The concept of continuously compounded interest rate can be explained by taking an example:

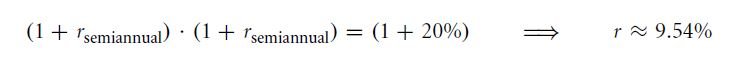

Say, an investment of $100 today is giving a return of $120 in the next year. So, the rate of return is 20%. If the interest is paid twice every year, and the rate of interest remains constant, and the amount earned at the end of the year is $120, the rate of interest can be given as:

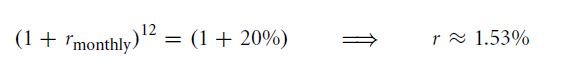

If the semi-annual interest rate is multiplied by 2, r becomes 19.08%. If you receive interest 12 times a year, then the rate of interest will be:

If we multiply the monthly rate of interest by 12, r becomes 18.36%. Now, if you receive interest 365 times in a year, then the rate of interest will be:

Multiply this daily rate of interest by 365 and r will be 18.25%.

The continuously compounded interest rate can be calculated by taking natural logarithm of 1 plus the simple rate of interest.

Similarly, the simple rate of interest can also be calculated from the above formula:

Continuously compounded interests can be added. These interest rates are symmetric. The range of continuously compounded interest rate lie between -∞ to +∞. Compounded interest rates are used in Black-Scholes option formula.

REVIEW QUESTIONS

- Calculate the continuously compounded interest rate if a bond pays $150 for every investment of $100.

- If a bond pays an interest rate of 10% compounded continuously, the money received after maturity is reinvested 20% interest rate, which is also compounded continuously. What will the value of a present day investment of $100? Calculate the simple and continuously compounded rate of interest over the two periods.

Links of Previous Main Topic:-

- Working with time varying rates of return

- Inflation

- Study of treasury bills and yield curve in time varying interest rates

- Why is the slope of yield curve upward

- Corporate insights about time varying costs of capital obtained from the yield curve

- Extracting forward interest rates

- Shorting and locking in forward interest rate

- Bond duration

- Duration stability

- Duration hedging

Links of Next Financial Accounting Topics:-

- Institutional knowledge about compounding and price quotes

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

- What matters

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management