most definitely the discount rates.

In the entire process they take a look at many options. They do not only aim for few similar looking firms only. They believe in the greater perspective no doubt. With comparable this is not the case though.

In this process people can compare their own firms to the few of the similar firms only. And also they use the valuation ratio for such comparisons of course. Comparable make sure that these firms are immediately available. Also, they ensure that they have proper value in the market.

Let us learn more about this is details.

For NPV a form can choose one or even more attributes.

- True NPV cannot be considered. Of course if one knows about it already then there is no need of the process. It is absolutely why one particular attribute should be the estimated NPV.

- Another can be the various earnings from the other similar firms that belongs to the same industry of course.

There are also many other attributes that one must know of as well. One may also consider the sales or the cash flow no doubt. But nothing beats the accuracy of the above-two mentioned points.

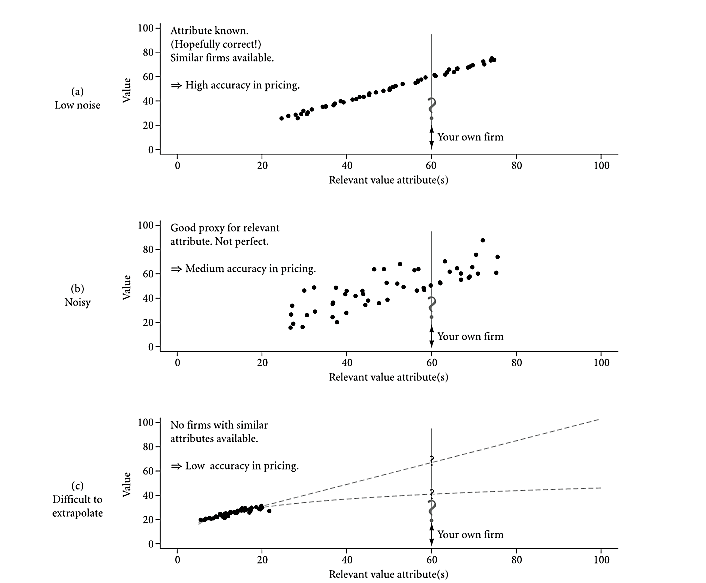

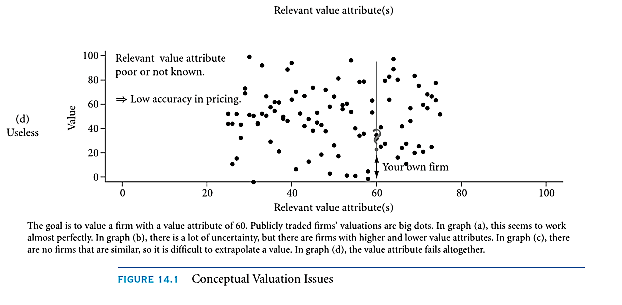

A person might also choose multiple attributes at the same time, but this is going to make things difficult. It is nearly impossible to draw so many graphs at one particular time of course. This is definitely why we must consider a single dimensional graph for our example.

The conclusion we derive is as such:

- It is important to consider another public traded company necessarily. This must also be similar to your own industry and firm. The measure must be extremely relevant. If it is so then all the things will perfectly fall in place.

- One must always consider a very good attribute. These must be completely relevant to the value.

If these conditions are perfectly fulfilled, then the law of one price will give the accurate value no doubt.

WHICH IS BETTER?

It is absolutely difficult to compare between the NPV and the comparables. It is because they are based on the same values. But then again, it is not impossible by any means of course.

The estimated NPV has a lot many advantages as a process. One must realize that with this process calculating the cash flow and the discount rates are extremely easy. It can also evaluate that how and when these cash flows will be utilized.

This process is very simple and is not a bit time consuming. Amidst so many advantages though this method also possess some of the greatest disadvantages as well. These are exactly two in numbers.

The very first advantage is that its verification by a third party seems difficult. Also, the cash flows can be far from being real and accurate.

Comparables also has its equal share of strength as well as weaknesses. One must understand that these comparables provide with far more realistic numbers. These can be easily verified by third parties as well.

This provides with great and accurate results. But then again this process cannot make a good judgement of the firms. Also deciding on a particular appropriate value attribute becomes quite difficult for the people.

In the conclusion one simply cannot find out the better among these two. These are quite equal to each other. Any one comes out to be a winner on a given circumstance. If you want to estimate a value of share in PepsiCo then the NPV will work. Especially, if the treasury bonds are taken as the alternative investment.

While in Coca-Cola the comparables will work the best no doubt. It is absolutely why determining a winner among these two can be difficult as well.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Valuation comparables financial ratios

Links of Next Financial Accounting Topics:-

- The price or earnings p or e ratio

- Problems with price or earnings ratios

- Other financial ratios

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management