You will learn how to talk and distinguish among the comparables and firms that run singularly. This is one of the many pit falls that you get to encounter.

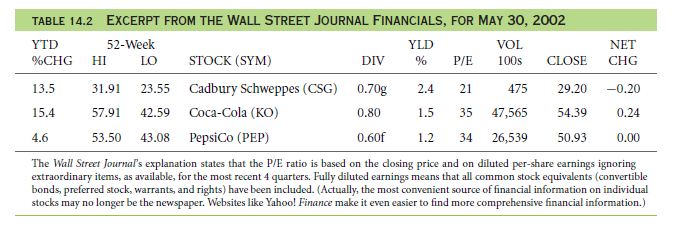

The table that is given below gives a straight from the wall street journal adventure that you get from 2002 of 31st may.

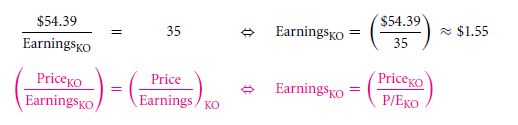

With the information that is given in the table above, you can find out the total earning of the coca cola company.

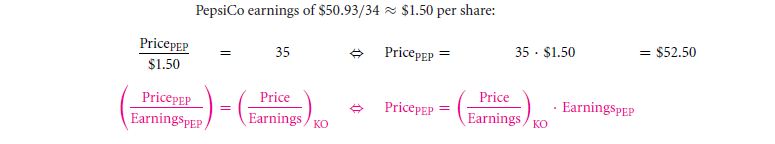

As the company seems to be on good rate, there seems to be a whole lot of good firms that can also amount up to the same structure of the business.

Further along the line, if the value that is the earnings is measured for the main company, there is a chance that the value the smaller firms make will be given a credited value.

The P/E ratios are not valued to the level of comparison at all. This is why there has to be a calculation that supports the value and also a valid explanation. The main explanation being that the law that is of one price everywhere is nothing but a lie. This holds valid only for this particular situation.

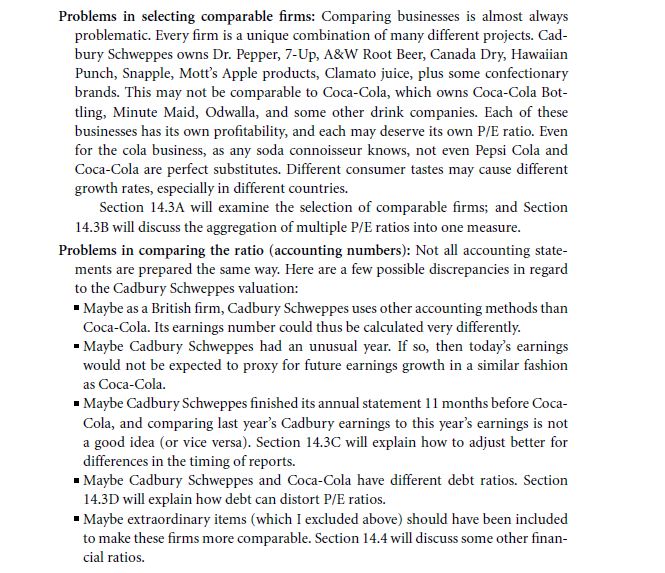

There seems to be a particular given output that makes a definite way. There are a couple of possible problematic outcomes that makes it harder for the companies to go and dive straight into the game of earning a profit.

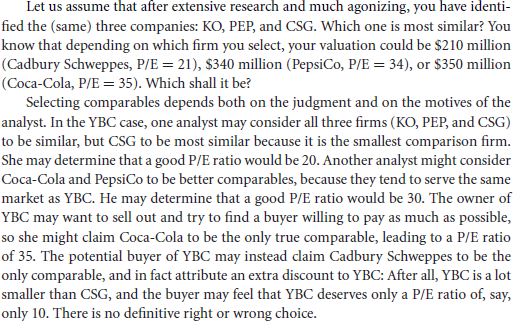

14.3 A SELECTION OF COMPARISON FIRMS

The entire deal with the art of comparables is that you need good and valued projects to compare something to. As you can get a hold of the assumed value, there has to be a natural way the assets are calculated. There are many factors that govern the calculation apart than the simple valuation form. Firms got to have similar business ventures, equivalent or equal projects and even there must not be any geographical barrier to these firms and project hence, no changes and alterations in the currency values. Only then do these projects qualify properly for the experiment.

