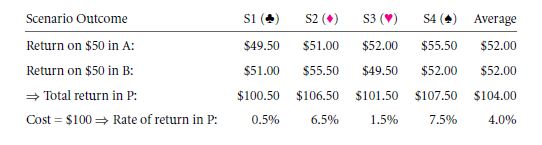

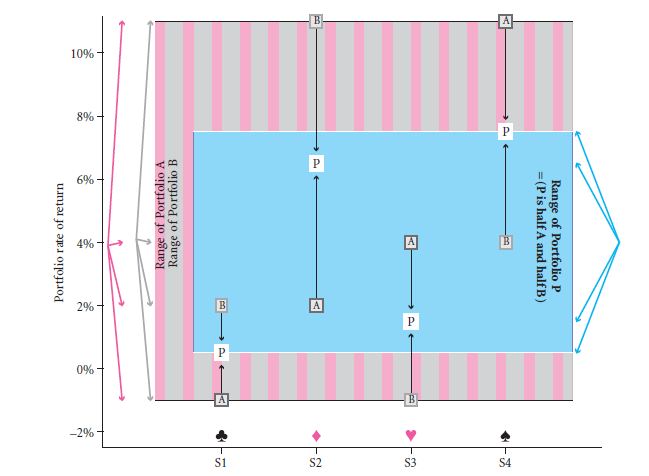

Viewing the practical aspect, we realise that we are neither bound to purchase resources in segregation nor individually. We can buy them bit by bit, or rather a small quantity of each. As a result of this case, it was discovered that the gross risk precisely portfolio risk has faced a fall. We shall now investigate upon its reasons. For that we commence with investment resources A and B. These are supposed to provide the identical rate of return. This arises in varied developments in the future. Say if one buys any of A or that of B worth $100, then the return that one can expect is $4. This estimated outcome is against a risk of $4.42. On a second note, say if one buys $50 worth of A and $50 worth of B precisely, then the case would be different, and for description we call it portfolio P. The $100 worth venture would be reflected as this:

There is a quicker return rate that are A along with B. there will be a portfolio of investments that get an increase in the rates.

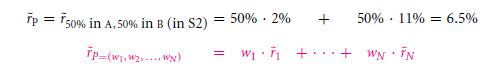

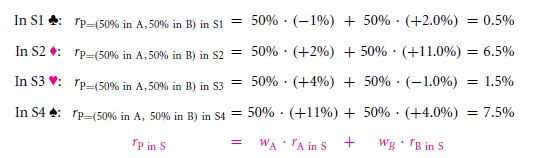

Looking at all the possible investments that can be done, you can get a handful of all the variables that are used in the equation 8.2.

You can use the measurements that are given by the algebraic measurements, that occur at different months.

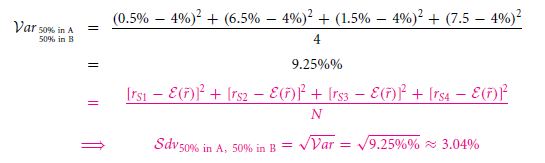

The investments that are made on either of A or B variables, gives a risk percentage of 4.42%.

The reason being diversification mixes with multiple other investments and gives us a certain rate to invest.

8.2A ASSUME INVESTORS CARE ONLY ABOUT RISK AND REWARD

Many of us will be reluctant to the idea of portfolio diversification. The investments that are made give a right value to the assets. They have low risk return rate. There is a risk involved rate. The market portfolio is used to get a hold of the total measurement of the likely risks that are to be incurred. There will definitely be many opportunities to invest on the project that you give a guarantee on. Is there any need to make investments on the required anomalies? As for the corporate ventures, there can be many possible assumptions to make a plunge on.

The diversifications that you face and get a high rate of return on the expected roles. Investors can multiply the project ventures.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Investor choice risk and reward

Links of Next Financial Accounting Topics:-

- How to measure risk contribution

- Expected rates of return and market betas for weighted portfolios and firms

- Spreadsheet calculations for risk and reward

- An investors specific trade off between risk and reward

- A shortcut formula for the risk of a portfolio

- Graphing the mean variance efficient frontier

- Adding a risk free asset