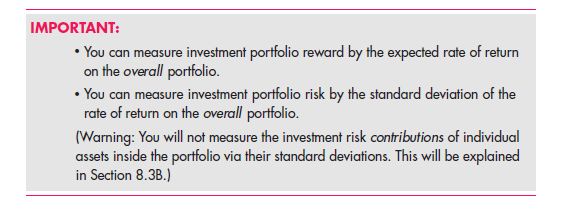

We are even now roaming around the same topic: the proper calculation of the cost of capital with the use of the NPV formula. Prior to our beginning with the concept of knowing the opportunity budgets of capital meant for a company’s own projects, one has to brush up with the knowledge of chances that the investors are bestowed upon. This implies that one must understand upon what all can the investors’ rewards, or what they do not like, which we call as risk. We will also see other issues as how are the investors measuring their jeopardies and recompenses, also how they set about work expansions, what are the various assortments an intelligent investor would stick to, and also the reasons for which market beta is considered as a proper measure of the involvement of a speculation resource towards the market assortment’s risk.

8.1 MEASURING RISK AND REWARD

Wear the sleeves of a venture capitalist and commence with the basic questions. Say we are given five assets that are tagged four equally same results. Now, the interrogations have to begin with how should one place the peril and recompense for a certain portfolio? It is good to state an easy to comprehend example which would then generalised for the purpose of understanding the underlying concepts. This gives us a wider sense of the case under study. To start with let’s track four of the uncertain securities namely A through D (say). We also take up a risk free asset and name it as F. These securities in turn could be individual; portfolios, or assets and or as such something. Now, this is the case with mutual fund.

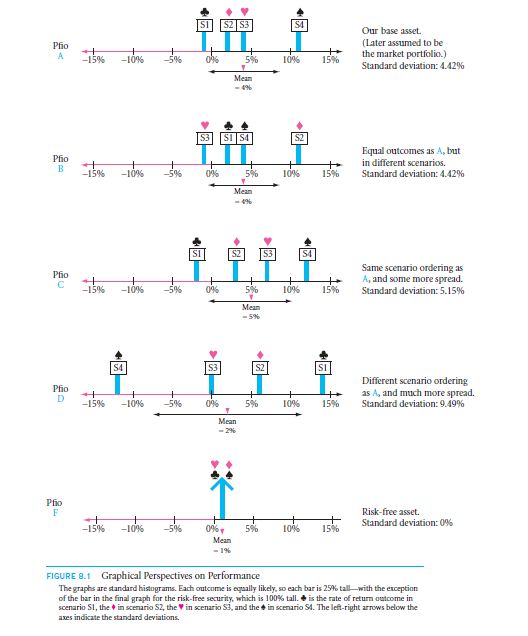

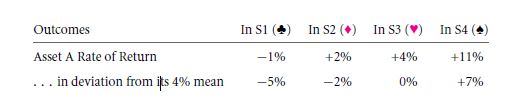

For explanation we make use of four names S1, S2, S3, and S4, as in Table 8.1. (If it is stress free to assume with respect to historical results, you can presume that case S1 took place at a time 1, S2 at 2 thus, so on. Further, say the task is to scrutinise this set of data. It is quite many times a useful comparison although it is not totally appropriate.) Which investment strategies do you deem better or worse, safer or riskier? It is the goal of this section to scrutinize the resources and scenarios inTable8.1 to polish your knowledge of the perceptions and quid pro quo of risk along with reward.

There exists four similarly possible circumstances; we name them as S1 through S4, as is shown in Table 8.1.

A diagram explains it more than a tabulated data, thus Figure 8.1 comes handy. As it very much reflected on the histogram, each case is likely to occur in the same degree, which is indicated by the histogram slabs being tall. The outcomes are denoted in the horizontal axis. Going by the example the assets that lie away to the right side is preferred because of its higher rate of return.

8.1 A MEASURING REWARD: THE EXPECTED RATE OF RETURN

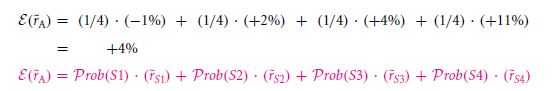

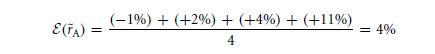

Even though the graphical representations are very helpful, there is a need for algebraic explaining formulas. These must be associated with the measurements. There will in fact be a good number involved. As per the rewards are concerned that is.

8.1 B MEASURING RISK: THE STANDARD DEVIATION OF THE RATE OF RETURN

Measuring up the risks will give a really proper and good measurement for the rewards that you are ought to get. There will be many specifications involved in the section denoted as section 6.1B. You will get to see that in the figure 8.1.

What you will get is the proper intuition about the current market.

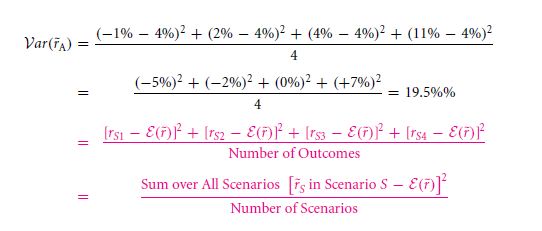

You cannot even decide on to compute the valuations that you further received. The variance that you will encounter is:

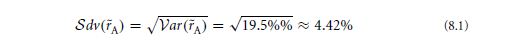

These variances will have a certain unit charge which will not be specifically interpreted. The measurement of this is further termed as standard deviation.

The rate of return that you get a hold of is the most commonly used measurement system of calculating the portfolio risk.

Links of Previous Main Topic:-

- Risk and return risk aversion in a perfect market

- Uncertainty default and risk

- Working with time varying rates of return

- A first encounter with capital budgeting rules

- Stock and bond valuation annuities and perpetuities

- The time value of money and net present value

- Introduction of corporate finance

Links of Next Financial Accounting Topics:-

- Portfolios diversification and investor preferences

- How to measure risk contribution

- Expected rates of return and market betas for weighted portfolios and firms

- Spreadsheet calculations for risk and reward

- An investors specific trade off between risk and reward

- A shortcut formula for the risk of a portfolio

- Graphing the mean variance efficient frontier

- Adding a risk free asset