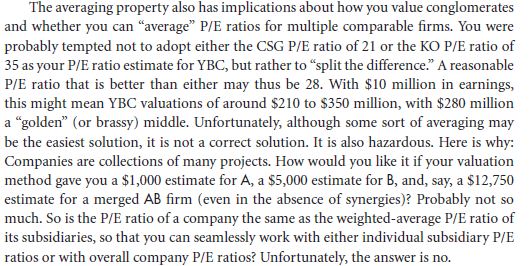

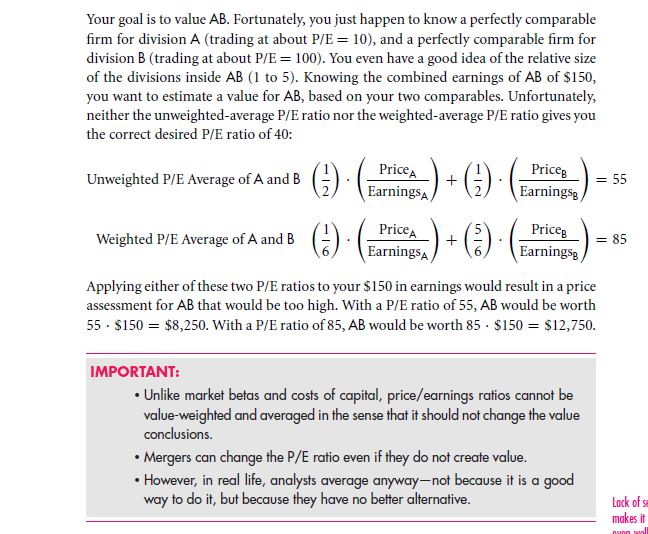

14.3 B (NON-) AGGREGATION OF COMPARABLES

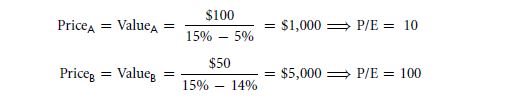

The NPV is mostly the analyzed version of the firms, supposing a firm A has the value of $1000 and B has the value of $5000, then, if they merge will there be any synergy? This is the prediction that is sorted out by the NPV. On understanding the assumed value of NP, there is a high chance that the answer will be a perfect no.

Now, let us consider that two firms have the great growth rate that makes up for a potential value earning, there can be a good expectancy rate.

In the case of a firm trying to work together in a certain project then the financials will be officially jointly collaborated and can get the passive acquisition. The total earning will be of $6000.

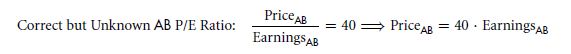

The P/E ratio will sum up to be that of $6,000/$150 = 40.

There is this particular aggregate division that you can look forward into in case there is a firm division. The single comparable unit valuation makes the calculation very difficult.

There is a great amount of the comparable formula that accounts to the value that is formed. If you look into the original calculation, there is a good reputation that a company forms. You can hence, for once agree on the calculative formulation that is formed as a result of the P/E ratio of the calculation.

How Bad Are Mistakes?

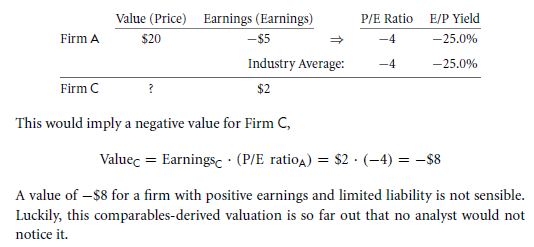

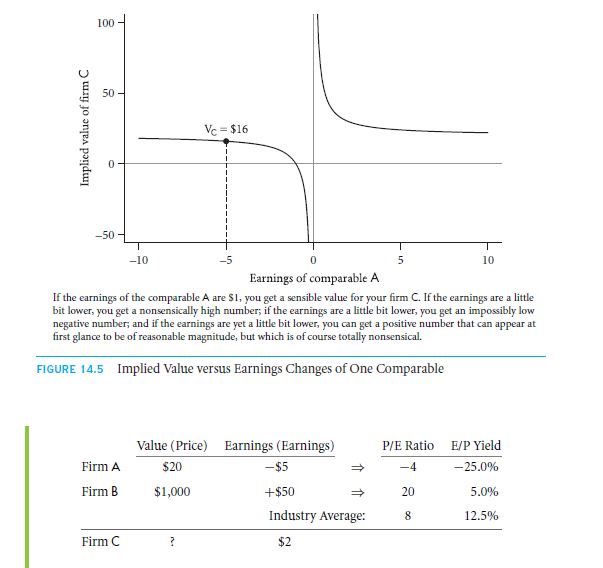

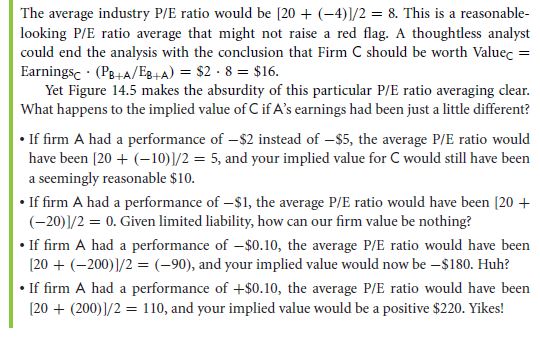

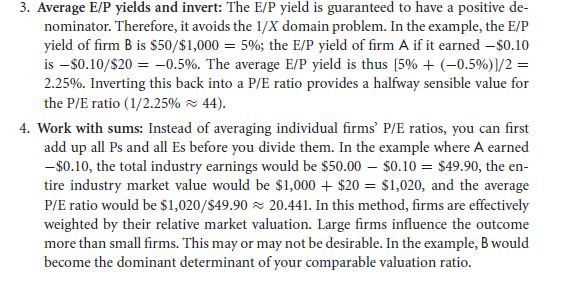

Averaging P/E ratios and the 1/X domain problem

The average value that you get a hold of is mostly wrong to hold on to. This creates the illusionary problem and nothing else. The ratio does not happen to be at all the sensible type and the denominator is but a small negligible amount that is not possible. There is a substantial analysis of the main calculative problem. The earning is calculated to be either a positive or a negative value and is mostly gotten over of. Not only is it distant, but also not a certain one, and can even be on a discontinued value. The earnings can get the better of a company that is questionable. Value that is accounted as is referred to as the 1/X domain problem error.

P/E average that is set on by the industry can be used to analyze the problems that can be overlooked at times.

There will always be minor changes that are used to make a production of the reasonable and unreasonable values. The earnings that are produced that is. There can be other variations that make the value look like a small earning value. There can be varied comparable values. The P/E ratios are made to mess up a value and calculate the average among the ratios.

Remedies for the 1/X Domain Problem

There is no certain method that can be used to calculate the value that is to be found for the problem that is for the deal. This is the deal that can be formed for the calculation that is and of course the hard earned area.

- Use the median, not the mean: the outline of the firm is a major determinant of the P/E ratio calculation. This is a contrasting anomaly that occurs at every single step. This is not dependent on the negative earnings that the firm that gets. Also forgoing the various factors that all account to the calculation and the value that is formed massively. This holds true for all the negative rated firms and projects too.

- Ignore non-positive earnings firms: this is a common sort of association that forms the varied formation. Getting an earning that is only positive along with a good P/E value is a matter of wishful thing.

All these various methods that are used are the most effective reasons that make up for the estimations that you get to make. Even with the negative values that a company earnings, there is a chance that gives the proper value that can be used.

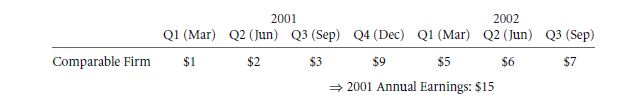

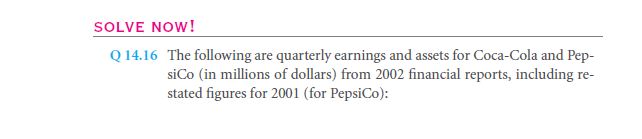

14.3 C TRAILING 12-MONTH (TTM) FIGURES ANDOTHER ADJUSTMENTS

There is good factor that comes in the value of all the details that is the time value. It has to be the annual earnings that you get a hold of and along with that there has to be the perfect report that is made. The second thing that must be considered as a valid one, is the earnings that must be reported.

There must be a 12 month trailing period that is needed to make a perfect adjustment.

There is a need to make the perfect qualification that is the caveat that has to be 3 in number.

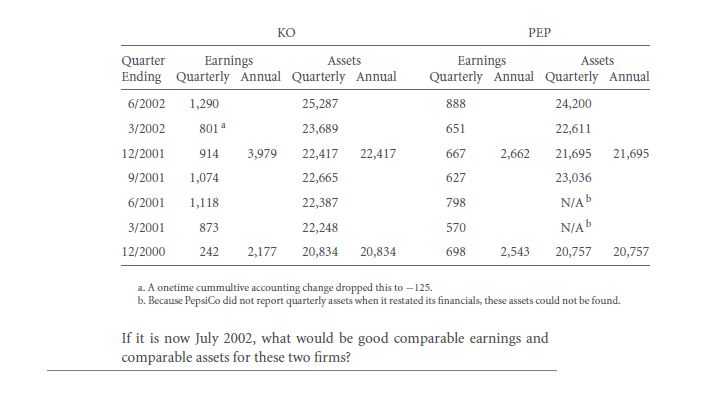

14.3 D DEBT AND ADJUSTMNETS FOR P/E RATIOS

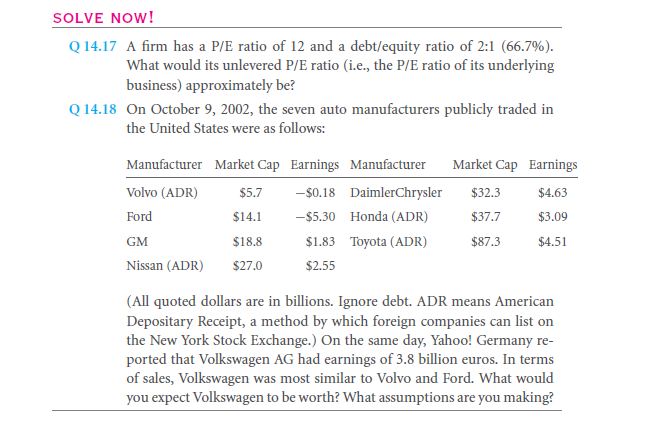

Many may want to know about the effect of debt on the P/E ratios. Of course a company will need debt and equity to sustain. But then again, when there are two similar companies but with different dent ratios then the scenario changes. These cannot be compared at all.

Of course people can expect that these companies have different capital structure. This in itself will overpower all the other characteristics. But it cannot be classified whether or not debt is affecting the company positively or negatively.

If it is a growth company then debt is equivalent to rise in the P/E ratio. And if it is a value company then of course the debt equals to the decrease in P/E ratio.

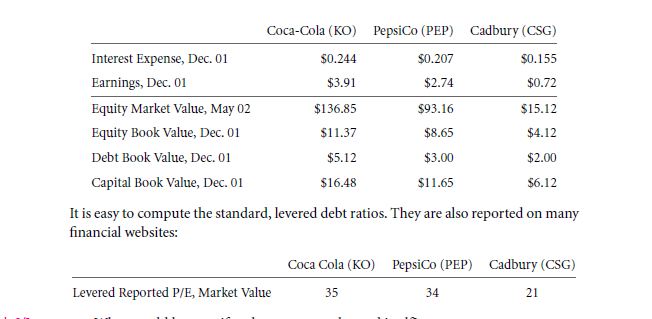

But then there are ways how one can still compare. Though this is a highly discouraged thing to do in the first place. One must at first add the debt to equity. And then they must add the payments made to creditors with the denominator.

The company that is to be analysed gives many factors like these and can give off the value that is equipped in the status that is to be found.

The brand evaluation remains neutral and semi dilute. There is a heavy way opf imparting that distinguishes the values of the P/E ratios.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Valuation comparables financial ratios

Links of Next Financial Accounting Topics:-

- The price or earnings p or e ratio

- Problems with price or earnings ratios

- Other financial ratios

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management